-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bonds Buoyed Ahead Jackson Hole Conf

US TSYS: Bonds Buoyed, Risk Sours Ahead Jackson Hole Economic Symposium

Rates trading mixed -- off lows after the bell with Bonds inching higher as appetite for risk sours as Pentagon officials hold press conference to discuss the bombing attacks, deaths at Kabul airport. Somber end to a day that would otherwise be more focused on Friday's Jackson Hole/remote economic symposium.

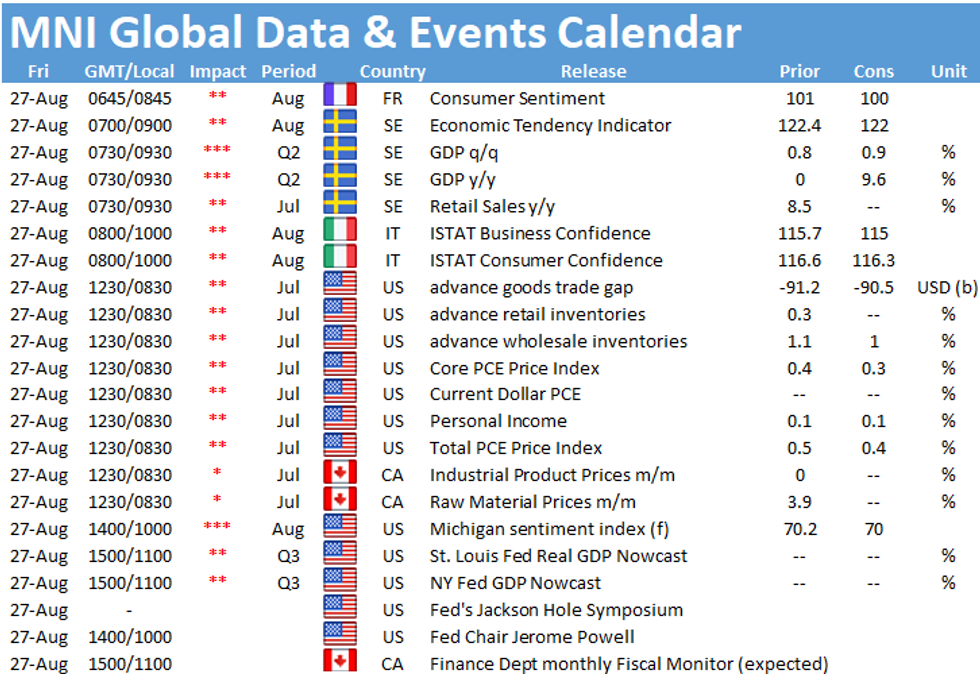

- The event agenda will be posted on the KC Fed site tonight at 2000ET. Fed chair Powell speaks Fri at 1000ET -- but six generally hawkish Fed speakers are expected to speak on Bbg, CNBC prior to the Fed chair's speech.

- Today, KC Fed's George, StL's Bullard and Dallas' Kaplan expressed their opinions.

- Rates weakened as KC Fed George expressed "good arguments" for tapering asset purchases sooner than later on Bbg interview, open minded about pace.

- USD firmed after StL Fed Bullard said the "ECONOMY IS BOOMING AND DOESN'T NEED MUCH MORE STIMULUS" Bbg while implying a timeline with: "FINISHING TAPER BY END-1Q WOULD GIVE FED `OPTIONALITY'" Bbg.

- Dallas' Fed Kaplan prefers to taper sooner at a gradual pace.

- Overall trade volumes remained heavy due to Tsy quarterly futures rolling, now over 75% complete. Tsys traded lower after $62B 7Y note (91282CCV1) auction tailed 5bp: 1.155% high yield vs. 1.150% WI. Strong Indirect take-up climbed to 61.07 vs. 58.37 in July (58.45% 5M avg).

- The 2-Yr yield is down 0.2bps at 0.2367%, 5-Yr is up 2.2bps at 0.8395%, 10-Yr is up 0.2bps at 1.3407%, and 30-Yr is down 1.2bps at 1.9365%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00063 at 0.07575% (-0.00163/wk)

- 1 Month -0.00325 to 0.08463% (-0.00125/wk)

- 3 Month -0.00300 to 0.12075% (-0.00762/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00012 to 0.15788% (+0.00525/wk)

- 1 Year -0.00212 to 0.23538% (-0.00125/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $912B

- Broad General Collateral Rate (BGCR): 0.05%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $358B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $42.281B submission

- Next scheduled purchase

- Fri 8/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage slips to 1,091.792B from 76 counter-parties vs. Wednesday's record high of $1,147.089B. Prior record high of $1,135.697B set Monday, Aug 23.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +3,000 Green Dec 98.50/98.75/98.87 broken put trees, 1.75

- +5,000 Green Dec 99.25 calls, 4.0 vs. 98.935/0.20%

- Block, +10,000 Red Mar'23 97.25 puts, 2.0

- +5.000 Jun/Red Sep/Red Dec 100 call strip, 4.0

- +5,000 Red Dec 99.50/99.75 2x1 put spds. 0.0

- +5,000 short Nov 99.50/99.62 2x1 put spds, 1.0

- 15,000 Green Sep 98.93/99.06 2x1 put spds vs. Green Oct 98.62/98.81 put spds, 1.75 cr/Oct sold over

- +5,000 short Nov 99.50/99.62 2x1 put spds, 1.0

- Overnight trade

- Block, +50,146 Blue Oct 98.12/98.37 put spds, 4.5

- 5,000 Blue Sep 98.87 calls, 1.0

- 3,500 Gold Sep 97.75 puts, cab

- 3,500 Gold Dec 98.00/98.25 put spds

- 2,000 Green Dec 99.12/99.25/99.50 call trees vs. 98.75/98.87 put spds

- 2,000 Green Dec 98.43/98.68/98.75/99.00 put condors

- 3,000 TYV 131.5/132.5 put spds, 18, over 20k on day

- +20,000 TYU 133.5/134 call spds, 10

- +2,000 TYU 133.5/133.75/134 call trees, 0.5

- +2,000 USV 156 puts, 13

- Overnight trade

- Block, 10,000 FVU 124 calls, 3

- 2,000 FVV 124/124.5 1x3 call spds

- 5,000 TYU 133.5 puts vs. TYX 130/131.5 put spds

- 2,000 TYV 131.5/133 2x1 put spds, 1.0 vs. 133-00/0.10%

EGB/Gilts cash close: Bunds at lowest levels in a month this morning

- Bunds were the underperformers in global core fixed income today with 10-year Bund yields up 1.5bp on the day as the curve bear flattened and Schatz remained flat on the day. Indeed, 10-year Bunds futures are at their lowest level in a month, but are higher than the nadir of around 8:00BST/9:00CET this morning.

- Greek spreads have widened notably today, with GGB-Bund 10-year spreads 4.7bp wider on the day. There is no real new news, but there continues to be market discussion of whether Greek bonds will be eligible for purchase under the APP when PEPP eventually ends next year. The market is still hopeful, but the ECB have not given much encouragement to this possibility yet.

- Most other EGB spreads have been unremarkable.

- Gilts have been less affected by the sell-off than either Bunds or Treasuries with the curve seeing a parallel shift lower.

FOREX: CAD underperforms as the USD is king on Thursday

- CAD has been the underperformer today, down 0.6% against the USD, with USDCAD reversing Tuesday's move lower but still moving nowhere near the highs of Friday. CAD has not been helped by falling oil prices today.

- The dollar has remained strong, initially on higher yields, and later on risk aversion as events in Afghanistan spook the market somewhat. In keeping with the latter, the yen and euro are the next best performers in G10.

- Focus is now shifting to tomorrow's Jackson Hole Economic Symposium. There are six scheduled media appearances from FOMC members ahead of Powell's speech which is due at 10:00ET/15:00BST.

PIPELINE: Total $8.85B Priced on Week

No new corporate or supra-sovereign issuance Thursday; $8.85B/wk

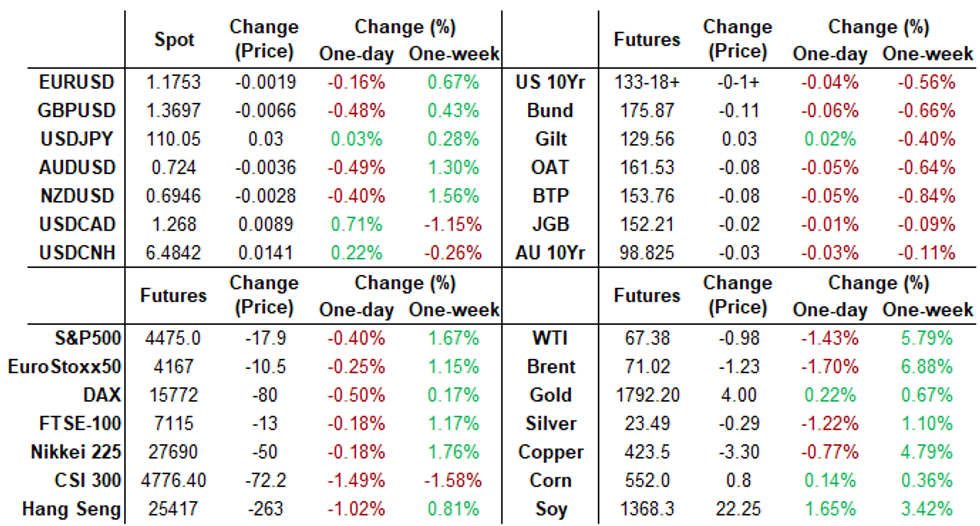

MARKET SNAPSHOT

Key late session market levels

- DJIA down 143.25 points (-0.4%) at 35364.8

- S&P E-Mini Future down 19.25 points (-0.43%) at 4479.75

- Nasdaq down 51.3 points (-0.3%) at 14999.74

- US 10-Yr yield is up 0.3 bps at 1.3424%

- US Sep 10Y are down 1.5/32 at 133-18.5

- EURUSD down 0.002 (-0.17%) at 1.1762

- USDJPY up 0.02 (0.02%) at 110

- WTI Crude Oil (front-month) down $1.08 (-1.58%) at $67.47

- Gold is up $0.13 (0.01%) at $1796.30

- EuroStoxx 50 down 11.25 points (-0.27%) at 4161.61

- FTSE 100 down 25.14 points (-0.35%) at 7118.82

- German DAX down 67.04 points (-0.42%) at 15769.34

- French CAC 40 down 10.45 points (-0.16%) at 6651.43

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.