-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Jobs Miss Not Enough to Stall Taper

US TSYS: Big Jobs Miss Not Big Enough to Forestall Late 2021 Taper

Big miss from forecasters on Aug jobs data (+235k vs.+725k est) and Big initial ranges in the minutes following Friday's early headline data.- Tsys initially gapped higher/broke range on the large data miss (July up-revision to +1.053M vs. +943k did little to temper the move. Tsys completely reverse post-data gap bid and extend session lows w/yld curves bear steepening to new highs shortly after. It took a little while to explain (justify?) moves as rates held to lower range.

- General agreement: on one hand the weaker than expected Aug jobs gain will forestall any taper annc at the Sep FOMC, RBS/NatWest economists said. On the other, it's still a +235k gain -- not small enough for the Fed "to back away from their 'this year' signal either."

- Wrightson economists downplayed any covid-tied lag to low job gains, positing the slowdown more likely due to "resumption of in-person school attendance along with the expiration of emergency unemployment benefits will boost labor supply in the months ahead, resulting in larger payroll gains in future months."

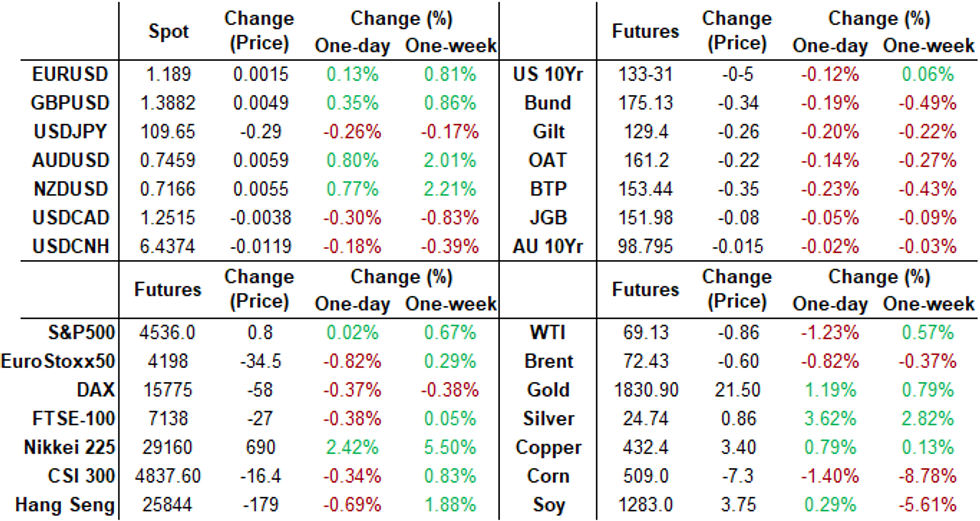

- The 2-Yr yield is up 0.1bps at 0.2061%, 5-Yr is up 2.1bps at 0.7852%, 10-Yr is up 3.9bps at 1.3223%, and 30-Yr is up 4.5bps at 1.942%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00275 at 0.07075% (-0.00538/wk)

- 1 Month +0.00000 to 0.08288% (-0.00313/wk)

- 3 Month -0.00213 to 0.11550% (-0.00438/wk) ** New Record Low

- 6 Month +0.00075 to 0.14838% (-0.00638/wk)

- 1 Year +0.00000 to 0.22275% (-0.01238/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.05%, $952B

- Broad General Collateral Rate (BGCR): 0.05%, $397B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $360B

- (rate, volume levels reflect prior session)

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

- Tue 9/07 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 9/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Thu 9/09 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 09/10 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage climbs to 1,074.707B from 74 counter-parties vs. $1,066.987B Thursday. Record high of $1,189.616B set Tuesday, Aug 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 3,000 Green Oct 98.93/99.06 2x1 put spds

- Block, 12,000 short Oct 99.56/99.62 put spds, 3.5

- +11,000 Blue Sep 98.50/98.62 put spds, 1.0 vs. 98.705/0.08%

- +10,000 short Dec 99.25/99.50 put spds

- 3,000 TYZ 131.5 puts, 23

- 10,000 TYV 130.75/131.75/132.75 put flys, 10

- +5,000 TYX 133 puts, 41

- +13,000 FVV 123.25 puts, 7

- Overnight trade

- +8,276 FVV 123.75/124.25 1x2 call spds, 7

- 3,700 TYV 133.25 puts, 25

- 2,000 TYV 132/133 put spds

FOREX: NFP Miss Extends Greenback Losing Streak

- The lower than forecast print for non-farm payrolls of 235k prompted a quick move lower in the greenback. Despite the initial moves reversing quite quickly, the dollar index remained under pressure throughout the US session settling around 0.25% lower for Friday.

- The move lower in the DXY extends its losing streak to 6 days and notably the index has fallen on 10 of the past 11 trading sessions.

- Antipodean FX tops the G10 pile on Friday with both AUD and NZD firming 0.8%. Despite the majority of the gains coming before the US data, the weaker numbers kept both currency pairs on the front foot to close the week.

- EURUSD spiked to noted resistance at 1.1909, matching with the July 30th highs. The single currency traded back down to around 1.1875 ahead of option expiries and the WMR fix, however, broad dollar pressure leaves the pair hovering just under the 1.19 mark ahead of the close.

- USDJPY fell firmly back below 110, with the move lower in equity indices adding some buoyancy to the Japanese Yen.

- CNY, CNH strength this week has put the redback at its strongest levels against the USD since mid-June, infitting with the weaker dollar theme since the Monday open.

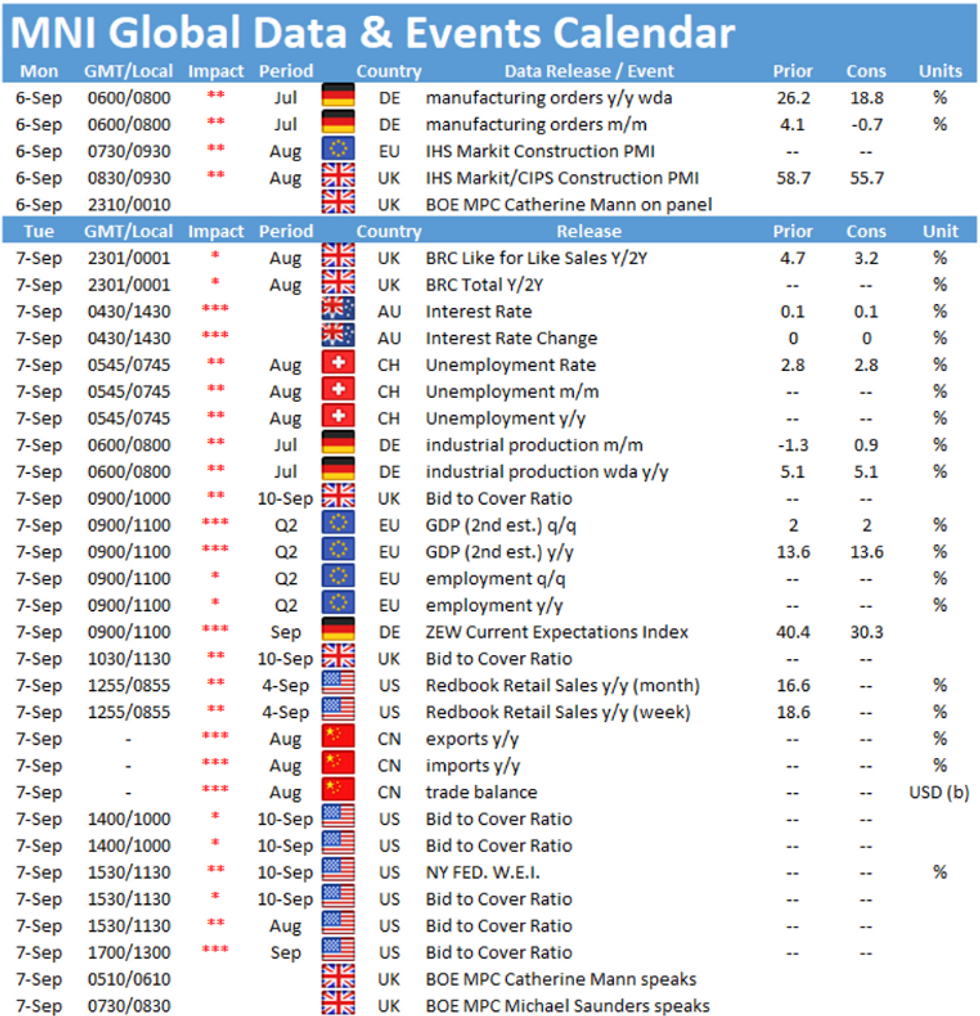

- US and Canadian Labor Day holiday on Monday. Markets will focus on key central bank meetings next week, including the RBA, BOC and Thursday's ECB decision. The week will be capped off by Canadian employment figures and US PPI data.

FOREX: Expiries for Sep06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E512mln), $1.1945-65(E1.1bln)

- GBP/USD: $1.3900-05(Gbp501mln)

- EUR/GBP: Gbp0.8590(E596mln)

PIPELINE: Issuers Sidelined Ahead August NFP

- Date $MM Issuer (Priced *, Launch #)

- 09/03 No new high grade debt issuance scheduled ahead NFP, to resume following extended holiday weekend

- $7.025B to price Thursday

- 09/02 $5B *World Bank 7Y +6

- 09/02 $1.025B *Japan Tobacco $625M 10Y +97.5, $400M 30Y 3.3%

- 09/02 $500M *China Development Bank 3Y Green +23

- 09/02 $500M *Contemporary Amperex Tech 5Y +85

- 09/02 $Benchmark Ahli United Bank 5Y +200a

EQUITIES: Stocks Dip on Tepid Jobs Report, With Taper Still on Track

- Equity markets initially responded positively to the poorer-than-expected August jobs report, with the headline missing expectations by some distance: +235k vs. Exp. +733k. The theory that bad economic data would delay any tapering of asset purchases was short-lived though, with the data suggesting underlying wage pressures were still present.

- Equity futures eventually settled lower, with the e-mini S&P off just over 5 points into the close. The S&P 500's financials sector led losses, with a bank names failing to benefit from the moderately steepening US sovereign curve.

- Across Europe, indices all closed solidly lower, with the CAC-40 closing off over 1% to be the poorest performing core market. The UK's FTSE-100 was spared from the bulk of the losses, but still dropped 0.3%.

COMMODITIES: Precious Metals Buoyed as USD Extends Lower

- Gold and silver held decent gains into the Friday close, with silver outperforming notably to touch the best levels since early August. The Silver rally puts the metal on track to top key resistance at the 50-dma (which contained prices post-NFP) at $24.87. A break north of here opens early August highs and the 200-dma of $25.88.

- In contrast, the disappointing payrolls release worked against energy markets, pressuring WTI and Brent crude futures into negative territory ahead of the extended Labor Day weekend.

- Despite the fade off the highs, WTI held the bulk of the Thursday gains, keeping the outlook tilted higher into the Friday close. A break back above $70.61 opens $71.69, and the August highs at $73.52.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.