-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Down 0.36% In Week of Dec 6

MNI: PBOC Net Injects CNY13.8 Bln via OMO Monday

MNI BRIEF: PBOC Increases Gold Reserves

MNI ASIA MARKETS ANALYSIS: Risk Appetite Rebounds Ahead NFP

US TSYS: ADP Miss Ahead May NFP; Stocks, Oil, Gold Bounce

Rates trade mildly higher after the bell, near middle of session range on light volumes (TYU2 appr 900k) w/ London out on two-day holiday.

- No LIBOR settles today and tomorrow w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325. Moderating market repricing chances of additional rate hikes out the curve (odds of additional 50bp in Fall gaining).

- Random volatility/thin liquidity continues. Tsys had bounced back near post-ADP highs (+128k vs. +300k est), reversed course as 30Y Bonds gapped lower/extend session lows (30YY tapped 3.1110%) reportedly in sympathy w/ selling in EGBs. Yield curves bear steepened off lows, 2s10s climbed to 28.921 high.

- Wide range for Crude (Brent 115.5 low/121.5 high), initially weaker on assumption Saudi and UAE were going to make up for Russian lost capacity (down 1mn bpd since invasion). Instead, Russia remains joint biggest contributor based on quota but market knows they can't make up that number - neither can Nigeria, Iraq etc. Crude reversed/legged higher after headlines annc EU approves "partial Russian oil ban, sanctions on Sberbank", Bbg.

- Fri data focus on May Employ Report (+325k vs. +428k prior), Fed Speak: Cleveland Fed Mester on CNBCs The Exchange to discuss employ report at 1340ET.

SHORT TERM RATES

US DOLLAR LIBOR: No LIBOR settles today and tomorrow w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325.

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $85B

- Daily Overnight Bank Funding Rate: 0.82% volume: $255B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.80%, $994B

- Broad General Collateral Rate (BGCR): 0.80%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $355B

- (rate, volume levels reflect prior session)

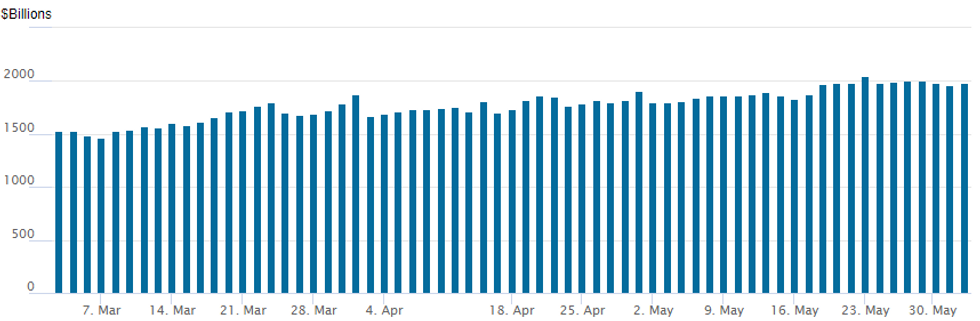

FED Reverse Repo Operation

NY Federal reserve/MNI

NY Fed reverse repo usage slips to 1,985.239B w/ 97 counterparties vs. 1,965.015B prior session, compares to Monday's record high $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Light volumes Thursday continued to rotate around downside (rate hike) puts. Limited flow, no LIBOR settles today and tomorrow w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325.

- Moderating market repricing chances of additional rate hikes out the curve (odds of additional 50bp in Fall gaining).

- 5,000 SFRU2 97.25/97.50 put spds

- 2,000 Blue Jun 96.6296.75/96.87/97.00 put condors

- -5,000 short Aug 96.87/96.93 call spds, 2.0 vs. 96.66/0.05%

- Pre-open:

- 7,500 short Jun 96.37/96.62 put spds

- 4,000 short Sep 96.00 puts, 8.5

- 4,000 TYU 119 calls, 132

- 6,500 USN 135/137 put spds

- 4,000 TYN 116/117 put spds, 8

- 4,000 FVN 111.5/112 put spds, 5.5

- +5,000 FVN 111.5 puts, 14.5-15.0

- 20,000 (16k Blocked) FVN 112 puts, 28.5

- 2,500 TYN 119 puts, 61

- 1,000 FVU 109/111 put spds

FOREX: USDCAD Beyond A Hawkish BoC

- At sub-1.26, USDCAD has now slipped -3.7% from the May 12 high of 1.3077 from a combination of a rolling over in USD strength and strong CAD factors including surprisingly strong inflation.

- The latest slide in the pair following recent BOC hawkishness (latest being Dep Gov Beaudry on increasing chance of rates north of 3%) and USD weakness sees the pair sitting just above support at 1.2562 (61.8% retrace of the Apr 5 – May 12 bull run).

- As noted in the MNI BoC Review, there is a wide range in some analyst expectations for the pair: TD view CAD as the most overbought on their dashboard and sees a high frequency fair value of 1.27-1.28 whilst ING sees a supportive CAD backdrop supporting both in the short-term by offsetting USD appreciation and longer-term with USDCAD eyed at 1.22 year-end.

- Some of this uncertainty comes from a real effective exchange rate sitting very close to long-run averages (offering little bias) and CFTC net spec positioning has shifted to a net short position but isn’t particularly large historically which could move either way.

- In addition, the pair remains heavily led by risk sentiment, with greater risk-off flows easily having potential to unwind recent moves.

Late Equity Roundup: Extending Highs

SPX eminis remain strong, extending session highs since noon (ESM2 +58.25 (1.42%) at 4156.25) as they shrugged off early negative guidance from Microsoft and weak auto sales from Ford and taking cues from surge in Gold and Crude prices, latter after trading $2-3 weaker.

- SPX leading/lagging sectors: Consumer Discretionary continued to gain (+2.8%) lead by autos: Tesla +5.7% at 782.57, while Ford holds +2.1% despite the drop in sales. Consumer Services (+2.56%) and Materials (+2.38%) followed.

- Laggers: Energy underperformed (-0.57%) followed by Utilities (-0.25%) while Health Care bounced off earlier lows to +0.18%.

- DJIA +267.89 (0.82%) at 33075.51; Nasdaq +287.7 (2.4%) at 12280.84.

- Dow Industrials Leaders/Laggers: Salesforce.com (CRM) extended strong rally +13.24 at 189.31, outpacing Boeing (BA) +9.04 at 139.69. Laggers: Amgen (AMGN) -7.67 at 245.75, United Health Care (UNH) -3.01 at 489.54, followed by JNJ -1.90 at 175.81.

E-MINI S&P (M2): 50-Day EMA Still Intact

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4184.74/4202.25 50-day EMA / High May 31

- PRICE: 4087.75 @ 14:31 BST June 2

- SUP 1: 3960.50/3807.50 Low May 26 / Low May 20 and bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain below Tuesday’s high but maintain a firmer tone. The contract on Tuesday briefly breached its 50-day EMA, at 4184.74 today. A clear break of this EMA would strengthen current bullish conditions and signal potential for a climb towards a key resistance at 4303.50, the Apr 26/28 high. Recent gains are still considered corrective and the primary trend is down. A reversal lower would refocus attention on the bear trigger at 3807.50.

COMMODITIES: Oil Bid By Supply Side Limitations, Gold By A Sliding USD

- Crude oil prices have been boosted today by falling US crude inventories in an already tight market and doubts over OPEC+’s ability to meet its agreement to accelerate the pace of the supply increases for output to increase by 648kbpd in July and August. Only Saudi Arabia and UAE aren’t already pumping at capacity.

- WTI is +1.5% at 117.00 and back near yesterday’s highs. Resistance remains $119.98 (May 31 high) having stopped just short of round number resistance at $120.

- Supply issues are seen lasting, with increases not just confined to front contracts, whilst the rising prices have been met by the most active strikes in CLN2 being $125/bbl and then $130/bbl calls.

- Brent is +1.2% at $117.68. Resistance remains $120.80 (May 31 high) whilst support is $112.80 from the earlier intraday low.

- Gold is up strongly, +1.25% at $1869.73 as the US dollar slides and testing initial resistance at $1869.7 (May 24 high) after which it opens the 50-day EMA of $1877. Gains are however still considered corrective with the primary direction seen lower.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/06/2022 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 03/06/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/06/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 03/06/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/06/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/06/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/06/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/06/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/06/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 03/06/2022 | 0900/1100 | ** |  | EU | retail sales |

| 03/06/2022 | 1230/0830 | *** |  | US | Employment Report |

| 03/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/06/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/06/2022 | 1430/1030 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.