-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Fed Hawks Get Word Out Pre-Blackout

Tsy/Eurodollar Roundup

Tsys remain under pressure in late trade, 30Y looking to extend recent session lows even as equities trade weaker/off lows amid sporadic program selling -- squaring up ahead the extended holiday weekend.

- Yield curves only mildly steeper despite the better long end selling, 5s30s just over 56.78 in late trade; 30YY climbs to 2.1212% (shy of Mon's 2.1491% high); 10YY tapped 1.7770% vs. Mon's 1.8064% high.

- Rates took the large Dec Sales miss in stride: headline -1.9% M/M vs -0.1% expected, with ex-auto/gas -2.5% vs -0.2% expected -- trimming losses w/stocks to session highs by midmorning. Ongoing geopol tension between US and allies vs. Russia over Ukraine border troop build.

- Steady refrain from hawkish Fed officials underscoring 3-4 .25bps hikes (more likely the latter) starting in March emboldened sellers and option hedgers. Fed enters media blackout at midnight through Jan 27, day after FOMC annc.

- With March becoming a crowded trade, option accts started shifting focus to mid-year (give or take a month or two) for more aggressive lift-off than currently priced in. For context: Fed Waller suggested during Bbg interview late Thu that if inflation remains high “the case will be made for four, maybe five hikes”.

- Near a perfect storm really for edge/potential profitability in putting on risk abatement hedges or simply for speculation – June was main focus today w/ paper buying June 98.93/99.06/99.18 put fly buyer -- EDM2 is at 99.265 -- looking for underlying to drift near that center strike for max profit. Anecdotal observations: implieds elevated, put skew still favored

- The 2-Yr yield is up 7.2bps at 0.9648%, 5-Yr is up 7bps at 1.5428%, 10-Yr is up 6.2bps at 1.7663%, and 30-Yr is up 6.4bps at 2.1066%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00343 at 0.07400% (+0.00129/wk)

- 1 Month -0.00300 to 0.10329% (-0.00200/wk)

- 3 Month +0.00215 to 0.24129% (+0.00515/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00186 to 0.39500% (+0.01857/wk)

- 1 Year +0.01214 to 0.72571% (+0.06400/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $892B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $341B

- (rate, volume levels reflect prior session)

NY Fed updated purchase schedule: no new buys Friday through Monday's MLK Jr holiday, resume next week Tuesday. NY Fed operations desk "plans to purchase approximately $40 billion over the monthly period from 1/14/22 to 2/11/22" vs. $60B prior as QE winds down.

- Tue 01/18 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause again around the FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

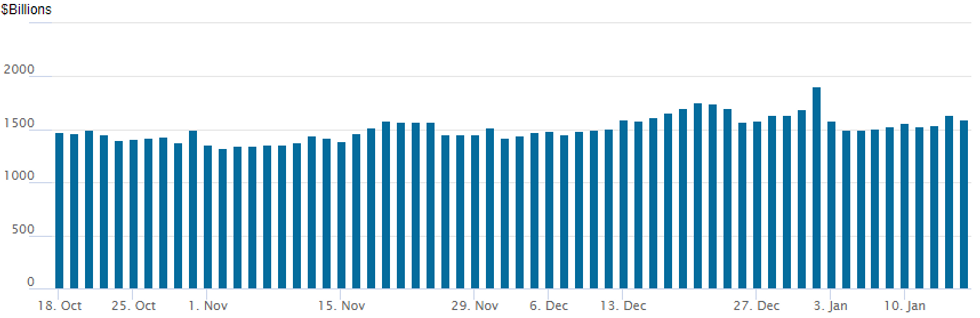

FED Reverse Repo Operation

NY Federal Reserve/MNI

After surging to $1,636.742B Thursday, NY Fed reverse repo usage recedes to $1,598.887B (80 counterparties) today -- well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +40,000 Sep 98.37/98.62 put spds, 2.75 ref: 98.73-.735

- 19,500 Dec 99.75 calls, 1.5 vs. 98.74/0.06%

- 7,500 Green Feb 97.81/98.37 strangles

- +20,000 Apr 98.75/99.00 put spds, 1.0

- +4,000 Jun 99.00/99.12 put spds, 2.0 vs. 99.29/0.12%

- +40,000 Jun 99.25/99.37/99.50 in-the-money put fly, 2.5

- +15,000 Jun 99.31/99.37/99.43 call flys, 0.5

- +20,000 Jun 98.93/99.06/99.18 put flys, 1.5 adds to block

- Overnight trade

- Blocks, +10,000 Jun 98.93/99.06/99.18 put flys, 1.5

- Block, 5,000 Sep 98.87/99.00 put spds, 4.5 vs. 99.06/0.10%

- 3,000 Jun 99.25/99.31/99.43 put trees

- 4,000 short Mar 98.25 puts

- 4,000 short Jan 98.56 puts, 2.0

- 10,000 FVH 119.75/120.25 1x2 call spds, 0.0

- +13,000 TYG 127.5 puts, 0.5

- 18,000 FVH 118.5 puts, 18.5 ref: 119-19.75 to -20

- -25,000 FVH 118/118.5 2x1 put spds, 0.5 ref: 119-23

- -25,000 FVG 120.25 calls, 4.5

- Overnight trade

- 10,000 TYG 127 puts

- 12,000 TYH 125.5 puts, 5

- 3,500 TYH 129 calls, 33

EGBs-GILTS CASH CLOSE: Prior Gains Reverse With U.S. Driving Price Action

Bund and Gilt yields rebounded from the drop of the three previous sessions Friday, erasing most of Thursday's sharp falls.

- As with most of this week, the US was the source of price action catalysts.

- UK and German yields fell to afternoon lows following very weak US retail sales data, but rebounded and moved higher after strong UMichigan consumer survey inflation expectations.

- The cash session closed on a weak note, with position squaring ahead of the weekend (particularly given the US long weekend).

- Next week sees a pullback in EGB issuance (E24.3bln vs E39.2bln this week).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at -0.583%, 5-Yr is up 3.5bps at -0.364%, 10-Yr is up 4.4bps at -0.046%, and 30-Yr is up 4.8bps at 0.252%.

- UK: The 2-Yr yield is up 3.5bps at 0.796%, 5-Yr is up 3.4bps at 0.97%, 10-Yr is up 4.5bps at 1.15%, and 30-Yr is up 3.9bps at 1.255%.

- Italian BTP spread up 1.2bps at 131.9bps / Spanish up 0.7bps at 68.4bps

EGB Options: Mostly Downside In Light Trade

Friday's Europe rates / bond options flow included:

- RXH2 169.5/168.5ps, bought for 29 in 7.25k

- OEH2 132.5/131.5ps 1x2 vs OEG2 133.25/132.25ps, bought the March, receives 25 in 3k

- IKH2 144/142ps 1x1.5, bought for 24 in 2k

FOREX: DXY Decline Hits Reverse, Steers Clear of 100-DMA Support

- Following several sessions of weakness, the USD Index reversed course of Friday, recovering after a major test of the 100-dma support. The greenback was among the best performers Friday, second only to the JPY, that benefited from a second session of declines for Wall Street equity markets.

- The greenback recovery was most prominent against some of the week's best performers, including the AUD, which retraced back to $0.72 just after the London close. This raises attention on the false break higher earlier in the week that saw prices climb north - but not close above - the 100-dma of 0.7286. Further weakness could see the pair retest the 2022 lows of 0.7130.

- Similarly EUR/JPY posted the largest range of the year so far - putting EUR/JPY through the 100-dma support of 130.02, opening further losses toward the 50-dma at 129.49 - which coincides with the 50% retracement for the Dec-Jan upleg.

- A US holiday on Monday should keep price action muted at the beginning of the week, with focus turning to Chinese GDP data, the BoJ rate decision, UK inflation and the continuation of Q1 earnings season for US corporates.

FX: Expiries for Jan17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1505-15(E657mln)

- USD/JPY: Y114.10-20($1.4bln), Y115.00($1.7bln), Y116.50($680mln)

- EUR/GBP: Gbp0.8410(E605mln)

- AUD/USD: $0.7285(A$577mln)

Equities: Stocks Lower for Second Session as Banks Tumble

- Wall Street trades lower just after the London close, putting stocks on the backfoot for a second session. This saw the S&P 500 show below the Tuesday lows, but the decline stopped short of a test on key support of the 4574.9 100-dma.

- Earnings were a key market driver, with the financials sector suffering under the weight of a sharp decline in JPMorgan and Citigroup share prices. Both bank's reports fell short of expectations, putting JPMorgan at a new 2022 low.

- Wells Fargo's earnings painted a different picture, with revenue well ahead of expectations to put their share price higher by as much as 3%.

- Just under 8% of the S&P500 report earnings next week, with highlights including Goldman Sachs, Bank of America, Morgan Stanley and Netflix.Full schedule including timings, EPS and revenue expectations here: https://marketnews.com/mni-us-earnings-schedule-q1...

COMMODITIES: Oil Up Strongly, Potentially On Geopolitical Tension

- Crude oil prices are up solidly again today with circa 2% gains, on track for the fourth straight weekly gain.

- Latest gains appear to be deteriorating geopolitics after Russia began moving military equipment towards Ukraine and Ukrainian government websites were hacked. There has been a lack of obvious triggers elsewhere in what has been a mixed day for equities and risk sentiment as greater Fed hikes are priced to combat inflation.

- WTI is +2% at $83.80 after clearing resistance at $83.71 (1.618 proj of the Dec 2-9-20 price swing). Next resistance is seen at $85.29 (1.764 proj). Support was earlier eyed at $77.83 (Jan 10 low).

- The most active strikes in the Feb'22 contract today have been $84/bbl calls.

- Brent is +1.8% at $86.0, also clearing two resistance levels, the latest $85.80 (1.5 proj of the Dec 2-9-20 price swing), and next eyeing $87.10 (1.618 proj).

- Gold meanwhile has dipped -0.3% at $1817.6 but remains towards the top of the range of the past few weeks. Resistance remains at $1831.9 (Jan 3 high) with support at $1800.2 (Jan 11 low).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2022 | 1500/1600 |  | EU | ECB Schnabel Message at FutureLab | |

| 17/01/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/01/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/01/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/01/2022 | 0200/1000 | *** |  | CN | GDP |

| 17/01/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 17/01/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 17/01/2022 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/01/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.