-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI ASIA MARKETS ANALYSIS: What Recession Concerns?

US TSYS: Tsy 2s10s Yield Curve Tops 40.0

Rates trading weaker after the bell, bonds near second half lows, curves inching steeper -- 2s10s tops 40.0 at 40.874 high -- vs. -9.561 inversion two weeks ago - the height of recession concern rhetoric. Light volumes to start the new week (TYM2 less than 770k) with much of Europe out for Easter Monday.

- Following some early price uncertainty, Tsys came under pressure, extended lows (30YY hit 2.9659%) on rate-lock selling before the broader market knew Morgan Stanley was going to issue $7B over 4 tranches, Wells Fargo a close second with $6.75B over 3 tranches.

- No react to in-line NAHB housing Market index for April at 77.

- Resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. MA studies also point south and scope is for a move towards 119-04+, Dec 3 2018 low (cont). Key short-term trend resistance is at 123-04, the Mar 31 high.

- Cross asset trade of note, Gold nearly traded over $2000.0 w/ 1997.63 session high, was back near steady at 1978.0 after FI close. BBG US$ index DXY climbed surged .364 to 100.864 high, crude levels reluctantly gained after Libya oilfield closure/force majeure event after political protests, tempered by reduced demand from China on forced covid lockdowns.

- The 2-Yr yield is down 0.2bps at 2.4521%, 5-Yr is down 0.2bps at 2.7856%, 10-Yr is up 2.5bps at 2.8527%, and 30-Yr is up 2.8bps at 2.9424%.

SHORT TERM RATES

US DOLLAR LIBOR:No new settlements -- below from last Tursday:

- O/N -0.00500 at 0.32229% (-0.00529/wk)

- 1 Month +0.04029 to 0.59433% (+0.08043/wk)

- 3 Month +0.01842 to 1.06271% (+0.05200/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00514 to 1.55671% (+0.01628/wk)

- 1 Year -0.02986 to 2.22157% (-0.05000/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $75B

- Daily Overnight Bank Funding Rate: 0.33% volume: $99B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.29%, $886B

- Broad General Collateral Rate (BGCR): 0.30%, $336B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $328B

- (rate, volume levels reflect prior session)

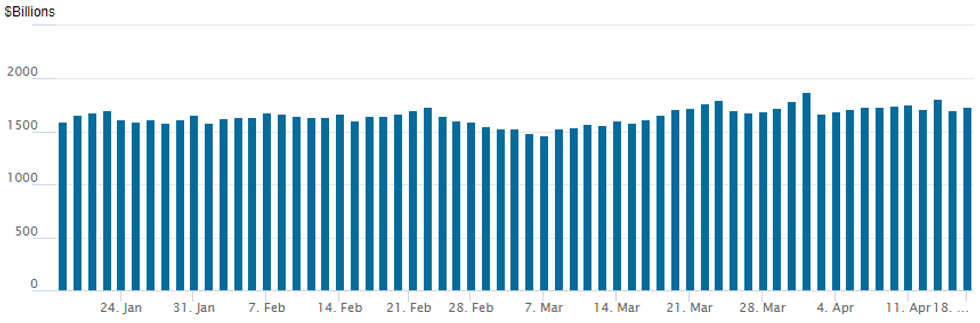

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,738.379B w/ 82 counterparties from prior session 1,706.935B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Hard to draw any conclusions from Monday's post-Easter Holiday trade. Limited option and underlying futures volumes with much of Europe still out for and extended weekend.- Underlying FI futures kicked off the new week moderately lower, holding to narrow ranges. Option trade mixed with better put trade in Treasury options, unwinding or positioning for a rebound ahead of the next Fed blackout that kicks off Friday at midnight, traders anticipating a 50bp hike at the next FOMC on May 4.

- +5,000 short Jun 97.00/short Sep 97.50 call spds, 0.0 Jun over

- +5,000 short Dec 97.37/97.62/98.00/98.25 call condors, 4.0

- -10,000 short May 96.50 puts, 9.0 ref 96.665

- +5,000 short Jul 97.87/98.00 call spds, 0.5 ref 96.67

- Overnight trade

- 1,000 Sep 97.75/98.00/98.25/98.50 call condors

- +3,000 USM 134 puts, 34 ref 140-10

- Update, total 10,600 USK 138 puts 20-18

- -4,500 TYM 122 puts, 225-228 ref 119-29.5 to -30

- -15,000 FVM 111.75/112.75 put spds, 17 ref 113-10

- +10,000 FVM 116.5 calls, 3.5

- Block, -10,000 TYM 119.5 puts, 62 w/ another -5k screen

- Update, total 4,000 TYK 120 calls, 19-24

- Overnight trade

- 5,100 FVM 114 calls 21.5-23

- +2,000 TYK 118/118.5/119 put flys, 2 ref 119-15.5

- 2,600 TYK 120 calls, 19

- +2,500 TYM 118.5 puts, 45

- +3,000 TYM 120/121/121.5 broken call trees, 2 cr ref 119-22.5

FOREX: AUD Nears Key Support on Poor Chinese Data

- China GDP data overnight came in ahead of market expectations, putting the Y/Y growth rate at 4.8% - a pace still below the Politboro target. Rolling lockdowns and a re-flaring of COVID across major industrial cities were cited, as the raft of data showed consumer spending falling at the largest clip since the initial breakout of the virus in 2020.

- Signs of weakness hampered the progress of AUD - the session's poorest performing currency - narrowing the gap in AUD/USD with first key support at the 0.7340 50-dma. The greenback fared better, putting the USD Index within range of new cycle highs amid the general risk-off environment Monday.

- Conflict across Ukraine persisted over the weekend, with Kyiv reporting several missile strikes in the Western city of Lviv - just 70km east of the Polish border. The strikes are said to have resulted in a number of fatalities, and show that no part of the country is exempt from the Russian invasion despite the pullback of Russian forces into eastern territories.

- Focus Tuesday turns to the return of EU and UK traders after the extended weekend as well as the release of US housing starts & building permits data. RBA minutes of their latest meeting cross as well as a speech from Fed's Evans.

- Earnings season enters its second week, with 15% of the S&P 500 by market cap reporting. Notable releases include Bank of America, IBM, Johnson & Johnson, Proctor & Gamble, Tesla and Netflix.

EQUITIES: Late Equity Roundup: Energy Leads the Charge

Equity indexes rebounding late -- looking to test early session high at the moment. No obvious driver ahead pick-up in earnings releases Tuesday. Energy names leading the charge, so to speak, followed by Banks.

- Bearish threat remains for SPX eminis, however, as EDM2 trades +13.50 at 4401.0, still below 50-day EMA that intersects at 4451.78. Close below 4400.00 signals scope for weakness towards 4321.07 next, a Fibonacci retracement.

- On the flipside, initial firm resistance has been established at 4519.75, Apr 8 high A break would ease the bearish threat.

- SPX leading/lagging sectors: Energy sector continues to outperform (+1.96%) as oil, gas and consumable fuels outpaces energy equipment/servicing names. Meanwhile, Financials sector (+0.97%) outpaces Materials sector (+0.49) as banks outperform..

- Laggers: Health Care sector still lagging (-0.72%) as pharmaceutical and biotech names underperform (Moderna/MRNA -5.34% at 156.66).

- Meanwhile, Dow Industrials currently trade +103.78 (0.3%) at 34553.36, Nasdaq -24.7 (0.2%) at 13375.08.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) surges +8.23 at 329.90, followed by American Express (AXP) +3.52 at 184.68. Home Depot (HD) continues to sag -3.28 at 301.24, followed by Honeywell -2.77 at 127.70 and Walt Disney -2.80 at 127.67

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4631.00 High Mar 29 and a key resistance

- RES 1: 4519.75/4588.75 High Apr 8 / High Apr 5

- PRICE: 4405.50 @ 1400ET Apr 18

- SUP 1: 4355.50 Low Apr 18

- SUP 2: 4321.07 61.8% retracement of the Mar 15 - Mar 29 rally

- SUP 3: 4239.00 Low Mar 16

- SUP 4: 4220.92 76.4% retracement of the Feb 24 - Mar 29 rally

COMMODITIES: Shuttered Fields Put Upside Back in Focus For Oil

- WTI and Brent crude futures traded positively Monday, putting the focus back on the upside for oil futures. After key support had been tested in the earlier half of last week, prices are back on the front foot, recording a fourth consecutive session of higher highs and higher lows. The shuttering of Libya's largest oil field has added to an already complicated supply picture, as widespread protests against the government spread throughout the oil industry. This drops Libya's daily output from as high as 1.2mln bpd, to less than half.

- Mainland European supply also remains in focus, with the Kremlin Monday stating that talks with Ukraine are continuing on an 'expert' level, but there remain few signs of progress. On gas payments, Moscow have stated that there remains time for payments to switch to RUB, with some settlements expected in May.

- The rally puts Brent futures in range of $119.74, the Mar 24 high and bull trigger. Meanwhile, $108.75/112.93 is being probed in WTI markets, the highs from Mar 30 / Mar 28.

- Gold trades well to kick off the new week amid lower US equity markets. The short-term outlook is bullish following last week’s move above $1966.1, the Mar 24 high. The breach highlights a range breakout and suggests scope for an extension of current short-term gains. The focus is on $2001.6 next, a Fibonacci retracement. On the downside, key support has been defined at $1890.2, the Mar 29 low. A breach of this support would reinstate a bearish threat.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2022 | 0430/1330 | ** |  | JP | Industrial production |

| 19/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 19/04/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/04/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 19/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 19/04/2022 | 1605/1205 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.