-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS - US Inflation Surges

MNI ASIA MARKETS ANALYSIS - US Inflation Surges

US TSYS: Belly Underperforms In A Day of Substantial Downside

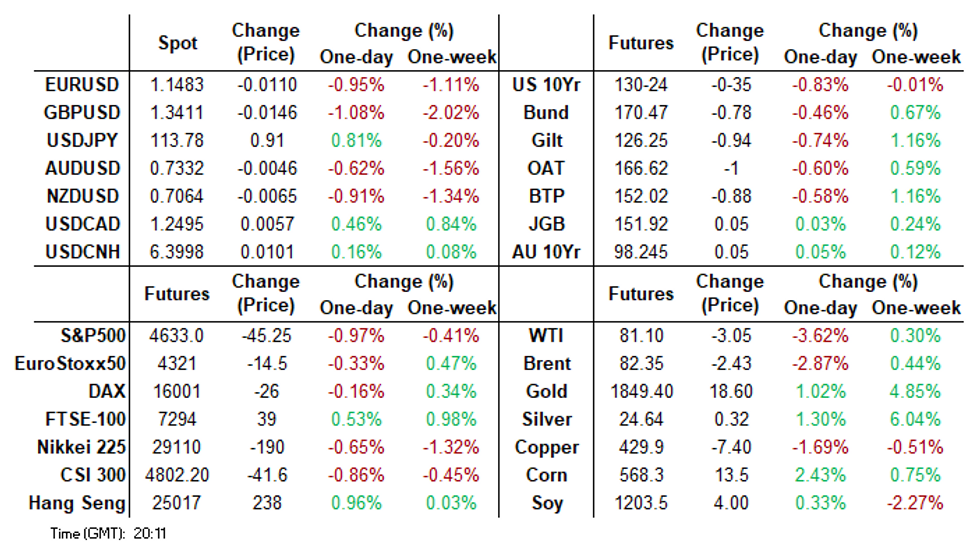

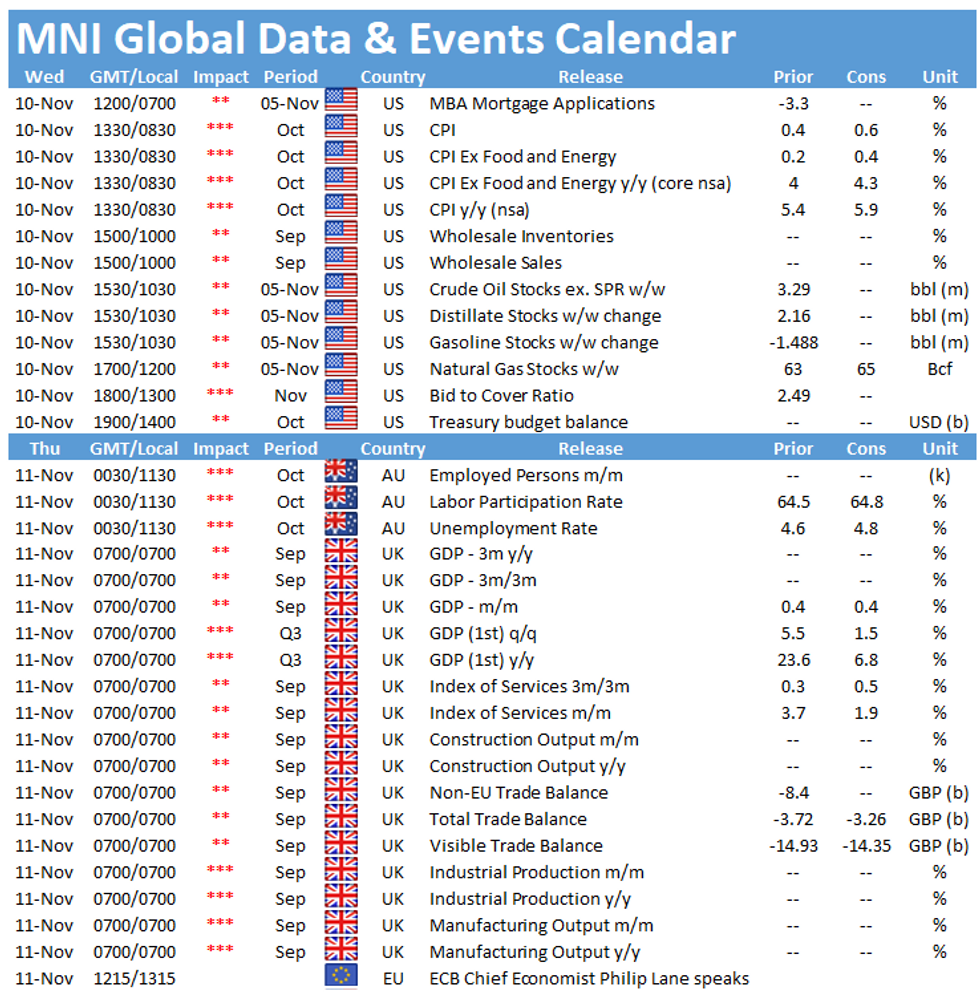

USTs have been offered through the day, spurred on by the bumper CPI print for October (6.2% Y/Y vs 5.9% expected).

- Cash yields are 9-14bp higher on the day, with the belly of the curve underperforming.

- The 30Y bond auction provided a further catalyst for selling pressure, with the sale incurring a large tail and triggering an immediate leg lower. Although yields subsequently pulled back from the intraday high, the current trading yield for the 30y is still above pre-auction trade.

- TYZ1 has pushed lower through the day and has made a second attempt at the intraday low. The contract currently trades at 130-22 in a relatively wide intraday range (L: 130-19+ / H: 131-25).

- Looking ahead, tomorrow's data slate will be light, with focus instead turning to the Michigan consumer confidence survey update on Friday.

US TSY 30Y BOND AUCTION: HIGH YLD 1.940%; ALLOT 32.58%

- US TSY 30Y BOND AUCTION: HIGH YLD 1.940%; ALLOT 32.58%

- US TSY 30Y BOND AUCTION: DEALERS TAKE 25.23% OF COMPETITIVES

- US TSY 30Y BOND AUCTION: DIRECTS TAKE 15.78% OF COMPETITIVES

- US TSY 30Y BOND AUCTION: INDIRECTS TAKE 59.00% OF COMPETITIVES

- US TSY 30Y BOND AUCTION: BID/COV 2.20

EGBs-GILTS CASH CLOSE: Global Inflation-Led Rout

European yields rose sharply Wednesday, with unexpectedly high inflation driving a global bond selloff.

- Higher-than-anticipated Chinese price data overnight set a bearish tone, with a big beat on US CPI data accelerating losses in Bunds and Gilts in the afternoon.

- Gilts underperformed both Bunds and Tsys, with most weakness at both ends of the curve (2s and 30s), and yields up by double-digits.

- Peripheries weakened, Italy 10Y spread ~4bp wider ahead of supply Thursday.

- Early focus Thursday is UK GDP; may prove a quieter session with US cash Tsy trading on holiday.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 3.9bps at -0.703%, 5-Yr is up 4.6bps at -0.54%, 10-Yr is up 4.8bps at -0.25%, and 30-Yr is up 5.1bps at 0.058%.

- UK: The 2-Yr yield is up 12bps at 0.572%, 5-Yr is up 11.4bps at 0.711%, 10-Yr is up 10bps at 0.924%, and 30-Yr is up 12.2bps at 1.049%.

- Italian BTP spread up 3.9bps at 117.8bps / Spanish up 2.8bps at 70.6bps

EUROPE FI OPTIONS SUMMARY: Largely Eyeing Downside In German Bonds

Wednesday's Europe bond / rate options flow included:

- DUZ1 112.20/112.10/112.00p fly, bought for 0.75 in 4k

- RXZ1 169.50p/172.50c combo bought for 7.5 in 2.5k (bought the put)

- RXH2 170/167ps, bought for 74 up to 53 in circa 7k

FOREX: Greenback Soars After Large CPI Beat, EURUSD Below 1.15 Level

- The dollar index rose to its best levels since July 2020 following the higher-than-expected CPI data from the US. Currently up just shy of 1%, the DXY may look to target the June 2020 lows, residing at 95.71.

- Higher US yields and renewed dollar strength prompted a strong reaction in USDJPY after the release. After closing at its lowest levels for 4 weeks yesterday, the pair came roaring back above the 113 handle to briefly trade above 114 before the rally ran out of steam. The trigger for a resumption of the underlying uptrend remains at 114.70, Oct 20 high.

- In other G10 FX the price action was a little more volatile in the immediate aftermath of the data. EURUSD traded roughly 20 pips lower on the release before reversing 40 points higher to trade at 1.1574. As the dust settled, the dollar garnered broad based support, taking the single currency to fresh yearly lows and beneath the 1.15 level which has previously been technically significant.

- Elsewhere, AUD and NZD both retreated over half a percent with cable a significant underperformer, dropping around 1% within close proximity to 1.3412, the Sep 29 low and bear trigger.

- Notable weakness in both SEK and NOK, falling 1.45% and 1.58% respectively against the greenback, with emerging market currencies also taking a plunge. USDZAR sticks out, rising 2.6% with USDMXN also bouncing 1.4% amid the pickup in US yields.

- Overnight, Australian employment data is scheduled before the UK publishes the first estimate for Q3 GDP. Widely expected to be a subdued afternoon amid market closures with North America out for the Veterans Day holiday.

FX OPTIONS: Expiries for Nov11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-70(E1.6bln), $1.1580(E566mln), $1.1650(E605mln)

- USD/JPY: Y113.00-20($1.8bln), Y113.25-45($1.5bln), Y113.50-60($1.7bln), Y113.70($1.5bln)

- AUD/USD: $0.7330-40(A$845mln)

EQUITIES: Solid CPI Puts Equities on Backfoot

- A multi-decade high inflation reading from the US put stock markets on the backfoot Wednesday, with hot inflation underpinning concerns that the Fed could move to hike rates sooner than previously expected, or at least accelerate the tapering pace of their asset purchase programme. The e-mini S&P came under pressure upon release, leading to a negative open at the bell.

- Markets appeared to find bottom alongside the strong reception for the Rivian IPO, with early indications showing very firm demand. The stock was indicated to open at $125 (and climbing) against an IPO price of $78. The ramp higher in opening price for the company coincided well with the recovery off the lows in both the NASDAQ and S&P futures. Rivian's IPO is the largest of the year, and the sixth largest US IPO of all time. Investors set to benefit include Amazon and Ford, both of which traded solidly following the bell.

- European markets were more positive, with UK's FTSE-100 leading gains with a rise of 0.9%, while upside in the likes of the German DAX and French CAC-40 were more muted.

COMMODITIES: Bouncing Greenback Reverses Recent Oil Gains

- A multi-decade high CPI print underpinned a solid USD rally into the Wednesday close, countering any support provided by a bullish set of DoE inventories data. WTI crude futures shed as much as 3% at some points of the session, putting WTI on track to test the week's lows of $81.05/bbl.

- Weekly DoE inventories numbers may have stalled declines, with the data showing a smaller than expected build in reserves. This was compounded by Gasoline and distillates stocks, which showed an unexpected draw of 1.5 and 2.6mln bbls respectively.

- Gold and precious metals were the main beneficiaries of the CPI release, with spot adding close to $45 to reach session highs of $1868.7. Gains faded ahead of the close, but gold still managed to print the best levels since mid-June on the initial reaction.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.