-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: FI Bid Evaporates into Month End

HIGHLIGHTS

- House Of Representatives Passes Short-Term Government Funding Bill

- NATO: Stoltenberg Refuses To Confirm That Ukraine Will Be Fast-Tracked Into NATO

- RUSSIA: Kremlin: Strikes Against New Territories Aggression Against Russia

- CHINA TELLS BANKS TO PROVIDE $85B PROPERTY FUNDING BY YEAR-END, Bbg

US TSYS: FI Support Evaporates Amid Late Month End Selling

Trading higher for much of the session, Tsys extended session lows into the close, bids scarce in month end trade, yield curves bear steepening off deeper inverted lows in early trade (2s10 +1.044 at -40.259 vs. -49.174 low).

- Mixed early data reacts has rates holding inside session' range. Fast two-way trade saw Tsys and equities extended lows as inflation metric remains hot: Core PCE 0.6% MoM vs. 0.5% est, 4.9% YoY, unrounded +0.562%.

- Knee jerk bid in 10s before support evaporated after midmorning Chicago PMI came out lower than expected - contractionary w/ sub-50 business barometer read of 45.7 vs. 52.2 in August. The 6.5pt slide to 45.7 in the Chicago PMI, which has closely tracked recent ISM movements, adds support for a sub-50 ISM reading, contrary to consensus for a decline from 52.8 to 52.4 for Monday's report.

- Technical view for TYZ2 at 112-18 (+3.5): Treasuries remain vulnerable and short-term gains are considered corrective. Recent weakness has reinforced current bearish trend conditions w/ price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's sentiment. The focus is on 109-20, a lower moving average band value. Initial resistance is 112-30+, the Sep 23 high.

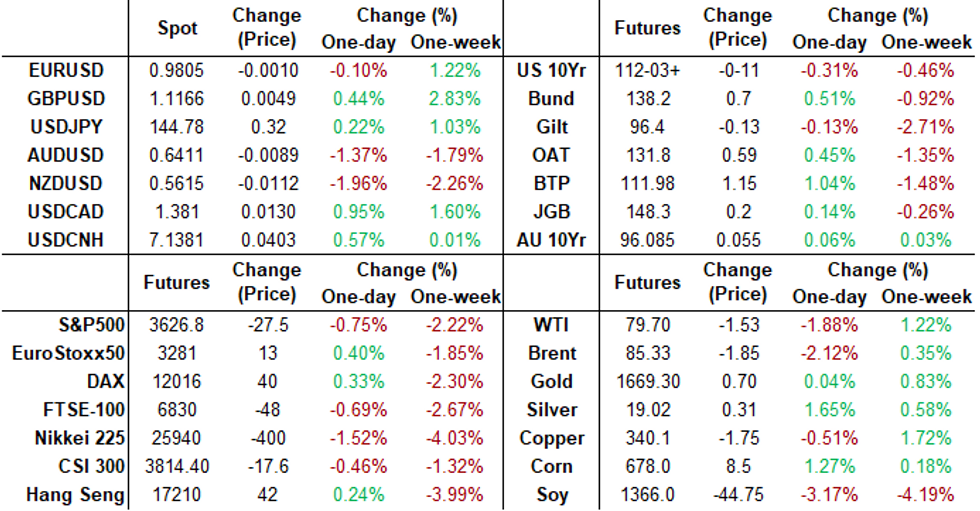

- Late cross-asset snapshot: stocks near late session lows on same month-end positioning, SPX eminis -37.25 at 3617.00, Gold firmer +0.61 at 1661.15, Crude paring midweek gains w/ WTI -1.40 at 79.83, US$ index -.030 at 112.224 (while GBP sits at 1.1155 after tapping 1.1234 high).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00414 to 3.06514% (-0.00429/wk)

- 1M +0.01485 to 3.14271% (+0.05242/wk)

- 3M +0.01185 to 3.75471% (+0.12628/wk) * / **

- 6M +0.02271 to 4.23200% (+0.03071/wk)

- 12M -0.00672 to 4.78057% (-0.05429/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.75471% on 9/30/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $260B

- Secured Overnight Financing Rate (SOFR): 2.96%, $906B

- Broad General Collateral Rate (BGCR): 2.97%, $350B

- Tri-Party General Collateral Rate (TGCR): 2.97%, $332B

- (rate, volume levels reflect prior session)

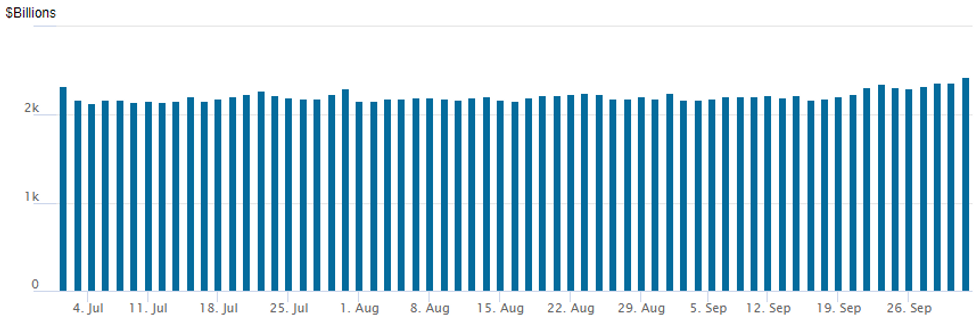

FED Reverse Repo Operation, Third Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,425.910B w/ 108 counterparties vs. $2,371.763B record in the prior session. Surpasses last week's record high of $2,359.227B marked Thursday, September 22.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Salient trade leaning toward upside calls, call spds following latest 12k SOFR call spd block, modest 10Y call spd volume at the moment after weekly midcurve put spd trade early overnight - expires next week Friday.- SOFR Options:

- 4,400 SFRZ2 98.25 calls, 1.0 ref 95.73

- 7,800 SFRV2 96.12 calls, 1.5

- 6,000 SFRZ2 95.37/95.62/95.87 call flys

- Block, 2,500 SFRZ4 (long Green Dec) 93.50/94.00/94.50 put flys, 2.5 (adds to +28k block on Thu)

- Block, 12,000 SFRX2 96.12/96.50 call spds, 3.0 ref 95.715

- Block, 2,500 short Dec 95.00/95.50 put spds, 12.5

- Eurodollar Options:

- 2,000 Dec 96.50 calls, 2.5 ref 95.335

- Treasury Options:

- 2,500 TYX 114 calls, 35 total volume >9.8k

- 9,500 TYZ2 110 puts, 47 ref 112-19.5 to -19

- 4,000 TYX2 115/117 call spds ref 112-24.5

- 2,700 TYX2 118.5 calls, 3 ref 112-25

- Block, 5,000 TYX2 115 calls, 18 ref 112-20.5

- 23,000 Wk1 TY 109/110 put spds (expire next Friday)

EGBs-GILTS CASH CLOSE: Solid End To Volatile Week/Month/Quarter

European yields fell to end the week/month/quarter, with German instruments outperforming UK counterparts, but 2Y and 30Y Gilts seeing the sharpest yield drops.

- Yields rose sharply in the late afternoon, with little discernable trigger (quarter and month-end possibly a factor), and in fact defied US data flow (including a very weak MNI Chicago PMI).

- French inflation surprised to the downside, but Italy's was in line and Eurozone was higher than expected.

- While the Gilt market has calmed considerably since mid-week, there was some modest disappointment that the OBR wouldn't publish a full forecast of the new budget earlier than 23 Nov.

- BoE Nov hike pricing ended the week close to 140bp, vs well above 160bp mid-week.

- BoI's Visco warned of big rate hikes risking a recession; no reaction in front-end rate pricing though.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.3bps at 1.761%, 5-Yr is down 6.9bps at 1.963%, 10-Yr is down 7.3bps at 2.108%, and 30-Yr is down 6.5bps at 2.09%.

- UK: The 2-Yr yield is down 16.5bps at 4.231%, 5-Yr is down 4bps at 4.394%, 10-Yr is down 5bps at 4.093%, and 30-Yr is down 14bps at 3.825%.

- Italian BTP spread down 6.3bps at 240.9bps / Spanish down 1.1bps at 118bps

EGB Options: Further Schatz Structure Unwind Features Friday

Friday's Europe rates / bond options flow included:

- Buy DUX2 107.70/108.10 cs in 17.5k, sell DUX2 107.10/106.60 ps in 17.5k - net receives 11.25. Had unwound 17.5k earlier in the week as well

- RXZ2 134/130 put spread bought for 81 in 4.25k

Late Equity Roundup: Midday Support Evaporates

Midday Stock index support wavered in the second half, SPX near lows in late FI trade, Utilities, Consumer Staples and Information Technology sectors weighing.

Currently, SPX eminis trade - 19 (-0.52%) at 3635.25; DJIA -233.25 (-0.8%) at 28993.36; Nasdaq 22.9 (-0.2%) at 10714.98.

- SPX leading/lagging sectors: Real Estate (+1.41%), Materials (+0.27%) and Financials (+0.05%) outperforming, banks outpacing diversified financials and insurance companies. Laggers: Utilities (-1.13%), Consumer Staples (-0.79%) and Information Technology (-0.65%) underperformed, the latter weighed by hardware makes underperforming semiconductor and software makers.

- Dow Industrials Leaders/Laggers: Home Depot (HD) +0.23 at 278.56, United Health (UNH) trimmed earlier gains to 508.91 +0.08, Walgreens Boots (WBA) +0.08 at 31.63. Laggers: Nike (NKE) hammered on poor earnings/inventory glut (NKE) -11.69 at 83.64, Boeing (BA) -2.91 at 122.42, McDonalds (MCD) -2.46 at 231.94.

E-MINI S&P (Z2): Bear Trend Intact

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 3960.72/4175.00 50-day EMA / High Sep 13

- RES 1: 3853.86/3936.25 20-day EMA / High Sep 20

- PRICE: 3630.5 @ 1505ET Sep 30

- SUP 1: 3600.00 Round number support

- SUP 2: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 3: 3506.38 1.50 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend conditions remain bearish and short-term gains are considered corrective. Moving average studies are in a bear mode position, highlighting the current trend direction. Attention is on key support at 3657.00, Jun 17 low. it has been pierced. A clear break would strengthen bearish conditions and confirm a resumption of the broader downtrend. This would open 3600.00. Initial firm resistance is 3936.25, Sep 20 high.

COMMODITIES: Oil Ending Mixed Week On Demand Fears, OPEC+ Meeting Ahead

- Crude oil is ending a mixed week on a softer note, led by WTI over Brent with fuel stations disrupted by Hurricane Ian coupled with an increase in US crude production.

- OPEC+ members missed their September output target but by less than the August shortfall (1.32mbpd vs 1.4mbpd) whilst Reuters sources report that oil output cut talks narrow to 0.5-1.0mbpd ahead of next week’s meeting.

- WTI is -2.1% at $79.51, unwinding the corrective bounce and moving closer to support at $76.11 (1.618 proj of Jul 29 – Aug 16-30 price swing).

- Brent is -0.7% at $87.90, still a long way off support at the bear trigger of $83.65 (Sep 26 low) and with resistance at $90.52 (20-day EMA) . ICE Brent net long positions saw a modest trimming in the week ending Sep 27.

- Gold is +0.1% at $1662.18 having earlier stopped just short of testing resistance at the 20-day EMA of $1678.3.

- Weekly moves: WTI +1.0%, Brent +2.0%, Gold +1.1%, US Nat Gas -0.1%, TTF Nat Gas +3%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/10/2022 | 2350/0850 | *** |  | JP | Tankan |

| 03/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 03/10/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/10/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/10/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/10/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 03/10/2022 | 1305/0905 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/10/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/10/2022 | 1400/1000 | * |  | US | Construction Spending |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/10/2022 | 1800/1900 |  | UK | BOE Mann Panellist at CD Howe Institute |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.