-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

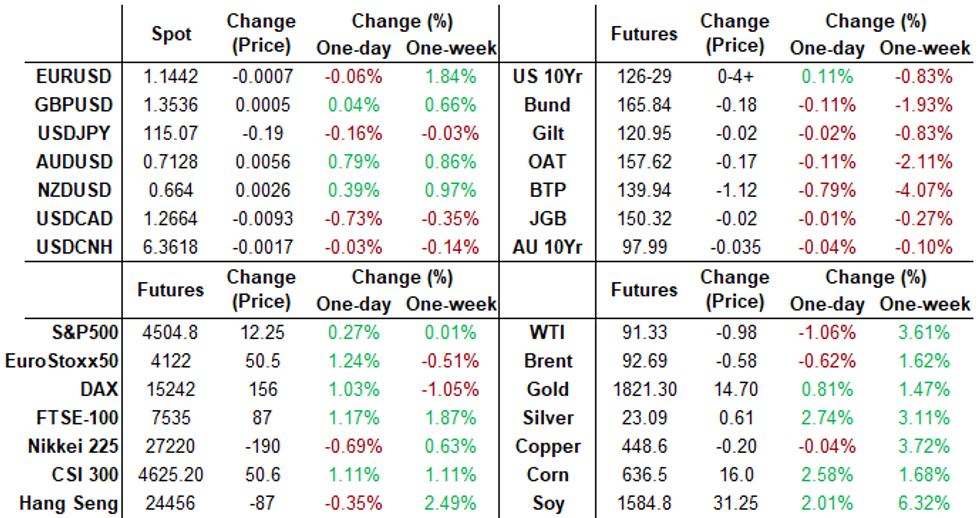

Free AccessMNI ASIA MARKETS ANALYSIS: Focus Turns To Thu's CPI

US: Tsy/Eurodlr Derivatives Roundup, Focus On Thu's CPI Inflation Data

US FI markets clawed back some ground Monday after perhaps leaning a bit too far over it's skis after Fri's strong Jan jobs gain of +467k vs. +125k est (total up-revisions of +709k for Nov-Dec) as 30YY gained 8bp to 2.2312%; 10YY +10bp to 1.9302%. Markets overestimated Covid's drag on Jan employ gains and overreacted to the data by selling off too far as more aggressive rate hikes priced in.

- Generally subdued start to next week, dearth of scheduled Fed speakers until Fed Gov Bowman and Cleveland Fed Pres Mester at separate events Wed, main focus on Jan CPI on Thursday (0.4% median est vs. 0.5% prior; 7.2% YoY est).

- BLS will release seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year late morning.

- Eurodollar/Treasury option trade included a steady drip of repositioning and/or outright unwinds of March and June expirys as option accts look to longer dates for more relative value.

- Other salient flow: Unlikely a hedge for hawkish Fed -- possibly a tactical play in event of a weak Tsy 3Y note auction (91282CDZ1), $50B sale Tues: +25,000 short Feb 98.00/98.12 put spds, 2.75 ref: 98.185.

- Early Blocks: Conditional bear curve steepeners: with paper buying March, April and June 1Y midcurve put spds vs. Golds expiry put spds.

- After the close, 2-Yr yield is down 1.4bps at 1.2964%, 5-Yr is down 0.3bps at 1.765%, 10-Yr is up 0.9bps at 1.9177%, and 30-Yr is up 1.1bps at 2.2214%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 at 0.07714% (-0.00400 total last wk)

- 1 Month +0.00942 to 0.12471% (+0.00900 total last wk)

- 3 Month +0.02343 to 0.36243% (+0.02243 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.06714 to 0.62257% (+0.02100 total last wk)

- 1 Year +0.09271 to 1.09171% (+0.05114 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 0.05%, $891B

- Broad General Collateral Rate (BGCR): 0.05%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Buy-operations resume Tuesday:

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

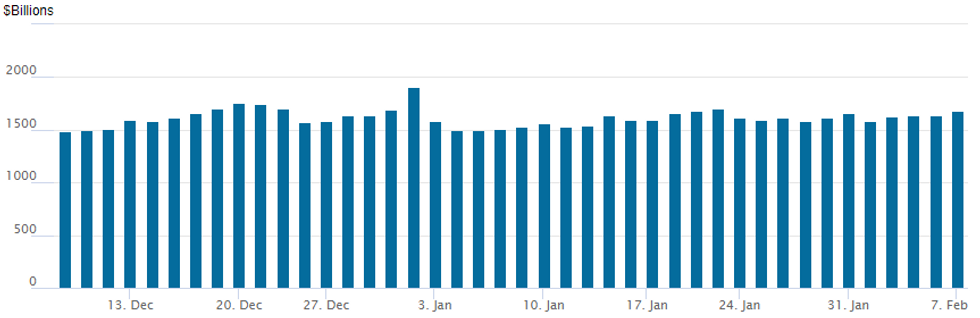

FED Reverse Repo Operation: Second Highest for 2022

NY Federal Reserve/MNI

NY Fed reverse repo climbs to second highest usage of $1,679.932B w/ 81 counterparties vs. $1,642.892B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Dec 99.25 calls vs. Dec 97.75/98.00/98.12/98.37 put condor, 0.0 net

- +5,000 May 98.81/98.93 put spds1.75 over May 99.31 calls

- -5,000 Dec/Red Sep 99.00 call spds, 2.0 Red Sep over

- -5,000 Jun 99.00/99.25 put spds, 16.0 vs. 98.975/0.30%

- +25,000 short Feb 98.00/98.12 put spds, 2.75 ref: 98.185

- 1,500 Mar 99.31/99.37/99.43/99.50 put condors

- +10,000 Apr 99.00/99.06/99.12/99.18 call condors, 1.25

- More conditional curve plays (similar to pre-open put spd/spd flattener Block)

- +5,000 short Apr 97.50/98.00 put spds 5.5 over Gold Apr 97.00/97.62 put spds

- +5,000 short Jun 97.50/98.00 put spds 4.5 over Gold Jun 97.00/97.62 put spds

- Overnight trade

- 2,500 Mar 99.25/99.50/99.62 put trees

- -10,000 Dec 98.00 puts, 17.0 vs. 98.375/0.32%

- -5,000 short Apr 98.00/98.25 put spds, 14.5, ref 98.025

- +4,500 Dec 97.62/98.12 put spds, 11.0 ref 98.39

- Block, total 10,000 short Mar 98.00/98.25 put spds 4.5 over Gold Mar 97.50/97.75 put spds

- 5,000 FVH 118/118.5/119 put trees, 10

- 10,000 FVH 118/118.25/119/119.25 put condors

- -14,000 FVJ 118.75 calls, 19.5 vs. 118-07.75

- 9,500 TYJ 128 calls, 28

- Overnight trade

- +20,000 TYH 124/125 put spds, 2-3

- 6,000 FVM 116.25 puts, 21.5

- Block, -20,000 FVH 118.75 puts vs. 17,000 FVJ 117.5 puts, 50

- Block, -7,500 FVH 118.5 puts vs. 6,000 FVJ 117.5 puts, 6

EGBs-GILTS CASH CLOSE: Lagarde Pulls Yields Back

ECB President Lagarde's appearance before the European Parliament ECON committee took centre stage Monday, with little data/speaker flow of interest otherwise.

- She didn't say much new ("no need to rush to premature conclusions"), but lack of hawkish surprises helped short-end German yields ease in particular.

- Short-end and periphery EGBs (especially Greece, +20bp vs Bunds on the day) sold off on the open after weekend comments from ECB's Knot over the weekend that we could see 25bp rate hikes in Q4-22 and Q1-23.

- Of note, MNI's interview w Kazaks out this afternoon included discussion on ending ECB's "triple-lock" forward guidance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at -0.287%, 5-Yr is up 0.5bps at 0.053%, 10-Yr is up 2.2bps at 0.227%, and 30-Yr is up 3.8bps at 0.393%.

- UK: The 2-Yr yield is up 1.3bps at 1.275%, 5-Yr is unchanged at 1.31%, 10-Yr is down 0.3bps at 1.408%, and 30-Yr is up 2.2bps at 1.503%.

- Italian BTP spread up 1.9bps at 156bps / Greek up 22bps at 228.6bps

EGB Options: A Few Hawkish Plays On ECB March Meeting

Monday's rates / bond futures options included:

- RXH2 164.5/167.5 combo, bought the call for 5 in 2.5k

- RXH2 163/162/161p fly, bought for 4in 4k (Target circa 0.48% in yield)

- RXH2 169p, sold at 3.55/3.56 in 10k (part of closing the RR)

- RXJ2 164.00/165.50/167.00c fly, bought for 21 in 5.1k

- RXJ2 158/156ps, bought for 16.5 in 3.5k

- DUH2 111.80/11.60ps, sold at 17 in 2.5k

- OEJ2 130.75/129.75ps 1x1.5, bought for 20.5 in 6k total

- 2RH2 99.375p, sold at 20.5 in 10k

- 2RH2 99.12/98.87ps, bought for 6 in 8.2k

FOREX: EUR Crosses Erode Recent Gains As ECB Temper Expectations

- The Euro underperformed on Monday and in particular EURAUD (-0.93%) and EURCAD (-0.88%) unwound recent strength as the ECB tempered expectations of premature tightening.

- President Lagarde used her platform at the European Parliament Economic and Monetary Affairs Committee to emphasize the safeguards in place “against a premature increase in interest rates”. Furthermore, she reiterated that any adjustments would be gradual, weighing on Euro-area front-end bond yields.

- The comments bolstered the downward trajectory for euro crosses, that had been in play throughout much of Monday, eating into the majority of Friday’s advance.

- EURUSD a touch softer on the day, however, the pair maintains a bullish theme following last week’s gains that resulted in the break of a number of key short-term resistance points. Initial support is seen at 1.1346.

- Overall subdued price action for currencies, evident by a close to unchanged US dollar index to start the week. A quiet data calendar is highlighted by US inflation data on Thursday that will likely be the driving force behind short-term greenback sentiment.

- Overnight, potential comments from RBNZ Governor Orr who is due to speak about the future of money at the Annual New Zealand Angel Summit, in Wellington.

FX: Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-65(E528mln), $1.1200(E1.2bln), $1.1250-60(E889mln), $1.1300-20(E2.3bln), $1.1380-00(E1.6bln)

- USD/JPY: Y115.50-65($636mln)

- GBP/USD: $1.3495-10(Gbp1.0bln), $1.3560(Gbp1.1bln)

- AUD/USD: $0.7100(A$732mln), $0.7125-35(A$645mln), $0.7150-55(A$521mln), $0.7165-75(A$893mln)

EQUITIES: Stocks Mixed-to-Flat as Markets Await Inflation Signals

- Wall Street indices traded mixed Monday, with none of the major indices moving with much conviction. The S&P500 slipped into minor negative territory, but managed to trade wholly inside the Friday range. In futures space, this translated to price action holding above the key support at the 4440 200-dma.

- Communication services names were again an underperformer, making up the worst performing sector in the index thanks to another slide in Meta's (Facebook) share price. The company shed another 4.5%, adding to last week's historic slide and putting the price at the lowest level since mid-2020.

- Earnings season has begun to wind down, with 9% of the S&P 500 due to report across the week beginning Feb 7th. Highlights include Amgen, Pfizer, Walt Disney, Coca-Cola and the ratings agencies Moody's and S&P Global.

- Healthcare and consumer staples make up the bulk of earnings, with Thursday the busiest session for the index.

- Full earnings schedule with timings, EPS & revenue expectations here: https://marketnews.com/mni-us-earnings-schedule-qu...

COMMODITIES: Oil Dips Ahead Of Iran Nuclear Negotiations

- Crude oil prices fell back after a bullish run as Iran nuclear negotiations are set to return to Vienna tomorrow following the Biden Administration on Friday waiving some sanctions, with the potential to ultimately see increased oil supply.

- WTI is -1% at $91.4, still some way above support of $90.07 (Feb 4 low) and then $86.34 (Jan 31 low) after its bullish price sequence. Resistance is seen at $93.17 (Feb 4 high).

- Brent is -0.5% at $92.76 having pulled back from an intraday high of $94 but still above initial support of $91.2 (Feb 4 low).

- Gold has increased +0.7% to $1821.6 after a subdued end to last week, seemingly on Russia-Ukraine tensions. It earlier cleared initial resistance at $1822.2 (Jan 27 high) before retracing and sits comfortably above support of $1780.4, the Jan 28 low and bear trigger.

Data Calendar for Tuesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 08/02/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2022 | 0745/0845 | * |  | FR | current account |

| 08/02/2022 | 0745/0845 | * |  | FR | foreign trade |

| 08/02/2022 | 0800/0900 | ** |  | ES | industrial production |

| 08/02/2022 | 0900/1000 | * |  | IT | retail sales |

| 08/02/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/02/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/02/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/02/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 08/02/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.