-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Late Risk-On, Eq's Near Resistance

US Tsys: Late Risk-On, SPX Nears Key Resistance

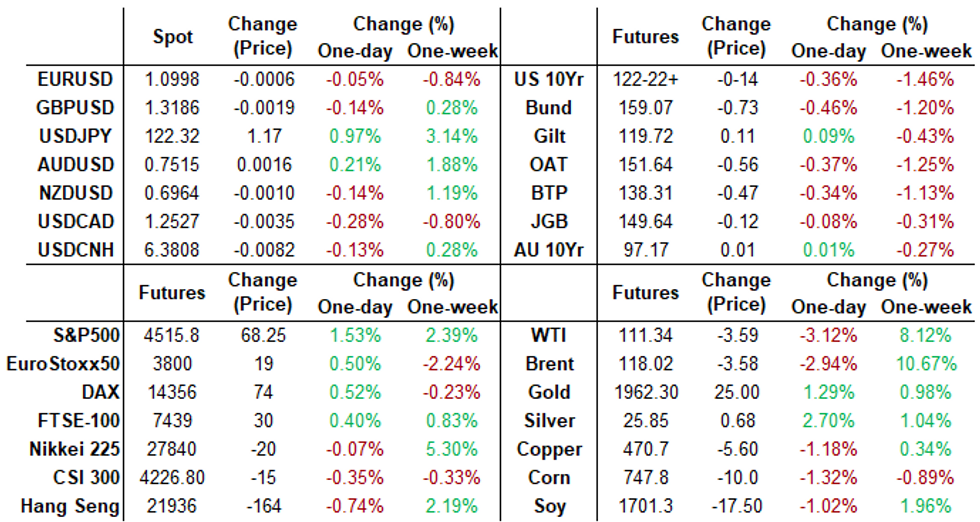

After holding near midday highs through the second half, US FI markets inching lower after the bell as equity indexes extend session highs: SPX eminis +66.0 at 4413.50 -- resistance of 4514.75 (Mar 22 high), a breach of which viewed as an important short-term bullish development and an extension would open 4578.50, the Feb 9 high.- Tsy 30YY back of 2.5 late: 2.5189% (+.0347), yield curves mixed 5s10s still well inverted -3.294 (-.328). Translation: uncertainty over pricing in forward policy (or confidence in Fed managing a soft landing) that is also inducing inversion in Eurodollar futures from EDM3 through EDM6.

- Tsys had see-sawed off morning lows to midday highs, trading desks reporting two-way trade across the board ahead the $14B 10Y TIPS auction that drew -0.540% high-yield back on Jan 20.

- Short end remains under pressure, trading desks reported domestic real$ selling in 2s earlier (various dealers starting to support 50bp hikes at May 4 FOMC). Two-way option-tied flow ahead serial April options expiring Friday, deal-tied selling across the curve.

- US Data/Speaker Calendar (prior, estimate) at 1000ET:

- Pending Home Sales MoM (-5.7%, 1.0%); YoY (-9.1%, -2.2%)

- U. of Mich. Sentiment (59.7, 59.7); Current Conditions (67.8, 67.6)

- Fed Speakers on tap Friday

- SF Fed Daly opening remarks at annual mon-pol conference, time TBA

- Fed Gov Waller discusses digital currency at 0910ET

- NY Fed Williams mon-pol outlook, BIS panel event w/Bank of Peru, 1000ET

- Richmond Fed Barkin on containing inflatio, Citadel event, 1130ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00085 at 0.32786% (-0.00085/wk)

- 1 Month -0.00943 to 0.44714% (+0.00057/wk)

- 3 Month -0.00014 to 0.96557% (+0.03157/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.03615 to 1.42586% (+0.13829/wk)

- 1 Year +0.04700 to 2.05786% (+0.27143/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $243B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $908B

- Broad General Collateral Rate (BGCR): 0.30%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $344B

- (rate, volume levels reflect prior session)

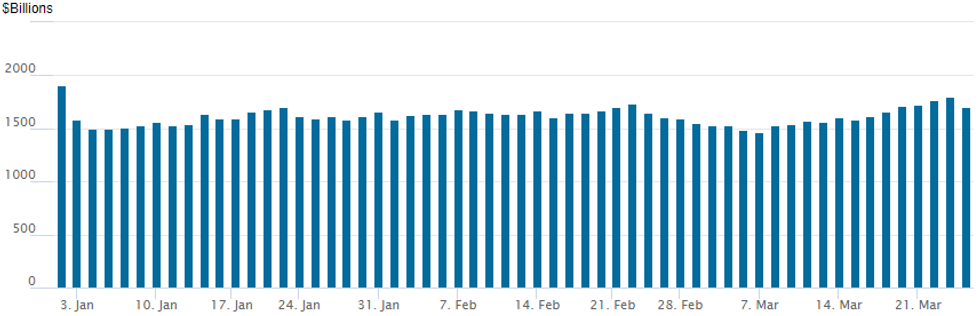

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,707.655B w/ 88 counterparties vs. Wednesday's $1,803.186B "22 high -- still well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Robust volumes in both Eurodollar and Treasury options Thursday, largely two-way with some accounts fading the early sell-off in underlying rates via put structure sales in Eurodollar options: via 2Y midcurve put spreads targeting a rebound in mid-2024 and late 2024.- Note: Uncertainty over pricing in forward policy (or confidence in Fed managing a soft landing): longer expirys continue to outperform. First price inversion: Red Jun'23 (97.050) vs. Red Sep'23 (97.055). Inversion flattens out in Blue Mar'26 through Golds (EDM6-EDH7) trading around 97.550.

- Sources reported sale of 10,000 Green Jun 97.75/98.00 put spds, 20.5 ref 97.305 and -5,000 Green Dec 97.75/98.25 put spds, 35.5 vs. 97.375/0.15% ahead the NY open.

- Better put structure buying emerged ahead midday: buying over +5,000 Sep 97.00/97.37/97.75 put flys, 6.5 ref 97.88, 5,000 Dec 97.00/97.25/97.50 put flys, 3.0 and Dec 97.00/98.00 put over risk reversals, 3.5.

- Treasury options saw better two-way in 5Y puts, salient early trade included +10,000 FVK 114.5 puts, 31.5-36.0

- -7,500 FVK 114.75/115.75 put spds, 33.0-32.5.

- Large 5Y call buying picked up late: Block buy of +30,000 FVK 116.25 calls, 16 vs. 114-30.5/0.22% after paper bought 10,000 FVK 117.5 calls, 4-3.5.

- Block, +10,000 Jun 98.18/98.31/98.50 put trees, 4.5 net

- +6,000 Sep 97.37/97.62 put spds 4.25 over 98.50/98.75 call spds

- +5,000 Red Mar'24 96.75/97.00 put spds, 9.0

- Block, 5,000 Dec 97.50/98.25 3x2 put spds, 55.0

- +5,000 short Jun 97.62/98.00 call spds, 4.5 vs. 97.075/0.10%

- +5,000 Dec 97.00/97.25/97.50 put flys, 3.0

- +3,000 Dec 97.00/98.00 put over risk reversals, 3.5

- over +5,000 Sep 97.00/97.37/97.75 put flys, 6.5 ref 97.88

- Block, 8,225 Dec 98.00/98.37 3x2 put spds, 18.0 net

- Overnight trade

- 1,750 Mar 97.37/98.00 1x2 call spds, 0.5-1.0

- -10,000 Green Jun 97.75/98.00 put spds, 20.5 ref 97.305

- -6,000 Jul 97.25/97.50 put spds, 4.5-4.25 ref 97.875

- -5,000 Green Dec 97.75/98.25 put spds, 35.5 vs. 97.375/0.15%

- Block, 30,000 FVK 116.25 calls, 16 vs. 114-30.5/0.22%

- 2,000 FVK 115.75 calls, 22.5, total volume >23.6k

- 5,000 FVJ 113.25 puts, .5

- +10,000 FVK 117.5 calls, 4-3.5

- 1,000 FVJ 115 calls, 7

- 4,000 TYM 126 calls, 24

- 3,000 FVM 120 calls, 2

- -10,000 FVK 115.75 calls, 21.5-21.0

- 5,000 TYJ 122.5 puts, 13

- 1,500 TYM 124.5/128.5 1x2 call spds, 29

- 2,500 TYJ 123 puts, 30

- Overnight trade

- 1,000 USK 149/154 1x2 call spds

- 2,000 wk1 10Y 123.5/124.5/125.5 call flys

- +10,000 FVK 114.5 puts, 31.5-36.0

- -7,500 FVK 114.75/115.75 put spds, 33.0-32.5

EGBs-GILTS CASH CLOSE: Yields Touch Fresh Multi-Year Highs Post-PMIs

Largely strong PMIs (particularly on the inflation side) set a bearish tone for the European FI space Thursday, with German instruments underperforming UK counterparts.

- With Eurozone PMI data looking stagflationary, German Schatz and Bobl yields reached the highest levels in 7-8 years.

- UK services PMI impressed; 10Y Gilt yields reached the highest levels since 2018.

- Periphery spreads were mixed (much as equity performance was mixed), with Italian spreads very slightly wider.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.4bps at -0.199%, 5-Yr is up 7.8bps at 0.27%, 10-Yr is up 6.6bps at 0.532%, and 30-Yr is up 4.6bps at 0.665%.

- UK: The 2-Yr yield is down 0.2bps at 1.348%, 5-Yr is up 1.3bps at 1.415%, 10-Yr is up 1.9bps at 1.646%, and 30-Yr is down 0.7bps at 1.841%.

- Italian BTP spread up 0.3bps at 152.1bps / Spanish down 2.3bps at 88.1bps

EGB Options: Euribor Dominates Proceedings

Thursday's Europe rates / bond options flow included:

- Large call spread strip: ERM2 100.37/100.50cs 1x2, bought the 1 for 3.5 in 16k / ERU2 100.37/100.50cs 1x2, bought the 1 for 1.25 in 16k / ERZ2 100.37/100.50cs 1x2, bought the 1, for 0.75 in 16k

- ERZ2 99.75/99.25 1x1.75 put spread bought for 8.25 in 15k

- 0RU2 98.875/98.625/98.375p fly, bought for 2.75 in 2.5k

- 2RU2 98.75/98.50/98.25p fly, bought for 2.75 in 5k

FOREX: JPY Breaks Another Key Level

- JPY extended the downleg into the Thursday close, with both USD/JPY and EUR/JPY moving through a number of notable technical levels. USDJPY marked a sixth consecutive session of higher highs, meaning this week, the pair has cleared the psychological 120.00, 121.00 and now 122.00 handles, strengthening bullish conditions.

- In the EURJPY cross, prices cleared major resistance at the 2021 highs of 134.13, tilting the RSI higher. This technical measure is now tilting toward flagged overbought conditions for the first time since early February - when it presaged a corrective dip lower from 133.00 to below 126.00.

- Scandi currencies traded well, with NOK and SEK higher against most others. The Norges Bank raised rates and steepened their rate path projection, indicating rates could be as high as 2.50% at end-2023 - a notable upgrade from their last look in December. A moderation in the oil price worked against NOK into the close, with Brent and WTI shedding 3% apiece.

- A recovery in Wall Street equities and weight in oil followed a report from Axios, citing the chief of staff to the Ukrainian President as saying that progress had been made in ceasefire negotiations with Russia, expressing "careful optimism".

- Focus Friday turns to UK retail sales numbers, the German March IFO release and US pending home sales data. Fedspeak continues to filter through, with Daly, Waller, Barkin and Williams on the docket. BoC's Kozicki also makes an appearance.

FX: Expiries for Mar25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E1.6bln)

- USD/JPY: Y119.25($1.0bln)

- AUD/USD: $0.7370-80(A$507mln)

- USD/CAD: C$1.2610-15($517mln)

Equity Roundup: Moderate Gains, Home Depot Leads DJIA

Stocks holding moderate gains, SPX eminis near midday highs as markets digest headlines from early NATO summit regarding Russia war in Ukraine. While early headlines that NATO was concerned over potential use of chemical, biological or nuclear weapons by Russia were disconcerting, renewed optimism over peace-talks underpinned stocks ahead midday.

- SPX eminis traded +44.0 at 4491.5 vs. 4497.75 highs, focus on key resistance of 4514.75 (Mar 22 high), a breach of which viewed as an important short-term bullish development and an extension would open 4578.50, the Feb 9 high.

- Dow trades +261.53 (0.76%) at 34619.89, and Nasdaq +166.9 (1.2%) at 14089.41.

- SPX leading/lagging sectors: Information Technology sector (+2.0%) lead by surge in semiconductors (+5.65%) outpacing Hardware (+1.07%) and Software (+0.69%). Notable mover: Nvidia (NVFA) +9.95% to 281.85, Intel (INTC) +6.06% at 51.2%. Materials sector (+1.48%) lead by Metals/Mining and Construction (+1.61-1.59%).

- Laggers: Real Estate sector (+.13%) and Consumer Staples (+0.37%), household and personal products underperforming.

- Dow Industrials Leaders/Laggers: United Health leading: +11.83 at 515.6; McDonalds (MCD) a distant second +3.33 at 239.45.

- Laggers: Home Depot (HD) continues to sell off -1.17 at 315.88. Incidentally, Home depot issued $4B in debt on the day: $500M 3Y +40, $750M 5Y +60, $1.25B 10Y +95, $1.5B 30Y +120.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4578.50 High Feb 9 and a key resistance

- RES 1: 4514.75 High Mar 22

- PRICE: 4468.00 @ 13:43 GMT Mar 24

- SUP 1: 4361.23 20-day EMA

- SUP 2: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 3: 4055.60 Low May 19 2021 (cont)

- SUP 4: 4029.25 Low May 13 2021 (cont)

COMMODITIES: Oil Prices Fall As EU Sanctions Questioned

- Oil prices continue their recent unsettled moves, today falling as questions mount over whether the EU will make an immediate ban on Russian oil imports.

- Canada has also announced it will increase exports of crude oil by 200k bpd and gas by 100k boepd by accelerating planned projects to help displace Russian supply.

- WTI -3.3% at $111.1, off the earlier intraday high of $116.64 that now forms resistance but still above the 20-day EMA of $102.83.

- The most active strikes in the May2022 contract have been $100/bbl puts.

- Brent is -3.3% at $117.6, off the earlier $123.74 and again above support at the 20-day EMA of $108.26.

- The most active strikes in the May22 contract have been $130/bbl calls.

- Gold is +0.9% at $1961.8 with the US targeting Russian gold in new sanctions. It’s through initial resistance of $1954.7 (Mar 15 high) and has re-opened $2009.2 (Mar 10 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 25/03/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 25/03/2022 | 0800/0900 | *** |  | ES | GDP (f) |

| 25/03/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/03/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/03/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/03/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 25/03/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/03/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/03/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 25/03/2022 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 25/03/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/03/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 25/03/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 25/03/2022 | 1645/1245 |  | CA | BOC Deputy Kozicki speaks at SF Fed conference on "A world of difference: households, the pandemic and monetary policy" |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.