-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: PPI Higher Then Forecasted

US TSY SUMMARY: Bond Auction Tails for Fourth Time

Thursday's trade felt more animated despite lighter volumes (TYU<885k after the bell) compared to Wed that saw nearly twice the volume and in-line July CPI and lower than est core CPI (0.3%).- Tsy futures extended early session lows after PPI came out higher than forecasted (+1.0% vs. +0.6%), weekly claims as expected (-12k to 375k), while continuing claims -.114m to 2.866M. Rates held narrow range on two-way trade through midday in anticipation of 30Y bond auction.

- Yield curves bear steepened as bonds sold off/extended session lows after the fourth consecutive 30Y auction tail: 2.040% vs. 2.030% WI; 2.21x bid-to-cover off 2.29x 5 auction avg.

- Performance not as poor as the prior July auction's 2.8bp tail, or 1.8bp 3 month average for that matter -- probably what spurred round of buying/short-set unwinds in minutes after results.

- Bond futures remain weaker but off lows amid renewed selling in 10s and 30s from misc accts includes prop and fast$. No deal-tied hedging after $40B high-grade debt issued in first half of the week.

- The 2-Yr yield is up 0.6bps at 0.2247%, 5-Yr is up 2bps at 0.8278%, 10-Yr is up 3.4bps at 1.364%, and 30-Yr is up 1.3bps at 2.0114%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00063 at 0.07800% (-0.00050/wk)

- 1 Month -0.00113 to 0.09550% (+0.00025/wk)

- 3 Month +0.00350 to 0.12475% (-0.00363/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00000 to 0.15738% (+0.00688/wk)

- 1 Year -0.00300 to 0.23988% (+0.00250/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.05%, $904B

- Broad General Collateral Rate (BGCR): 0.05%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $350B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.025B accepted vs. $4.200B submission

- Next scheduled purchases

- Fri 8/13 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Mon 8/16 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 8/17 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Reverse Repo Operations, Over $1T Again, But No New High - Yet

NY Fed reverse repo usage climbs to $1,000.460B from 70 counterparties vs. $998.654B on Tuesday. Compares to record high of $1,039.394B on Friday, July 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Over +40,000 Blue Mar 99.50 calls, 2.0 (30k Blocked; >+60k/wk)

- +5,000 short Dec 99.37/99.50 2x1 put spds, 0.5

- +5,000 Blue Dec 98.00/98.37 2x1 put spds, 4.25

- -5,000 Blue Mar 98.00/99.12 strangles, 15.5

- -5,000 Blue Sep 98.50/98.75 put spds, 10.5

- Overnight trade

- +6,000 Green Dec 98.43/98.68/98.75/99.00 put condors, 6.0

- -5,000 Gold Dec 97.62/98.12 put spds, 8.5

- 1,500 short Dec 99.50/99.68 2x1 put spds

- -5,000 TYZ 133 straddles, 2-30 to 2-29

- -5,000 TYV 131/135 strangles, 22

- +6,000 FVU 123.75/124 strangles, 24

- -2,000 TYU 133.5 straddles, 133.5, 59

- -5,000 TYV 131.5/134.5 strangles, 35

- Overnight trade

- +7,500 wk2 TY 133/133.25 put spds, 1 vs. 133-26/0.06%

- +1,500 TYV 132/132.5 put spds, 10

- +6,000 USU 161 puts, 27

EGBs-GILTS CASH CLOSE: Peripheries Impress

Bunds and Gilts weakened slightly Thursday, with Gilts underperforming amid bear steepening.

- Periphery spreads took advantage, with Italy outperforming. 10Y BTP spreads/Bunds came tantalizingly close to the key 100bp mark again.

- Bonds initially pushed lower after the higher US PPI print, but we have since faded off the lows.

- Little in the way of European-specific catalysts otherwise.

- Issuance is done until Tuesday next week, and there are no central bank speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.746%, 5-Yr is up 0.4bps at -0.724%, 10-Yr is up 0.4bps at -0.46%, and 30-Yr is up 0.2bps at -0.007%.

- UK: The 2-Yr yield is up 3.2bps at 0.155%, 5-Yr is up 3.9bps at 0.313%, 10-Yr is up 3bps at 0.601%, and 30-Yr is up 4.1bps at 0.987%.

- Italian BTP spread down 2.7bps at 100.4bps/ Spanish down 1.9bps at 68.2bps

OPTIONS/Bund Call Short Cover Features

Thursday's European rate/bond options flow included:

- RXU1 178 calls bought for 9 and 10 in 25k total. Said to be a short cover

- RXU1 176/175ps, bought for 20 in 1k

- ERV1 100.50/100.62cs vs 100.50/100.37, sold the call spread at 3.75 in 4.5k

- 0RH2 100.50^ vs 100.25/100ps, bought the ps for 2.75 in 1.5k (also traded Weds)

- 0RH2 100.50/100.37/100.25p ladder, bought for 2 in 3k

- 0LU1 99.62/99.50/99.25 broken put fly, bought for 4 in 2.5k

- 3LU1 99.25/99.00ps vs 2LU1 99.25p, bought the blue for 2 in 4k

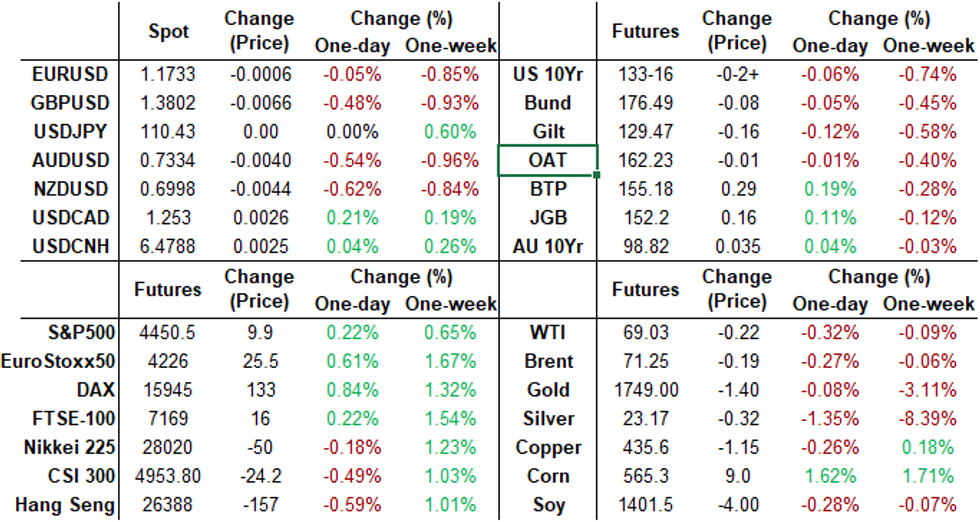

FOREX: GBP, AUD and NZD Give Up US CPI Inspired Gains

- Broad dollar indices are trading around 0.15% higher on Thursday as US yields reversed yesterday's move lower.

- G10 movers were concentrated in Antipodean FX and Sterling, all retreating over 0.5% and given back the entirety of yesterday's advance.

- EURUSD and USDJPY lacked inspiration both trading in incredibly narrow 20-pip ranges. EURUSD's lack of traction higher leaves the 1.1704-06 key support vulnerable in the short-term.

- EURGBP had a notable move back to the 0.85 level, that had marked previous support for the pair before the move down to 0.8450, representing the lowest level since February last year. Moving average studies remain in a bear mode highlighting a downside theme.

- For cable, the pair remains below the 50-day EMA at 1.3886, the key upside level. Support undercuts at the Jul 27 low of 1.3767. Should this give way, the outlook deteriorates, opening scope toward the bear trigger of 1.3572.

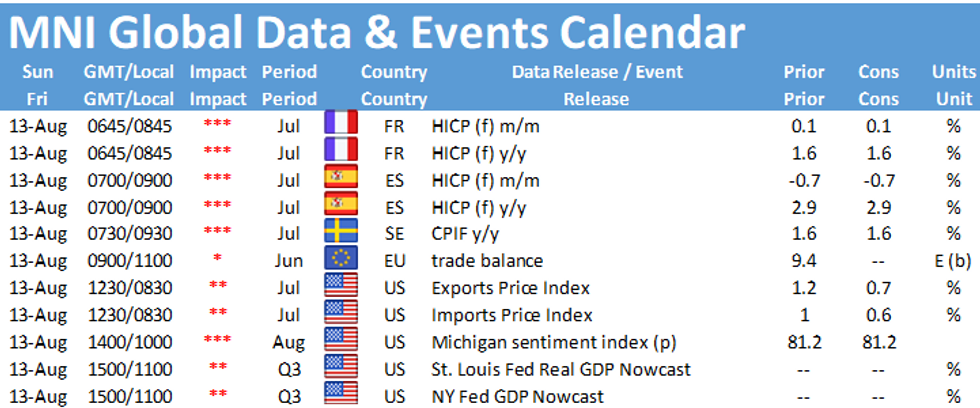

- Friday's docket is doubtful to trigger any significant currency volatility, with University of Michigan Sentiment data unlikely to move the dial. Attention will likely turn towards next week's US retail sales report as well as the latest set of FOMC minutes on Wednesday.

FX/Expiries for Aug13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-60(E562mln), $1.1825-35(E926mln)

- USD/JPY: Y110.00($540mln), Y110.45-50($1.7bln), Y111.25($665mln)

- AUD/USD: $0.7600(A$627mln)

- USD/CAD: C$1.2475($612mln), C$1.2600-10($1.2bln), C$1.2650-60($1.1bln)

PIPELINE: No New Issuance

- Date $MM Issuer (Priced *, Launch #)

- 08/12 No new $Benchmark issuance Thursday

- $4.8B Priced Wednesday

- 08/11 $1.1B *Air Lease Corp $600M 3Y +60, $500M 7Y +125, relaunched, upsized to $1.1B

- 08/11 $1B *Royal Caribbean 5NC 5.5%

- 08/11 $1B *Equifax 10Y +105

- 08/11 $800M *Public Service Co Oklahoma $400M 10Y +90, $400M 30Y +115

- 08/11 $500M *Ventas Realty 10Y +120

- 08/11 $400M *Sichuan Development 5Y 2.8%

EQUITIES: Cash Markets Inch to a New Record High

- The Dow Jones inched to a new record high Thursday, printing up at 35,510.7 thanks to a solid contribution from saleforce.com and Apple. The gains were somewhat short-lived however, with prices retreating into the close to make for a mixed performance on Wall Street.

- The healthcare and tech sectors outperformed in the S&P 500 - running somewhat counter to the trend evident from Monday's opening bell - while energy and material resumed their recent decline.

- Across Europe, with the picture was similarly mixed as Germany's DAX and France's CAC-40 posted solid gains, but the UK's FTSE-100 lagged.

- Focus Friday turns to US import/export price indices as well as the prelim August Michigan confidence survey.

COMMODITIES: Silver Continues to Look Weak as Death Cross Forms

- Despite gold grabbing the headlines earlier in the week on the acute slip lower, silver is now solidly the underperformer, with the Gold/Silver ratio now trading at the best levels of the year the yellow metal solidly outperforms in relative terms.

- For the spot Silver price, markets formed a death cross in the DMA space this week, meaning the 50-dma slipped below the 200-dma, which may add further pressure in the near-term.

- In energy markets, WTI and Brent crude futures finished broadly flat, taking the cue from the OPEC monthly oil market report, which kept world oil demand forecasts for 2021 and 2022 unchanged.

- NatGas futures traded under pressure, with the active contract shedding over 3% on the larger than expected build in stockpiles: EIA data showed a build of 49BCF in the most recent week, the largest since early July.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.