-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Focus Back on FOMC, Risk-Off Recedes

Focus Back on FOMC, Steady Rate Expected

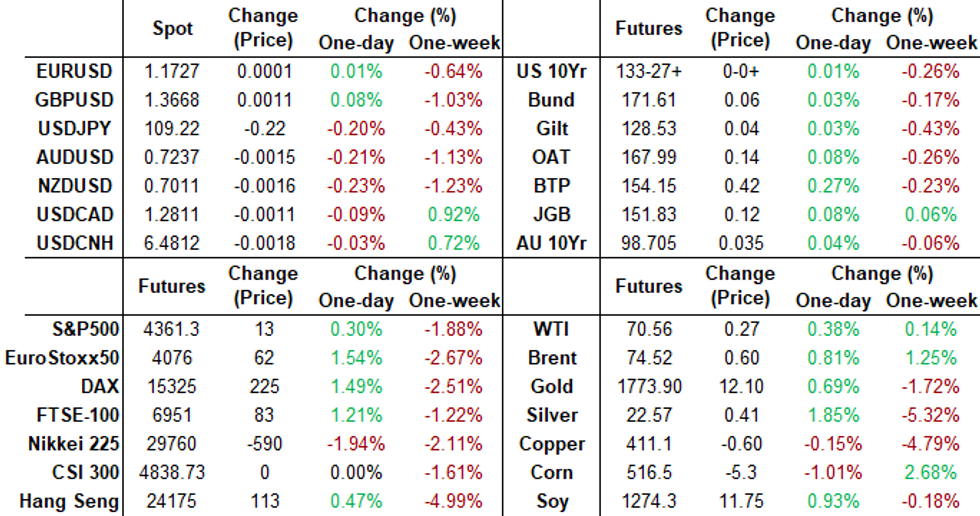

Monday's risk-off/safe-haven bid for rates as global equities sold off sharply eased Tuesday as contagion angst tied to potential default risk of China's Evergrande cooled. Tsys traded weaker but off lows by the close, equities mildly higher (ESZ1 +14.0 at 4362.0). Focus turned back to Wed's FOMC annc -- for the most part.

- There was a brief risk-off react to latest Evergrande headlines in early trade

- that were not unexpected: Tsys blipped higher briefly after latest Evergrande headline stirred default angst after China's second largest real-estate developer missed payments to two banks. China, however, said this may be the case Monday while it appeared to be a knee-jerk react recently as Tsy futures pared losses but reversed move just as quickly.

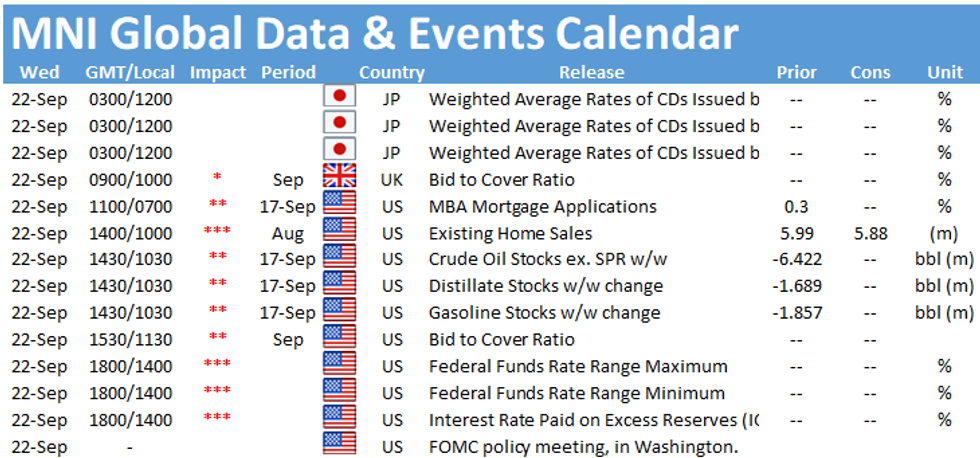

- As to the FOMC, steady rate and policy announcement widely expected, most sell-side analysts anticipating a taper annc at the November FOMC meeting.

- Aside from two-way positioning, trade included option-tied hedging ahead Fri's Oct Tsy option expiry and vs. decent pick-up in corporate issuance: $12.5B, $4B Nigeria 3pt lead.

- Tsys steady/mixed after $24B 20Y Bond auction re-open (912810TA6) stops through: drawing a high yield of 1.795% (1.850% last month) vs. 1.800% WI. Bid-to-cover 2.36 vs. 2.44 in August.

- After the bell the 2-Yr yield is down 0.4bps at 0.2118%, 5-Yr is up 0.5bps at 0.8292%, 10-Yr is up 1.4bps at 1.3243%, and 30-Yr is up 1.2bps at 1.8591%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00513 at 0.06675% (-0.00400/wk)

- 1 Month -0.00175 to 0.08175% (-0.00175/wk)

- 3 Month +0.00300 to 0.12838% (+0.00450/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00088 to 0.15338% (+0.00113/wk)

- 1 Year -0.00200 to 0.22413% (-0.00025/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $928B

- Broad General Collateral Rate (BGCR): 0.05%, $385B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $356B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $3.042B submission

- Next scheduled purchases

- Wed 9/22 No buy operation scheduled due to FOMC

- Thu 9/23 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 9/24 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED Reverse Repo Operation, Third Consecutive Record High

NY Fed reverse repo usage climbs to new record high of 1,240.494B from 78 counter-parties vs. Monday's record $1,224.289B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +59,000 Blue Oct 98.37 puts, 2.5-3.0, Open interest 105,472 coming into session

- -10,000 Blue Oct 98.50 puts, 5.5 vs. 98.575/0.36%, adds to -20k Mon

- +2,500 Green Dec 99.25 calls, 3.0 vs. 98.99/0.15%

- +3,000 Sep 99.75 calls, 7.5 vs. 99.73/0.50%

- +5,000 Sep 99.43/99.50/99.75 broken put trees, 1.5 vs. 99.735/0.10%

- +5,000 short Dec 99.25/99.50 put spds 1.5 over 99.68 calls (99.57 to .575 ref)

- Overnight trade

- 4,200 short Dec 99.43/99.56/99.50/99.62 call condors

- +10,000 Blue Mar 99.50 calls, 1.5

- Block +6,000 Blue Oct 98.75 calls, 2.0

- +5,000 FVZ 122.75 puts, 14.5

- 4,600 FVX 123.75 calls, 17

- +6,000 TYV 132/132.5 put spds, 3 vs. 133-08/0.09%

- Overnight trade

- +10,000 wk2 TY 131 puts, 3 (133-04.5 ref)

- +4,000 TYZ 130/132 put spds, 25 (132-31.5 ref)

- +5,000 FVX 122.75/123.25 2x1 put spds, 0.5 (123-13.75 ref)

EGBs-GILTS CASH CLOSE: Greece Shines

Bunds pared early losses to finish flat on the session, with Gilts underperforming and bear steepening Tuesday. It was a risk-on atmosphere for most of the session, with equities bouncing sharply from Monday's sell-off, driving cross-asset price action.

- The standout though was Greece, with 10Y spreads falling 5+bp vs Germany after ECB's Stournaras said he expects the ECB to buy GGBs post-PEPP.

- No impactful data today but plenty of supply: syndication of inaugural Green gilt (GBP10bln size on books > GBP100bln) was the highlight but also sold were 3bln of 7Y Bund and E1bln of Finnish RFGB.

- Focus turns to the Fed decision Wednesday and the BoE /PMI data Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at -0.712%, 5-Yr is up 0.2bps at -0.633%, 10-Yr is up 0.3bps at -0.317%, and 30-Yr is up 0.1bps at 0.173%.

- UK: The 2-Yr yield is up 2.3bps at 0.279%, 5-Yr is up 2.2bps at 0.485%, 10-Yr is up 1.3bps at 0.807%, and 30-Yr is up 1.7bps at 1.119%.

- Italian BTP spread down 2.2bps at 101.3bps / Greek down 5.2bps at 109bps

EGB Options: German Condors And Flies

Tuesday's European rates / bond options flow included:

- OEV1 135.75/136.00/136.25 1x2.3x1.3 call fly vs OEX1 135.50/136.00/136.50 1x3x2 call fly, bought the Nov for 4.5 in 2.75k

- RXV1 172.5/173/173.5c fly, bought for 4 in 1.5k

- RXX1 174 call bought for 13 in 5k. Same bought earlier in 4k

- RXX1 170.50/169/168.50/167 put condor, bought for 25.5 in 20k

- 3LZ1 99.00/98.87/98.75/98.62p condor, bought for 2.25 in 2.5k

FOREX: Dollar Indices Consolidate, CHF Remains Well Bid

- US Dollar Indices held expectedly narrow ranges on Tuesday as market participants await the September FOMC decision/statement due on Wednesday.

- With the bounce in equities waning throughout the latter half of the trading day, safe haven currencies remained well supported. Notably the Swiss Franc continued its recovery, resulting in USDCHF (-0.40%) sliding a full 100 pips from Monday's highs to around 0.9235.

- Antipodean FX extended on Monday's decline with AUDJPY and NZDJPY losing just shy of 0.5% and closely tracking downside momentum in the Bloomberg commodity index.

- Much more limited price action for the likes of EUR, GBP and CNH which remain close to unchanged. USDCAD also remains closely tied to the 1.2800 mark and flat for the day despite a more pronounced near 1% range following yesterday's election.

- The pair continues to display a stronger bullish short-term outlook following the recovery from 1.2494, Sep 3 low. Furthermore, moving average conditions are in bull mode reinforcing this theme, opening up the potential for a move towards the 1.2949 bull trigger, Aug 20 high.

- Overnight, the Bank of Japan kick off a busy central bank schedule over the next 48 hours.

- The main event comes later in the day with the Federal reserve meeting. Eagerly anticipated, the FOMC will likely set up a taper start in late 2021, increasingly likely in November.

FOREX: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1675-85(E1.2bln), $1.1745-50(E703mln)

- USD/JPY: Y109.00($595mln), Y109.45($685mln), Y109.80-00($1.2bln)

- EUR/JPY: Y128.50(E630mln)

- AUD/USD: $0.7250-65(A$787mln)

- USD/CAD: C$1.2750($1.5bln), C$1.2775($640mln), C$1.2840-55($542mln)

PIPELINE: Prospective Issuers Hit Sidelines After Mon's Stock Rout

Issuance that was expected to be relatively light this week, around $25B (near a third of last week's total debt issuance) as issuers hit the sidelines ahead Wednesday's FOMC annc.

- However, Monday's global stock rout on China's Evergrande default fears has sent prospective issuers to the sidelines as yields fell. Total high-grade corporate and supra-sovereign debt issuance has dropped under $10B and likely comprised of supra-sovereigns like Nigeria's three-tranche:

- 09/21 $4B #Nigeria $1.25B 7Y 6.125%, $1.5B 12Y 7.375%, $1.25B 30Y 8.25%

- 09/21 $Benchmark MetLife 3Y +45a, 3Y FRN/SOFR

- 09/21 $1.5B Rocket Mortgage $750M each: 5NC2, 12NC6

- 09/21 $1B Brookfield Property 5.5NC2

- 09/21 $850M Mondelez WNG 3Y +55a, 5Y +65a

- 09/21 $800M JM Smucker WNG +10Y +105a, 20Y +115a

- 09/21 $800M Tempur Sealy 10NC5

- 09/21 $4B #Nigeria $1.25B 7Y 6.125%, $1.5B 12Y 7.375%, $1.25B 30Y 8.25%

EQUITIES: Stocks Bounce, But Recovery Left Wanting

- Futures across Wall Street traded solidly Tuesday, with the e-mini S&P extending the bounce off Monday's lows to as much as 100 points. The S&P 500's real estate and energy sectors led the bounce, with industrials the sole sector to trade lower. Two stocks rose for every 1 that declined Tuesday, helping relieve some of the upward pressure on the VIX, which ebbed lower by around 3 points.

- Despite Tuesday's bounce, the outlook is bearish following the clear breach of the 50-day EMA. A key S/T support and bear trigger has been established at 4293.75. Price needs to trade above yesterday's high of 4418.00 to suggest the tide may have turned and signal scope for stronger recovery.

- Notable gainers in the US included Autozone, American Express and Twitter, which traded with gains of 2.5% or more, while gaming stocks including Las Vegas Sands, Penn National Gaming and Wynn Resorts slipped.

- Equity markets across Europe were similarly positive, with the gains led by France's CAC-40 and the German DAX. Both indices traded higher by 1.5% or so, with the likes of Vivendi, Deutsche Boerse and L'Oreal leading the bounce.

COMMODITIES: Oil More Stable, But No Sign of Bucking Monday Weakness

- WTI and Brent crude futures traded on a more stable footing Tuesday, although showed little sign of wholly reversing the Monday losses.

- Having traded back above $71.50/bbl level, WTI faded from the European morning, briefly showing back below the $70/bbl level. Despite weakness on Monday/Tuesday, WTI futures maintain a bullish outlook. Initial support is seen at $69.78, the 20-day EMA. Key support has been defined at $67.56, Sep 9 low.

- The correction lower in NatGas markets is extending off the mid-September high, with the market lower for a fourth consecutive session. First support undercuts at the September lows at $4.378.

- Gold and precious metals markets were more positive, with the yellow metal recouping losses toward the $1800/oz level. Despite the recovery off last week's lows, bears remain in control, and a deeper decline would open the key support at $1690.6, Aug 9 low. On the upside, initial firm resistance has been defined at $1808.7, Sep 14 high. A break of this level is required to ease bearish pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.