-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA MARKETS ANALYSIS: Setting Sites On FOMC, October NFP

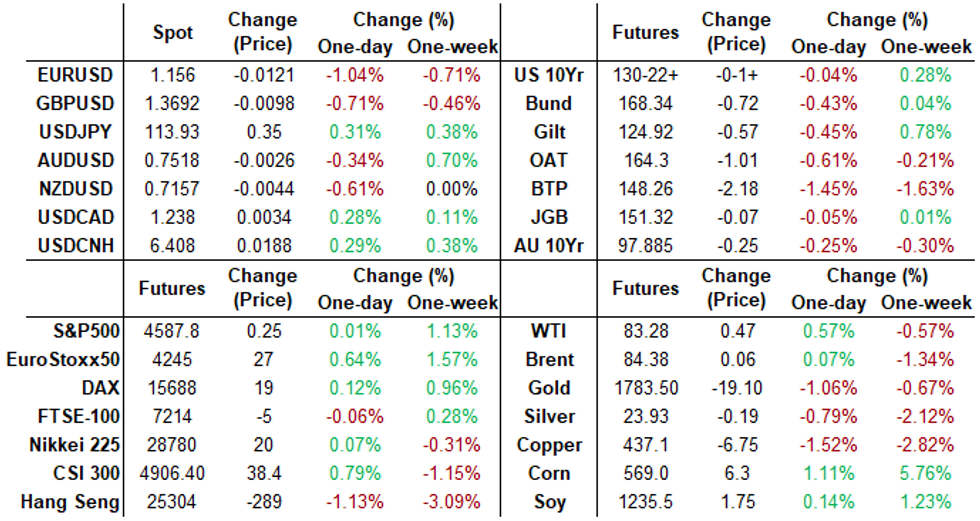

US TSYS: Off Lows Late, Set Sights On FOMC, Oct NFP Next Week

Futures volume surged heading into the close -- month end extensions w/ TYZ1 trading another appr 200k to 1.9m after the bell. Though futures finishing near late session highs, 10s mildly weaker/hold on narrow range since late morning.- Tsys followed EGBs lower on the open amid carry-over widening in sovereign spds after Thu's ECB policy annc (mkt underwhelmed w/ECB Lagarde presser: "not for her to say" if markets had got ahead of themselves; specs piling on rate hike bets targeting 3Q'22.

- Rates held weaker levels after Sep core PCE climbs 0.2%, +3.6% YoY, yield curves bending flatter after posting mildly steeper earlier. Sources noted prop buying 30s vs. real$ sales.

- Yield curves held flatter but off lows as futures turn steady to mixed by late morning, bonds outperformed Sources noted continued buying in 2s-3s from domestic real$ and central banks, not to mention the +15k block buys in 5s, has short end back to steady. Curve levels shows broad range of moves after 5s30s nearly dipped below 71.0 for first time since March 2020 (L: 71.144 / H: 81.21).

- Aside from FOMC policy annc on Wednesday next week, markets get October employment data -- at the moment, mean estimate is +400k from 42 economists polled by Bbg with a range +250k to +700k.

- By the bell the 2-Yr yield is unchanged at 0.4891%, 5-Yr is up 0.2bps at 1.1864%, 10-Yr is down 2.8bps at 1.5521%, and 30-Yr is down 4.3bps at 1.9383%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00150 at 0.07213% (-0.00138/wk)

- 1 Month +0.00112 to 0.08750% (-0.00038/wk)

- 3 Month +0.00062 to 0.13225% (+0.00738/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00737 to 0.20100% (+0.02900/wk)

- 1 Year -0.00950 to 0.36113% (+0.04425/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $84B

- Daily Overnight Bank Funding Rate: 0.07% volume: $272B

- Secured Overnight Financing Rate (SOFR): 0.05%, $871B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $317B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $4.722B submission

- Next scheduled purchases

- Mon 11/01 1100-1120ET: Tsy 22.5Y-30Y, appr $2.025B

- Tue 11/02 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 11/03 No buy operation due to FOMC annc

- Thu 11/04 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 11/04 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 11/05 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

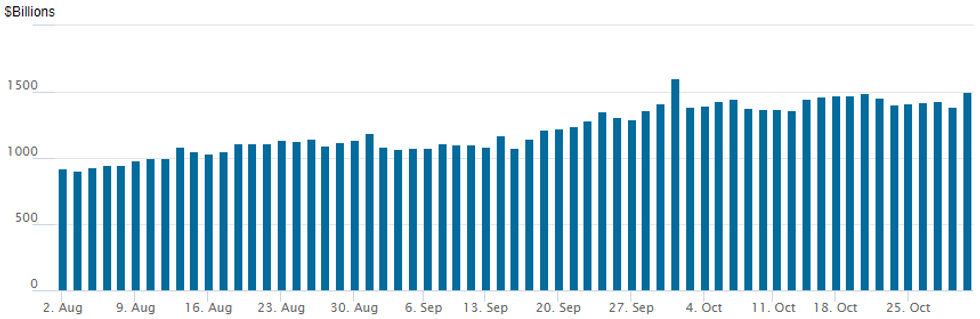

FED Reverse Repo Operations, Surged to Second Highest Usage

NY Federal Reserve/MNI

NY Fed reverse repo surged to second highest usage on record at $1,502.296B from 94 counterparties vs. $1,384.684B on Thursday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 17,175 short Nov 98.87/99.00 put spds, 3.0

- Block, 13,275 Red Dec'22 98.75/99.12 put spds, 12.0

- Block, 12,500 Jun 99.37/99.62 put spds, 8.5

- 2,000 Blue Dec 98.00/98.12/98.25 put trees, 0.0

- Overnight trade

- -4,000 short Dec 99.25/99.37/99.50 put flys, 2.0

- +8,000 short Dec 99.25/99.37 call spds, 4.5 vs. 99.16/0.15%

- +6,000 Green Nov 98.25/98.37/98.50 put flys, 2.0

- +4,000 Dec 99.37/99.75 put spds, 2.0

- 2,000 short Feb 99.12/99.25/99.37 call trees

- +10,000 TYZ 131.75 calls, 14

- 5,000 TYF 127.5 puts, 20 129-21.5 ref

- 7,500 TYZ 128/129.5 put spds, 19

- 3,700 TYZ 128.25 puts, 9

- Overnight trade

- 17,300 TYZ 129.5 puts, mostly 24, 23 last

- 3,000 TYZ 130.5 straddles

- 5,000 TYZ 131.25 calls, 23

- Block, +7,500 TYZ 128.5 puts, 10

- Block, +7,000 TYZ 130 puts, 30 vs. 130-19.5/0.37%

- Block, +10,000 FVZ 121.25 puts, 21.5

EGBs: Peripheral Spreads Blow Wider as ECB Support Seen Waning

- Markets took further their view that the ECB failed to push back against rate hike expectations by pushing peripheral European spreads wider still Friday, with solid volumes seen throughout the session. IT/GE and SP/GE 10y yield spreads closed wider by 9 and 6bps apiece, with a similar impact seen across the front-end of the curve.

- Bund futures extended the Thursday weakness to touch a fresh low of 167.71, marking a pullback off the midweek highs of over 2 points. The German curve traded flatter still, taking the lead from similar moves stateside.

- Focus in the coming week turns to the Fed rate decision on Wednesday as well as the decisions from the RBA, Bank of England and Norwegian central bank.

FOREX: EURUSD Sinks As Greenback Comes Marching Back

- After yesterday's largest intra-day range for EURUSD since mid-June of 110 pips, an even more powerful reversal ensued on Friday, leading the single currency to plummet well over 1%, taking out the ECB lows to trade just shy of the October lows at 1.1525.

- Thursday's rally fell short of a key resistance at 1.1711, the top of a bear channel drawn from the Jun 1 high. Today's weakness confirms broader trend conditions remain bearish below this channel resistance. Support can be found at 1.1493, 50.0% retracement of the Mar '20 - Jan '21 bull phase.

- Particular EUR weakness prompted negative price action in the crosses, with EURJPY, EURAUD, EURCAD and EURNZD all falling comfortably over 0.5%.

- The US dollar came roaring back after the dollar index found strong touted support at the 50-day MA. Additionally, the 23.6% retracement of the 2021 Low-High held at 93.30.

- The greenback rally sent the dollar index (+0.85%) soaring to the best levels of the week, signalling further strength to the mid-Oct highs, residing at 94.56.

- The dollar bid was broad based, gaining against all other G10 currencies. Particular weakness was seen in the Norwegian Krona, with USDNOK rising 1.4% on Friday.

- US ISM Manufacturing PMI headlines Monday's calendar, before the RBA meet early on Tuesday.

FX: Expiries for Nov01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1620-30(E985mln), $1.1695-00(E652mln)

- USD/JPY: Y111.00($935mln)

- AUD/USD: $0.7600(A$500mln)

- USD/CAD: C$1.2350($692mln)

PIPELINE: October Total High-Grade Issuance $148.8B

$8.8B Priced Thursday, $28.1B/wk puts October total at $148.8B well over October 2020 total issuance of $111.65B- Date $MM Issuer (Priced *, Launch #)

- 10/28 $4B *Rep of Peru $2.25B 12Y +150, $750M 2051 Tap +150, $1B 50Y +180

- 10/28 $1.75B *Capital One $1.25B 6NC5 fix/FRN +70, $500M 11NC10 fix/FRN +105

- 10/28 $1.25B *Rio Tinto 30Y +85

- 10/28 $700M *Ares Capital 10Y +170

- 10/28 $600M *Kimberly-Clark WNG 10Y +48

- 10/28 $500M *Fifth Third 6NC5 +53

EQUITIES: Tech Sector Soft as Apple, Amazon Add Post-Earnings Weight

- Stock markets traded mixed Friday, with tech indices underperforming thanks to poor turnouts from the likes of Amazon and Apple, who both traded lower by around 3% apiece post-earnings.

- Despite Friday's modest weakness, S&P E-minis remain bullish. Futures rallied Tuesday this week and registered a fresh all-time high. This confirms a resumption of the uptrend and the focus ison 4591.25, a Fibonacci projection.

- Trend signals such as moving average studies remain in a bull mode reinforcing current trend conditions. A key support is at 4317.25, Oct 12 low. The 50-day EMA at 4436.22 represents the initial firm support handle.

- European stocks were more mixed, with French and Spanish indices making decent progress, while the FTSE-100 and DAX finished with minor losses.

COMMODITIES: Gold Closes Below 50-dma

- Oil markets traded either side of unchanged, however the session cemented the underlying bull trend for oil, with both WTI and Brent crude futures shrugging off the pressure of the firmer dollar.

- WTI futures faced resistance earlier this week and the contract remains below recent highs. Attention is on the 20-day EMA that intersects at $80.58. Key resistance and the bull trigger has been defined at $85.41, Oct 25 high. A break would resume the uptrend.

- Spot gold concluded a tough week by finishing south of the 50-dma at $1780.9, a development that clears the way for further losses toward next support at 1760.4 - the Oct 18 low as well as the more key level of 1746.0 marking the early October lows.

- Precious metals traded under pressure throughout the Friday session as the greenback reversed recent losses to enjoy the best session in months. A close back above 94.00 for the USD index signals strength toward the recent mid-October highs of 94.561.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.