-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 30YY Surge, Give Peace a Chance

US TSYS: FI Summary, 30YY Back To Late Fri Lvls

Tsy bond yields have surged to highs for the week -- back near late Friday levels before Mon-Tue massive risk-off consolidation saw 30YY fall to 2.066% low Tuesday -- currently at 2.2666% +.1620 after the bell.

- Markets went from a cessation of risk-off following better than expected ADP jobs data (+475k vs. +375k est; huge Jan up-revision from -301k to +509k) to cautious risk-on by noon as Fed Chairman Powell brought a level of normalcy back to markets: expecting March liftoff as appropriate, keeping 50bp hike in reserve if inflation stays hot later in year, gradual/predictable balance sheet runoff soon after.

- High-gear risk-on in second half -- no obvious standout headline driver, but some desks cite short covering in stocks on hopes of some peace accord as Ukraine delegates said to be heading to talks with Russian counterparts. Leading SPX sectors at the moment: Energy, Financials and Materials -- all seeing some relief bounce after punishing sell-off/reaction to global sanctions on Russia.

- Thursday data focus on weekly claims, unit labor costs, durables while Fed Chairman Powell returns to Senate for second monetary policy testimony.

- After the bell, 2-Yr yield is up 16.3bps at 1.504%, 5-Yr is up 14.6bps at 1.7404%, 10-Yr is up 12.9bps at 1.856%, and 30-Yr is up 11.9bps at 2.2234%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00243 at 0.07943% (+0.00229/wk)

- 1 Month +0.00786 to 0.24243% (+0.01186/wk)

- 3 Month +0.01128 to 0.52214% (-0.00086/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.03200 to 0.79586% (-0.03285/wk)

- 1 Year +0.04158 to 1.21829% (-0.11242/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.07% volume: $247B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.062T

- Broad General Collateral Rate (BGCR): 0.05%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $361B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

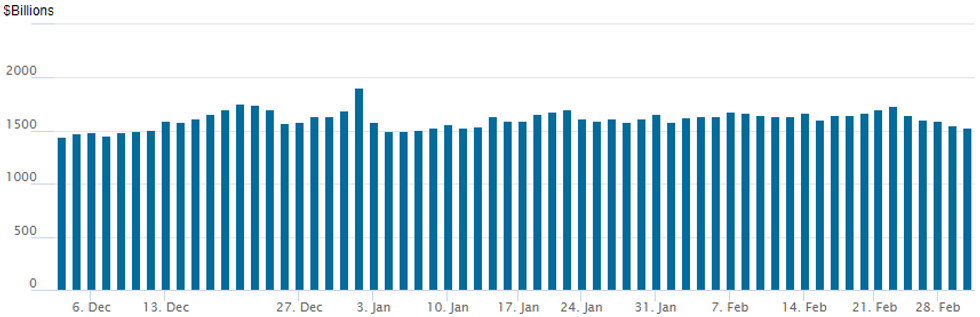

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,526.211B w/ 80 counterparties vs. $1,552.950B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Early Wednesday risk-off accelerated to risk-on in the second half, option accounts happy they held onto low delta (rate-hike insurance) put positions as yields surged back to late Friday levels -- 30YY at 2.2658 +.1653 after the close.

- Mon-Tue risk-off surge in FI markets tied to knock-on effect of Russia's invasion of Ukraine saw chances of NO hike in on March 16 climb to mid-teens Tue amid growing opinion that current events will/may derail central bank plans to hike rates.

- Apparently not the case according to Fed Chairman Powell as he sees 25bps liftoff still appropriate on March 16.

- Early week trade included decent pick-up in call buying in short end Eurodollar options (Whites-Reds, EDH2-EDZ3 climbed as much as 0.470) but legacy positions in low delta puts held.

- Wed's reversal in rates (Reds -0.27-0.29) saw renewed buying in downside puts. Two salient trades: +50,000 short Dec 95.00/95.50 put spds, 1.5 -- where the upper strike is associated with 4.5% rate by the end of 2023. Meanwhile, block/cross action included 30,000 Jun 98.25/98.50 put spds, 3.0 ref 98.87.

Treasury option highlights: - Treasury option highlights: +7,500 TYJ 126.5/127/127.5 put flys, 3 net -- where June underlying futures are trading at 127-06.5 at the moment (-1-16.5), paper bought over 25,000 TYJ 126 puts at 20. Mixed 5Y trade: Block total of 20,844 FVM 116.25 puts, 16-16.5, while paper sold -35,000 FVJ 119.25/120.25 call spds, 11.5.

Eurodollar Options:

+50,000 short Dec 95.00/95.50 put spds, 1.5

Block, 30,000 Jun 98.25/98.50 put spds, 3.0 ref 98.87

+5,000 Jun 98.50/98.75 2x1 put spds, 1.5 - 2-legs over

Block/Cross at 1206:34-06:20ET

-37,818 Dec 98.00 puts, 29.5 vs. 98.24/0.40%

+20,750 Dec 98.25 puts, 40.5 vs. 98.24/0.50%

+34,900 Dec 98.37 puts, 46.0 vs. 98.24/0.55%

-10,714 Dec 98.75 puts, 69.0 vs. 98.24/0.70%

+15,000 short Apr 97.37/97.62 put spds, 5.5

Treasury Options

+7,500 TYJ 126.5/127/127.5 put flys, 3 net, wings over

5,000 TYJ 126 puts, 20, total near 25k

Block, Total -20,844 FVM 116.25 puts, 16-16.5

-35,000 FVJ 119.25/120.25 call spds, 11.5

5,000 TYM 124/125 put spds

+30,000 wk2 TY 130 calls, 13

FOREX: USDCAD At 5-Week Lows On Oil/Hawkish BOC, Cross/JPY Strongly Supported

- The Bank of Canada initiated lift-off today by raising the overnight rate by 25bps to 0.5%. While CAD strength had largely been as a result of the prior significant surge in crude futures, a hawkish tilt to the statement provided an additional tailwind for the Canadian dollar, prompting USDCAD (-0.75%) to plumb fresh 5-week lows.

- After briefly testing the key short-term support of 1.2636 (Feb 10 low) that forms the bottom of the post Jan26 BOC/FOMC range, a sustained clearance should open 1.2560 (Jan 26 low).

- The 2% bounce in equity indices and oil price advance of around 8% on Wednesday also lent support to the likes of AUD, NZD and GBP while historical safe havens CHF (-0.26%) and JPY (-0.55%) were weighed upon.

- The divergence in G10 majors was evident with Cross/JPY being extremely well supported throughout the trading day as CAD/JPY rallied over 1.25%.

- EURUSD trades unchanged for the session, however, the single currency experienced some strong volatility after extending yesterday’s downward momentum to trade at 1.1058 amid fresh highs in the dollar index above 97.80. However, as equity markets bounced, EURUSD rose back above the 1.11 mark, looking likely to close just below session highs of 1.1143.

- Thursday will see the ECB Monetary Policy Meeting Accounts, as well as euro area unemployment, German car production and sales, and final services PMI data. BOC Governor, Tiff Macklem is then due to hold an online press conference about the Economic Progress Report with a Q&A scheduled.

Equity Roundup: Near Late Session Highs

Stocks trading near session highs after FI close -- back near last Fri's levels as risk appetite improved. Better than expected ADP private jobs gain of +475k vs +375k est (and massive Jan up-revision to +509k from - 301k!) set the stage for lower rates ahead Fed chairman Powell's testimony to Hse Fncl Services Comm.- Fed Chairman Powell remains inclined for 25bp liftoff on March 16, but keeping 50bp hike option open if inflation "stays hot".

- Stocks powered higher in the second half, ESH2 topping 4397.0. No obvious standout headline driver, but some desks cite short covering after the rout since Monday on hopes of some peace accord as Ukraine delegates said to be heading to talks with Russian counterparts.

- Leading SPX sectors at the moment: Energy, Financials and Materials -- all seeing some relief bounce after punishing sell-off/reaction to global sanctions on Russia.

COMMODITIES: Mixed Fortunes For Oil And Gold

- Crude oil prices have seen large swings on changing geopolitical headlines, but supply concerns dominate once again with ~7+% gains in crude oil prices heavily concentrated towards front-dated contracts.

- In line with expectations, the Russian Mission in Vienna has confirmed that OPEC+ has agreed to maintain the modest production increase of 400kbpd next month despite pressure from the US to increase supply.

- WTI is +7.1% at $110.8, having earlier cleared a further three resistance levels with the highest being $110.84 (2.5 proj of the Aug – Oct – Dec’21 price swing).

- The most active strikes in the Apr’22 contract have been $120/bbl calls.

- Brent is +7.8% at $113.2, through the second resistance level of $112.45 (2.382 proj of the same price swing).

- Gold meanwhile is -1% at $1925.4, hindered by a sizeable recovery in rate hike expectations that were further boosted as Powell largely indicated policy continuation. It continues to sit well above the key short-term support of $1878.4 (Feb 24 low) needed to break to suggest a deeper pullback within the bull channel.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/03/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/03/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 03/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/03/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/03/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/03/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 03/03/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 03/03/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/03/2022 | 1000/1100 | ** |  | EU | retail sales |

| 03/03/2022 | 1000/1100 | ** |  | EU | unemployment |

| 03/03/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/03/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/03/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/03/2022 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 03/03/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/03/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/03/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/03/2022 | 1500/1000 |  | US | Fed Chair Pro Tempore Jerome Powell | |

| 03/03/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/03/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 03/03/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/03/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/03/2022 | 1630/1130 |  | CA | BOC Governor Macklem speech, "Economic Progress Report." | |

| 03/03/2022 | 2030/1530 |  | CA | BOC Governor Macklem testifies at House committee. | |

| 03/03/2022 | 2130/1630 |  | US | New York Fed's Lorie Logan | |

| 03/03/2022 | 2300/1800 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.