-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Taps Sacks For White House Job

MNI US MARKETS ANALYSIS - NFP Followed by Ample Fedspeak

MNI US OPEN - Soft NFP Report Should Cement December Cut

MNI ASIA MARKETS ANALYSIS: Covid Case Count Spurs Safe Haven Bid

US TSY SUMMARY: Yld Bounce Stalls

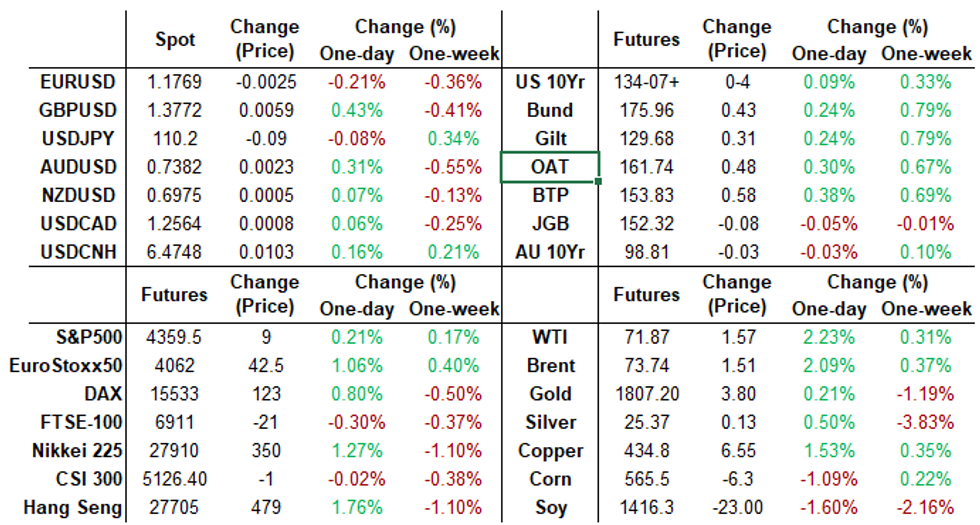

The strong bounce in Tsy ylds from Mon-Tue sharp decline ran out of gas Thursday, finishing day off session lows (10YY 1.2599% vs. 1.2316%L; 30YY 1.8957% vs. 1.8783%L).

- Tsy futures traded higher after weekly claims (weekly claims 419k vs. 350k est; continuing claims 3.236M vs. 3.1M est; July rev to 368k), after bouncing off session lows a few minutes after ECB steady policy annc -- deposit and key refi rates unch'd but revised forward guidance, perhaps not as dovish as anticipated as Bunds trade lower as well.

- Covid case count headlines (7-day avg case count +53%; 20% of all US cases coming from FL) pushed Tsys to new session highs, though equities managed to trade higher into the FI close (ESU1 +9.0).

- Tsys holding off midday highs after 10Y TIPS auction draws -1.016% high yield vs. -0.997% WI. Bid-to-cover steady with prior auction at 2.50. Indirect take-up climbs to 70.14% vs. 68.59% in May (68.68% 5M avg) Primary dealer take-up slips to 14.31% vs. 14.88% 5M avg. Direct take-up 15.55% vs. 14.88% 5M avg.

- The 2-Yr yield is down 1bps at 0.1978%, 5-Yr is down 2.6bps at 0.7105%, 10-Yr is down 2.5bps at 1.2632%, and 30-Yr is down 3.7bps at 1.9022%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00050 at 0.08338% (-0.00238/wk)

- 1 Month +0.00262 to 0.08925% (+0.00562/wk)

- 3 Month -0.01263 to 0.12525% (-0.00900/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00412 to 0.15725% (+0.00512/wk)

- 1 Year +0.00100 to 0.24400% (+0.00188/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $71B

- Daily Overnight Bank Funding Rate: 0.08% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $913B

- Broad General Collateral Rate (BGCR): 0.05%, $383B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.660B submission

- Next scheduled purchases

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $898.197B from 73 counterparties vs. $886.206B on Wednesday (compares to June 30 record high of $991.939B).

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block/Pit +50,000 Green Dec 98.50 puts, 3.0 vs. 99.105/0.10%

- -4,000 Green Sep 99.00/99.12 put strips, 14.5

- +1,000 long Green Dec 99.12 straddles, 75.0

- 15,000 Green Mar 100 calls, 0.5 (adds to +13k at 1.0 Wed)

- +5,000 Blue Sep 98.50/98.62/98.75 put trees, 0.5 cr

- +5,000 Green Dec 98.37/98.62/98.87 put flys, 3.0

- Overnight trade

- Block, 30,300 Blue Aug 99.12 calls, 1.5 vs. 98.80/0.10%

- 10,000 TYU 132.5/133.5 put spds, 15

- +2,000 TYQ 133.75/134.25 strangles, 9-10

- 2,000 TYU 134 straddles, 138

- 5,000 TYQ 133.5 puts, 2

- 3,500 TYQ 133.25 puts

- Overnight trade

- 2,000 FVU 122.5/123/123.5 put flys

- 1,500 TYU 129.5/131.5/133.5 put flys

EBGs-GILTS CASH CLOSE: ECB Day Resolves in Dovish Direction

Markets ultimately took the ECB decision and press conference as dovish, though price action was very much two-way for most of the European afternoon Thursday.

- After an initial knee-jerk move lower on the ECB statement (a move whose cause was not totally clear, perhaps the newly-communicated statement not as dovish as some hoped), Bund yields moved quickly to session lows - only to retrace to where they began the afternoon. Periphery spreads ended marginally lower.

- With minimal data and no supply, the only highlight apart from the ECB was a speech by BoE's Broadbent but that didn't provide major revelations - this may have taken a bit of impetus out of the potential for action at the August MPC meeting though - Gilts outperformed.

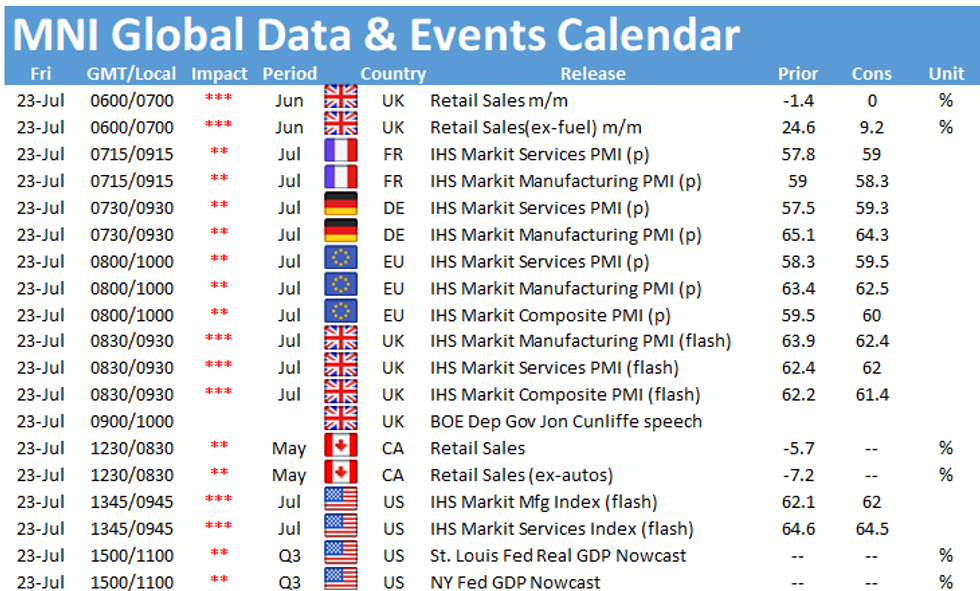

- UK retail sales and flash PMIs highlight Friday's calendar.

- Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.72%, 5-Yr is down 2bps at -0.702%, 10-Yr is down 2.9bps at -0.424%, and 30-Yr is down 3bps at 0.058%.

- UK: The 2-Yr yield is down 3.2bps at 0.07%, 5-Yr is down 3.4bps at 0.267%, 10-Yr is down 3.6bps at 0.567%, and 30-Yr is down 5.3bps at 1.003%.

- Italian BTP spread down 1.7bps at 106.6bps

OPTIONS/EUROPE SUMMARY: Plenty of German Bond Downside (pre/post ECB)

Thursday's options flow included:

* RXU1 174.50/172.50ps bought for 37 in 8.4k, also earlier for 39/40 Total 16.8k all day

* RXU1 174.50/173.50ps 1x1.5, bought for 11 in 2k

* RXU1 166.5p bought for 1 in 1.7k

* RXV1 171.50/170.00/169.00/166.50 broken put condor vs 175.00/176.50cs, bought the condor for 1 in 4.7k.

* DUU1 112.20/112.10/112.00p fly, bought for 1 and 1.5 in 3k

* DUU1 112.20/112.10ps 1x2, bought for 1 in 1k

* DUU1 112.30/20ps 1x2 bought for 2.75 in 5k

* DUU1 112.20/112.10ps, bought 1.5 in 10k

* 3RU1 100.25/100.12ps 1x2, bought the 1 for 0.75 in 10k

* 3RH2 100.25/100.12/100p fly, bought for 1.75 in 1k

* 3RU1 100.25/100.12ps 1x2, bought the 1 for 1 now in 4k - Bought 10k for 0.75 earlier

* LH2 99.87/100/100.12c fly, bought for 0.75 in 4k

* 2LZ1 99.25 p bought up to 9.75 in 9k

* 2LZ1 99.12/99.00ps (ref 99.33) vs 0LZ1 99.25/99.12ps, bought the 2yr for 1.25 in 5k

FOREX: Euro Ends Lower Following ECB, GBP Advances

- Two-way price action for the single currency following the first ECB monetary policy statement and press conference since the ECB strategy review.

- Despite an alteration to the forward guidance, the majority of analysts appear convinced the changes offer little new significance for markets at this stage.

- With some potentially expecting a more dovish scenario, EURUSD popped above 1.18 to print a fresh weekly high at 1.1831.

- Some cited marginal dovish tweaks, highlighting the central bank's stance "may also imply a transitory period in which inflation is moderately above target". This could point to why EURUSD eventually headed lower, however, short-term positioning and dollar dynamics may be equally attributable. The pair resides 0.2% lower for Thursday, just above the week's lows at 1.1770 with a more notable 0.65% move south in EURGBP.

- Despite the technical outlook turning favourable, EURGBP has had a sharp reversal and key support is seen roughly 0.5% from current spot at 0.8504, the July 14 low. Similarly, 1.3817 resistance in cable, the 20-day EMA, will need to hold for GBP bears. The most recent Covid data showed another daily decline in cases, potentially bolstering recent signs that UK COVID case growth could have topped out.

- AUD and NOK extended on gains made yesterday, both gaining roughly 0.4% against the greenback.

- UK Retail Sales and Eurozone Flash PMI's headline the European data schedule, before Canadian Retail Sales and US PMI's close out the weekly calendar.

Expiries for Jul23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-10(E1.5bln), $1.1725-35(E1.2bln), $1.1800(E724mln), $1.1865-70(E1.1bln), $1.1925(E731mln)

- USD/JPY: Y110.75($500mln)

- GBP/USD: $1.3775-85(Gbp643mln)

- EUR/GBP: Gbp0.8525(E510mln)

- AUD/USD: $0.7400-20(A$1.1bln)

- USD/CAD: C$1.2470-75($576mln)

PIPELINE: DirecTV Priced, Chile Still Expected to Launch

- Date $MM Issuer (Priced *, Launch #)

- 07/22 $2.3B *DirecTV 6NC2 5.875%

- 07/22 $2B #JP Morgan PerpNC5 4.2%

- 07/22 $900M #World Bank 2031 tap FRN/SOFR +34

- 07/22 $500M *Ukraine 6.876% 2029 Tap 6.3%

- 07/22 $Benchmark Republic of Chile 12Y +155a, Tap 20Y +160a, 40Y +170a

EQUITIES: Off Highs, Rally Falters

Equity markets started the session well, with a strong finish in the Asia-Pac region feeding into a positive European morning. This price action soon faded upon the opening bell, however, with reports of a fresh wave of website outages (reminiscent of the Fastly outage in early June) knocking a number of popular websites offline.

- This sent stocks slightly lower, but losses were muted with the S&P500 trading either side of unchanged after the London close.

- The stocks that drove the bounce off Monday's lows, namely the energy and financials sectors, lagged throughout Thursday trade and were the poorest performers in the S&P 500.

- Earnings remain a key market driver, with some of the poorest performers in the S&P 500 including Southwest Airlines and Texas Instruments slipping after their reports. At the other end of the table, Domino's Pizza traded with gains of over 10% following their strong turnout.

COMMODITIES: Oil Benchmarks on Track for 10% Rally From Week's Low

- Both WTI and Brent crude futures traded constructively Thursday, adding to the recovery from the week's low and remaining on course for 10% gains.

- Gains came despite the more mixed performance from equity markets as traders took the view that OPEC+'s recent agreement will likely fail to meet the demand from a tighter market throughout H2 this year, helping boost and steepen the front-end of the futures curve.

- NatGas futures joined the oil rally, but underperformed relative to WTI, Brent as the EIA NatGas Storage Change data came in above expectations, with a build of 49 BCF.

- Gold and silver recovered early losses as the equity bounce faltered, but gold still managed to print a lower low for the third consecutive session. A close below the 100-dma at $1795.4 would be bearish, opening $1792.4, the 50% retracement of the recent rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.