-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Consolidate Pre-Data Deluge

MNI (LONDON) - Highlights:

- Treasuries consolidate week's rally with labor market data deluge ahead

- JPY firms further as markets wary of Fed pricing

- French politics in focus, with PM announcement seen "imminent"

US TSYS: Broad Consolidation Of The Week’s Rally Before Important Data

- Treasuries have sold off a little but broadly consolidate sizeable rallies seen ever since the US came back from Labor Day.

- Cash yields are 1-1.5bp higher on the day, with both 2s and 10s briefly dipping below 3.75% overnight before lifting.

- 2s10s is at 0.0bps off a latest recent high of +1.2bps. It topped out at +2bps the Monday after last month’s payrolls report.

- TYZ4 has kept to relatively narrow ranges overnight and at 114-17+ is little changed on the day under reasonable cumulative of 345k ahead of a busy data docket.

- An overnight high of 114-22+ maintains what is seen as a bullish outlook, with next resistance at 114-31+ (76.4% retrace of Aug 5-8 pullback) whilst stronger data could see 113-25 (20-day EMA) come more into play.

- Data should continue to dominate the session after historically high issuance earlier in the week did little to stop the large firming in Treasuries. Nonfarm payrolls awaits tomorrow (MNI Preview here).

- Data: Challenger job cuts Aug (0730ET), ADP Aug (0815ET), Jobless claims (0830ET), ULCs/Productivity Q2 final (0830ET), S&P Global US Serv/Composite PMI Aug final (0945ET), ISM Services Aug (1000ET)

- Bill issuance: US Tsy sells $80bn 4-w and $80bn 8-w bills (1130ET)

STIR: Close To 110bp Of Cuts To Year-End As Soft JOLTS Report Still Weighs

- Fed Funds implied rates hold a little above yesterday’s post-JOLTS lows but the report still clearly weighs (see table) ahead of multiple labor releases and the ISM services as a prelude to tomorrow’s NFP report.

- Cumulative cuts from 5.33% effective: 36bp Sep, 72bp Nov, 109bp Dec, 141bp Jan and 207bp June.

- SF Fed’s Daly (’24 voter) told Reuters late yesterday that the Fed needs to cut rates to keep the labor market healthy but it’s now down to incoming economic data to determine by how much. She didn’t know how large a rate cut was currently needed.

- Yesterday’s Beige Book seemed to be a downgrade from the last edition in July when it came to the labor market. It had described employment as having risen at a "slight pace" (that's now "flat to up slightly") with "modest to moderate" wage growth (that's now "a modest pace"). From yesterday: “Employers were more selective with their hires and less likely to expand their workforces, citing concerns about demand and an uncertain economic outlook. Accordingly, candidates faced increasing difficulties and longer times to secure a job."

STIR: OI Points To Mix Of Long Setting & Short Cover In SOFR Following JOLTS

OI data points to a mix of net long setting and short cover during yesterday’s rally in SOFR futures.

- Fed Funds moved to price ~50/50 odds of a 50bp cut at this month’s FOMC at one stage, as softer than-expected JOLTS jobs data triggered the latest round of dovish repricing.

| 04-Sep-24 | 03-Sep-24 | Daily OI Change |

| Daily OI Change In Packs |

SFRM4 | 1,130,840 | 1,140,526 | -9,686 | Whites | +27,811 |

SFRU4 | 1,372,690 | 1,351,343 | +21,347 | Reds | +31,848 |

SFRZ4 | 1,235,373 | 1,255,056 | -19,683 | Greens | -2,362 |

SFRH5 | 947,408 | 911,575 | +35,833 | Blues | +54 |

SFRM5 | 887,514 | 881,295 | +6,219 |

|

|

SFRU5 | 683,834 | 660,496 | +23,338 |

|

|

SFRZ5 | 942,970 | 931,355 | +11,615 |

|

|

SFRH6 | 630,777 | 640,101 | -9,324 |

|

|

SFRM6 | 635,500 | 641,392 | -5,892 |

|

|

SFRU6 | 538,043 | 538,027 | +16 |

|

|

SFRZ6 | 486,622 | 482,087 | +4,535 |

|

|

SFRH7 | 303,231 | 304,252 | -1,021 |

|

|

SFRM7 | 291,641 | 290,868 | +773 |

|

|

SFRU7 | 228,158 | 229,579 | -1,421 |

|

|

SFRZ7 | 236,126 | 237,011 | -885 |

|

|

SFRH8 | 168,135 | 166,548 | +1,587 |

|

|

MNI: US Payrolls Preview: Deciding 25bp or 50bp For A First Cut

- We have published and e-mailed to subscribers the MNI US Payrolls Preview

- Please find the full report including detailed MNI analysis and views from 17 analysts here: https://media.marketnews.com/USNFP_Sep2024_Preview_156b327b83.pdf

EUROPE ISSUANCE UPDATE

Spain auction results

- E535mln of the 1.00% Nov-30 Obli-Ei. Avg yield 0.908% (bid-to-cover 2.25x).

- E1.3bln of the 2.50% May-27 Bono. Avg yield 2.535% (bid-to-cover 3.23x).

- E1.5bln of the 3.50% May-29 Bono. Avg yield 2.582% (bid-to-cover 2.74x).

- E3.228bln of the 3.45% Oct-34 Obli. Avg yield 3.042% (bid-to-cover 2.07x).

France auction results

- The French auction was successful again - with the top of the target range sold (E12.0bln) and all four LT OATs sold seeing their stop price exceed the pre-auction mid-price.

- There was a strong skew to the on-the-run 10-year 3.00% Nov-34 OAT with over half of the total amount sold of that issue (E6.969bln). In spite of this, the bid-to-cover for this issue was still in line with that of August (where E2bln less was sold) and the bid-to-cover across all of the other lines was also solid.

- E6.969bln of the 3.00% Nov-34 OAT. Avg yield 2.95% (bid-to-cover 2.19x).

- E1.4bln of the 1.25% May-36 OAT. Avg yield 3.04% (bid-to-cover 3.97x).

- E1.779bln of the 0.50% May-40 OAT. Avg yield 3.23% (bid-to-cover 2.78x).

- E1.848bln of the 3.25% May-55 OAT. Avg yield 3.49% (bid-to-cover 2.66x).

Gilt auction results

- The 5-year gilt auction was on the soft side again with a 0.9bp tail (in line with the August auction) but the LAP (lowest accepted price) of 101.341 was below the pre-auction mid-price of 101.358.

- Following the result, the 4.125% Jul-29 gilt has moved below the lowest accepted auction price.

- Gilt futures are also moving lower - but started their move just below the auction window closed.

- GBP4bln of the 4.125% Jul-29 Gilt. Avg yield 3.82% (bid-to-cover 3.29x, tail 0.9bp).

FRANCE: La Parisien-Appointment Of New PM 'Imminent', Barnier Still Favourite

Le Parisien is reporting that according to its sources, the appointment of a new prime minister is 'imminient', with former foreign minister Michel Barnier the favourite to be named as head of the next gov't. As we noted earlier (see 'FRANCE: Barnier Tipped For PM Position As Frustration w/Macron Grows', 0841BST), the name of Barnier only emergedon 4 Sep. Le Figaro reports that Macron is in consultations with party group heads on backing Barnier for Matignon.

- Le Parisien: "[caretaker PM] Gabriel Attal sent a message to his close relations planning a transfer of power at 4 p.m.[CET] after a press release to formalize the appointment of the new Prime Minister scheduled (in principle!) for 1 p.m."

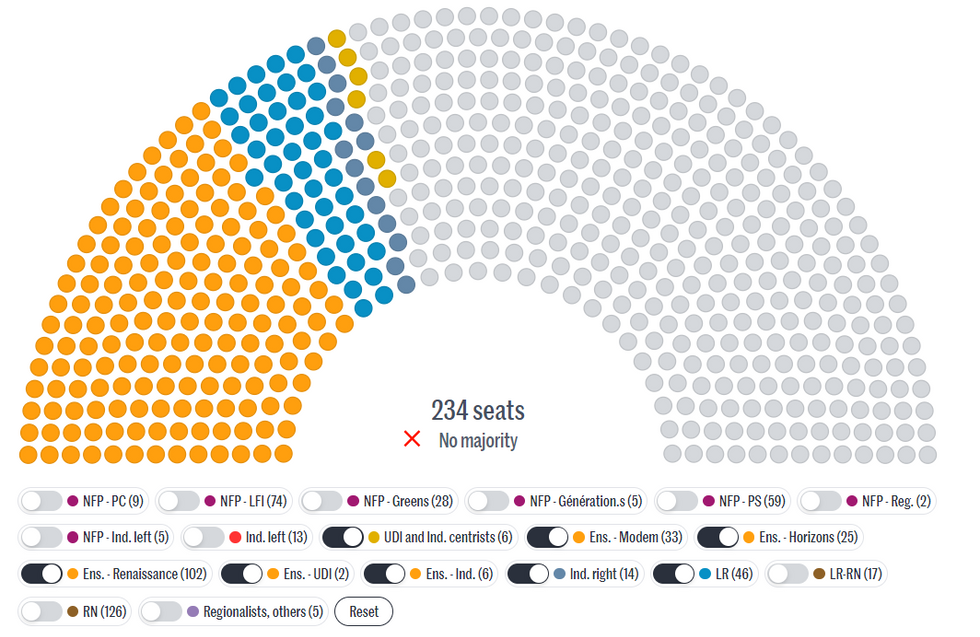

- In the event that Barnier is named as PM, there will be immediate focus on whether his gov't will be able to carry a majority in the National Assembly. The combined forces of Macron's centrist Ensemble, the conservative Les Republicains (LR) from where Barnier hails, and other centrist/centre-right groups comes to fewer than the 289 seats required for a majority (see chart below).

- Should all other political forces vote against such a gov't in a censure vote, the administration would fall. Backing from the centre-left Socialist Party (PS, 63 seats) would be enough to give such a gov't a majority. However, to date the PS has maintained its alliance with other New Popular Front members.

Source: Le Monde

Source: Le Monde

RUSSIA: Putin Claims He Will Support Harris Amid US Crackdown On Kremlin Media

At the Eastern Economic Forum in Vladivostok President Vladimir Putin speaks on the US presidential election. Putin claims that "Our favourite was [Joe] Biden", and that as Biden shifted his support to VP Kamala Harris, "we will do the same". Says that "Trump introduced sanctions and restrictions", while "Maybe Harris will abstain from sanctions". Adds that "We will respect the US people's choice."

- Putin's comments come after joint action from the US Treasury, State, and Justice departments on 4 September that charged and sanctioned executives from Russian state media and put restrictions on outlets linked to the Kremlin. The US accused the Putin gov't of a campaign of disinformation intended to influence the upcoming election.

- White House NSA spox John Kirby said Russia's efforts were aimed at "reducing international support for Ukraine, bolstering pro-Russian policies and interests, and influencing voters here in the US". Kirby: "RT is no longer just a propaganda arm of the Kremlin, It's being used to advance covert Russian influence actions."

- Attorney General Merrick Garland: "We will be relentlessly aggressive in countering and disrupting attempts by Russia and Iran, as well as China or any other foreign malign actor, [to] interfere in our elections and undermine our democracy,"

- Since the 2016 presidential election, there have been accusations that the Kremlin has used disinformation to boost Donald Trump' chances. Reuters: "U.S. intelligence assessments found that Moscow tried to help Trump in 2016, when he defeated Democrat Hillary Clinton, and in 2020 when he lost to Democrat Joe Biden. Moscow has denied the allegations."

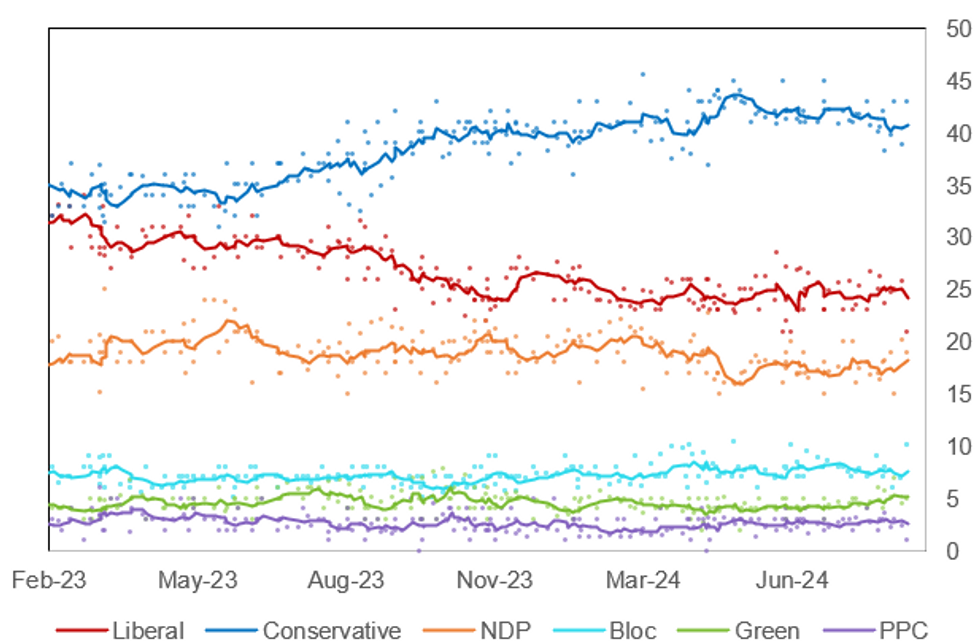

CANADA: Trudeau Gov't On Thin Ice After NDP Withdraws From C&S Agreement

Canada faces the increased likelihood of a snap general election after Jagmeet Singh, head of the left-wing New Democratic Party (NDP), said on 4 Sep that he would be pulling his party's support from a confidence-and-supply agreement. The NDP's withdrawal leaves Prime Minister Justin Trudeau's minority centre-left Liberal Party (LPC) gov't in the vulnerable scenario of relying on cobbling together support to pass legislation on a bill-by-bill basis.

- The NDP's withdrawal does not automatically trigger a general election (due in Oct 2025 at the latest), and Singh has not confirmed that he will instruct his party to vote against the gov't in any confidence vote.

- Main opposition centre-right Conservative Party (CPC) leader Pierre Poilievre has called on Singh to "commit today to voting for a carbon tax election at the earliest confidence vote". The NDP offered the statement that "Voting non-confidence will be on the table with each and every confidence measure,"

- Without the NDP's 24 seats, the LPC holds 154 seats in the House of Commons. The combined total of the CPC, Quebec-interest Bloc Quebecois, environmentalist Greens and independents sits at 156.

- Polling shows the Conservatives with a large and consistent lead of ~15-20% over the LPC. If reflected in an election this would almost certainly translate into a sizeable CPC majority.

- Poilievre garnered market interest when running for the CPC leadership in 2022 by threatening to remove BoC Governor Tiff Macklem for being an "ATM" for Trudeau's deficit spending. He has been quieter on the prospect recently, but any snap election campaign could bring the issue back into focus.

Chart 1. General Election Opinion Polling, % and 6-Poll Moving Average

Source: Angus Reid, Nanos Research, Leger, EKOS, Abacus Data, Mainstreet Research, MNI

Source: Angus Reid, Nanos Research, Leger, EKOS, Abacus Data, Mainstreet Research, MNI

FOREX: Greenback on the Backfoot as Markets Await Deluge of Jobs Data

- The USD starts the session on the backfoot, drifting slightly lower against all others in G10. The action picked up throught the European morning on a slight pick-up in volumes through a phase of EUR/USD buying. Currency futures saw a small, but notable, uptick in activity, but was largely isolated to EUR/USD and GBP/USD - with no leading move in US rates or equity markets.

- Options interest clustered in EUR/USD just above spot - with the most notable strikes today including: $1.1075-90(E3.0bln), $1.1100(E1.1bln), $1.1120-25(E1.6bln), $1.1145-55(E2.6bln), $1.1180-00(E2.1bln).

- Reversing a small part of yesterday's weakness, Scandi currencies are recovering slightly, but the broader trend remains higher in the short-term as high beta and growth-proxy currencies remain sensitive to a US rate shock, and S/T DMAs remain in bull mode for both EUR/NOK and EUR/SEK.

- A stacked session for data should keep markets on edge Thursday, with participants looking to glean any final clues on the state of the US labour market ahead of tomorrow's labour market report. ADP employment change, Challenger job cuts, weekly claims data, ISM Services and the final services PMI for August.

OPTIONS: Expiries for Sep05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0940-60(E3.4bln), $1.0975-90(E1.9bln), $1.1000-20(E2.2bln), $1.1050-60(E1.1bln), $1.1075-90(E3.0bln), $1.1100(E1.1bln), $1.1120-25(E1.6bln), $1.1145-55(E2.6bln), $1.1180-00(E2.1bln)

- USD/JPY: Y143.75-80(E1.0bln), Y144.95-00($1.6bln), Y145.50($1.5bln), Y146.00($1.3bln), Y147.85-00($1.1bln)

- GBP/USD: $1.3075(Gbp689mln)

- EUR/GBP: Gbp0.8480-85(E790mln)

- EUR/JPY: Y161.60(E747mln)

- AUD/USD: $0.6625(A$1.7bln), $0.6640(A$1.6bln), $0.6690(A$1.3bln), $0.6730(A$714mln), $0.6750(A$628mln)

- NZD/USD: $0.6065-70(N$2.9bln), $0.6150(N$1.0bln), $0.6175(N$1.6bln)

- USD/CAD: C$1.3565($705mln), C$1.4100($1.7bln)

COMMODITIES: WTI Futures Remain Below Key Support at $70.88

- WTI futures maintain a softer tone following this week’s sharp sell-off. The break lower has resulted in a breach of key support at $70.88, the Aug 5 low. The clear break of this level confirms a resumption of the downtrend that started Apr 12 and paves the way for an extension towards $66.66, a Fibonacci projection. MA studies are in a bear-mode position highlighting a clear downtrend. Initial resistance is at $74.13, the 20-day EMA. The trend in

- Gold is unchanged and remains bullish. Moving average studies are in a bull-mode set-up and this continues to highlight a dominant uptrend. The recent breach of $2483.7, the Jul 17 high, confirmed a resumption of the primary uptrend and the focus is on $2536.4 next, a Fibonacci projection. The 20-day EMA has been pierced. The next firm support to watch lies at $2440.9, the 50-day EMA. Short-term weakness is considered corrective.

EQUITIES: Bullish Theme in E-Mini S&P Intact Despite This Week's Sell-Off

- Eurostoxx 50 futures have reversed course this week and a bearish tone remains intact for now. The move down has resulted in a break of both the 20- and 50-day EMAs. This highlights the start of a corrective cycle, paving the way for a pullback towards 4805.47 initially, a Fibonacci retracement. Initial firm short-term resistance has been defined at 4998.00, the Sep 3 high. A break of this level would reinstate the recent bullish theme.

- A bullish theme S&P E-Minis remains intact, however, Tuesday’s sharp sell-off signals the start of a corrective cycle. Price has traded through the 20-day EMA and pierced support at the 50-day average, at 5520.21. A clear break of the 50-day EMA would signal scope for a deeper retracement towards 5459.75, a Fibonacci retracement. Key near-term resistance has been defined at 5669.75, the Sep 3 high. A breach of it would be bullish.

| Date | GMT/Local | Impact | Country | Event |

| 05/09/2024 | 1215/0815 | *** | ADP Employment Report | |

| 05/09/2024 | 1230/0830 | *** | Jobless Claims | |

| 05/09/2024 | 1230/0830 | ** | Non-Farm Productivity (f) | |

| 05/09/2024 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 05/09/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 05/09/2024 | 1500/1100 | ** | DOE Weekly Crude Oil Stocks | |

| 05/09/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 05/09/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 06/09/2024 | 0130/1130 | ** | Lending Finance Details | |

| 06/09/2024 | 0600/0800 | ** | Trade Balance | |

| 06/09/2024 | 0600/0800 | ** | Industrial Production | |

| 06/09/2024 | 0645/0845 | * | Industrial Production | |

| 06/09/2024 | 0645/0845 | * | Foreign Trade | |

| 06/09/2024 | 0700/0900 | ECB's Elderson speech at ESCB Conference | ||

| 06/09/2024 | 0900/1100 | *** | GDP (final) | |

| 06/09/2024 | 0900/1100 | * | Employment | |

| 06/09/2024 | 0900/1100 | * | Retail Sales | |

| 06/09/2024 | 1230/0830 | *** | Employment Report | |

| 06/09/2024 | 1230/0830 | *** | Labour Force Survey | |

| 06/09/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 06/09/2024 | 1245/0845 | New York Fed's John Williams | ||

| 06/09/2024 | 1400/1000 | * | Ivey PMI | |

| 06/09/2024 | 1500/1100 | Fed Governor Christopher Waller | ||

| 06/09/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.