-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

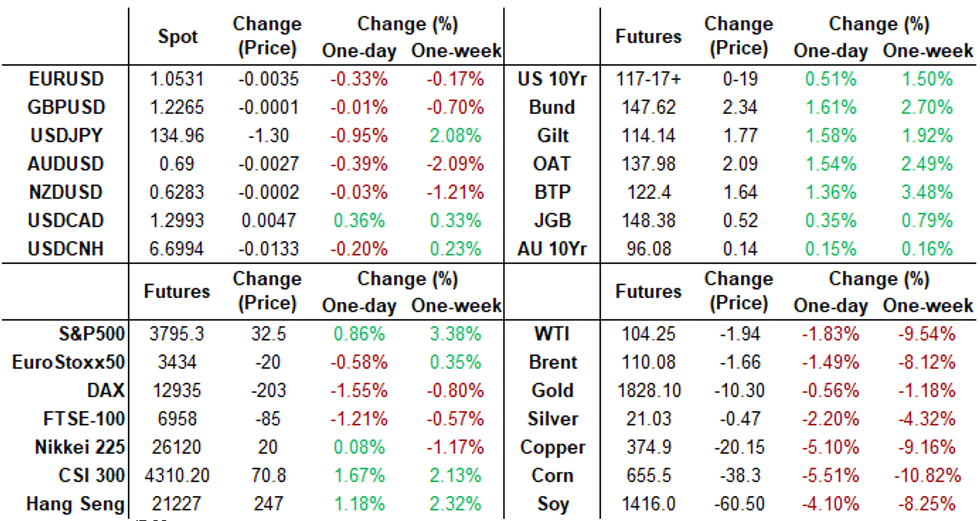

Free AccessMNI ASIA MARKETS ANALYSIS: Weak Data Tempers Forward Guidance

US TSYS: Second Round Weak PMIs Tempers Forward Rate Hike Guidance

Tsys trade higher after the bell -- well off midmorning highs to near middle of the session range.- Not much of a reaction after 229k weekly claims, 1.315M continuing claims slightly above estimates, 226k and 1.312M respectively, Tsy ylds continued to ease (30YY slipped to 3.1438% low in the first half) after second consecutive set of weak PMIs:

- Mfg: 52.4 vs expected 56.0 and last of 57.0

- Services: 51.6 vs expected 53.3 and last of 53.4

- Comp: 51.2 vs expected 53.0 and last of 53.6

- Meanwhile, Fed speakers bang on about another 75bp hike in July (Fed Gov Bowman, w/ additional 50bp hikes by year end) -- a temporary silver lining for stocks as the economic slow-down (still not good news) quells further rate hike pricing by year end. Indeed, markets started to price in rate cuts by early-mid 2023.

- SPX eminis futures ESU2 currently +19.5 (0.41%) at 3782.25 vs. 3797.25 high. DJIA +29.11 (0.1%) at 30509.55; Nasdaq +109.4 (1%) at 11162.19.

- Eurodollar futures anticipated repricing earlier: near term recession expectations remain as futures inversion crept forward: Dec'22 currently trading 96.24 vs. Mar'23 at 96.28, w/ EDH3/EDH4 at -48.5. Interpretation: Since Wed's Senate testimony from Fed Chair Powell, futures pricing END of rate hikes has migrated from mid-2023 to end of this year. Pricing fluid as markets contend with ongoing slowdown.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00029 to 1.57100% (+0.00357/wk)

- 1M -0.00914 to 1.62357% (+0.01128/wk)

- 3M +0.01272 to 2.19729% (+0.10143/wk) * / **

- 6M +0.00872 to 2.83529% (+0.05586/wk)

- 12M -0.04657 to 3.53329% (-0.05257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.19729% on 6/23/22

- Daily Effective Fed Funds Rate: 1.58% volume: $85B

- Daily Overnight Bank Funding Rate: 1.57% volume: $261B

- Secured Overnight Financing Rate (SOFR): 1.45%, $942B

- Broad General Collateral Rate (BGCR): 1.46%, $378B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $359B

- (rate, volume levels reflect prior session)

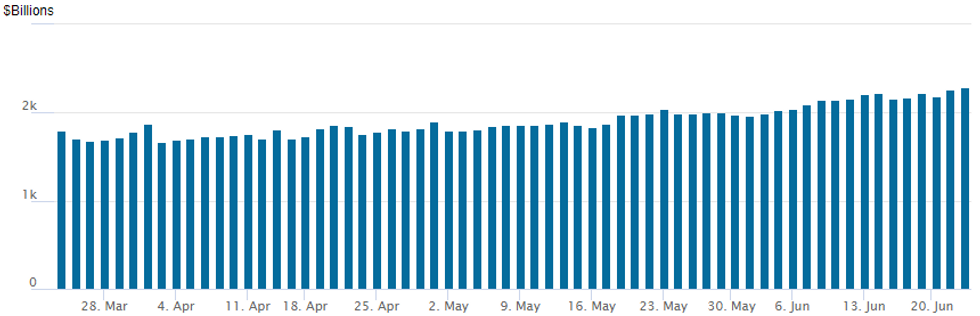

FED Reverse Repo Operation, Second Consecutive High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,285.442B w/ 99 counterparties vs. prior record $2,259.458.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option trade turned mixed Thursday, overall volumes light with one exception -- not particularly unusual for thin summer participation. Largest trade in some time: 100,000 SFRN2 96.12/96.25 conversion spd/box trade on screen, 12.5 net ref: 96.975-.99 -- new position, no open interest. One option desk said trade "just so mkt makers can hit rebate levels before month end," citing traders.- Limited trade appeared bearish on the surface with accounts either fading the continued underlying (that saw 30YY fall to 3.1438% low) or taking profits/rolling strikes. Salient trade included a buy of 6,300 Eurodollar short Jun 96.62/96.75/97.00 call trees after a sale of 4,000 Blue Sep 97.00 straddles, 58.0-57.5. Treasury 5Y call skew sale had paper selling -8,000 FVQ 111/112.75 call spds 40.5 over FVQ 110 puts .

- 100,000 SFRN2 96.12/96.25 conversion spd/box trade on screen, 12.5 net ref: 96.975-.99 -- new position, no open interest.

- 6,000 SFRH3 96.75/97.37 1x2 call spds

- Block, 4,000 SFRZ2 96.12/96.50/96.62/96.75 broken put condors, 6.5 net/belly over

- Block, 12,500 short Jul 96.12/96.62 put spds, 8.0 vs. 96.87/0.24%

- Block 9,000 SFRZ2 97.62/99.25 call spds, 7.5 vs. 96.565/0.14%

- 6,300 short Jun 96.62/96.75/97.00 call trees

- -4,000 Blue Sep 97.00 straddles, 58.0-57.5

- Block, 5,000 Oct 96.00/96.25 put spds, 11.0 opener

- Block, -8,000 FVQ 111/112.75 call spds 40.5 over FVQ 110 puts

- -5,000 FVQ 112 calls, 44

- -15,000 FVQ 111.5 calls, 47.5-46.5

- +2,000 TYQ 116 puts, 34

- Block, 16,400 TYQ 117/118/119/120 call condors, 19

EGBs-GILTS CASH CLOSE: Historic Rally As Recession Talk Swirls

EGBs had one of their strongest daily rallies in recent history Thursday, as much weaker-than-expected June flash PMI data indicated rapidly weakening European economic activity.

- Amid a bull steepening curve move, Bobl yields fell at one point by the fastest (over 30bp) since 1998, and closed about 60bp off the month's highs.

- Bunds rallied the most in a decade, testing support at 1.40%.

- Periphery EGBs and Gilts couldn't keep pace with the blistering German rally.

- The UK curve shifted down in parallel by about 20bp through the 10Y segment.

- BTP spreads widened, while GGBs underperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 25bps at 0.812%, 5-Yr is down 26.2bps at 1.159%, 10-Yr is down 21.2bps at 1.426%, and 30-Yr is down 14.9bps at 1.686%.

- UK: The 2-Yr yield is down 20.5bps at 1.939%, 5-Yr is down 20.5bps at 1.961%, 10-Yr is down 18.2bps at 2.317%, and 30-Yr is down 15.9bps at 2.572%.

- Italian BTP spread up 5.1bps at 195.8bps / Greek up 11.2bps at 234.7bps

EGB Options: Closing Time

Thursday's Europe rates / bond options flow included:

- RXQ2 140p, sold at 23 in 11k (closing)

- RXQ2 141.5p, sold at 32 in 5.5k (closing)

- RXQ2 149.50c, bought for 107 in 10k (closing)

- RXQ2 139.50p, sold at 28 in 6.2k (closing)

- OEQ2 124.50c , bought for 43 and 45 in 12.5k(closing)

- OEQ2 120.5p, sold at 23 and 21 in 10k(closing)

- OEQ2 118.50p, bought for 10.5 in 12.5k(closing)

- ERU2 99.625/99.375ps, bought for 14.5 in 20k

- ERZ2 99.00/98.78ps, bought for 7.5 in 10k (closing)

FOREX: EURJPY Dives 1.6% On Weak PMIs/Global Growth Concerns

- The Euro sustained early pressure on Thursday following a very disappointing set of Eurozone preliminary PMI data. With German and French services and manufacturing sectors growing far slower than forecast, EURUSD feel just shy of 100 pip to print a low of 1.0483 ahead of NY trade.

- Amid growing US recession fears USDJPY had also underperformed throughout early trade on Wednesday, but the weakness extended in the lead up to a dismal set of US PMI numbers that included a 23-month low for Manufacturing and 5-month low for Services.

- While the data had no lasting impact on the greenback, the underlying risk-off tone continued to dampen the EURJPY exchange rate, down 1.6% for the session.

- The pair has been maintaining a bullish technical outlook of late, however, the sharp pullback during today’s session indicates the pair’s ongoing short-term sensitivity to bouts of poorer global sentiment. The move down has narrowed the gap with initial firm support residing at 140.62, the 20-day EMA. In similar vein, AUDJPY has maintained a downward trajectory and has had an even larger adjustment of -1.70%

- Elsewhere, the Norwegian central bank rate decision delivered mixed messages: the bank raised rates by 50bps - a larger hike than forecast - but indicated this more sizeable pace of tightening would not be maintained further out the curve, with just 25bps likely to follow in August. As a result, the NOK trades close to unchanged against the Euro, despite initial supportive price action.

- Looking ahead to tomorrow, markets will get Japanese core CPI data and it is worth noting New Zealand are out for a local holiday. In Europe, UK retail sales for May will be published shortly before German IFO data. University of Michigan sentiment data headlines the US docket.

- RBA Governor Lowe is due to participate in a panel discussion at an online event hosted by the Union Bank of Switzerland as well as potential comments from Fed’s Bullard and BOE’s Pill and Haskel.

FX: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0390-00(E970mln), $1.0450(E664mln), $1.0495-00(E1.3bln), $1.0600(E761mln)

- GBP/USD: $1.2280-00(Gbp560mln)

- AUD/USD: $0.6895-00(A$1.1bln), $0.7100-20(A$989mln)

- USD/CAD: C$1.2950($675mln)

- USD/CNY: Cny6.8250($550mln), Cny6.8300($800mln)

Late Equity Roundup: Late Rebound

Off modest second half lows, stocks inching higher after the FI close -- resilient after weaker data tempers more aggressive rate hikes after year end. SPX eminis futures ESU2 currently +19.5 (0.41%) at 3782.25 vs. 3797.25 high. DJIA +29.11 (0.1%) at 30509.55; Nasdaq +109.4 (1%) at 11162.19.

- SPX leading/lagging sectors: Utilities rebound from weaker midweek performance (+2.12), followed by Health Care (+1.87%) and Consumer Staples (+1.76%). Laggers: Energy sector still underperforming (-4.61%) followed by Materials (-1.85%) and Financials (-1.16%).

- Dow Industrials Leaders/Laggers: United Health Grp (UNH) extends week' rally, +8.27 to 497.95 -- after annc $1.5B purchase of health tech company EMIS on Tue. SalesForce (CRM) +5.29 at 172.74 and Home Depot (HD) +4.44 at 273.42. Laggers: Caterpillar (CAT) -10.39 at 177.44 (MS Price Target Cut to $161.00/Share From $164.00); Chevron (CVX) -6.53 at 141.34.

E-MINI S&P (U2): Bearish Threat Remains Present

- RES 4: 4396.75 High Apr 22

- RES 3: 4308.50 High Apr 28

- RES 2: 4057.77/4204.75 50-day EMA / High May 31

- RES 1: 3843.00/3903.24 High Jun 15 / 20-day EMA

- PRICE: 3778.25 @ 14:51 BST June 23

- SUP 1: 3639.00 Low Jun 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

A bearish threat in S&P E-Minis remains present and the primary downtrend is intact. S/T gains are still considered corrective. Moving average studies are in a bear mode condition and recent fresh cycle lows point to a continuation of the trend. The focus is on 3600.00 next, and below. Initial resistance is at 3843.00, the Jun 15 high. The next firm resistance is seen at 3903.24, the 20-day EMA. A break would signal scope for a stronger short-term recovery.

COMMODITIES

- WTI Crude Oil (front-month) down $2.14 (-2.02%) at $104.04

- Gold is down $10.39 (-0.57%) at $1827.24

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/06/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/06/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 24/06/2022 | 0700/0900 | *** |  | ES | GDP (f) |

| 24/06/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/06/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/06/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/06/2022 | 1130/0730 |  | US | St. Louis Fed's James Bullard | |

| 24/06/2022 | 1130/1330 |  | EU | ECB de Guindos Panels UBS Discussion | |

| 24/06/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 24/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/06/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/06/2022 | 1330/1430 |  | UK | BOE Pill Speaks at Walter Eucken Institute Conference | |

| 24/06/2022 | 1345/1445 |  | UK | BOE Haskel Panels Chatham House London Conference | |

| 24/06/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/06/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/06/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/06/2022 | 2000/1600 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.