-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Just A Bill -- Off To Capitol Hill

US TSYS: Mnth/Qtr-End Buying Tsys, Equities Weak; Funding Bill Passes Senate

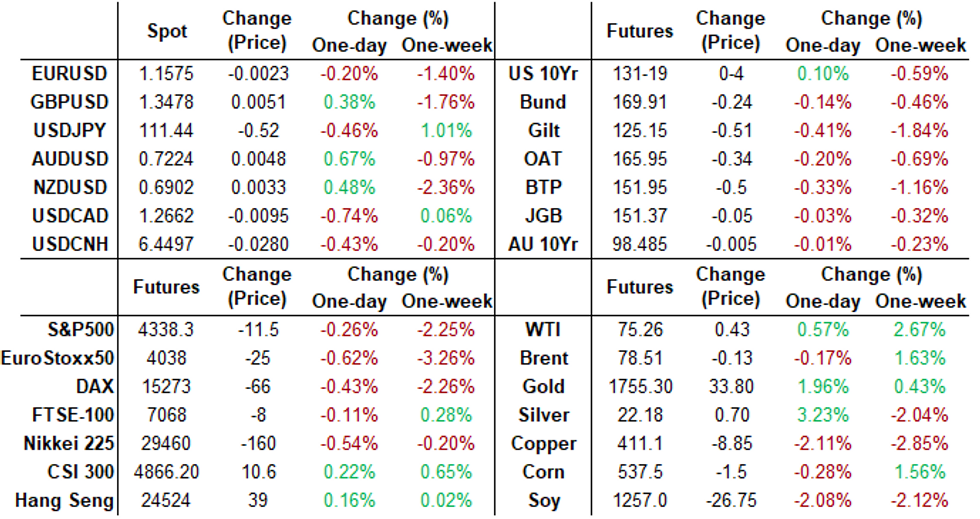

No month/quarter-end fireworks after Thursday's closing bell, Tsy futures mildly higher/near middle session range, equities attempting to pare losses with another hour to go in the session (ESZ1 -15.0). Yield curves managed to steepen, 5s30s +2.8 at 109.5 after the bell.- Not much of a react to weekly claims +11K to 362k. Still expansive: MNI Chicago Business Barometer fell 2.1 points in September to 64.7, the lowest reading February after declining to 66.8 in August. Not much of a react to Fed speakers including Fed Chair Powell and Tsy Sec Yellen as they testified to House panel.

- Though it didn't roil markets, focus on stopgap bill to fund US Govt through Dec 3 had passed in the Senate and was off to the House for another vote.

- Sources reported prop and fast$ buying in intermediates, short term plays to get ahead of month end buying from real$. Though duration estimates were not exceptionally large (US Tsy +0.7Y), TYZ1 saw decent buying from 131-19 to -22.5 after the bell.

- Swap spds widened in shorts to intermediates on decent rate paying in 2s-7s around midmorning. Limited deal-tied hedging while Sep looked to finish month w/just over $215B high-grade corporate debt issued, third largest for the year.

- The 2-Yr yield is down 0.2bps at 0.2873%, 5-Yr is down 0.3bps at 0.9874%, 10-Yr is up 0.4bps at 1.5202%, and 30-Yr is up 2.4bps at 2.0846%.

MONTH-END EXTENSIONS: PRELIMINARY Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.02Y, real extension 0.04Y; US Gov inflation linked 0.01Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.07 | 0.09 | 0.1 |

| Agencies | 0.08 | 0.06 | 0.05 |

| Credit | 0.09 | 0.12 | 0.11 |

| Govt/Credit | 0.07 | 0.1 | 0.09 |

| MBS | 0.09 | 0.07 | 0.09 |

| Aggregate | 0.09 | 0.09 | 0.09 |

| Long Gov/Cr | 0.06 | 0.08 | 0.12 |

| Iterm Credit | 0.07 | 0.1 | 0.1 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.12 | 0.12 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00438 at 0.07463% (-0.00213/wk)

- 1 Month -0.00213 to 0.08025% (-0.00488/wk)

- 3 Month -0.00075 to 0.13013% (-0.00212/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00112 to 0.15850% (+0.00312/wk)

- 1 Year -0.00400 to 0.23663% (+0.00700/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.05%, $872B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $340B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.001B accepted vs. $8.298B submission

- Next scheduled purchase

- Fri 10/01 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.425B

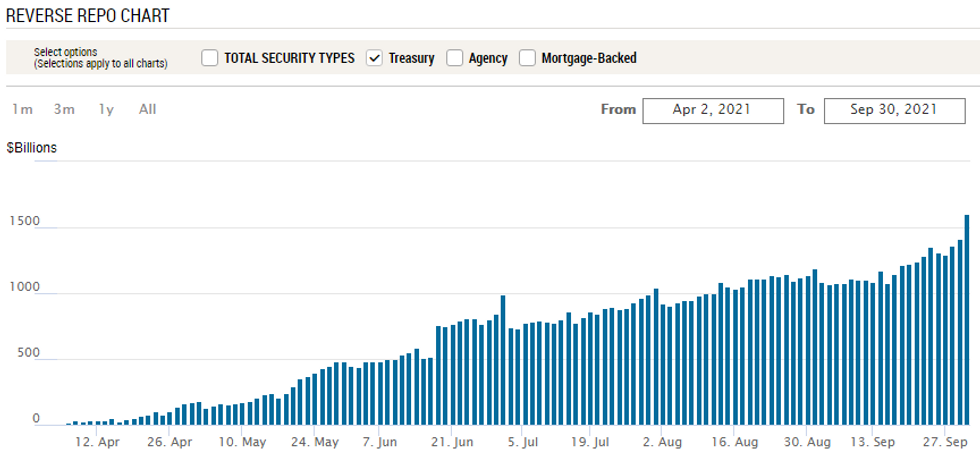

Fed: Record Reverse Repo Operation, Headed to $2T?

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to another new record high: $1,604.881B today while counter-parties jump to 92. Wednesday's prior record was $1,415.840B. At this pace, reverse repo usage will be over $2T by next week!

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -35,000 (20k Blocked) Blue Dec 98.25/98.50 put spds, 11.5 98.40 ref

- +5,000 Green Feb/Green Mar 99.12/99.37 1x2 call spd strip, 2.5

- +5,000 Jun 99.62/99.75 put spds 2.25

- +5,000 short Oct 99.43 puts, 1.5 vs. 99.485/0.28%

- Overnight trade

- 2,000 Green Dec 98.37/98.75/99.00 broken call flys

- 1,500 Blue Oct 98.37 puts vs. Blue Dec 97.87/98.37 put spds

- Block, +5,000 Green Oct 99.00/99.12 call spds, 1.0 vs. 98.86/0.10%

- 2,500 TYX 126.25/126.5 put spds

- 2,500 TYX 129/129.25/130 broken put flys, 1

- 6,800 TYX 126.25 puts, 1

- Update, over 10,000 wk2 TY 130.5/131 put spds, 12

- 5,000 FVX 122.75 calls

- Overnight trade

- 13,500 FVX 123 calls, 11

- 6,900 TYX 131 puts, 22-24

- 5,000 TYX 130 puts, 9

EGBs-GILTS CASH CLOSE: Gilts Underperform Bunds Again

Gilts underperformed Bunds again, with the long end of both the UK and German curves weakening, despite weaker equities, and some anticipation that large month-end extensions would be supportive.

- The spread of 10Y Gilts/Bunds hit a fresh 5-year high, as yields hit fresh multi-month highs.

- Meanwhile periphery EGBs traded mixed, with Italy and Spain spreads widening, and Greece and Portugal tightening.

- Eurozone CPI data (France, Italy, Germany) was largely in line w expectations albeit mostly at multi-year highs, while UK Q2 GDP was revised up 0.7pp to 5.5%.

- Final Eurozone PMIs feature Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.688%, 5-Yr is up 0.1bps at -0.557%, 10-Yr is up 1.2bps at -0.201%, and 30-Yr is up 2.4bps at 0.275%.

- UK: The 2-Yr yield is up 0.4bps at 0.409%, 5-Yr is up 1.1bps at 0.636%, 10-Yr is up 3bps at 1.021%, and 30-Yr is up 3.7bps at 1.372%.

- Italian BTP spread up 1.9bps at 105.6bps / Spanish up 0.8bps at 65.9bps

EGB Options: Mixed Trade Included Large Sterling Conditional Steepener

Thursday's European rates / bond options flow included:

- DUX1 112.2/112.1 1x3 put spds, -5,000 at 0.25

- RXX1 168.50 put bought vs sold 171/172 2x3 call spread bought for 17.5 (3kx6kx9k). closing.

- ERM3 100.37/100.50/100.62c fly 1x3x2, bought for 2.5 in 1.5k

- 0LZ1 99.12p vs 3LZ1 98.875p, bought the blue for 1.75 in 20k

- 3LZ1 98.50 put, bought for 6.5 in 6k

- SFIZ1 99.80/99.85/99.90c fly, bought for 1 in 10k

- SFIZ1 99.80/99.90cs, bought for 3 in 5k (ref 99.765)

FOREX: Single Currency Spirals as Month-, Quarter-End Boosts Volatility

- The EUR was comfortably the poorest performer in G10 Thursday, with EUR/USD extending the downtrend into month- and quarter-end despite the pullback in the USD Index. EUR/USD cleared 1.16 with conviction, touching the lowest levels since mid-July.

- GBP saw some very modest reprieve after two consecutive sessions of heavy selling pressure. GBP/USD tested the week's lows of 1.3412 briefly, before recovering off the mat to trade with minor gains following the London fix.

- In early US trade, USD strength was again the theme, helping the USD Index climb to fresh 2021 highs of 94.503. This faded through the Wall Street open, but the there's little sign yet of any bearish reversal. This keeps upside targets intact at 94.469 (the 38.2% Fib for the 2020 - 2021 downtick) and the late September highs of 94.742.

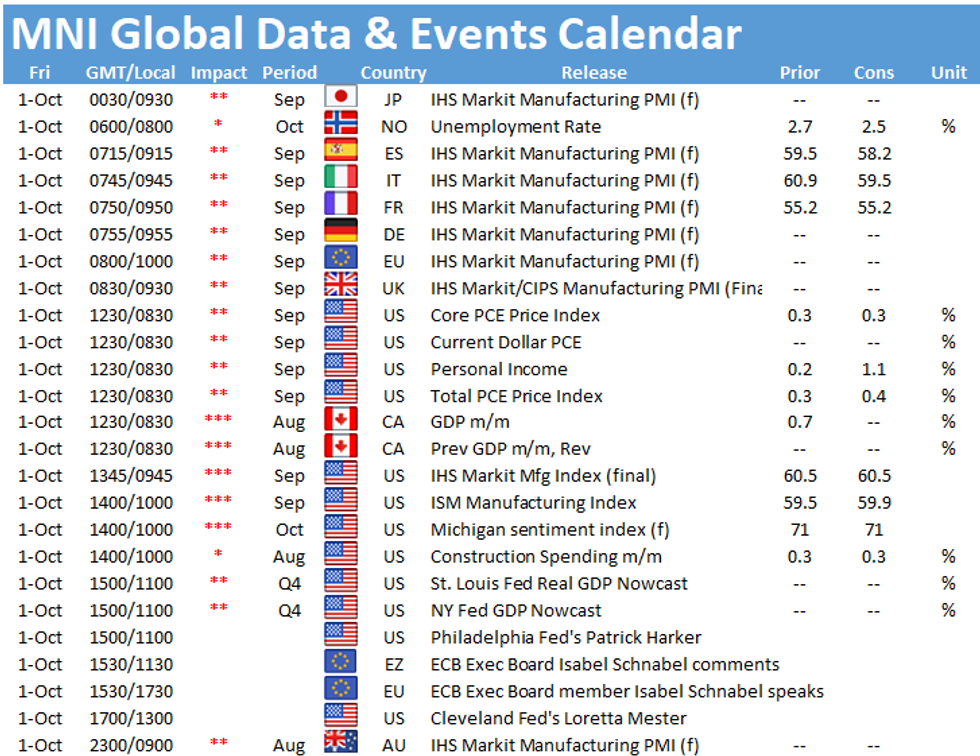

- Focus Friday turns to Japan's Tankan survey, US personal income/spending data and Canadian GDP. Fed's Harker & Mester and ECB's Schnabel are due to speak.

FOREX: Expiries for Oct01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E886mln)

- USD/JPY: Y110.50-70($1.6bln)

- AUD/USD: $0.7200(A$1.4bln)

- USD/CAD: C$1.2400-15($1.3bln); C$1.2600($1.8bln), C$1.2670-90($620mln), C$1.2700-20($1.3bln), C$1.2800($1.4bln), C$1.2850($2.0bln)

PIPELINE: Sep Issuance Third Highest for 2021

Sep 2021 total issuance at $215.635B -- could go higher but nothing on tap Thursday as issuers glide into quarter-end. This month's issuance third highest for 2021, behind March with $232.62B and January with $227.55B. Current month surpassed Sep '20 total of $207.82B.

- Date $MM Issuer (Priced *, Launch #)

- 09/30 No new issuance Thursday

- $6.25B Priced Wednesday; $28.6B/wk; $215.635B

- 09/29 $1.5B *Enbridge $500M each: 2Y +30, $5Y +60, 08/01/51 tap +125

- 09/29 $1.25B *SEK (Swedish Export Cr) 3Y SOFR +17

- 09/29 $1.15B *Athene $650M 5Y +73, $500M 5Y FRN/SOFR, 10Y +110

- 09/29 $1B *Everest Reinsurance 31Y +115

- 09/29 $750M *APICORP 5Y Green +40

- 09/29 $600M *Bank of Nova Scotia 60NC5 3.625%

EQUITIES: Stock Decline Resumes, E-mini S&P Nears Last Week's Low

- Weakness in equity markets resumed Thursday, with early strength across European and Asia-Pacific hours fading through the opening bell. A lower than expected MNI Chicago PMI added further weight to a market led lower by the consumer categories, as retail sales fell sharply on concerns that supply chain issues will persist over the key Christmas shopping period.

- The likes of Gap, Nordstrom and Ross Stores slipped as much as 5%, following a warning from Bed Bath & Beyond who continue to forecast a slowdown in retail traffic and no let-up of supply issues.

- The e-mini S&P cracked back below the 100-dma at 4339.8, with bears needing to push prices back below mid-September's 4293.75 to extend losses. A fall through there opens 4224.00 and 4095 - the point at which the index enters a traditional correction (10% off the cycle high).

COMMODITIES: Oil Dips as OPEC+ Hint More Supply Could Be Forthcoming

- WTI and Brent crude futures were torn between two dueling factors on Thursday, having initially been boosted by headlines from China, in which the authorities had reportedly ordered their top energy firms to secure adequate supplies "at all costs". Oil markets received firm support in response, with WTI making headway back above $76/bbl.

- The gains were short-lived, however, as Reuters cited sources in reporting that OPEC+ were considering options at their next meeting to release more oil to the market. Options cited included a front-loading of their pre-agreed oil output hikes, boosting supply by 800,000bpd in November.

- Oil backtracked on the comments, with WTI and Brent headed into the NYMEX close in negative territory.

- In metals markets, gold and silver saw a minor relief rally, with a stall in the greenback's recent strength allowing both metals to recoup a portion of recent losses. Silver headed higher by as much as 2.5% while gold rallied back above $1750/oz.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.