-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Early Geopol Risk Roils, Focus Turns To Fed

MNI ASIA MARKETS ANALYSIS: South Korea Rescinds Martial Law

MNI ASIA MARKETS ANALYSIS - US-UK-Australia Security Pact Rocks The Boat

US TSYS SUMMARY: Retail Sales & AUKUS Security Pact Steal The Limelight

Treasuries have traded weaker while the S&P and Nasdaq recovered most of the losses posted earlier in the session.

- UST cash yields are now 1-4bp higher on the day with slight underperformance in the belly of the curve. TYZ1 trades at 133-02, towards the bottom end of the day's range (L: 132-30 / H: 133-14+).

- US retail sales data for August surprised higher with Advance reading coming in at 0.7% M/M vs -0.7% expected and the Ex Auto figure printing 1.8% M/M vs the 0% consensus.

- The US, UK and Australia earlier announced a new security pact in a bid to counter Chinese naval power in the South China Sea. Under the new AUKUS agreement, the US and UK will assist Australia in building nuclear submarines. The move was warmly received by Taiwan and Japan, while being swiftly rebuked by China as well as France, which has now lost a previous submarine deal struck with Canberra.

EGBs-GILTS CASH CLOSE: Gilts Underperform

A mixed day for the European FI space Thursday, with Gilts underperforming, Bunds flat, and periphery spreads tightening.

- With few catalysts emanating from Europe, US data surprises once again dictated the tempo in the afternoon - after strong retail sales numbers, Treasuries sold off, with Bunds and Gilts following.

- Gilt yields rose steadily for most of the session, leaving the UK/Germany 10Y spread nearing 2-year highs.

- In the morning, ECB's Rehn said rate hikes were not "within sight". We also had heavy supply, from France (E9bln in OAT) and Spain (E5.2bln in Bono/Obli), plus Austria 15Y syndication (E5bln in RAGB).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.2bps at -0.703%, 5-Yr is up 0.3bps at -0.621%, 10-Yr is up 0.4bps at -0.302%, and 30-Yr is up 0.3bps at 0.195%.

- UK: The 2-Yr yield is up 2.2bps at 0.285%, 5-Yr is up 3.7bps at 0.49%, 10-Yr is up 3.9bps at 0.817%, and 30-Yr is up 4.1bps at 1.118%.

- Italian BTP spread down 1.2bps at 99.6bps / Spanish down 0.9bps at 64.1bps

FX OPTIONS: Expiries for Sep17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740-50(E1.2bln), $1.1800(E1.2bln), $1.1970-80(E1.4bln)

- AUD/USD: $0.7300(A$511mln), $0.7325(A$2.5bln)

- USD/CAD: C$1.2635-45($896mln), C$1.2700($773mln), C$1.2745-60($1.5bln), C$1.2790-00($1.1bln)

- USD/CNY: Cny6.4300($652mln)

Price Signal Summary - EURJPY Weakness Extends

- In the equity space, S&P E-minis recovered yesterday but it appears too early to determine whether this is a correction or the start of a recovery that resumes the uptrend. Attention remains on the key 50-day EMA at 4410.32. This average is an important support. Key resistance is unchanged at 4539.50, Sep 3 high. EUROSTOXX 50 futures continue to consolidate. The contract remains above 4132.50, Sep 9 low. A break of this support would expose 4078.00, Aug 19 low. The bull trigger is unchanged at 4252.00, Sep 6 high.

- In FX, EURUSD is trading lower this morning. Recent weakness highlights a short-term bearish theme and a stronger sell-off would open 1.1758 next, 61.8% of the Aug 20 - Sep 3 rally. Initial resistance is at 1.1851, Sep10 high. The key resistance remains 1.1909, Jul 30 and Sep 3 high. Recent activity in GBPUSD is consolidating. The pair has defined short-term directional parameters at; 1.3913 as resistance, Sep 14 high and support at 1.3727, Sep 8 low. A clear breach of either level would provide a clearer directional signal. The Yen is firmer. USDJPY has tested support at 109.11, Aug 16, Sep 15 low. A break would open the firmer support at 108.72, Aug 4 low. EURJPY is approaching 128.60, 76.4% of the Aug 19 - Sep 3 rally. A break would signal scope for a test of key support at 127.94, Aug 19 low.

- On the commodity front, Gold is trading lower this morning but remains in a range. Bulls need to see a break of $1834.1, Jul 15 high to confirm a resumption of gains. Support to watch is unchanged at $1774.5, Aug 19 low. A break would threaten a bull theme and signal scope for a deeper reversal. WTI futures maintain a bullish outlook. The contract has cleared $71.30, the bear channel top drawn from the Jul 6 high. This reinforces current bullish conditions and opens the primary resistance and bull trigger at $74.77, Jul 7 high.

- In FI, Bund futures remain vulnerable and the contract has traded lower today. Further downside is likely and scope is for 171.16 next, 2.50 projection of the Aug 5 - 11 - 17 price swing. Gilt futures remain in a bear mode following last week's breach of support at 128.03, the Jul 6 low (cont). The contract has also traded lower this week and the focus is on 127.39, 1.50 projection of the Aug 20 - 26 - 31 price swing.

FOREX: Greenback Bounces To Three-Week Highs

- The US dollar was back in favour on Thursday as a strong US retail sales report fuelled an already buoyant greenback. The dollar index rose to its highest level since August 27, just shy of 93.00.

- Prior to the data, dollar sentiment had recovered following pressure on commodities and a short-term break lower in EURUSD.

- EURUSD maintains a weaker tone and Thursday's sell-off has confirmed a resumption of bearish pressure. After clearing horizontal support through 1.1800 the pair extended through Monday's low of 1.1770 and has tested below 1.1758, 61.8% of the Aug 20 - Sep 3 rally. Further weakness would open 1.1735, Aug 27 low ahead of the key support at 1.1664, the Aug 20 low.

- With the majority of the euro move witnessed before the US data, USDJPY was most impacted in the retail sales aftermath, rising around 40 pips from 109.40 to 109.80. This extends the bounce from yesterday's noted support at 109.11.

- Elsewhere dollar gains were broad based with GBP, AUD, NZD, CAD and CNH all falling close to 0.5%. The offshore Yuan move represents the biggest drop in nearly a month as concerns on China Evergrande Group's debt crisis and Beijing's latest push to rein in private industries exacerbates market sentiment.

- Notable weakness was seen in the Swiss franc, losing 0.75% against the dollar. USDCHF hovers just beneath the July highs of 0.9275 which if breached would see the pair trading at it's best levels since April. Interestingly the downtrend drawn from the 2020 highs looks to intersect around 0.9280, strengthening the importance of this area.

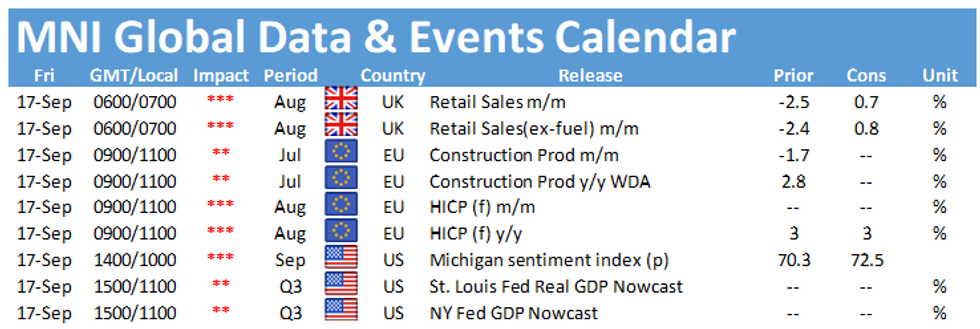

- UK Retail Sales will kick off a light calendar on Friday before final readings for Eurozone CPI are released. The week will be capped off with US consumer sentiment data from the University of Michigan.

EQUITIES: Stocks Resume Slide Despite Strength in Retail Sales

- A better-than-expected set of August retail sales failed to prop up equities Thursday, with the opening bell reversing the improvement overnight in futures. All three major indices edged lower by 0.6% or so with broad-based losses across most US sectors.

- Energy and materials names underperformed, largely in a reversal of strength in the sector as buoyant energy prices prompted a sharp rally earlier in the week. Consumer discretionary names were lower, but shielded from the bulk of the losses thanks to better sales data.

- Gold and precious metal miners took a particular hit, with Freeport-McMoRan off near 8% as spot gold and silver prices fell 2% and 4% respectively.

- Continental trade was more positive, with Spain's IBEX-35 outperforming to post gains of 1.1% at the close. The EuroStoxx50 edged higher by 0.6%.

COMMODITIES: Gold, Silver Under Pressure

- Having traded largely horizontally for the bulk of the week, spot gold broke to new September lows Thursday, re-correlating with equities and sending spot gold briefly through $1750/oz. Silver underperformed gold, dropping as much as 4% to boost the gold/silver ratio back toward the best levels of 2021.

- Dollar strength was the primary catalyst for the downtick in commodities, with the USD Index rising to touch fresh September highs. A better-than-expected set of retail sales for August boosted the dollar, with the data feeding directly into next week's FOMC meeting.

- Following the sharp rally in oil over the past two weeks, WTI and Brent crude futures edging into negative territory largely on profit-taking and greenback strength. The outlook remains positive, however, with Wednesday highs of $73.14 well within range.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.