-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Back Near Pre-FOMC Lvls

US TSYS: Fed "Vigorously" Using it's Tools

Rates trading near late session highs after the bell, decent volumes (TYU2>1.5M), 30YY -.0974 at 3.2398, yield curves managing to hold steeper profile: 2s10s +2.391a t 9.619, 5s10s +1.621 at -7.397.- Debatable drivers for the rally in rates that kicked off overnight deemed risk-off as stocks traded weaker/paring Tue's gains on the back of sharply lower crude oil prices (WTI fell to 101.67 low vs. 109.71 high as demand eased and markets anticipated a 3M gas-tax proposal from Pres Biden).

- Rates held near highs in second half after Fed Chair Powell's Senate testimony initially deemed less hawkish for rates with the goal to bring inflation back down to our 2%. "We will make our decisions meeting by meeting, and we will continue to communicate our thinking as clearly as possible," he said in written testimony to Congress. "We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy."

- Unwilling to take chance of 100bp hike off the table, followed by Chicago Fed Evans calling 75bp hike in July "very reasonable", helped keep futures in check as buy interest moderated.

- Tsy futures holding near session highs (USU2 +2-21 at 136-01; 30YY 3.2346% at the moment) after $14B 20Y bond auction (912810TH1) re-open : 3.488% high yield vs. 3.488% WI; 2.60x bid-to-cover vs. last month's 2.50x.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00371 to 1.57129% (+0.00386/wk)

- 1M -0.00886 to 1.63271% (+0.02042/wk)

- 3M +0.03014 to 2.18457% (+0.08871/wk) * / **

- 6M -0.01529 to 2.82657% (+0.04714/wk)

- 12M -0.04557 to 3.57986% (-0.00600/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.15443% on 6/22/22

- Daily Effective Fed Funds Rate: 1.58% volume: $67B

- Daily Overnight Bank Funding Rate: 1.57% volume: $242B

- Secured Overnight Financing Rate (SOFR): 1.45%, $957B

- Broad General Collateral Rate (BGCR): 1.46%, $372B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $362B

- (rate, volume levels reflect prior session)

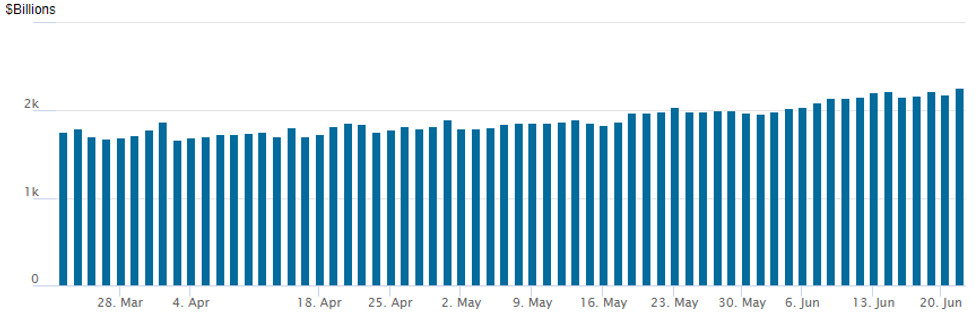

FED Reverse Repo Operation: New Record High

NY Federal reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,259.458B w/ 95 counterparties vs. $2,188.627 prior session. Compares to last Friday's record high of $2,229.279B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Devil's advocate plays the range. While Tuesday's option trade hedged for/anticipated correctly for a rebound in underlying rate futures, Wednesday's trade centered on the opposite. With a few exceptions, midweek flow faded the strong rally in underlying futures via put buying.- Debatable drivers for the rally in rates that kicked off overnight deemed risk-off as stocks traded weaker/paring Tue's gains on the back of sharply lower crude oil prices (WTI fell to 101.67 low vs. 109.71 high as demand eased and markets anticipated a 3M gas-tax proposal from Pres Biden).

- Rates held near highs in second half after Fed Chair Powell's Senate testimony initially deemed less hawkish for rates with the goal to bring inflation back down to our 2%. Unwilling to take chance of 100bp hike off the table, followed by Chicago Fed Evans calling 75bp hike in July "very reasonable", helped keep futures in check as buy interest moderated.

- Trade highlights included block buys of 20k each: Dec 95.62/96.00/96.12/96.50 put condors, 8.0 and Dec 95.62/96.12/96.25/96.75 put condors, 14.0. SOFR options included buy of 6,500 SFRV2 95.75/95.93/96.06/96.25 put condors and -5,000 97.25/97.62 call spds 0.5 over SFRZ2 96.12/96.25/96.50 broken put flys vs. 96.50/0.14%.

- Block, total 10,000 short Aug 96.00/96.50 put spds, 10.0 vs. 96.64/0.10%

- Block, -5,000 97.25/97.62 call spds 0.5 over SFRZ2 96.12/96.25/96.50 broken put flys vs. 96.50/0.14%

- +3,000 SFRZ2 97.75/98.00 call spds, 2.0

- 6,250 SFRV2 95.75/95.93/96.06/96.25 put condors

- Block, 20,000 Dec 95.62/96.00/96.12/96.50 put condors, 8.0

- +10,000 Dec 96.62 straddles, 91.5 vs. 96.15/0.35%

- Block, total 20,000 Dec 95.62/96.12/96.25/96.75 put condors, 14.0 net

- +5,000 Dec 95.25/96.00 2x1 put spds, 5.5, adds to Tue buys

- 3,000 short Sep 96.00/96.37 put spds

- 11,200 short Dec 97.75/98.25 call spds

- 3,000 Mar 95.75/96.75 put spds

- 0-negative rate hedge? late overnight buying in Mar'23 100, Jun'23 100.12 calls at 1.5, and Red Se'23 100.12 and 100.25 calls at 2.0

- -1,200 FVQ 108.5 puts, 8

- +2,000 TYQ 118.5 calls, 31

- -10,000 TYQ 115 puts, 29, total over -22k/day

- 5,000 TYU 116.5 puts, 1-44

- 2,000 FVU 115 calls, 6

- 4,000 TYN 115.5 puts, 6

- 2,000 FVQ 109.5 puts, 22

- 3,000 TYU 115 puts, 101

- 2,500 TYU 117/118 put spds

- over 30,000 wk1 TY 113/114 put spds

- Block, 5,000 TYN 118/119.25 put spds, 115

EGBs-GILTS CASH CLOSE: Yields Move Lower Alongside Oil Prices

EGBs rallied strongly across the board throughout Wednesday's session.

- A sharp drop in oil prices overnight, triggered in part on global growth concerns, helped drag on yields (and equities) early.

- Though stocks rallied in the afternoon, the oil bounce alongside was relatively tame and core FI held gains.

- Gilts outperformed Bunds (despite May UK inflation slightly above expectations); the UK curve bull steepened with Germany bull flattening.

- BTP spreads opened wider but narrowed over the course of the day. GGBs underperformed.

- Attention turns to PMI data Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 9.3bps at 1.062%, 5-Yr is down 13.1bps at 1.421%, 10-Yr is down 13.3bps at 1.638%, and 30-Yr is down 14bps at 1.835%.

- UK: The 2-Yr yield is down 17.2bps at 2.144%, 5-Yr is down 17.4bps at 2.166%, 10-Yr is down 15.5bps at 2.499%, and 30-Yr is down 14bps at 2.731%.

- Italian BTP spread down 4.3bps at 188.4bps / Greek up 9bps at 226.4bps

EGB Options: Mostly Downside In Euribor

Wednesday's Europe rates / bond options flow included:

- RXQ2 152 call, bought for 10 in 6k and 10.5 in 4k

- RXQ2 153/154.5cs, bought for 3 in 5.8k

- RXQ2 141.50 put sold at 68 in 3.75k vs RXQ2 149.5 call bought for 45 in 7.5k

- RXU2 145/147.5/150/153.5 call condor vs 142/139.5 put spread 5 paid 5500 condor

- ERZ2 98.25/98.00ps, sold at 6.75 in 10k (ref 98.545)

- ERZ2 98.50/98.25/98.00p fly bought for 2.75 in 6k

FOREX: Lower Yields Weigh On Greenback, EUR Crosses Buoyant

- Treasury yields plunged across the curve as fears of an economic recession sent investors into the relative safety of US government debt. G10 currencies were mixed but overall, lower core yields weighed on the USD index, which reversed significantly following initial strength on Wednesday.

- This prompted a steady and substantial bounce in EURUSD (+0.42%) from the 1.0470 early European lows all the way back to the 1.0600 area. Equities aside, growth fears fed into a sense of souring risk sentiment, which also boosted Euro crosses with EURNZD and EURAUD the standout performers, rising around 1% within close proximity of the May highs.

- USD/JPY (-0.25%) retreated off this week's multi-decade cycle high, putting the rate back below the Y136.25 in what's likely to be only a brief respite. USDJPY broke to new cycle highs this week, with price clearing short-term resistance at 135.59, Jun 15 high and this resistance point held as short-term support during today’s session. Overall, the technical break higher confirms a resumption of the primary uptrend and maintains the bullish price sequence of higher highs and higher lows.

- EURNOK had a firm 0.9% rally as a downleg in oil prices undermined sentiment somewhat ahead of tomorrow’s Norges bank meeting. Tighter policy has been well signposted for the June meeting, with the bank signalling a rate hike is “most likely” to be delivered. The size of the hike, however, is less forecastable and may keep NOK volatility elevated over the next 24 hours.

- European flash PMIs for June will headline Thursday’s docket as Fed Chair Powell continues to testify on the Semi-Annual Monetary Policy Report before the House Financial Services Committee.

FX: Expiries for Jun23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0455-65(E2.1bln), $1.0500(E1.8bln), $1.0595-00(E1.1bln)

- USD/JPY: Y132.00($1.2bln), Y132.80-00($1.0bln), Y134.00($641mln), Y135.00($999mln)

- GBP/USD: $1.2280-00(Gbp530mln), $1.2380-00(Gbp1.1bln), $1.2495-15(Gbp570mln)

- EUR/GBP: Gbp0.8515(E1.2bln), Gbp0.8575-90(E531mln), Gbp0.8620(E531mln)

- EUR/JPY: Y143.00(E541mln)

- USD/CAD: C$1.2800($1.4bln), C$1.2915($1.2bln)

- USD/CNY: Cny6.60($1.5bln), Cny6.70($1.6bln), Cny6.75($840mln), Cny6.80($1.4bln)

Late Equity Roundup: Real Estate, Pharma Finishing Strong

Stocks trading mildly higher after FI close, near second half highs after a weaker start. SPX emini futures ESU2 currently +18.25 at 3786.0 vs. 3693.5 low.

- Overnight weakness tied to global growth concerns and a reversal in Oil off highs that spurred risk-off bid for rates. Oil slid on hopes over Federal fuel tax suspension for three months (WTI fell through 50- and 100-dma's to 101.67 low in early NY trade).

- Oil gradually climbing off lows, however, lending to bounce in stocks (O&G shares, Materials, Industrials weaker, however).

- SPX leading/lagging sectors: Real Estate (+2.34), followed by Health Care (+1.87%), latter on strong gains in pharmaceuticals (MRNA +5.01%, ABBV +3.16%, LLY +2.65%, JNJ +2.43%), and Utilities (+1.57). Laggers: As noted Energy sector still underperforming (-3.59%) followed by Materials (-0.82%) and Industrials (-0.11%).

- DJIA 109.62 (0.36%) at 30639.2; Nasdaq 58.6 (0.5%) at 11127.06.

- Dow Industrials Leaders/Laggers: United Health Grp (UNH) extended Tue's rally, +12.29 to 492.61 -- after annc $1.5B purchase of health tech company EMIS. JNJ +4.02 at 177.03, AMGN +3.15 at 241.56. Laggers: Caterpillar (CAT) -7.02 at 189.35, Chevron (CVX) -5.81 at 148.78, while MKE slipped 2.92 to 105.76.

E-MINI S&P (U2): Bearish Trend Condition Intact

- RES 4: 4396.75 High Apr 22

- RES 3: 4308.50 High Apr 28

- RES 2: 4069.81/4204.75 50-day EMA / High May 31

- RES 1: 3843.00/3918.03 High Jun 15 / 20-day EMA

- PRICE: 3717.00 @ 14:25 BST June 22

- SUP 1: 3639.00 Low Jun 17

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis trend readings remain bearish and short-term gains are still considered corrective. Moving average studies are in a bear mode condition and recent fresh cycle lows point to a continuation of the downtrend. The focus is on 3600.00 next, and below. Initial resistance is at 3843.00, the Jun 15 high. The next firm resistance is seen at 3918.03, the 20-day EMA. A break would signal scope for a stronger short-term recovery instead.

COMMODITIES

- WTI Crude Oil (front-month) down $3.73 (-3.41%) at $105.82

- Gold is up $4.73 (0.26%) at $1837.70

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/06/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/06/2022 | 0600/0800 | ** |  | SE | PPI |

| 23/06/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/06/2022 | 0715/0915 |  | FR | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/06/2022 | 0800/1000 |  | EU | ECB Economic Bulletin | |

| 23/06/2022 | 0800/1000 |  | EU | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/06/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/06/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/06/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 23/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/06/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 23/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/06/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.