-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Mild Risk-On Ahead ADP Private Employ

US TSY SUMMARY: Modest Risk-On

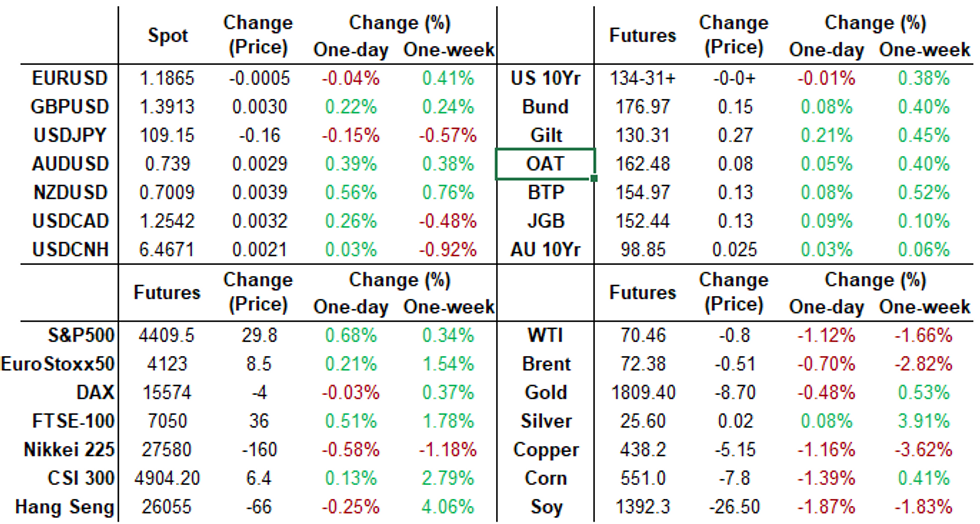

Tsys traded marginally mixed into Tuesday's close, off midmorning highs as risk appetite improved with equities posting decent late gains (ESU1 +29.0), US$ gains.

- Rather modest volumes (TYU1 <925k) after solid beat on June factory orders (+1.5% vs +1.0% expected); ex-transport +1.4%, and with strong upward revisions to May.

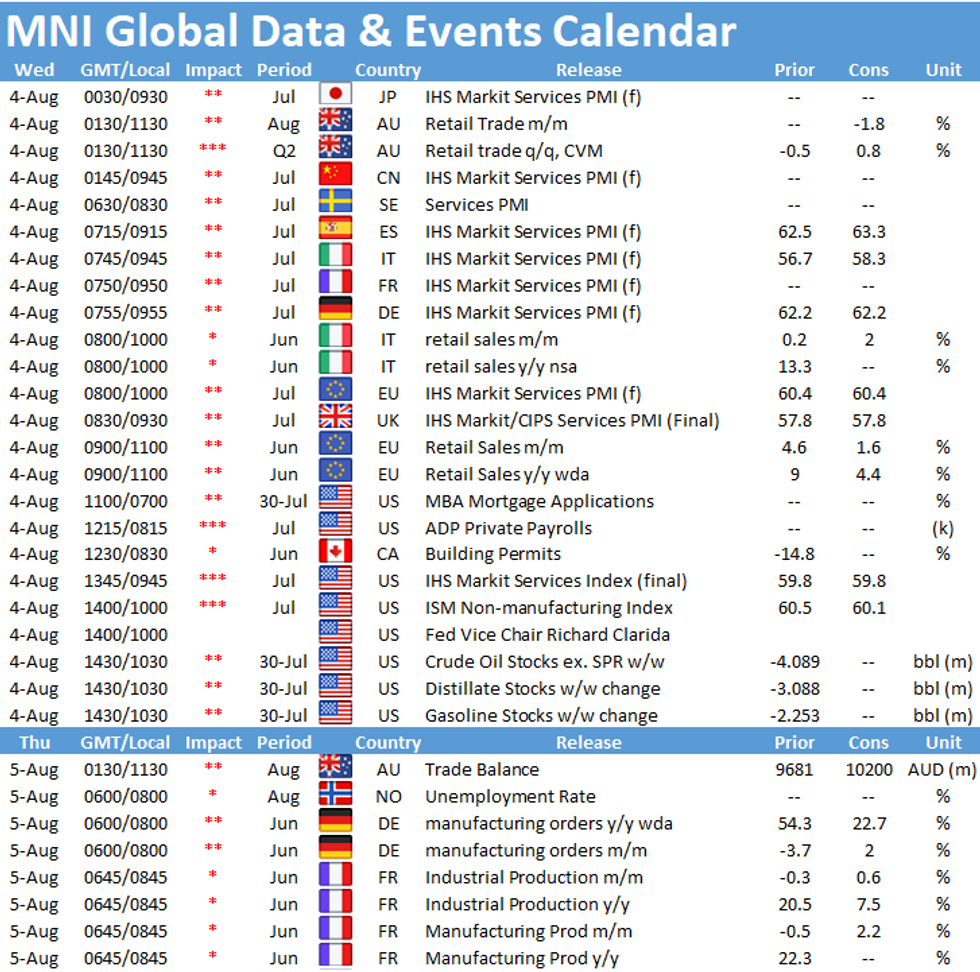

- Otherwise rather subdued trade ahead Wednesday's ADP Private employ data (690k est vs. 692k prior) and Friday's headline July employment data (+875k est vs. +850k fin June).

- The 2-Yr yield is unchanged at 0.1722%, 5-Yr is down 0.2bps at 0.6521%, 10-Yr is down 0bps at 1.1772%, and 30-Yr is down 0bps at 1.8497%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00188 at 0.08138% (+0.00450/wk)

- 1 Month +0.00075 to 0.09038% (-0.00013/wk)

- 3 Month -0.00237 to 0.12138% (+0.00362/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00150 to 0.15513% (+0.00200/wk)

- 1 Year -0.00025 to 0.23213% (-0.00300/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08% volume: $246B

- Secured Overnight Financing Rate (SOFR): 0.05%, $986B

- Broad General Collateral Rate (BGCR): 0.05%, $398B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $360B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.506B submission

- Next scheduled purchases

- Wed 8/04 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 8/05 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations -- Back Below $1T

NY Fed reverse repo usage recedes to $909.442B from 72 counterparties vs. $921.317B on Monday. Compares to last Friday's new record high of $1.039.394B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- +40,000 short Sep 99.62/99.68 put spds, 1.0 vs. 99.745/0.15%

- +10,000 short Sep 99.56/99.68/99.75 put flys, 0.5 vs. 98.745/0.10%

- Block, 15,144 Blue Aug 98.62 puts, 2.0 vs. 98.89/0.10%

- +2,500 Blue Oct 98.37/98.62 2x1 put spds, 2.0

- 7,000 Blue Sep 98.50 puts, 1.5

- +1,500 Green Sep 98.87/99.12 put spds, 3.5

- Overnight trade

- +10,000 short Dec 99.37/99.50/99.62 put flys, 2.0

- +6,500 Dec 99.75 puts 1.0 vs. 99.84/0.10%

- 6,000 wk2 TY 132.75/133.5/134 broken put flys, 2

- +8,000 TYU 132.5 puts, 5

- Overnight trade

- over +20,000 TYU 135.75 calls from 19-17, 17 last on 10k

- +5,000 TYU 132.5/133 put spds, 3

EGBs-GILTS CASH CLOSE: Short End Notably Weaker

German and UK yields finished a little off session lows after what appeared to be late-afternoon (1500BST onward) profit-taking into the close Tuesday as equities bounced.

- Curves flattened, with short-end weakening (Gilts notably so ahead of BoE decision Thursday). 10Y Bund yields touched a fresh 6-month low at -0.492%; Gilts went as low as 0.50% (near the Jul low). Periphery EGB spreads edged lower.

- Today, Austria sold E1.3bln of 4-/10-Yr RAGBs, and the UK sold E2.0bln of Jul-51 Gilt. Wednesday sees Germany sell E4bln of Bobl.

- Little in data / speakers; Weds sees final Services PMIs, with first/only readings for Spain and Italy.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at -0.771%, 5-Yr is up 0.7bps at -0.748%, 10-Yr is up 0.5bps at -0.482%, and 30-Yr is unchanged at -0.011%.

- UK: The 2-Yr yield is up 2.3bps at 0.057%, 5-Yr is up 0.5bps at 0.23%, 10-Yr is down 0.1bps at 0.52%, and 30-Yr is down 1.2bps at 0.946%.

- Italian BTP spread down 1bps at 104.8bps / Spanish down 0.5bps at 71.5bps

OPTIONS/Tuesday Sees Mixed Structures In Sterling And Sonia

Tuesday's European rate/bond options flow included:

- OEV1 135.5p, bought for 9 in 1.5k

- DUU1 112.20/112.00ps, bought for half in 3k

- SFIM2 99.80/99.60ps 1x2, sold the 1 at half in 1k

- 0LZ1 vs 0LU1 99.75/99.87cs, bought the Dec for 1 in 2k

- 0LZ1 99.62/99.75cs 1x2, bought for 1.25 in 3k

- 0LZ1 99.75/99.84/100c fly 1x3x2, bought for 0.75 in 2k

FOREX: Antipodean FX Hold onto Gains

- Despite the greenback recovering losses throughout US hours, AUD (+0.40%) and NZD (0.53%) have held onto the majority of overnight gains. These strong performances were inspired by marginally hawkish central bank rhetoric.

- The RBNZ released a statement outlining their intention to step up efforts to reign the roaring housing market by tightening mortgage lending standards. The RBA then defied market consensus and chose to stick with its tapering plan, despite the ongoing resurgence of Covid-19 in Australia.

- NOK had been the strongest currency in G10 heading into the start of US trade. However, a sharp move lower in crude futures prompted a reversal from these elevated levels, with both EURNOK and USDNOK reverting to unchanged on the week.

- Echoing this move in oil, USDCAD found fresh impetus, extending on gains above the 1.25 handle to reach 1.2552 as of writing. On the topside, initial resistance is at 1.2607, Jul 23 high. A break of this level would signal the resumption of bullish activity.

- Elsewhere, activity was limited in the currency space. USDJPY briefly traded below 109 to fresh lows of 108.88 before bouncing back above the figure, where volatility subsided. Attention is on 108.47, a Fibonacci retracement as a technically bearish focus continues to dominate the outlook.

- Kiwi Unemployment will kick off Wednesday's APAC session, shortly followed by Aussie Retail Sales. The US docket will include ADP employment change followed by ISM Services PMI.

FX/Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E598mln), $1.1830-35(E591mln), $1.1845-55($1.8bln), $1.1920-25(E601mln)

- USD/JPY: Y110.50($1.3bln)

- GBP/USD: $1.3750(Gbp502mln)

- EUR/GBP: Gbp0.8550(E841mln)

- EUR/JPY: Y129.25(E710mln)

PIPELINE: Starting to Launch

Still waiting for JP Morgan, National Bank of Canada- Date $MM Issuer (Priced *, Launch #)

- 08/03 $2B #UBS 3Y +60a, 3Y FRN/SOFR+60a, 6NC5 +105a

- 08/03 $1.5B #Rockwell Automation $600M 2NC1 +20, $450M 10Y +60, $450M 40Y +95

- 08/03 $1.3B #Ashtead Capital $550M 5Y +90, $750M 10Y +130

- 08/03 $650M #Invitation Homes 10Y +100

- 08/03 $Benchmark National Bank of Canada 3Y +45, 3Y FRN/SOFR

- 08/03 $Benchmark JP Morgan 4NC3 fix to FRM +65a

- 08/03 $Benchmark Bank of China 2Y FRN

EQUITIES: Late Rally Counters Early Negativity

- Wall Street started the Tuesday session on shaky footing, with the e-mini S&P coming under early pressure to press cash markets into the red shortly after the opening bell. This sentiment soon reversed, with sizeable volumes crossing alongside the London close to put the e-mini S&P through the overnight highs and back into positive territory.

- A tick higher in the early underperformers (notably energy) underpinned the recovery, with earnings also adding a tailwind. The likes of Eli Lilly rallied sharply following their report.

- This keeps the upside argument in tact for the e-mini S&P, with first resistance at the week's high of 4419.75, before alltime highs at 4422.50.

COMMODITIES: Oil Benchmarks Shrug Off Tanker Seizure Off UAE Coast

- Both WTI and Brent futures continued to trade heavy, extending this week's weakness and shrugging off reports of a tanker seizure in the Gulf of Oman. WTI futures extended losses, taking out Monday's low to hit the lowest levels since mid-July. Markets took out the 50-day EMA at 70.06, which switches from support to resistance. This re-initiates the downside argument, opening $65.01, Jul 20 low and the key support.

- Reuters reported that Iranian-backed forces were believed to be behind the seizure of the tanker the Asphalt Princess, with an armed group in control of the vessel. With the situation remaining unstable, markets will likely keep watch of the situation, which may be arresting any downside pressure on energy products.

- Gold and silver were rangebound. The gold outlook is bullish and the recent pullback was considered corrective. Price still needs to clear $1834.1, Jul 15 high to confirm a resumption of the bull cycle. This would open $1853.3, a Fibonacci retracement. Support to watch is $1790.0, Jul 23 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.