-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Big Jan Job Gains, Nov/Dec Revised Up

Eurodollar/Treasury Roundup: Covid Drag Overestimated

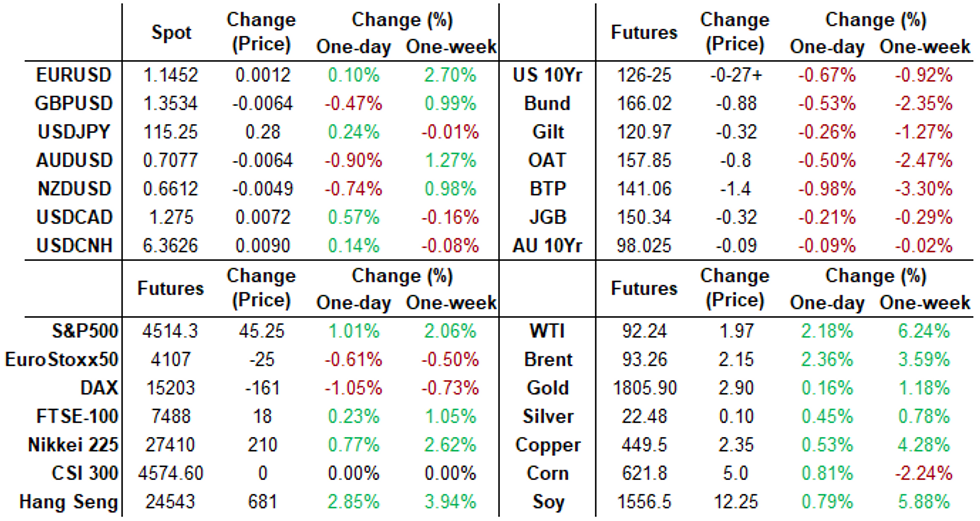

US FI markets trading broadly weaker after the bell, nice risk-on tone to the end the week with equities making new session highs late (ESH2 taps 4530.75) after trading weaker on this morning's headline Jan employment release.- Sell-side economists overestimated knock-on effects of Covid variant on the economy while giving Wednesday's huge ADP miss (-301k) too much credit in adjusting Jan NFP forecasts lower (some called for -250k job losses).

- Friday's stellar gain of +467k jobs in Jan and up-revision totals for November and December of +709k weighed heavily on rates (and equities briefly) as markets rushed to reprice more aggressive rate hikes in 2022 and spill-over to 2023.

- Short end rates now price in appr 50% chance of 50bp liftoff in March and another 50bp go in Jun, with 150bps total hikes by year end.

- Equities traded weaker post data but recovered and traded higher into late trade. Markets will be keeping close eye on next Thu's CPI inflation metric (0.4% est vs. 0.5% in Dec) while latest earnings cycle winds down.

- Overall option volumes were not overwhelming, some continued unwinds of existing long put and put spds, some repositioning to hedge greater chance of 50bps hike in June. Implied weaker after initial gains on severity of post-data sell-off, settled in as real vol evaporated in the second half.

- The 2-Yr yield is up 12.2bps at 1.318%, 5-Yr is up 11.3bps at 1.7831%, 10-Yr is up 10bps at 1.9302%, and 30-Yr is up 8bps at 2.2312%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 at 0.07700% (-0.00400/wk)

- 1 Month +0.00400 to 0.11529% (+0.00900/wk)

- 3 Month +0.02400 to 0.33900% (+0.02243/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02672 to 0.55543% (+0.02100/wk)

- 1 Year +0.05514 to 0.99900% (+0.05114/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 0.05%, $935B

- Broad General Collateral Rate (BGCR): 0.05%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

- No buy-operation Friday, resume next week:

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

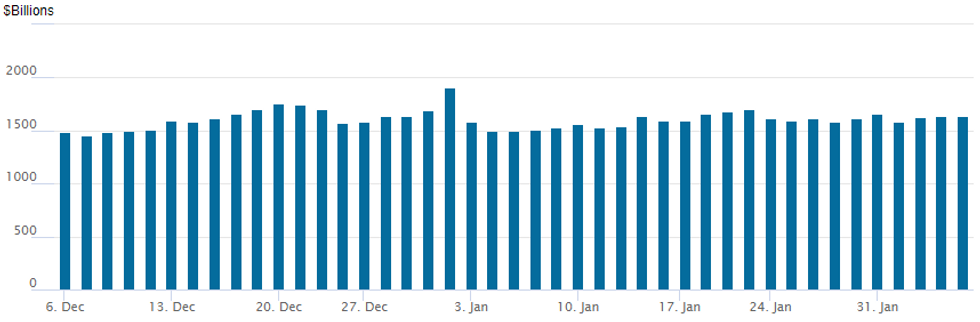

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $1,642.892B w/79 counterparties vs. $1,640.397B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

SOFR Options:- Block, total 19,500 Dec SOFR 97.87/98.12/98.37 call flys, 4.0

- Block, 3,000 Sep SOFR 98.50/98.62/98.75 call flys, 2.0

- -8,000 May 99.00/99.12/99.25 put flys, 1.25

- +10,000 Jun 99.12/99.12/99.37 call flyus, 1.25

- +2,500 Dec 98.00/99.00 strangles, 23.5

- -2,500 short Jun 97.75/98.00 put spds, 9.0 ref: 98.06

- Overnight trade

- 10,800 short Mar 98.00/short Jun 97.56 put spds

- 3,000 short May 98.06 puts, 17.0

- 3,000 short Feb 98.12/Blue Feb 97.75 put spds

- 3,000 Jun 99.00 calls, 18.0

- 2,000 Jun 98.37/98.50/98.62 call flys

- 1,750 Sep 98.68/short Sep 97.75/Green Sep 97.75 put fly

- Block, 5,000 Apr 99.00/99.12 put spds, 6.0 vs. 99.07/0.20%

- 13,800 short Feb 98.12 puts, 1.0

- 11,300 Jun 99.12/99.18 put spds

- 3,000 FVH 118/118.5/119 put flys

- Update, -55,000 TYH 125 puts, 4-5

- +5,000 TYM 124 puts, 32 ref 126-23.5

- 9,500 TYH 125.5 puts, 6

- 13,000 TYH 124.5 puts

- Overnight trade

- 9,500 wk1 TY 127.5 puts, 8

- 13,000 FVH 118.25 puts, 7.5

- Block, 5,000 FVH 118.25 puts, 7.5

- 2,200 TYH 127/127.5 put spds, 15

- 2,000 TYH 126/127 put spds

EGBs-GILTS CASH CLOSE: Hawkishness Increasingly Priced In

Yields continued to soar across the curve Friday as a much stronger-than-expected US employment report dispelled any lingering doubts that the global monetary regime will be much more restrictive in 2022.

- Weakness was evident from the very start of the session as hawkish sentiment carried over from Thursday's ECB/BoE decisions, with short-end Euribor most noticeably being sold as near-term ECB hikes were priced in.

- Periphery EGBs also got hit hard amid ECB tightening prospects; GGB/Bund spread hit the widest since May 2020.

- Long-end Gilts marginally outperformed Bunds though yields ended well up from intraday lows; UK short-end underperformed Germany though.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8bps at -0.252%, 5-Yr is up 9.1bps at 0.048%, 10-Yr is up 6.1bps at 0.204%, and 30-Yr is up 2bps at 0.352%.

- UK: The 2-Yr yield is up 11.5bps at 1.259%, 5-Yr is up 8.5bps at 1.305%, 10-Yr is up 3.9bps at 1.407%, and 30-Yr is up 2bps at 1.476%.

- Italian BTP spread up 4.4bps at 154.4bps / Greek up 12.1bps at 206.5bps

EGB Options: Some Closing Out As Bond Futures Sink

Friday's Europe rates / bond options flow included:

- RXH2 169.5/167.5ps sold 20.5k at 157 vs buying 20k RXH2 166/164.5/163.5/162 put condors at 27

- RXH2 163.5/162ps, bought for 10 in 20k (Short Cover)

- RXH2 162/160ps, bought for 43 in 3k

- RXH2 164.5p, bought for 29 and 31 in 6k

- RXH2 168/166.5ps, sold at 88 in 4k

- OEH2 131.50/131.00ps, sold at 34 in 9k

- OEK2 130/129ps, bought for 23.5 in 16.5k

- ERZ2 100.25/99.75ps 1x2, bought for 5.5 in 9.5k

FOREX: EURUSD Holds Firm Despite Stellar US Employment Data

- An above consensus US NFP print of +467k jobs, accompanied by impressive upward revisions to prior month’s figures, was initially supportive for the US Dollar, recouping losses as US treasury yields spiked following the data.

- Despite the initial USD relief rally, the gains were slowly eroded throughout the session with a bounce in global equity indices also hampering the greenback’s progress. As of writing, the US dollar index is up 0.04%, however, if the index were to slip into negative territory this would represent five consecutive declining sessions.

- The dollar’s most apparent weakness is shown by EURUSD that although marginally lower from the NFP release, remains 0.1% higher for Friday after a morning breach of the 2022 highs to 1.1484. Cluster resistance is seen between 1.1484-1.1495 and the single currency’s resilience on Friday may signal the strong potential for further short-term gains.

- With EUR crosses well supported, the relative dollar strength was seen most notably against AUD and NZD both retreating over 0.75%. Both GBP (-0.44%) and CHF (-0.59%) also came under pressure with USDJPY consolidating above the 115.00 mark, up 0.25% for the session.

- Elsewhere, the Canadian dollar also struggled following a much poorer set of employment figures. Despite consolidating, the USDCAD outlook remains bullish. The recent break of the 50-day EMA has opened 1.2843, as a Fibonacci retracement target. First support is at 1.2650, the Jan 27 low.

- With China returning next week, Monday’s calendar looks fairly light for major data. Of note, ECB President Lagarde is due to testify at a virtual hearing before the European Parliament Economic and Monetary Affairs Committee.

- US CPI will headline the week’s data docket, scheduled for release on Thursday.

FX: Expiries for Feb07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E633mln)

- USD/JPY: Y115.00($568mln)

- GBP/USD: $1.3400(Gbp591mln)

- AUD/NZD: N$1.0600(A$1.4bln)

- USD/CAD: C$1.2730-50($560mln)

EQUITIES SPX Recovering

The unexpected jobs gain for Jan and up-revisions for December is dampening risk appetite for stocks at the moment as More aggressive rate hikes being priced back in (appr 50% chance of 50bp liftoff in March and another 50bp go in Jun, 150bps total hikes by year end).

That said, SPX eminis are gradually recovering from modest post-data selling, late index level recap:

- DJIA up 200.46 points (0.57%) at 35309.54

- S&P E-Mini Future up 59.75 points (1.34%) at 4528.5

- Nasdaq up 336.2 points (2.4%) at 14213.39

- +3.05% Consumer Discretionary

- +2.00% Energy

- +1.21% Financials

COMMODITIES: WTI Closing Out The Week Up 6%

- Crude oil prices are up strongly again today on further supply fears, this time from Shell deferring expansion work worth 150kbpd at the Bonga oilfield by another two years, plus a boost from far stronger than expected US payrolls.

- This sees WTI up more than 6% for the week and >22% ytd.

- WTI is up +2.1% at $92.18, having cleared another two resistance levels, the highest being $92.85 (2.5 proj of the Dec 2-9-20), before it dropped back to sit above $91.58, the 2.382 proj of the Dec 2-9-20 price swing.

- Brent is +2.3% at $93.25, currently hovering around the 2.382 proj of the Dec -2-9-20 of $93.24.

- Away from oil, the White House said it is continuing to look at options to lower gas prices for the American people. HH natural gas prices have softened this week but remain up 21% ytd.

- Gold meanwhile is again little changed, +0.1% at $1807.2, remaining comfortably between resistance of $1822.2 (Jan 27 high) and support of $1780.4 (Jan 28 low).

Data Calendar for Monday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/02/2022 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 07/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 07/02/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 07/02/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/02/2022 | 0700/0800 | ** |  | DE | industrial production |

| 07/02/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/02/2022 | 1545/1645 |  | EU | ECB Lagarde Intro at EU Parliament | |

| 07/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/02/2022 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.