-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA MARKETS ANALYSIS: Heading Into Fed Blackout

US TSYS: Fed Speak Tempers Hawkish Pricing Ahead Blackout

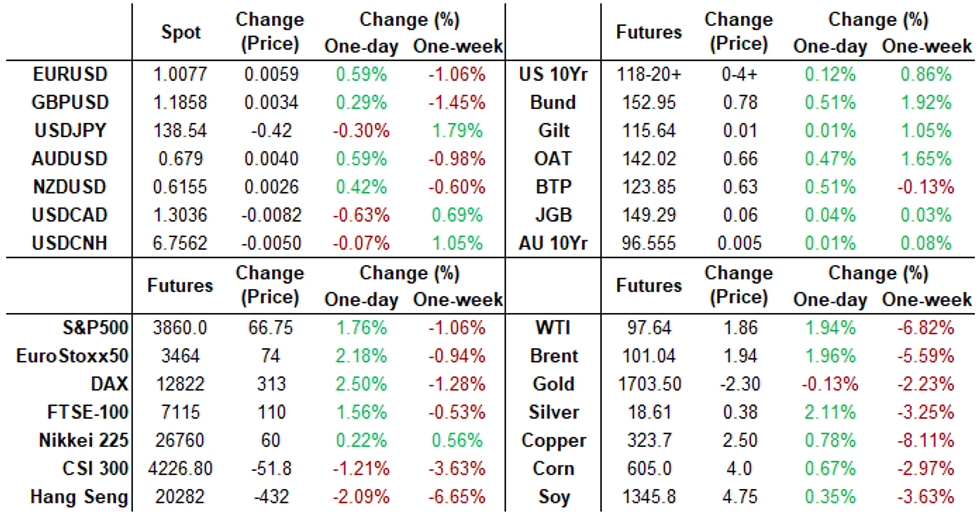

Tsys trading moderately higher, inside session range as Fed speak appeared to move markets more than economic data. Reminder: Fed enter policy blackout at midnight tonight.

- Tsys reversed early pre-data gains on slightly better than expected June Retail Sales +1.0% MoM vs. 0.9% est, Sales Ex-autos +1.0% MoM vs. 0.7% est. Down-revisions to control group (-0.3% for May vs. 0.0% prior) spurred rebound with futures back to pre-data levels. Overlooked: lower-than-expected import price numbers, including an 0.4% drop in M/M ex-petroleum import prices, the 2nd consecutive contraction. The stronger dollar is starting to feed through into lower import prices

- Fed Speak delivered brief real vol as mkts extended session ranges. Rates moved higher as Atlanta Fed Bostic walked back post-CPI comments that "everything is in play for future policy decisions" that helped spur the 100bp, saying today that the Fed wants "orderly" policy transition, that moving "too drastically" would undermine economy.

- Rates sold off after StL Fed Bullard lived up to his hawk status saying he would not rule out the possibility of 100bp hike at next FOMC, seeing little difference now between 75 and 100bp.

- SF Fed Daly helped temper the hawkish rhetoric as rates pared gains stating she is already "seeing signs inflation is slowing", while concern over recession not high on her list of outcomes.

- Currently, 2-Yr yield is down 0.2bps at 3.1305%, 5-Yr is down 1.2bps at 3.0529%, 10-Yr is down 3.1bps at 2.9281%, and 30-Yr is down 1.4bps at 3.09%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00700 to 1.56514% (+0.00457/wk)

- 1M -0.03571 to 2.12029% (+0.22058/wk)

- 3M -0.00272 to 2.73757% (+0.31457/wk) * / **

- 6M -0.07000 to 3.31129% (+.26286/wk)

- 12M -0.08186 to 3.89643% (+0.25157/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.74029% on 7/14/22

- Daily Effective Fed Funds Rate: 1.58% volume: $91B

- Daily Overnight Bank Funding Rate: 1.57% volume: $271B

- Secured Overnight Financing Rate (SOFR): 1.53%, $934B

- Broad General Collateral Rate (BGCR): 1.51%, $369B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $362B

- (rate, volume levels reflect prior session)

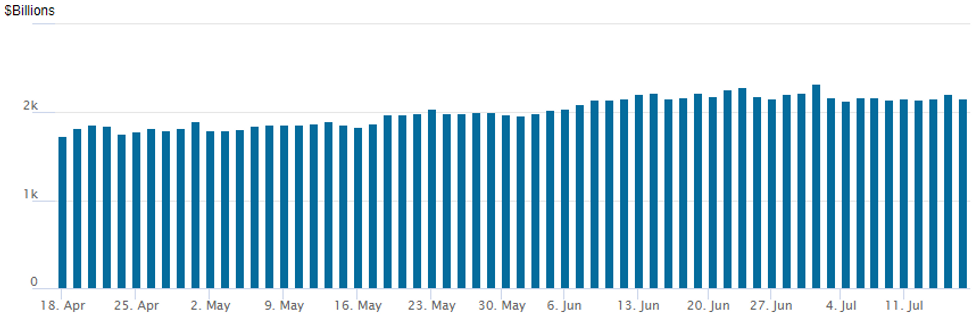

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,153.750B w/ 95 counterparties vs. $2,207.121B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Difficult to draw any strong conclusions from the limited FI option volume trade Friday. Limited trade appeared to be focus on unwinding downside (higher Tsy yield) puts as underlying futures, particularly in the short end traded higher as more aggressive rate hike pricing evaporates.- Highlight Tsy option trade included a sale of 20,000 TYU 115.5/121.5 put over risk reversals from 2-3, and scale seller of over 10,000 FVQ 112 puts from 28.5-22.0. Meanwhile a large Sep SOFR Put Fly strip package Block crossed midmorning: 10,000 SFRU2 96.62/96.81/97.00 put flys, 5 w/ 10,000 SFRU2 96.68/96.87/97.06 put flys, 4 w/ 10,000 SFRU2 96.75/96.93/97.12 put flys, 4.

- BLOCK Sep SOFR Put Fly strip package:

- 10,000 SFRU2 96.62/96.81/97.00 put flys, 5 w/

- 10,000 SFRU2 96.68/96.87/97.06 put flys, 4 w/

- 10,000 SFRU2 96.75/96.93/97.12 put flys, 4

- Block, 4,000 SFRQ2 97.37/97.75 call spds, 1.0 vs. 96.725/0.05%

- 5,000 SFRZ2 95.00/95.50/96.00 put flys

- 2,000 short Jul 96.62 straddles

- 5,000 Jul 96.50 puts, 1.5

- 1,500 Jul 96.50/96.56 1x2 call spds

- 3,000 TYQ 117 puts

- 4,000 TYQ 116.5 puts, 3 ref 118-21

- 3,000 TYQ 119.5/120.5 call spds, 10 ref 118-21

- Update, -20,000 TYU 115.5/121.5 put over risk reversals 2-3

- 2,000 TYU 116 puts, 28 ref 118-21

- 1,400 TYU 116/116.5/117/118.5 broken put flys

- over 10,000 FVQ 112 puts, 28.5-22.0

- 2,500 TYU 116/117.5 put spds

- 2,200 TYQ 117 puts, 6 ref 118-21.5

- 1,000 TYQ 118.75/119.25 call spds vs. 117.75/118.25 put spds

- 2,300 TYU2 120 calls, 56

EGBs-GILTS CASH CLOSE: Short End Sees Relief, But BTP Spreads Widen

The German curve bull steepened while the UK's twist steepened Friday.

- The front end outperformed, helped by mixed/weak US data as well as some Fed speakers who pointed to a 75bp and not 100bp July hike.

- BTP spreads widened amid continued political uncertainty - note publication of an MNI exclusive "Italy PM Draghi Expects To Quit Next Wednesday - Sources".

- Attention turns swiftly to the ECB decision next week - a 25bp hike is fully priced, with a modest chance of a 50bp raise (about 15% now, vs around 40% Thurs morning).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 5.7bps at 0.466%, 5-Yr is down 4.5bps at 0.829%, 10-Yr is down 4.9bps at 1.129%, and 30-Yr is down 2.7bps at 1.356%.

- UK: The 2-Yr yield is down 4.3bps at 1.919%, 5-Yr is down 3.4bps at 1.799%, 10-Yr is down 1.5bps at 2.086%, and 30-Yr is up 2.8bps at 2.579%.

- Italian BTP spread up 6.8bps at 214bps / Spanish down 0.4bps at 115.4bps

EGB Options: Large Euribor Upside Structures To End The Week

Friday's Europe rates / bond options flow included:

- ERH4 98.875/99.50cs 1x2, bought the 1 for -4 in 20k

- ERH4 99.375/99.87cs 1x2, bought the 1 for -3.5 in 20k

- 0RU2 98.00/97.87ps vs 99.00/99.12cs, bought the ps for 0.25 in 5k (ref 98.495, -10 del)

FOREX: Firmer Risk Sentiment Weighs On Greenback

- An extension of Thursday’s late bounce in major equity indices put the US dollar on the backfoot to end the week. The USD index is seen roughly half a percent lower on Friday, however, the index looks set to rise around 1% for the week and post the highest weekly close since October, 2002.

- Additionally, despite some forecasters now looking for a 100bp fed rate hike, St. Louis Fed President James Bullard and Federal Reserve Governor Christopher Waller have both backed raising rates by 75bp this month. Furthermore, some analysts have noted that today’s fresh data may support this view, likely taking the shine off the USD as well as potential profit taking dynamics before the week’s close.

- The broad dollar weakness has moderated the pressure on EUR/USD, with the rate back above the parity level that gave way earlier this week and making a push back towards the 1.01 mark.

- In similar vein, a solid bounce in the likes of Aussie, which had come under initial pressure on Friday, following weaker than expected Chinese growth data. AUD, NZD and CAD all reside over a half percent stronger on the day.

- Next Monday’s data highlight will be New Zealand CPI, which is expected to have risen to 7.1% Y/y. Markets will also receive inflation data from the UK and Canada next week, before central bank meetings/decisions for both the BOJ and ECB on Thursday.

FX: Expiries for Jul18 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9975(E689mln), $1.0000(E1.1bln), $1.0150-60(E1.1bln)

- USD/CNY: Cny6.7750($1.7bln)

Late Equity Roundup: CitiGroup Outperforms, Buoys Bank Sector

Stocks trading near late session highs after the FI close, improved risk appetite after Atlanta Fed Bostic, SF Fed Daly helped temper hawkish policy rhetoric (since Wed's hit CPI) as rates pared losses stating she is already "seeing signs inflation is slowing", concern over recession not high on her list of outcomes.

- SPX eminis currently trading +65.5 (1.73%) at 3858.75; DJIA +589.57 (1.92%) at 31217.75; Nasdaq +175.3 (1.6%) at 11426.19.

- SPX leading/lagging sectors: Financials outperform (+3.76%) while some banks missed earnings est's, Citigroup (C) beat: 2.19 eps vs. 1.699 est. Citi shares gaining 14.5% in late trade, buoying other bank shares. Health Care (+2.14%) and Consumer Discretionary (+1.87%) followed. Laggers: Utilities (+0.16%), Consumer Staples (+0.28%) and Real Estate (+1.33%).

- Dow Industrials Leaders/Laggers: United Health (UNH) +23.77 at 526.20; as note, bank shares bounced: Goldman Sachs (GS) +13.86 at 299.45, JPM +5.39 at 113.39. Laggers: Procter Gamble (PG) -0.49 at 144.78, Coca-Cola (KO) +0.18 at 62.37, Boeing (BA) +0.20 at 147.35.

- Earnings expected next Monday: Bank of America (BAC), Charles Schwab(SCHW), Goldman Sachs (GS).

E-MINI S&P (U2): Recovers From Yesterday’s Low

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3960.58 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3856.00 @ 1530ET Jul 15

- SUP 1: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded lower Thursday but did find support at the day low of 3723.75 and price is firmer today. The outlook remains bearish, following the reversal from 3950.00, the Jun 28 high. A resumption of weakness and a break of yesterday’s 3923.75 low, would open key support at 3639.00, Jun 17 low. On the upside, clearance of resistance at 3950.00 is required to reinstate a bullish theme. This would expose the 50-day EMA, currently at 3960.58.

COMMODITIES

- WTI Crude Oil (front-month) up $1.86 (1.94%) at $97.65

- Gold is down $4.8 (-0.28%) at $1705.16

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2022 | - |  | UK | BOE Saunders at Resolution Foundation (Time TBA) | |

| 18/07/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/07/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.