-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI ASIA MARKETS ANALYSIS: Consumer Sentiment Sours

US TSY SUMMARY: Drop In Consumer Sentiment Triggers Bull Flattening

Following an initially quiet start, US TSYS rallied sharply following the release of the University of Michigan Consumer Sentiment survey for August, which reported an abrupt deterioration in confidence.

- The preliminary read came in at 70.2, well below the 81.2 expected print.

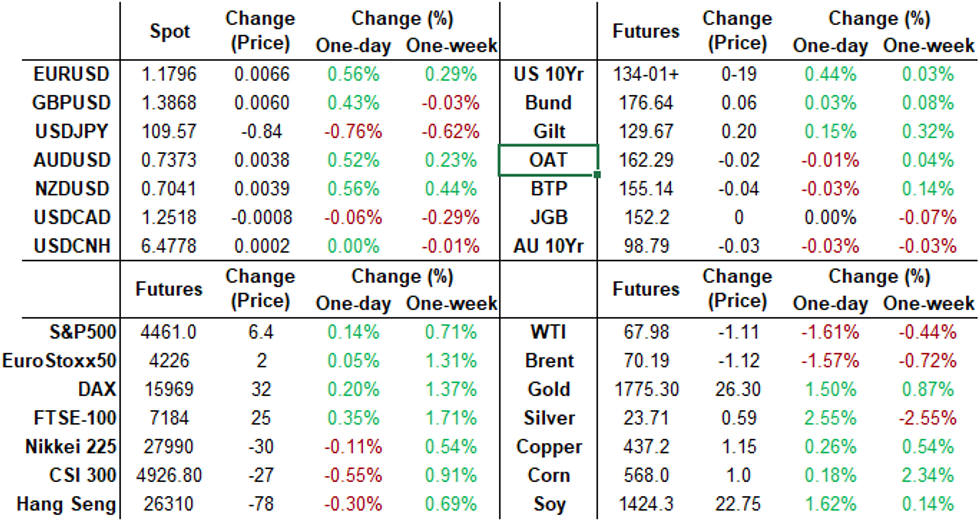

- TSY cash yields are now 1-6bp lower on the day with the curve bull flattening.

- Last yields: 2-year 0.2151%, 5-year 0.7892%, 10-year 1.2951%, 30-year 1.9448%

- TYU1 has traded up towards the highs of the day and last printed 133-30+ (L: 133-15 / 133-31+).

- Equities have taken a leg lower with the S&P500 trading down to 4463.32, from an afternoon high of 4467.03.

- Focus next week shifts to Advance Retail Sales on Tuesday, while Fed Chair Powell scheduled to take part in a town hall discussion on the same day.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00037 at 0.07763% (-0.00087/wk)

- 1 Month -0.00275 to 0.09275% (-0.00250/wk)

- 3 Month -0.00050 to 0.12425% (-0.00413/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00075 to 0.15663% (+0.00613/wk)

- 1 Year -0.00113 to 0.23875% (+0.00138/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $247B

- Secured Overnight Financing Rate (SOFR): 0.05%, $909B

- Broad General Collateral Rate (BGCR): 0.05%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $363B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $34.314B submission

- Next scheduled purchases

- Mon 8/16 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 8/17 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

Reverse Repo Operations, New High

NY Fed reverse repo usage climbs to new record high of $1.1T from 70 counterparties vs. Thursday's record of $1,087.342B.

System reserves continue to climb, rising by $81.4B in the week to Weds Aug 11, and $182.6B over the past 4 weeks. Fed net asset purchases have totaled $100B over the past 4 weeks, but the vast majority of the reserves created have been withdrawn into reverse repo (total $85B).

- The other big contributor to reserve growth has been the drawdown in the Treasury General Account, amounting to $57.7B last week, and $270.0B over the past four weeks.

OPTIONS/Long-End Tsy Put Seller Stands Out

Friday's Eurodollars/Treasury options flow included:

- EDV1 99.8125/99.875 call spread 1x2 (+1 leg) bought for 1.75 on 10k (ref 99.82)

- 2EU1 99.06/98.81ps 3x2, sold at 10.5 in 5k

- 2EZ1 99.12/98.75ps 1x2 vs 2EZ1 99.50c, sold the ps at 7 in 5k

- 3EU1 98.75/98.62/98.37 with 3EZ1 98.50/98.25/98.00p ladder strip, sold at 9 in 2k

- TYX1 131.5/134.5 strangle 49's sold 10k settled 54

- USU1 161p, bought for '14 in 5k

EGBs-GILTS CASH CLOSE: BTPs Can't Quite Break Through

Core FI rallied strongly in the afternoon for the 2nd time this week after softer than expected US data - Wednesday it was CPI, today a very weak UMichigan consumer sentiment survey.

- Bunds and Gilts had been strengthening with bull flattening going into the 1500BST release, but yields extended to session lows following, and closed not far off.

- Outside of that, the main source of price intrigue was in Italian 10Y BTP spreads, which tested 100bp vs Bunds (99.5bp session low - Jun 17 low of 98.1bp would be next up).

- Relatively light volumes befit a nearly blank events calendar. French and Spanish Jul CPI final readings came in more or less unchanged from flash, and only supply was UK bills. No ECB/BoE speakers either.

- Tonight sees ratings reviews of Ireland (Moody's) and Belgium (DBRS), but a limited slate early next week (no major data, supply or speakers Monday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.7bps at -0.739%, 5-Yr is down 0.6bps at -0.73%, 10-Yr is down 0.7bps at -0.467%, and 30-Yr is down 1.5bps at -0.022%.

- UK: The 2-Yr yield is down 1.9bps at 0.136%, 5-Yr is down 1.8bps at 0.295%, 10-Yr is down 2.8bps at 0.573%, and 30-Yr is down 2.6bps at 0.961%.

- Italian BTP spread up 0.9bps at 101.3bps /Spanish spread up 0.4bps at 68.6bps

OPTIONS/Euribor Put Selling And Bund Put Buying Feature Friday

Friday's European rates/bond options flow included:

- RXU1 175p, bought for 7 in 2,854

- RXV1 172.5/174.5^^, sold at 101 in 1.5k

- RXZ1 170.00 put bought for 40 in 3k

- ERU1 100.50p, sold at 0.15 in 20k

FOREX: Greenback Under Pressure, JPY and CHF Outperform

- Broad dollar indices lost ground on Friday on the back of weaker import price index data and a sharp drop in University of Michigan sentiment data.

- The dollar index (-0.56% as of writing) had been on the backfoot, approaching the post CPI lows before the data, however the releases exacerbated the weakness, with the index sharply extending to the lowest levels of the week.

- Notable advances were seen in historically safe haven currencies with the Japanese Yen and Swiss Franc seeing particular strength.

- USDJPY (-0.72%) continued to trade with a heavy tone, extending losses for the week sub 110.00, hovering just above 109.50. Initial support not seen until 108.72, before more significant support at 108.47, a Fibonacci retracement.

- USDCHF (-0.86%) reversed aggressively almost back to unchanged on the week after a strong breakout, initiated last Friday following the payrolls data. The pair may look to 0.9120 previous lows for some short-term support.

- Elsewhere gains in line with the magnitude of DXY weakness were seen for GBP, AUD, NZD and NOK.

- The laggards were the Chinese Yuan and the Canadian Dollar, unable to benefit from the USD weakness.

- Attention will likely turn towards next week's US retail sales report as well as the latest set of FOMC minutes. The RBNZ will also meet where they are expected to raise the official cash rate to 0.5%. Additionally, the UK and Canada will report July CPI data.

FX/Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/GBP: Gbp0.8590-00(E515mln)

- USD/CNY: Cny6.45($1.4bln)

EQUITIES: Staples Over Cyclicals as S&P Hits Another High

- A solid showing from the consumer staples sector drove the S&P 500 to a new alltime high Friday, keeping the current bull run intact to extend gains to over 100% from the COVID-inspired bottom.

- A rally across food and beverage names including Tyson, Kellogg and Kraft Heinz as M&A speculation circulated after the proposal to buy Pilgrim's Pride from Brazil's JBS - a deal worth around $7bln.

- Recent gains have confirmed a resumption of the uptrend and signals scope for further strength. The focus is on 4481.75 next, a Fibonacci projection. Key support is 4224.00, Jul 19 low.

- Gains across continental markets were similarly uniform, with gains of 0.2-0.4% across core indices. The UK's FTSE-100 outperformed, touching new 18-month highs in the process.

COMMODITIES: WTI, Brent Ebb Lower as Recovery Fades

- WTI and Brent crude futures headed into the Friday close lower, with oil benchmarks fading as the recovery off the Monday low runs out of steam. The moves follow a sharp downtick in the Uni. of Michigan sentiment survey, which dropped 11 points. A drop of that size has only been seen on a handful of occasions: the depths of the COVID crisis, the 2008 financial crisis, Hurricane Katrina and the 1990 Kuwait crisis.

- WTI crude futures hold south of the 50-day EMA at 69.98, which switches from support to resistance. This re-initiates the downside argument, opening $65.01, Jul 20 low and the key support.

- While energy products slipped, precious metals gained, with USD weakness and a vague sense of risk-off buoying both gold and silver. Silver had lagged off the Monday lows but the gap closed somewhat Friday, with silver rallying as much as 2.5%.

- Nonetheless, silver hold below the Monday lows, with the formation of a death cross (50-dma < 200-dma) this week adding to recent bearish pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.