-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-Off Tone Into Month End

US TSYS: 10YY Well Below 3.0%

Month-end risk-off tone held in late trade, Tsys near late session highs after the bell, 30YY slips to 3.1163% low, 10YY well below 3.0% to 2.9685% - lowest since June 10. Meanwhile, stocks trade weaker - but trading off midmorning lows after the rate close, SPX ESU2 futures around 3797.0 at the moment.

- Tsys loosely tracked higher EGBs coming into the session, extended gains post-data: PCE deflator and May spending on the soft side (0.2% vs. 0.4% est), on top of prior personal spending revised lower. Not much of a reaction as Chicago PMI tumbled to 56.0 in June, giving back last month's recovery.

- Month/half-yr end as trading desks continue to mull hard landing after Wed's central bank policy meeting in Sintra. Tsy extension est +.07yr.

- Technicals for TYU2: Treasuries have recovered from Tuesday’s low of 116-11. Key short-term resistance is unchanged at 118-09+, the Jun 30 high where a break would signal a resumption of recent gains. This would open the 50-day EMA, at 118-16 - an important short-term pivot resistance.

- Note that the primary trend is down. Initial firm support to watch is 115-20, the Jun 17 low. A breach would expose 114-07+, the bear trigger.

- Reminder, slightly early close Fri (1300ET) going into extended 4th of July holiday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00871 to 1.57900% (+0.00286/wk)

- 1M +0.07357 to 1.78671% (+0.15400/wk)

- 3M +0.00800 to 2.28514% (+0.05071/wk) * / **

- 6M -0.01157 to 2.93514% (+.06857/wk)

- 12M +0.00543 to 3.61900% (+0.07429/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.28514% on 6/30/22

- Daily Effective Fed Funds Rate: 1.58% volume: $85B

- Daily Overnight Bank Funding Rate: 1.57% volume: $238B

- Secured Overnight Financing Rate (SOFR): 1.51%, $940B

- Broad General Collateral Rate (BGCR): 1.51%, $352B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $332B

- (rate, volume levels reflect prior session)

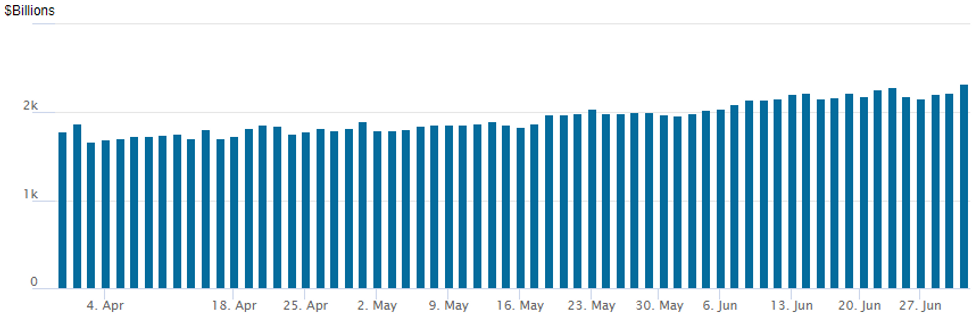

FED Reverse Repo Operation, New Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,329.743B w/ 108 counterparties vs. $2,226.976B prior session. Compares to prior record high of $2,285.428B from Thursday June 23.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Two-way call, put trade into month risk-off support in underlying futures, fair amount of Aug/Sep ratio call and put calendar spds in 5s and 10s.SOFR Options:

- 3,300 SFRU2 96.62/96.87/97.12 put trees

- 4,000 Green Jul 96.75/97.00 put spds

- 3,760 Green Jul 96.93/97.06 put spds

- 4,000 SFRQ2 96.75/97.00/97.12 broken put flys vs. 97.37/97.75 call spd

- 5,000 SFRZ2 97.18 calls vs. SFRH2 96.00/96.37 put spds

- total 7,225 Jun'23 96.50/97.00/97.50/98.00 call condors

- 10,000 Sep 99.37/99.50 put spds

- 5,000 short Aug 97.37/97.62 call spds

- 3,500 TYQ 115/116 put spds, 7 total volume appr 10k

- 1,600 TYQ 117/TYU 120 1x2 call spds

- 5,00 TYQ 116.75 puts, 28 ref 118-08

- 3,000 TYQ/TYU 113 put spds, 12

- 1,600 TYQ/TYU 114 put spds, 16

- 2,500 USQ 141 calls, 43 ref 138-00

- 3,000 TYQ 117/119 strangles, 1-0

- 8,000 FVU 115 calls, 10 ref 111-29.25 to -30.25

- 2,150 TYQ2 120 calls, 15 ref 117-31

EGBs-GILTS CASH CLOSE: Risk-Off Rally Continues

Bund yields continued to plummet Thursday, continuing the price action following a below-expected German inflation print Wednesday.

- Schatz and Bobl yields erased the last three weeks' rise, with the German curve outperforming its UK counterpart.

- Bull steepening was the common theme as rate hikes were priced out (ECB end-2022 implied rates fell 14bp, BoE -8bp), with growth fears resurfacing (commodity prices dropped sharply, European equities down 1.5-2% to end a miserable half-year).

- BTP spreads fell to session lows on a Reuters sources report saying the ECB will buy periphery EGB bonds with proceeds from maturing core/semi-core instruments bought under PEPP. But the move eventually faded, due in part to the risk-off move overall, but also perhaps lingering doubts over whether this is a "done deal".

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 18.9bps at 0.649%, 5-Yr is down 21.6bps at 1.067%, 10-Yr is down 18.3bps at 1.336%, and 30-Yr is down 12.3bps at 1.615%.

- UK: The 2-Yr yield is down 19.9bps at 1.842%, 5-Yr is down 18.2bps at 1.893%, 10-Yr is down 15.6bps at 2.229%, and 30-Yr is down 10.5bps at 2.564%.

- Italian BTP spread up 4.6bps at 192.8bps / Greek up 12.8bps at 228bps

FOREX: US Dollar Reverses Lower As US Yields Plunge

- US 10-year note yields dropped back below 3% for the first time in 3 weeks, weighing heavily on the greenback as currency markets dealt with additional month-end dynamics.

- The greenback had extended gains initially on Thursday, sitting in firm positive territory approaching the NY crossover. Potential profit-taking ahead of month-end rebalancing may have been a factor for a swift reversal in sentiment and a consistent grind lower through the US trading session.

- Furthermore, the dollar weakness was exacerbated after data on US consumer spending and the key PCE deflator gauge advanced less than expected, signaling US inflation may have peaked.

- Still, the dollar is still headed for its best quarter since 2016, helped by higher rates and haven flows amid downbeat expectations for economic growth and the DXY remains up just shy of a half percent this week.

- EURUSD had significantly narrowed the gap with 1.0350, May 13 low and the technical bear trigger. Troughing at 1.0383, the pair was a key beneficiary to the reversal in greenback sentiment, rising over 100 pips to print fresh highs at 1.0488.

- Strength in the Japanese Yen was a notable standout today as the interest rate differential between 10-year U.S. notes and Japanese notes narrowed by roughly 10 basis points. The pair has firmly faded off the cycle peak posted yesterday at 137.00, the highest print since 1998. JPY is the strongest currency across G10, up 0.75% against the US dollar.

- Eurozone June CPI Flash Estimate y/y headlines the data docket tomorrow before the US ISM Manufacturing PMI marks the final major data point of the week.

FX: Expiries for Jul01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0350(E766mln), $1.0450(E807mln), $1.0475-80(E914mln), $1.0540-50(E1.2bln), $1.0575(E2.2bln), $1.0600-15(E2.5bln), $1.0630(E994mln), $1.0700(E1.6bln)

- USD/JPY: Y133.50($1.5bln), Y134.00($1.6bln)

- EUR/JPY: Y145.00(E545mln)

- AUD/USD: $0.6800(A$884mln), $0.6900-05(A$838mln), $0.7050(A$2.0bln)

- NZD/USD: $0.6400(N$1.2bln)

- USD/CNY: Cny6.6500($685mln), Cny6.8000($547mln)

Late Equity Roundup Holding Midrange Into Month End

Major stock indexes holding weaker but well off mid-morning session lows with month/half-yr end rebalancing on traders minds: SPX eminis trading -35 (-0.92%) at 3787 vs. 3741.75 low; DJIA -292.05 (-0.94%) at 30745.06; Nasdaq -145.5 (-1.3%) at 11034.86.

- SPX leading/lagging sectors: Utilities outperform (+1.16%) followed by a rebound in Real Estate (+0.35%) and Industrials (+0.04%). Laggers: After making strong gains Mon-Tue, Energy sector (-2.55%) continues to trade weaker w/ Crude (WTI -4.00 at 105.78), Exxon, Marathon, Hess, Phillips 66 all weaker; next up: Materials (-1.41%) followed by Consumer Discretionary (-1.38%) with retailing and autos lagging.

- Dow Industrials Leaders/Laggers: Travelers Insurance (TRV) +2.95 at 168.75, Proctor Gamble (PG) +1.47 at 143.67, Johnson & Johnson (JNJ) +0.74 at 177.73, while Home Depot (HD) pares earlier gains to to 274.74 (+0.87). Laggers: Salesforce (CRM) -6.26 at 164.35, Goldman Sachs (GS) -5.59 at 297.69, Caterpillar (CAT) -4.59 at 178.89.

E-MINI S&P (U2): Extends This Week’s Retracement

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4020.77 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3785.0 @ 1500ET June 30

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis have continued to weaken today and extend this week’s bearish cycle and the pullback from Tuesday’s high of 3950.00. The next support lies at 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low. On the upside, a breach of resistance at 3950.00 is required to reinstate a bullish theme. This would open the 50-day EMA, currently at 4020.77.

COMMODITIES: Oil Slides On Growth Fears As Biden Looks To Gulf Alliance

- Crude oil prices have moved sharply lower in the US and less so in Europe on slowing growth fears (evidenced by softer than expected consumer spending and the Atlanta Fed GDPNow currently implying a technical recession in 1H22) and following signs that US gasoline demand may be easing.

- A very small upward move following the OPEC+ agreement to stick to the existing production plan was reversed, helped by Biden saying he’ll ask the Gulf Alliance to boost oil production.

- WTI is -3.7% at $105.70, testing support at $105.6 (Jun 27 low) and potentially opening $101.53 (Jun 22 low).

- Brent is -1.25% at $114.81 as it continues to hold above support at $111.26 (Jun 27 low).

- Gold is -0.64% at $1806.08, again flirting with support at $1805.2 (Jun 14 low) having fleetingly cleared it earlier in the session. A clear break could open a bear trigger at $1787.0 (May 16 low).

- Henry Hub natural gas prices meanwhile slide even further, sinking -15% to $5.55 after a federal agency said the Freeport terminal can’t restart without written permission.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/07/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.