-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

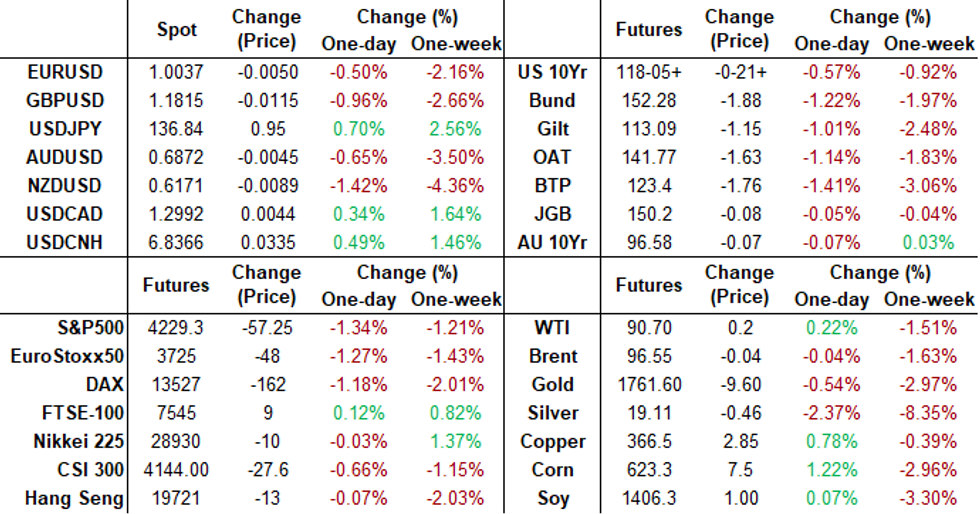

Free AccessMNI ASIA MARKETS ANALYSIS: 30Y Yld Climbs Back to Mid-July Lvl

US Tsys: 30YY At 4-Wk Highs, Yield Curves Bear Steepen

Tsy futures holding narrow range near lows by the close, 30YY tapped 3.2339% high earlier - highest since July 11, currently 3.2213%. Yield curves bear steepened w/2s10s +4.141 at -28.004 - August 1 level.

- Initial cross-over weakness from EGBs followed higher than expected German PPI overnight (+5.3%, +37.2% YoY due to surge in energy prices); UK retail sale up 0.3% last month, but the cost of those sales increased more rapidly by 1.3%.

- Little react to Richmond Fed Barkin this morning as he reiterates the Fed is "very seriously" focused on inflation and will do "what it takes" to lower it to 2% despite "risk of recession on path to 2%". No new ground there, trading desks set sights on next Fri's annual eco-summit in Jackson Hole, Fed Chair Powell scheduled at 1000ET.

- After a decent start, trade volume thinned out in the second half (TYU2 just over 1M), no Tsy or corporate supply, though Tsy Sep/Dec rolls generating some volume (Dec takes lead Wed, Aug 31). Sep options also expire next week Friday could start to generate some two-way hedging on the day.

- Technicals for TYU2 currently trading 118-03 (-24.0), Treasuries maintain a softer tone and the contract has traded lower today. 118-05, 50.0% of the Jun 14 - Aug 2 bull cycle, has been cleared and this signals scope for an extension towards 117-14+ next, the Jul 21 low. Price has recently cleared a trendline support drawn from the Jun 14 low and this reinforces the current bearish theme. Initial firm resistance is at 119-31, the Aug 15 high.

- Currently, 6.2bps at 3.259%, 5-Yr is up 8bps at 3.1071%, 10-Yr is up 9.9bps at 2.9813%, and 30-Yr is up 8.2bps at 3.2188%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00328 to 2.32114% (+0.00628/wk)

- 1M +0.01857 to 2.38671% (-0.00529/wk)

- 3M -0.02629 to 2.95771% (+0.03614/wk) * / **

- 6M +0.04000 to 3.54757% (+0.03828/wk)

- 12M +0.02015 to 4.01586% (+0.05686/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.98400% on 8/18/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $285B

- Secured Overnight Financing Rate (SOFR): 2.28%, $973B

- Broad General Collateral Rate (BGCR): 2.26%, $398B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $385B

- (rate, volume levels reflect prior session)

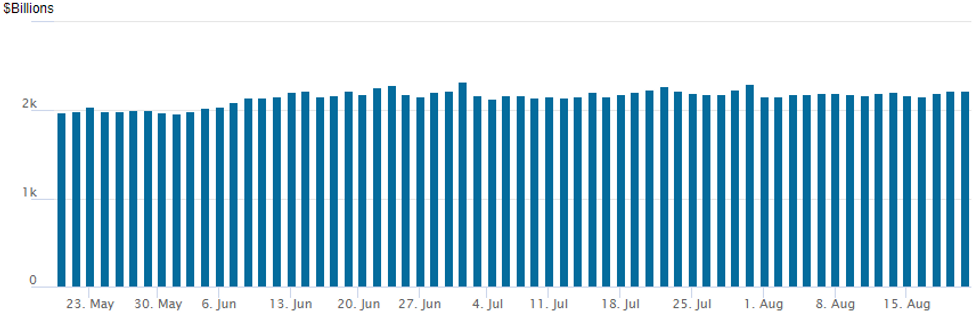

FED Reverse Repo Operation

NY Fed reverse repo usage inches higher to $2,221.680B w/ 98 counterparties vs. $2,218.161B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Robust put trade returned Friday as underlying rates traded lower following a spike in German PPI overnight (+5.3%, +37.2% YoY due to surge in energy prices). Meanwhile Richmond Fed Barkin reiterated the Fed's focus on reducing inflation, even in the face of potential recession. Salient trade:- SOFR Options:

- -5,000 SFRZ2 97.25/97.50/97.75 call flys, 0.5 ref 96.44

- Block, 5,000 SFRZ2 96.37/96.62/96.75/97.00 put condors, 5.5

- 3,000 SFRH3 95.81/96.00/96.18 put flys

- 21,400 short Aug SOFR 96.00 puts, 2.5 ref 96.595

- Eurodollar Options:

- 42,250 Dec 98.75/99.00 put spds, 25.0

- 4,500 Green Sep 96.25 puts

- +4,000 Blue Dec 97.62/97.87 put spds, 18.75 vs. 97.225/0.09% legged

- Treasury Options:

- 2,705 TYU2 119.25/120 1x3 call spds, 1 net 3-leg over

- 5,000 TYU 118/118.25 strangles, 54

- 5,000 TYX 113/114 put spds, 6 ref 118-08

- 2,000 TYX 119/121 call spds

- 6,000 TYU 117 puts, 10

- 1,500 TYV 121/TYX 119 put diagonal calendar

- Update, over 10,000 TYU 119 puts, 53-102

- +5,000 TYV 113/114 put spds, 4 vs 118-05/0.05% adds to 10k Block

- -10,000 wk1 FV 111/111.75 put spds, 17

- 1,800 TYV 116/121 strangles, 43

- 3,600 TYU 119 puts, 53 ref 118-15.5

- Block, 10,000 TYV 113/114 put spds, 3

- 9,400 TYU 117.5 puts, 11-12 ref 118-19.5 to -18

EGBs-GILTS CASH CLOSE: Bearish End To An Ugly Week

A tumultuous week for the space ended with further weakness in both the UK and German curves, with the short-end / belly once again bearing the brunt of upward central bank hike repricing.

- Bear steepening replaced the bear flattening earlier in the week, and it was Germany's turn to underperform the UK in contrast to recent sessions.

- However, Gilts had been underperforming most of the session after stronger-than-expected retail sales data, and the short end remained under pressure: UK yields were up 14+bp at one point to a fresh post-2008 high before fading.

- Periphery spreads widened, but trade was orderly following a jump at the open.

- Key events next week include flash PMI data and the Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 8.1bps at 0.824%, 5-Yr is up 12.2bps at 1.042%, 10-Yr is up 12.8bps at 1.23%, and 30-Yr is up 11bps at 1.404%.

- UK: The 2-Yr yield is up 7.1bps at 2.525%, 5-Yr is up 9.4bps at 2.276%, 10-Yr is up 10.1bps at 2.411%, and 30-Yr is up 9bps at 2.714%.

- Italian BTP spread up 4.2bps at 227bps / Greek up 2.3bps at 247.1bps

EGB Options: More Euribor Downside To End The Week

Friday's Europe rates / bond options flow included:

- RXV2 154.5/157cs vs 149p, bought the ps for 126 in 3.6k (short cover)

- RXV2 145.5 put bought for 81 in 4k

- OEV2 123.5/122ps, bought for 29 in 3k

- DUU2 110.00/109.30/108.60p fly sold at 41.5 and 41 in 5k

- DUU2 109.70/109.40ps, sold at 20.5 in 1.5k

- DUV2 109.00/108.50ps sold at 20.5 down to 19.5 in 7.5k

- ERZ3 96.50/96.00ps vs 98.00c, bought the put spread for flat in 10k x 1k

FOREX: USD Index Set Close At Five-Week Highs, GBP Plummets

- Broad greenback strength that built momentum late Thursday has extended into Friday’s trading session. The USD Index (+0.55%) looks set to close above 1.08 at a five-week high after advancing around 2.3% this week.

- As the US Dollar rally gathered pace, notable moves down in NZD (-1.37%) and GBP (-0.94%) gained traction throughout the day.

- The Kiwi was largely playing catch up to the dollar move after relatively outperforming on Thursday. Weaker domestic trade figures and retreating equities, however, weighed on the local currency which has also seen AUDNZD rally back above 1.11, closing in on the August highs.

- The UK’s higher than expected retail sales data did little to cast aside the UK's bleak growth prospects. The break of 1.2000 in cable has seen significant follow through, while underpinning the EURGBP bid that sees the cross rising close to a half a percent.

- GBPUSD briefly pierced the 1.1800 mark in late trade on Friday and technical focus is on the cycle low from July at 1.1760, which is also the bear trigger. Below here we have 1.1673, the 1.00 projection of the May 27 - Jun 14 - 16 price swing.

- In similar vein, the higher US yields prompted USDJPY to print fresh highs for the week at 137.23 before moderating around 30 pips ahead of the close.

- EURUSD price action remains heavy and despite consolidating in European trade around 1.0075, the pair has slowly grinded south since, gravitating towards parity. Overall, both fundamental and technical prospects for the Euro remain weak with eyes on 0.9952, the Jul 14 low as the key bear trigger.

- A very light data docket on Monday will place focus on Tuesday’s release of European Flash PMIs.

Late Equity Roundup, Consumer Discretionary, Financials Weighing

Stocks continue to drift around session - and week lows in late Friday trade, SPX eminis back to last Fri morning lvls at the moment, lead by Consumer Discretionary, Financial and Communication Services sectors. Currently, SPX eminis trade -56.5 (-1.32%) at 4230.5; DJIA -299.53 (-0.88%) at 33699.01; Nasdaq -255 (-2%) at 12710.46.

- SPX leading/lagging sectors: Health Care sector outperforms (+0.30%), followed by Energy (+0.15%) as petroleum shares trade mixed after strong gains this week: Halliburton (HAL) -0.80% after gaining near 4% Thu, Marathon (MRO) -0.14 vs. +3.72% Thu; Utilities (-0.17%) and Consumer Staples slip to -0.41%. Laggers: As noted, Consumer Discretionary (-2.14%), Financials (-2.11) and Communication Services (-1.98%) sectors underperformed. Real rates weighed on Tech Sector -1.75% in late trade.

- Dow Industrials Leaders/Laggers: United Health (UNH) +4.71 at 549.93, JNJ +2.70 at 169.47 and Merck (MRK +1.03 at 92.43. Laggers: Goldman Sachs (GS) -6.24 at 348.28, Salesforce (CRM) -5.04 at 182.89 and Boeing (BA) -5.59 at 163.10.

- Equity earnings cycle nearly complete, still some notable announcements next week: Nvidia (NVDA) late Wednesday $508 est, Dell late Thursday $1.636 est

E-MINI S&P (U2): Corrective Pullback

- RES 4: 4419.15 2.236 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4400.00 Round number resistance

- RES 2: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 1: 4327.50 High Aug 16

- PRICE: 4235.00 @ 1100ET Aug 19

- SUP 1: 4208.25/4157.93 Low Aug 12 / 20-day EMA

- SUP 2: 4072.15/3913.25 50-day EMA / Low Jul 26 and a key support

- SUP 3: 3820.25 Low Jul 18

- SUP 4: 3723.75 Low Jul 14

The S&P E-Minis outlook remains bullish. Recent gains confirmed an extension of the positive price sequence of higher highs and higher lows. Moving average conditions are in a bull mode set-up too and the focus is on 4345.75 next, a Fibonacci projection and potentially 4400.00 further out. On the downside, initial firm support is at 4144.39, the 20-day EMA. A pullback would allow an overbought trend reading to unwind.

COMMODITIES: Oil Edges Lower Over The Week As Gold Slides On USD Strength

- Crude oil is currently largely flat as it moves close to ending a week of two halves down a bit more -1.5%. Global slowdown worries kickstarted by softer China data and renewed hopes of an Iran nuclear deal were partially offset by a resurgence in US crude and gasoline demand.

- On the Iran deal, unconfirmed leaked reports most recently suggest US concessions to Iran, whilst if verified could see further downward pressure on prices.

- WTI is +0.1% at $90.62 having got close to testing resistance at the 20-day EMA of $92.37 before retreating. It still remains vulnerable though, with support at $85.73 (Aug 16 low).

- Brent is -0.2% at $96.37, having very briefly cleared the 20-day EMA resistance of $97.56, potentially opening $100.38 (Aug 12 high) but with a bear trigger seen at $91.22 (Jul 14 low).

- Gold is -0.6% at $1748.81 with a torrid week for the yellow metal with USD strength and Treasury yields climbing. It has traded below a first support at $1754.4 (Aug 3 low) and opens $1711.7 (Jul 27 low).

- EU gas continues to remain in focus, most recently as Gazprom will halt Nord Stream flows between Aug 31-Sep 2, citing maintenance of a gas turbine at Portovaya and planning to restore gas flows to the current 33 mcm/day or the 20% of capacity that flows have been running at in recent weeks. The move saw TTF Sep’22 prices spike over 6% to above €260/MWh and close at a fresh record high.

- Weekly moves: WTI -1.6%, Brent -1.8%, Gold -3%, EU Gas +18.7%, US Gas +6.2%

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2022 | 0115/0915 |  | CN | PBOC LPR announcement | |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/08/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.