-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Risk-On Carries On

US TSYS: Risk-On Carries On

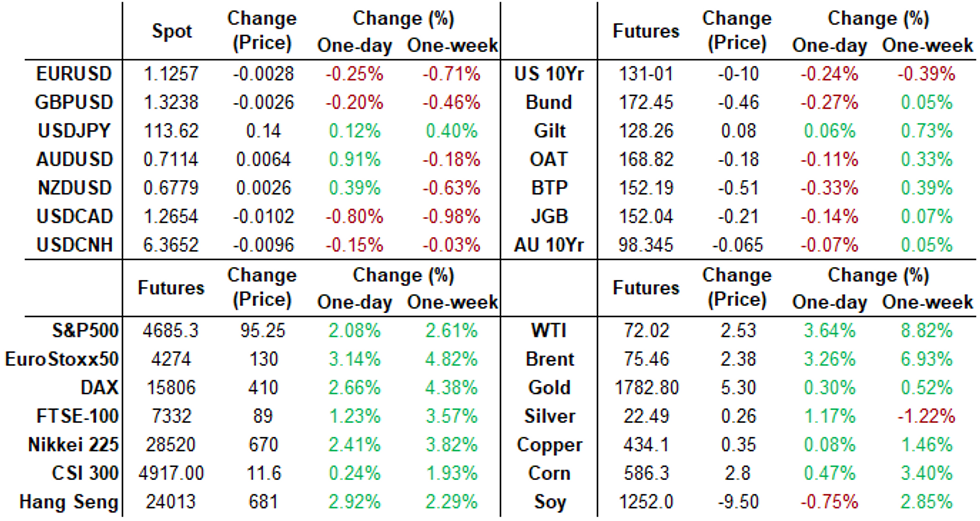

Second consecutive session for risk-on trade, Tsys near lows after the bell (30YY tapped 1.8078% high), equities pushing higher late (ESZ1 +85.0 to 4675.00 -- around Nov 25 levels).- Not a heavy economic data day (US OCT TRADE GAP -$67.1B VS SEP -$81.4B; Q3 UNIT LABOR COSTS +9.6%; Y/Y +6.3%; US REDBOOK: DEC STORE SALES +15.3% V YR AGO MO), markets more reacting to headlines re: Omicron variant less severe than feared -- though it spds more readily. Light data ahead for Wed: JOLTS Job Openings, Tsy 10Y note auction re-open.

- Late US fiscal headlines positive: MCCONNELL SAYS DEAL REACHED WITH SCHUMER ON RAISING DEBT LIMIT.

- Treasury futures held near lows after $54B 3Y note auction (91282CDN8) stopped through: 1.000% high yield vs. 1.002% WI; 2.43x bid-to-cover in-line with 5-auction average and better than Nov's 2.33x.

- Indirect take-up dipped to 52.17% vs. last month's year high of 57.62%, while direct bidder take-up holds near 1+ year high at 18.01% (18.04% Nov). Primary dealer take-up bounces to 29.81% vs. 24.34% in Nov, over the 5M average of 28.06%.

- The 2-Yr yield is up 5.4bps at 0.6852%, 5-Yr is up 4.7bps at 1.2532%, 10-Yr is up 4.1bps at 1.4751%, and 30-Yr is up 1.9bps at 1.7891%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00462 at 0.07575% (-0.00075/wk)

- 1 Month -0.00113 to 0.10200% (-0.00213/wk)

- 3 Month +0.00825 to 0.19825% (+0.01062/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00713 to 0.28338% (+0.01225/wk)

- 1 Year +0.01700 to 0.48250% (+0.02100/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $994B

- Broad General Collateral Rate (BGCR): 0.05%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.574B accepted vs. $2.655B submission

- Next scheduled purchases

- Wed 12/08 1010-1030ET: Tsy 2.25Y-4.5Y, appr $7.375B

- Thu 12/09 1010-1030ET: Tsy 0Y-2.25Y, appr $10.875B

- Thu 12/09 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 12/10 1010-1030ET: Tsy 7Y-10Y, appr $2.825B

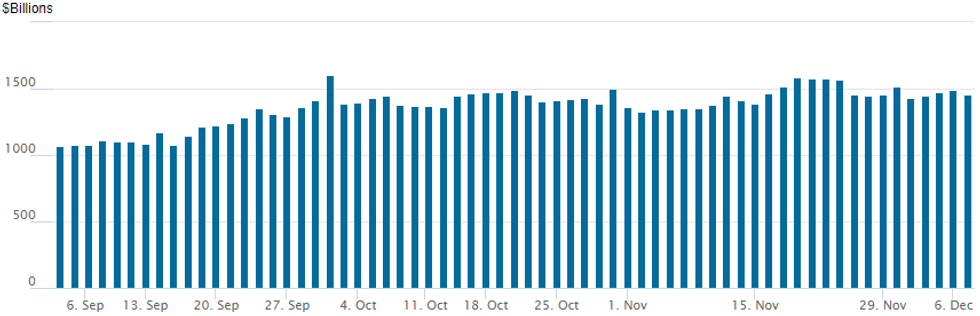

FED Overnight Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,455.038B from 73 counterparties vs. $1,487.996B on Friday. Record high remains at 1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Red Jun'23 96.50/97.50 put spds, 9.5

- 12,500 Mar 99.62/99.75/99.87 call trees

- 18,000 Mar 99.75/99.87 call spds

- +2,000 Red Dec'22 97.50/98.12 put spds, 5.25

- +8,000 Apr 98.62 puts, 1.25 vs. 99.495/0.06%

- +17,000 short Feb 98.31/98.50/98.68 put flys, 3.0

- +5,000 Jun 99.25/99.50 2x1 put spds, 0.0

- Overnight trade

- 2,000 Dec 98.12/98.18/98.25

- 3,000 Jan 98.62 puts vs. Mar 98.25/98.62 put spds

- 2,000 Blue Jan 98.00/98.12/98.25 put trees

- Block, total 10,200 Mar 99.50/99.62 put spds, 3.0 vs. 99.68/0.20%

- 12,000 TYF 130.25/130.5 put spds, 8

- +4,000 TYH 134 calls, 12

- 7,200 FVH 120.5 puts

- 5,000 TYG 130.5 straddles

- -11,200 TUH 108.87 puts, 17

EGBs-GILTS CASH CLOSE: Gilts Outperform As BoE Hike Calls Retreat

German and UK yields were mixed Tuesday with Bunds underperforming in a risk-on session.

- Though equities soared, including the FTSE recovering all its late November losses, UK 10Yr yields touched a fresh post-September low; 30s since the first week of 2021.

- In the past day, multiple sell-side analysts have pushed back their BoE first hike calls, from December to February.

- BTPs underperformed in the periphery after rallying Monday.

- Mixed ECB news this morning, with Austria's Holzmann seeing potential for rate hikes alongside asset purchases; conversely an FT piece corroborating an earlier Reuters report that some GC members want to postpone post-PEPP decisions past next week's meeting.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at -0.701%, 5-Yr is up 2.5bps at -0.601%, 10-Yr is up 1.3bps at -0.375%, and 30-Yr is down 0.3bps at -0.093%.

- UK: The 2-Yr yield is down 0.6bps at 0.462%, 5-Yr is down 0.4bps at 0.572%, 10-Yr is down 0.8bps at 0.73%, and 30-Yr is down 2.2bps at 0.803%.

- Italian BTP spread up 2.9bps at 129.6bps / Spanish down 1.5bps at 70.9bps

EGB Options: Almost Entirely Puts

Tuesday's Europe rates / options flow included:

- RXG2 171.5/170ps, bought for 23 in 2k

- RXG2 173.5/172ps 1x1.4, bought for 14 in 1k vs selling RXF2 173.5/172ps 1x2 at 12 in 1.5k

- RXG2 171.5/170ps, bought for 23 in 2k

- OEF2 134/133.5ps 1x2. Bought for 2 in 1.5k

- OEF2 133.5p, sold at 13.5 in 3.5k

- 0RU2 100.25/99.87ps 1x2, bought for 0.75 in 2k

- SFIG2 99.55/99.45/99.35p fly, bought for 1.5 (Covers the February BoE meeting)

- 0NH2 98.80/98.60/98.40 put ladder bought for 1.5 in 5k

FOREX: AUD and CAD Extend Recovery Amid Bolstered Risk Sentiment

- A second wave of positive sentiment across global markets lent further support to commodity-tied currencies such as the Australian dollar and the Canadian dollar.

- AUD led G10 gains with AUDUSD distancing itself further from the November 2020 lows around 0.6990. As well as bolstered sentiment and yesterday’s PBOC easing, some analysts have interpreted the latest RBA statement through a hawkish lens which may have extended the Aussie’s bounce.

- AUDUSD is up 0.92%, trading at 0.7115 as of writing. Clearance of last Friday’s high at 0.7099 suggests there may be scope for a stronger correction, opening 0.7194, the 20-day EMA.

- Similarly, USDCAD (-0.85%) has breached short-term support at 1.2714, suggesting a deeper sell-off towards the 50-day EMA at 1.2597 could be on the cards.

- The Norwegian krone has also extended on Monday’s gains amid the sharp bounce back in crude futures despite the announcement that the government will re-introduce additional measures to limit the spread of COVID-19.

- Despite AUD and CAD gains against the greenback, the dollar index still traded in marginally positive territory. Largely down to a soft Euro, euro crosses made some impressive moves to the downside that saw EURAUD and EURCAD fall over 1%.

- EURUSD itself made a push towards recent lows following a break of 1.1267. The broader trend remains bearish and key short-term resistance has been defined at 1.1383, Nov 30 high. Moving average studies remain in bear mode and the bear trigger resides at 1.1186/85.

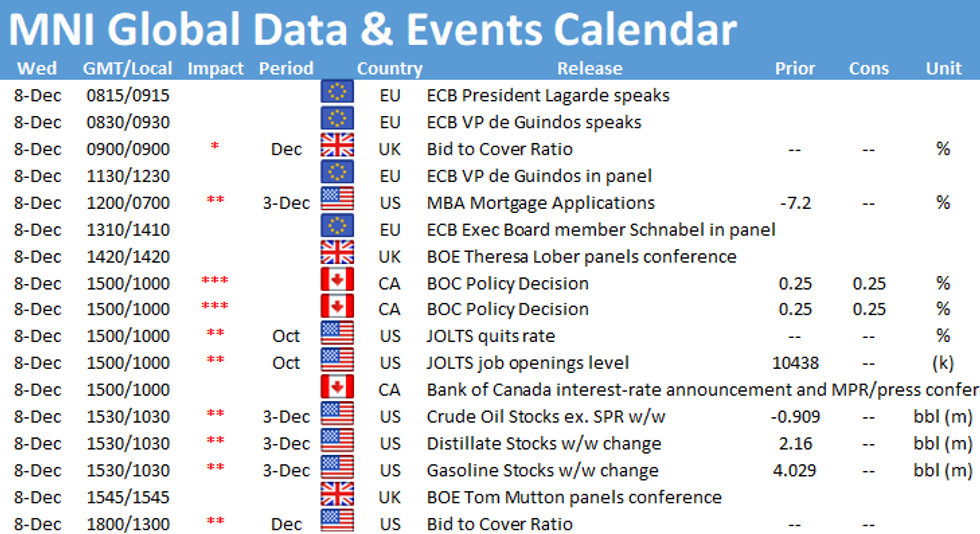

- Tomorrow’s main event risk will be the Bank of Canada decision/statement. Elsewhere there may be comments from RBA’s Lowe as well as JOLTS data from the U.S.

Expiries for Dec08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1290-05(E522mln), $1.1350-60(E572mln)

- USD/JPY: Y113.00-05($563mln), Y113.80($524mln), Y114.25($550mln)

- USD/CNY: Cny6.3300($910mln), Cny6.4000-10($1.2bln)

EQUITIES: Stocks Surge to Narrow Gap With Alltime Highs

- Wall Street moved in harmony with global equities Tuesday, putting the S&P500 higher by over 2% and well within striking distance of the alltime highs posted mid-November at 4744. The tech sector led gains, with semiconductors a particular bastion of strength as markets continue to price out the likelihood of broad activity restrictions in the face of the new COVID variant.

- Notable individual performers included AutoZone, NVIDIA and Etsy, all of which rallied 6% or more. All sectors traded higher, but defensive names including consumer staples and utilities lagged slightly.

- In futures space, the e-mini S&P added close to 100 points, nearing first resistance of 4740.50 - the Nov 22 high and bull trigger.

- Europe outperformed their US counterparts, with the EuroStoxx50 higher by over 3% into the close to enjoy the best session of the year so far. The move prompted the index to close the gap opened at end-November and erase the entirety of the omicron variant-inspired sell-off.

COMMODITIES: Oil Re-Couples With Equities On Lower Omicron Concern

- Oil futures are up 4+% today on reduced Omicron fears as they followed equities climbing higher throughout the day. Prices dipped fleetingly ahead of the start of the Biden-Putin call but have since moved higher.

- WTI is +4.7% at $72.73 in a corrective climb after yesterday’s solid rise, although remains 7% below pre-Omicron levels. Resistance is seen at $73.18, the 20-day EMA.

- Brent is +4.1% at $76.07, also in a corrective climb and after breaking the 20-day EMA of $75.82 now looks at the 50-day EMA of $77.34.

- Weekly DOE inventories released tomorrow.

- US natural gas prices are up 1.7% today but in a broad sense have only roughly stabilised after yesterday’s slump on mild winter weather and increased stockpiling.

- Gold is +0.42% at $1786.1 but has kept to a relatively narrow range today aside from a sharp $10 dip which was swiftly reversed. Attention remains on the bull channel base at $1763.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.