-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

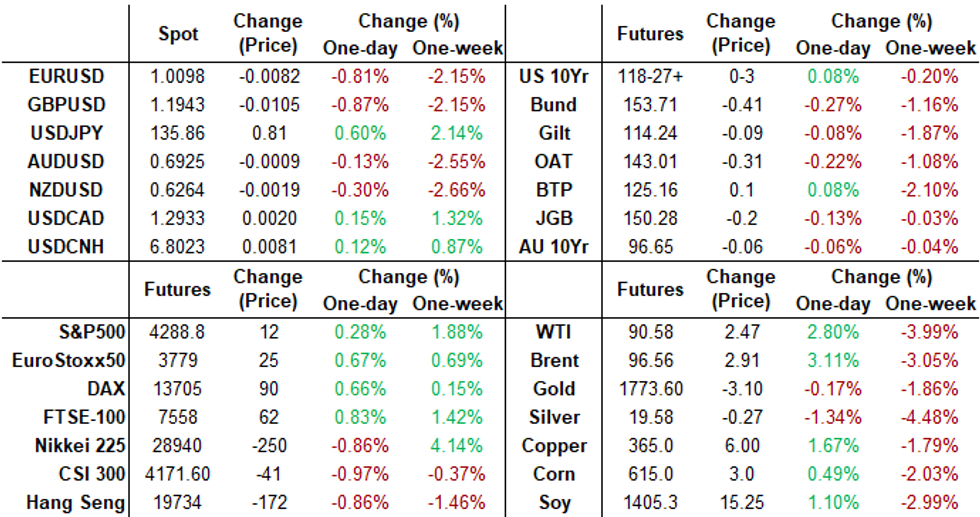

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Jawboning At Work

US TSYS: Fledgling Hawk MN Fed Kashkari Flexes Wings

Tsy futures back near where they started the day, mildly higher - well off early session highs after Philly Fed Mfg moved the needle for once. Multiple Fed speakers had net effect of deflating rate rally through the second half.

- Tsy futures pared early gains after latest Philly Fed Mfg index topped estimate: +6.2 vs. -5.0 est (-12.3 prior read), while weekly claims come out at 250k vs. 264k est. Trading desks noted fast$, prop acct selling across the curve as Tsy futures receded to pre-open levels, 30YY slipped to 3.1029% low before rebounding to 3.1480% first half high.

- Limited reaction to slightly weaker than expected Existing Home Sales (4.81M vs 4.86M est, MoM much weaker than expected at - 5.9% vs. - 5.1%, while U.S. Leading Index stronger than expected at -0.4% vs -0.5% est, -0.8% prior.

- Mixed comments from SF Fed Daly on CNBC kicked things off: 50 or 75bp hike reasonable vs comments from Aug 11 (i.e. post US CPI miss) that 50bp was base case but open-minded on whether 75bp is needed should data evolve differently. Daly mirrored July minutes she didn't want to "overdo policy and find we've tightened the economy" more than needed. Daly effect less of a factor today then after CPI.

- MN Fed Kashkari, however, reiterated need for more interest-rate increases to slow inflation boosts recession risks.

- StL Fed Bullard: still sees the Fed needing to hike to 3.75-4% by year-end, but now also explicitly lends support to a third 75bp hike at the Sept FOMC.

- KC Fed's George ('22 voter), a 50bp dissenter at the June but not July FOMC, offers a balanced, open tone behind how much further the hiking cycle will go.

- Currently, 2-Yr yield is down 5.8bps at 3.2266%, 5-Yr is down 2.4bps at 3.0271%, 10-Yr is down 1.8bps at 2.8786%, and 30-Yr is down 1.3bps at 3.1381%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00429 to 2.31786% (+0.00300/wk)

- 1M +0.00257 to 2.36814% (-0.02386/wk)

- 3M +0.00743 to 2.98400% (+0.06243/wk) * / **

- 6M -0.00014 to 3.50757% (-0.00172/wk)

- 12M +0.00014 to 3.99571% (+0.03671/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.97657% on 8/17/22

- Daily Effective Fed Funds Rate: 2.33% volume: $92B

- Daily Overnight Bank Funding Rate: 2.32% volume: $286B

- Secured Overnight Financing Rate (SOFR): 2.29%, $966B

- Broad General Collateral Rate (BGCR): 2.26%, $400B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $388B

- (rate, volume levels reflect prior session)

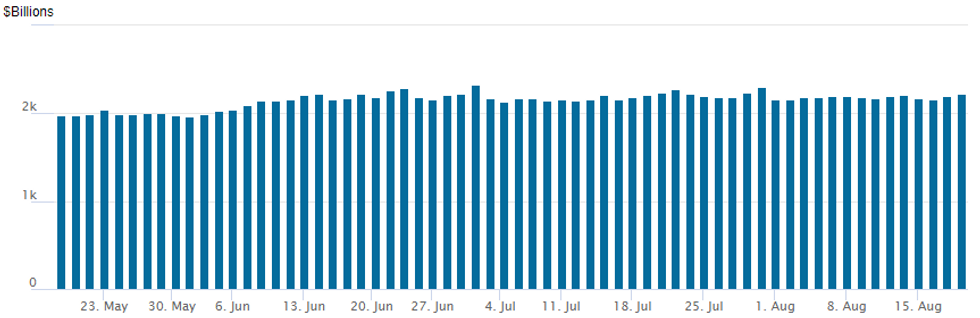

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,218.161B w/ 98 counterparties vs. $2,199.631B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Light volumes persisted Thursday, but early trade favored upside calls amid carry-over support for underlying futures after Wed's July FOMC minutes cooled 75bp hike speculation. Salient trade included 10,000 TYU 121.5/123/124.5 call flys (expire next week Friday), and 10,000 Dec Eurodollar 96.50 calls at 10.0 vs. 96.105/0.25%.- SOFR Options:

- +2,500 SFRU2 96.93/97.00/97.06 call flys, 1.0

- Block, 5,000 SFRZ2 96.00/96.25 put spds, 6.5 ref 96.47

- Block, 5,000 SFRH3 95.75/96.12 put spds, 12.0 ref 96.355

- 3,500 short Aug SOFR 96.00/96.25/96.50 put flys

- 3,500 SFRZ2 95.00/95.50/96.00 put flys

- 1,500 SFRZ2 96.18/96.31 put spds

- Eurodollar Options:

- +10,000 Dec 96.50 calls, 10.0 vs. 96.105/0.25%

- 2,000 Oct 96.00 puts, 12.5

- 3,500 Dec 96.25 calls, 17.0 ref 96.10

- Treasury Options:

- 1,500 FVU 111/111.25 3x2 put spds, 3.5 net

- 10,000 TYU 121.5/123/124.5 call flys

- 5,000 TYV 123 calls, 8

- +1,000 USU 136 puts, 21

- +5,000 wk1 US 136 puts, 21-23

- 3,200 TYU 119 puts, 47 ref 118-22.5

- 5,300 TYU 119 puts, 33

EGBs-GILTS CASH CLOSE: UK Short-End Once Again Underperforms

Gilts and EGB yields pulled back from morning highs, with both the German and UK curves closing Thursday a little flatter.

- UK inversion deepened as the short-end once again underperformed (2Y UK yield high topped Wednesday's high by 0.1bp). Early on, 10Y Bund yields hit the highest since Jul 22 (1.15%) and Gilt since Jun 30 (2.353%) before fading.

- September ECB hike pricing picked up a couple of basis points with a 50bp hike fully priced and then some after Schnabel suggested to Reuters interview that she favours another half-point raise next month.

- A relatively calm session for periphery EGBs as well; Greece underperformed.

- Final Eurozone CPI was in line and had little market impact. UK retail sales in focus Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.8bps at 0.749%, 5-Yr is up 2.7bps at 0.925%, 10-Yr is up 2bps at 1.103%, and 30-Yr is up 0.4bps at 1.296%.

- UK: The 2-Yr yield is up 5.2bps at 2.455%, 5-Yr is up 3.5bps at 2.183%, 10-Yr is up 2.3bps at 2.311%, and 30-Yr is up 0.2bps at 2.625%.

- Italian BTP spread down 0.4bps at 222.9bps / Greek up 1.6bps at 244.8bps

EGB Options: Euribor Call Structures Feature

Thursday's Europe rates/bond options flow included:

- OEU2 125.50/124.00ps bought for 35 in 6k vs ~2k at 125.72

- ERZ2 98.50/98.375/98.25/98.125p condor, bought for 1.5 in 12k

- ERZ2 99.00/99.125/99.50 broken call ladder 1x1x0.5, sold at 2.5 in 10k (closing)

- ERM3 99.00/99.12/99.87c ladder with ERU3 98.87/99.12/99.75c ladder sold the strip at 1 in 2k

- ERM3/ERU3 98.75/99.00/99.25c fly strip sold at 3.75 in 16k

- 0RU2 98.62/98.75cs bought for 1.75 in 15k

- SFIU2 97.50/97.60/97.70c fly, bought for 1.75 in 5k

FOREX: Greenback Strength Extends, EURUSD Cracks Support

- The dollar index has made fresh three-week highs on Thursday, and has extending just shy of 1% to reach 1.0750 as we approach the APAC crossover. Greenback support was underpinned throughout the US session by stronger than expected Philly Fed data and lower initial jobless claims.

- Notable declines in EUR and GBP as price action has gained momentum following the breaks of short-term supports at 1.0123 and 1.2004 respectively. Both currencies trade with steep 1% losses on the day, extending their gaps lower from last Friday's close.

- 1.0007/0.9952 Low Jul 15 / 14 and the bear trigger remain the key levels for EURUSD on the downside.

- Despite the move lower in US yields, the bid for the dollar spread across the currency space in late US trade, prompting USDJPY to spike through resistance at 135.50/58, promptly rising to a high of 135.90. The first level on the topside is 135.96, 61.8% retracement of the Jul 14 - Aug 2 downleg which has held for now. Above here targets 136.58, the Jul 28 high.

- In emerging markets, the firmer greenback weighed on LatAm FX as well as the South African Rand. USDTRY looks set to close above 18.00 for the first time, following the CBRT’s surprise 100bp cut in the face off surging domestic inflation.

- UK and Canadian retail sales data round off the week. There is no US data on Friday which should keep any FedSpeak and geopolitical developments in focus.

Late Equity Roundup: Energy Sector Holds Lead; Health Care Wanes

Stocks rebounding late, looking to test upside of narrow session range as Energy sector outperforms. Currently, SPX eminis trade -3.75 (-0.09%) at 4272.75; DJIA -116.31 (-0.34%) at 33864.53; Nasdaq +0.9 (0%) at 12939.03.

- Equity earnings after the close: Applied Materials (AMAT) $1.772, Ross Stores (ROST) $1.013 est. (pre-open: Estee Lauder (EL) beat: $0.42 vs. $0.319 est, Kohl's Corp (KSS) $1.11 vs. $1.019 est.)

- SPX leading/lagging sectors: As noted, Energy outperforms (+2.42%) lead by petroleum shares: APA Corp (APA) +7.02%, Devon Corp (DVN) +4.97%, Halliburton (HAL) +4.61%, and Marathon (MRO) +4.31%; followed by Information Technology (+0.59%) and Utilities (+0.40%). Laggers: Real Estate (-0.89%), Health Care (-0.55%) weighed by Moderna (MRNA, -5.45%), and Financials (-0.08%).

- Dow Industrials Leaders/Laggers: Cisco (CSCO) +2.77 at 49.42, Caterpillar (CAT) +1.07 at 197.00, and Boeing (BA) +0.90 at 168.10. Laggers: Walgreens Boots (WBA) -2.77 at 38.10 (after sell of sale of 11 million shares held in Option Care Health late Wed), 3M (MMM) -1.86 at 145.57, Amgen (AMGN) -1.77 at 248.81.

E-MINI S&P (U2): Trend Outlook Remains Bullish

- RES 4: 4419.15 2.236 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4400.00 Round number resistance

- RES 2: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 1: 4327.50 High Aug 16

- PRICE: 4287.75 @ 1500ET Aug 18

- SUP 1: 4208.25/4144.39 20-day EMA

- SUP 2: 4063.32/3913.25 50-day EMA / Low Jul 26 and a key support

- SUP 3: 3820.25 Low Jul 18

- SUP 4: 3723.75 Low Jul 14

The S&P E-Minis outlook remains bullish. Recent gains confirmed an extension of the positive price sequence of higher highs and higher lows. Moving average conditions are in a bull mode set-up too and the focus is on 4345.75 next, a Fibonacci projection and potentially 4400.00 further out. On the downside, initial firm support is at 4144.39, the 20-day EMA. The 50-day EMA intersects at 4063.32 - a key support.

COMMODITIES: Crude Oil Extends Gains, EU Nat Gas Settles At Record High

- Crude oil has jumped on a combination of yesterday’s US EIA demand recovery, the OPEC Secretary General reiterating their view is that oil demand was robust with concerns over a China economic slowdown exaggerated, and Zelensky saying negotiations will only be possible after a Russian withdrawal.

- Brent has seen larger gains on Shell cutting production at its Rhineland refinery, Germany’s largest oil refinery, on continued disruption from low water levels.

- WTI is +2.6% at $90.41 as it pushes back against recent technical vulnerability and instead moves closer to resistance at the 20-day EMA of $92.57.

- Brent is +2.9% at $96.38, moving further away from the bear trigger at $91.22 (Jul 14 low) and instead nearing the 20-day EMA at $97.66, clearance of which would open key short-term resistance at $100.38 (Aug 12 high).

- Gold is -0.2% at $1758.41, suffering with dollar strength partly offset by Tsy yields rallying. It comes close to key short-term support at $1754.4 (Aug 3 low), clearance of which would open $1711.7 (Jul 24 low).

- European natural gas meanwhile made further headlines as they settled at a record high, 6.7% higher at EUR 241/megawatt-hour, with prices about 11 times higher than usual for this time of year.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/08/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 19/08/2022 | 2330/0830 |  | JP | Natl CPI | |

| 19/08/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/08/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 19/08/2022 | 0600/0800 | ** |  | DE | PPI |

| 19/08/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.