-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Russia/Ukraine Tensions Spur Risk-Off

EXECUTIVE SUMMARY

MNI Chicago Business Barometer Adjusted Higher In December

MNI: BOC Hiking Next Week to Stem Inflation-Perrault

US TSYS: FI Round-Up: Ylds Recede, Option Plays Fade Aggressive Hikes

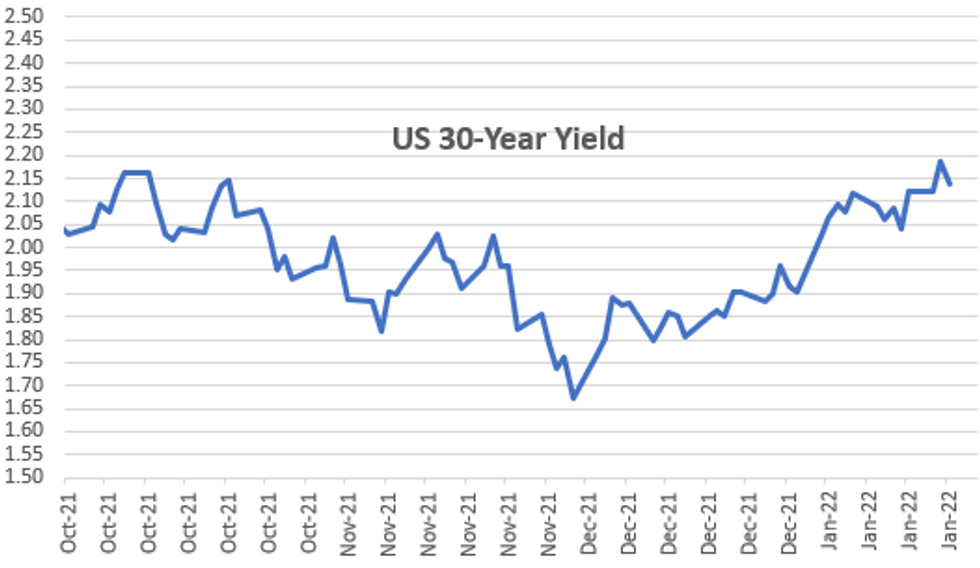

Combination of technical support on the heels of Tuesday's sharp rout in rates and geopolitical tensions over Russia/Ukraine helped Treasury markets regain some ground Wednesday.- On the day, 10YY fell from 1.9006% high to 1.8199% low, 1.8306% after the bell; 30YY from 2.2134% high to 2.1352% low, 2.1426% after the bell.

- Contributing factors: 10Y German Bund yield went positive briefly amid growing concern over supply chain shortages weighing on German economy.

- With underlying futures rebound, accts looked to hedge cooling in tighter policy expectations priced into Whites (EDH2-EDZ2 with four .25bp quarterly hikes starting in March): +70,000 Jun 99.25/99.37/99.50 call flys, 2.25 with Jun'22 futures trading 99.225. In that vein: fading tighter policy move by the Fed via put condor sale: -10,000 Jun 99.06/99.18/99.31/99.43 put condors at 4.25.

- Limited react to data, Housing starts 1.4% vs. -1.7% est, Permits 9.1% vs. -0.8% est; Redbook JAN STORE SALES +14.8%. MNI's Chicago Business Barometer, was revised up to 64.3 in December from 63.1, as a result of the annual seasonal adjustment recalculation. Despite the upwards revision at the end of the year, in aggregate, the Barometer was revised down by -0.1 point in 2021 and revised up by +0.1 point in 2020.

- Tsy futures held near session highs following brief two-way following $20B 20Y note auction re-open (912810TC2) stop-through: 2.210% high yield vs. 2.220% WI; year high 2.48x bid-to-cover better than last month's 2.59x.

- The 2-Yr yield is down 2bps at 1.0225%, 5-Yr is down 4.7bps at 1.6113%, 10-Yr is down 4.6bps at 1.8271%, and 30-Yr is down 4.8bps at 2.1396%.

US/RUSSIA: Another Round Of Diplomacy As Tensions Increase

- US Secretary of State Anthony Blinken is in Ukraine today. The visit is intended ‘…to reinforce the United States' commitment to Ukraine's sovereignty and territorial integrity.’ Blinken’s trip to Ukraine comes amid another diplomatic blitz to resolve the Ukraine crisis.

- Blinken will fly to Berlin later today, or early tomorrow, to meet with German Foreign Minister Annalena Baerbock and representatives of the ‘Transatlantic Quad’ (US, Germany, France, and the United Kingdom).

- Blinken will then meet with his Russian counterpart Sergei Lavrov in Geneva on Friday. Baerbrock herself has been in Moscow this week delivering an unexpectedly firm German position to Lavrov.

- The US State Department is hopeful that the diplomatic talks can provide a de-escalation but the threat of war remains high and movement of military hardware has ramped up this week. In particular, eastern divisions of the Russian military are being prepped for mobilisation to war games in Belarus.

- The status of Nordstream 2 as a deterrent is currently unclear. The soon to be completed Gazprom gas pipeline has been opposed by US throughout the project. They believe it hands control of Europe’s energy supply to Moscow. Sanctions on the pipeline were vetoed by President Joe Biden last year and another bill to impose sanctions, introduced by Senator Ted Cruz, failed to pass the Senate last week.

- The official line from the White House is that the threat of sanctions on the pipeline must be available to the US and Western allies in the event of a Russian invasion of Ukraine.

- An alternate bill to impose highly punitive sanctions on Russia and Putin’s inner circle from Senator Robert Menendez (D-NJ) was placed on the Senate’s legislative calendar yesterday and is expected to pass the Senate with bipartisan support.

- Germany remains a key variable in the response to Russian aggression. Germany operated a pragmatic position towards Russia and the Nordstream 2 pipeline throughout the Chancellorship of Angela Merkel and there appears to be continuity on that position in the current Administration of Olaf Scholtz. Nordstream 2 would deliver increased energy security to Germany, and it appears that the current position of Germany is that blocking Nordstream 2 may be on the cards in the event of an outright Russian invasion of Ukraine.

CANADA

BOC: The Bank of Canada will raise its record low 0.25% policy interest rate next week against compelling evidence inflation and price expectations have gone too far, Scotiabank chief economist Jean-Francois Perrault, a former deputy finance minister and central bank official, told MNI Wednesday.

- The central bank's own survey published Monday showing a record 67% share of firms expecting CPI topping the Bank's 1%-3% target band over the next two years and Wednesday's report of the fastest inflation since 1991 mean a course correction on monetary policy is needed, Perrault said by phone. The Bank will also hike by 25 basis points in March and by half a point in April, when the ebbing of the pandemic should allow more confidence for monetary tightening, Perrault said.

- Total hikes of 175bps this year would still leave a negative real policy rate, he said. For more, see MNI Policy main wire at 1142ET.

OVERNIGHT DATA

- The Chicago Business BarometerTM, produced with MNI, was revised up to 64.3 in December from 63.1, as a result of the annual seasonal adjustment recalculation. Despite the upwards revision at the end of the year, in aggregate, the Barometer was revised down by -0.1 point in 2021 and revised up by +0.1 point in 2020.

- US REDBOOK: JAN STORE SALES +14.8% V YR AGO MO

- US REDBOOK: STORE SALES +15.2% WK ENDED JAN 15 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- US MBA: REFIS -3% SA; PURCH INDEX +8% SA THRU JAN 14 WK

- US MBA: UNADJ PURCHASE INDEX -13% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.64% VS 3.52% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 121.34 points (-0.34%) at 35244.1

- S&P E-Mini Future down 12 points (-0.26%) at 4559.25

- Nasdaq down 41.9 points (-0.3%) at 14463.73

- US 10-Yr yield is down 4.6 bps at 1.8271%

- US Mar 10Y are up 9/32 at 127-21

- EURUSD up 0.0026 (0.23%) at 1.1351

- USDJPY down 0.37 (-0.32%) at 114.24

- WTI Crude Oil (front-month) up $1.04 (1.22%) at $86.47

- Gold is up $29.25 (1.61%) at $1842.98

- EuroStoxx 50 up 10.46 points (0.25%) at 4268.28

- FTSE 100 up 26.11 points (0.35%) at 7589.66

- German DAX up 37.16 points (0.24%) at 15809.72

- French CAC 40 up 39.15 points (0.55%) at 7172.98

US TSY FUTURES CLOSE

- 3M10Y -7.76, 165.389 (L: 164.167 / H: 171.797)

- 2Y10Y -2.667, 80.026 (L: 79.745 / H: 84.57)

- 2Y30Y -2.882, 111.252 (L: 111.143 / H: 117.075)

- 5Y30Y -0.194, 52.48 (L: 50.63 / H: 56.277)

- Current futures levels:

- Mar 2Y up 1/32 at 108-16.5 (L: 108-13.37 / H: 108-18.125)

- Mar 5Y up 5.25/32 at 119-5.75 (L: 118-25.25 / H: 119-07.75)

- Mar 10Y up 8.5/32 at 127-20.5 (L: 127-02 / H: 127-23.5)

- Mar 30Y up 24/32 at 154-14 (L: 153-07 / H: 154-19)

- Mar Ultra 30Y up 1-17/32 at 187-18 (L: 184-30 / H: 187-25)

US 10YR FUTURE TECHS: (H2) Downtrend Accelerates

- RES 4: 129-26 50-day EMA

- RES 3: 129-03+ 20-day EMA

- RES 2: 128-27 High Jan 13 and key short-term resistance

- RES 1: 128-01+ High Jan 18

- PRICE: 127-18 @ 16:19 GMT Jan 19

- SUP 1: 127-02 Low Jan 19

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

The downtrend in Treasuries has accelerated this week and further weakness is likely near-term. The contract has cleared support at 127-30, Jan 10 low. This has confirmed a resumption of the underlying downtrend and maintains the bearish price sequence of lower lows and lower highs. Moving average studies are in a bear mode too. The focus is on 127-00. Firm short-term resistance has been defined at 128-27, Jan 13 high.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.005 at 99.540

- Jun 22 +0.025 at 99.210

- Sep 22 +0.020 at 98.945

- Dec 22 +0.020 at 98.670

- Red Pack (Mar 23-Dec 23) +0.030 to +0.035

- Green Pack (Mar 24-Dec 24) +0.025 to +0.045

- Blue Pack (Mar 25-Dec 25) +0.040 to +0.045

- Gold Pack (Mar 26-Dec 26) +0.040 to +0.045

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00785 at 0.07814% (+0.00414/wk)

- 1 Month +0.00543 to 0.10914% (+0.00585/wk)

- 3 Month +0.00114 to 0.25514% (+0.01385/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01728 to 0.44714% (+0.05214/wk)

- 1 Year +0.01657 to 0.80357% (+0.07786/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $269B

- Secured Overnight Financing Rate (SOFR): 0.05%, $954B

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $346B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $20.212B submission

- Next scheduled purchases:

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

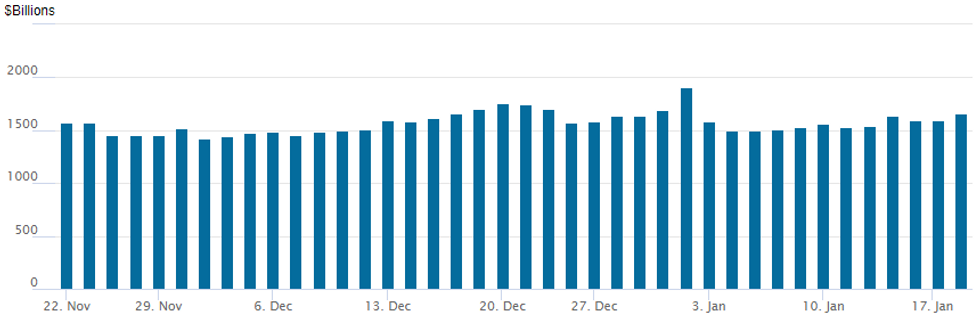

FED Reverse Repo Operation, Highest Usage in 2022 So Far

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to $1,656.576B (highest for 2022 so far) w/83 counterparties today vs. $1,597.137B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: GS 6Pt Jumbo Near Half $28.8B to Price Wednesday

$28.8B to Price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 01/19 $12B Goldman Sachs $2B 3NC2 +70, $650M 3NC2 SOFR+70, $3B 6NC5 +100, $350M 6NC5 SOFR+112, $4B 11NC10 +125, $2B 21NC20 +120

- 01/19 $6B #Morgan Stanley $1.25B 3NC2 +62.5, $2.25B 6NC5 +87.5, $2.5B 11NC10 +112.5

- 01/19 $3B #CADES 10Y social +47

- 01/19 $2B *Target $1B 5Y +38, $1B 30Y +85

- 01/19 $1.5Bk #JBS 7Y +170a, 30Y +235a

- 01/19 $1.3B #Bank of NY Mellon $850M 5Y +45, $450M 10Y +70

- 01/19 $1.25B #NWB +2Y SOFR +15

- 01/18 $1B *Caisse des Depots et Consignations (CDC) 3Y SOFR+22

- 01/19 $750M #JFM 3Y Green +26, upsized from $500M

- 01/19 $Benchmark Romania 5Y +160a, 10Y +195a

EGBs-GILTS CASH CLOSE: Intraday Reversal; GGBs Underperform

Gilts (and GGBs) underperformed as stronger-than-expected UK December CPI set a bearish tone for Wednesday's session, added to by a nascent stabilisation in equities.

- Greece's 10-Yr syndication was seen as having soft demand, with E3bln sold on books of >E15bln, about half the demand of last June's sale. GGB spreads widened ~10bp.

- GIlt yields ended sharply higher across the curve, but closing levels reflected an intraday move lower from multi-month highs.

- 10Y Bund yields crossed the 0.00% watermark at the open, but ended negative.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.57%, 5-Yr is up 0.3bps at -0.341%, 10-Yr is up 0.6bps at -0.012%, and 30-Yr is up 1.4bps at 0.293%.

- UK: The 2-Yr yield is up 4.1bps at 0.908%, 5-Yr is up 3.3bps at 1.057%, 10-Yr is up 3.9bps at 1.256%, and 30-Yr is up 4.3bps at 1.372%.

- Italian BTP spread up 1.6bps at 135.1bps / Greek up 9.6bps at 174.3bps

FOREX: Greenback Off Best Levels, Consolidates Prior Day’s Rally

- The US dollar traded sideways for the majority of the US trading session following a small retrace of yesterday’s strong rally. While the Dollar Index is seen 0.2% lower on the day, the DXY remains above the 95.50 mark, a short-term pivot level of significance.

- In line with greenback weakness, EUR, GBP, CAD, CHF and CNH were all supported.

- However, the outperformers were AUD (+0.56%) and NZD (+0.41%), largely down to an extension of positive price action in the commodity space, with both metals and oil prices providing tailwinds.

- NZDUSD remains well supported below the 0.6750 mark with firm technical support coming in at 0.6700. The Kiwi had caught a bid overnight as participants added hawkish RBNZ bets, with money markets now pricing ~31bp worth of tightening come the end of the Feb MPC meeting.

- A turn higher for AUDUSD and importantly a break of 0.7314, Jan 13 high would resume the recent upleg and cancel the developing bearish technical threat.

- Worth noting some interesting price action in the Canadian Dollar. Canadian CPI printed in line with median estimates, however, the BOC core indices were above expectations. Perhaps with a buy the rumour, sell the fact dynamic in play, USDCAD put in a fresh low at 1.2450, closely matching with Fibonacci support, and then sharply rose immediately after the data back to 1.2520. The pair’s squeeze quickly lost steam after that, consolidating around the 1.2490 level. A move through 1.2448 would open 1.2387, the Nov 10 low.

- Aussie Employment data headlines the overnight session before the Norges Bank rate decision in the early European session.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2022 | 0130/1230 | *** |  | AU | Labor force survey |

| 20/01/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/01/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 20/01/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.