-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:

- MNI State Dept: No Sign Of "Full-Blown Conflagration" Despite Mid-East Flareups

- MNI FED: Beige Book Sees Minor Dent In Otherwise Sharp Increase In Fed Rates

- MNI US-MEXICO: Cabinet-Level Talks On Migration To Take Place Friday

- MNI US: IP In Line After Revisions, Ends 2023 With A Weak Quarter

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Strong Data Weighs on Tsys, Rate Cut Projections Recede

- Treasury futures gapped lower after stronger than expected in December, rising 0.55% M/M (cons 0.4) after a marginally upward revised 0.35% M/M (initial 0.28). The control group, which feeds into GDP, was the clear standout, jumping 0.76% M/M (cons 0.2) after a slightly upward revised 0.47% (initial 0.40).

- A flurry of additional data kept Tsys anchored: Import/Export index come out higher (0.0% vs. -0.5% est) / lower (-0.9% vs. -0.7% est) respectively. Industrial production fared slightly better than expected in December, rising 0.05% M/M (cons -0.1) but the beat was offset by a downward revised 0.0% M/M (initial 0.2) in Nov.

- March'24 10Y futures initially fell to 111-11 (-16) before trading down to 111-09 by midmorning, just above initial technical support at 111-06+ (Low Jan 05). Tsy 10Y climbed to 4.1268% high before finishing at 4.1019%. After climbing to the highest levels since October, curves bear flattened: 2Y10Y -8.268 at -24.833

- This morning's data dampened rate cut projections for the first half of 2024: January 2024 cumulative -0.6bp at 5.323%, March 2024 chance of rate cut falls to -57.2% w/ cumulative of -14.9bp at 5.180%, May 2024 no longer pricing in 25bp cut -- currently at -85.6% w/ cumulative -36.3bp at 4.966%. June 2024 still pricing in a 25bp cut, cumulative -61.5bp at 4.714%. Fed terminal at 5.315% in Feb'24.

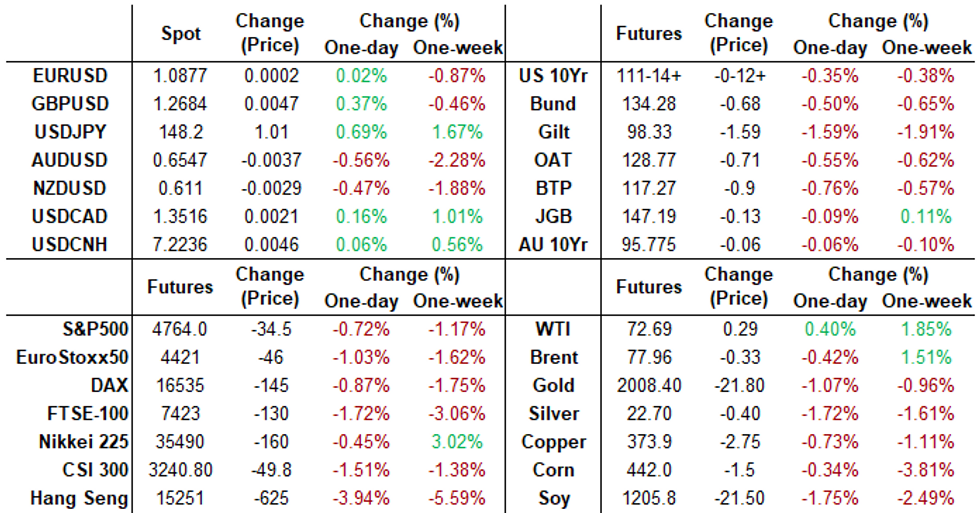

- Cross asset summary: stocks weaker with S&P eminis -27.5 at 4771.0, oil near steady (WTI +0.27 at 72.67), Gold weaker (-22.60 at 2005.85).

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00302 to 5.33478 (-0.00320/wk)

- 3M +0.01166 to 5.30957 (-0.00696/wk)

- 6M +0.02709 to 5.11611 (-0.03736/wk)

- 12M +0.03590 to 4.68892 (-0.10086/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.854T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $695B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $667B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $253B

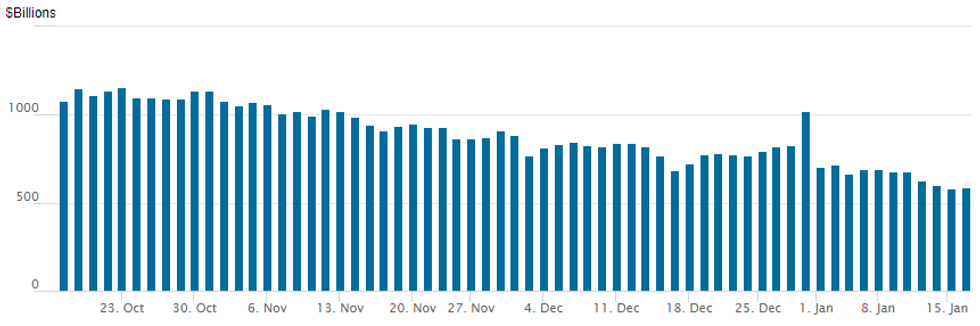

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches back up to $590.191B vs. $583.103B yesterday - the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties bounces to 77 vs. 65 yesterday, the lowest since July 7, 2021.

SOFR/TREASURY OPTION SUMMARY

Better volume reported in puts Wednesday after higher than expected Retail Sales dampened rate cut expectations through midyear. Heavy volume reported in underlying futures: SFRH4 contract with over 630,000, SFRM4 with 725,000. No obvious headline driver but more rate cut/unwind related after this morning's data dampens projections for the first half of 2024: January 2024 cumulative -0.6bp at 5.323%, March 2024 chance of rate cut falls to -57.2% w/ cumulative of -14.9bp at 5.180%, May 2024 no longer pricing in 25bp cut -- currently at -85.6% w/ cumulative -36.3bp at 4.966%. June 2024 still pricing in a 25bp cut, cumulative -61.5bp at 4.714%. Fed terminal at 5.315% in Feb'24.

- SOFR Options:

- 13,000 SFRU4 95.00/95.62/96.00 broken put flys

- +10,000 SFRZ4 97.50/98.00/98.50 call trees, 1.0

- 20,000 0QH4 97.50/97.62 call spds

- 5,000 SFRH4 95.00/95.06/95.12 call trees

- 3,000 SFRM4 95.25/95.50/95.75 put flys

- 3,000 SFRM4 95.25/95.50/95.75 put trees, ref 95.39

- 5,000 SFRG4 95.06 calls ref 94.925

- 4,000 SFRU4 95.00/95.62/96.00 broken put flys

- 3,000 SFRM4 94.87/95.12 put spds vs. SFRM4 95.56/95.81 call spds

- 6,000 SFRG4 94.75/94.87 2x1 put spds

- 3,000 SFRH4 94.93/95.06/95.18 call flys

- 10,000 SFRM4 95.75/95.87 call spds vs. 95.00/95.12 put spds

- 5,000 SFRM4 95.25/95.37/95.50/95.62 call condors

- 5,000 SFRM4 95.25/95.50/95.75 call flys

- over 8,800 SFRG4 94.75 puts

- 3,000 0QH4 96.12/96.25/96.37/96.50 put condors ref 96.55

- Treasury Options:

- +4,000 TYH4 115/115.5 2x1 call strip, 20

- over 32,000 TYH4 109 puts, 9-13

- 4,000 FVH4 109/110/111 put flys

- 4,000 USG4 124/126 call spds ref 120-26

- 3,000 TYG4 110.75/111.5 2x1 put spds

- -3,800 TYJ4 114 calls, 39

- -5,950 FVJ4 109.5 calls, 32

- 3,250 TUH4 103 puts, 21.5 last

- 1,300 TYH4 112/113/114 call flys ref 111-25

- 2,000 TUH4 102.5/102.75/103 put trees ref 102-27.38

- Block, 20,000 FVG4 108 puts, 11 ref 108-13

EGBs-GILTS CASH CLOSE: Strong Bear Flattening Move As Cuts Priced Out

European curves bear flattened sharply Wednesday as central bank cutting expectations receded further.

- Stronger-than-expected UK inflation data set a bearish tone for the session (headline, core and services all surprising to the upside - our review is here), while ECB's Lagarde noted in an interview this morning that "too optimistic" markets regarding cuts could impair disinflation progress.

- The bear-flattening sell-off extended through the afternoon on strong US retail sales data.

- Market-implied 2024 BoE cuts retraced by a full 25bp reduction (now just 104bp seen this year vs 130bp yesterday), while ECB 2024 cuts pulled back by 10bp.

- The UK inflation data ensured Gilts underperformed Bunds, while periphery spreads widened modestly on the more hawkish ECB outlook and broader risk-off moves amid the repricing.

- ECB's Nagel speaks after the close. Thursday sees largely 2nd tier European data, with another appearance by ECB's Lagarde, and the accounts of the ECB December meeting.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.8bps at 2.698%, 5-Yr is up 8.8bps at 2.242%, 10-Yr is up 5.8bps at 2.316%, and 30-Yr is up 0.4bps at 2.469%.

- UK: The 2-Yr yield is up 21.5bps at 4.378%, 5-Yr is up 23.7bps at 3.907%, 10-Yr is up 18.8bps at 3.985%, and 30-Yr is up 15.5bps at 4.64%.

- Italian BTP spread up 2.9bps at 160.1bps / Spanish bond spread up 1.4bps at 93.5bps

EGB Options: Large Iron Fly Selling In Euro Rates Features Wednesday

Wednesday's Europe rates/bond options flow included:

- DUH4 106.80/107.10cs, bought for 1.5 in 20k.

- SFIH4 94.90/95.00/95.10/95.20c condor bought for 1.5 and 1.75 in 5.25k

- ERH4 96.37/96.50/96.62c fly, sold at 1 in 10k

- ERJ4 96.75/97.00/97.25 call fly paper paid 3.75 on 5K

- ERM4 96.50p, bought for 9.75 in 17.6k

- ERM4 96.50/96.75/97.00 iron fly, sold at 19.5 in 14.5k total

- ERU4 96.25/95.75ps 1x2, bought for 1.25 in 12.5k

- ERZ4 97.50/97.25/96.75 broken p ladder, bought for 1.25 in 5k

FOREX Higher US Yields & Lower Equities Prompting Further JPY Declines

- Further upward pressure on US yields, and the notable 15bp move for the 2-year, has prompted an extension of overall greenback strength on Wednesday. The 0.2% advance for the USD index screens as more moderate than the prior session, but extends the week’s advance to 1.12%. Greenback gains have once again been most notable against the struggling Japanese Yen.

- USDJPY registered another near 1% range on the session, reaching as high as 148.52 in the aftermath of the stronger-than-expected US retail sales data, and in particular the substantially higher control group figure. The data has weighed on the front-end of the Treasury curve, which continues to filter through to a weaker JPY, which remains the most sensitive to diverging yield differentials.

- Additionally, risk-off sentiment continues to permeate through to equity markets, with the S&P 500 dropping close to 1% on the session, weighing on the likes of AUD and NZD. Notably, AUDUSD’s low of 0.6525 closely matches a strong medium term pivot point and touted key support at the December 7 low.

- Bucking the trend in G10 is GBP, which relatively outperforms following the above-estimate inflation data this morning, with headline, core and services all surprising to the upside. As such, GBP retains its crown as one of the best performing major currencies this year, with cable up 0.32% as we approach the APAC crossover.

- In emerging markets, it’s worth noting that USDMXN had a decent extension higher early on Wednesday, reaching as high as 17.3860, briefly extending yesterday’s impressive 2% advance by a further percentage point, before those gains were steadily pared across the afternoon.

- Australian employment will headline Thursday’s APAC docket, before focus will turn to US jobless claims and Philly fed manufacturing data. Wires will continue to be monitored for any significant headlines emanating from officials at the World Economic Forum in Davos.

FX Expiries for Jan18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0740-52(E1.0bln), $1.0880-85(E743mln), $1.0915-20(E613mln), $1.0975-90(E2.0bln), $1.1065-75(E1.8bln)

- USD/JPY: Y143.90-05($1.5bln), Y145.00($1.5bln), Y148.00-05($770mln)

- GBP/USD: $1.2600(Gbp552mln), $1.2640-60(Gbp746mln)

- AUD/USD: $0.6490(A$578mln), $0.6650(A$1.1bln), $0.6735-50(A$1.2bln)

- NZD/USD: $0.6200(N$867mln)

- USD/CAD: C$1.3380-90($1.1bln)

- USD/CNY: Cny7.2000($2.2bln)

Late Equities Roundup: Real Estate, Utility Sectors Underperforming

- Stocks declined for the second consecutive session Wednesday, off second half lows with Real Estate and Utility sector shares underperforming. Currently, DJIA is down 150.31 points (-0.4%) at 37209.91, S&P E-Mini future down 36.5 points (-0.76%) at 4762, Nasdaq down 135.7 points (-0.9%) at 14808.33.

- Laggers: Real Estate and Utility sector underperformed late, real estate investment trusts (REITs), particularly office and industrial REITs weighed: Boston Properties -5.11%, Alexandria Real Estate -3.64%, Prologis -3.02%. Independent power and electricity providers weighed on the Utility sector: NextEra Energy -3.74%, AES Corp -3.587%, Entergy -2.89%.

- Leading gainers: Consumer Staples and Health Care sectors outperformed late, food and beverage shares buoyed the former: Campbell Soup +1.86%, JM Smucker +1.72%, Conagra +1.36%. Equipment and service providers helped the Health Care sector: Humana +3.23%, UnitedHealth +1.86%, Elevance Health +1.39%.

- Corporate earnings: Discover Financial, Alcoa and Kinder Morgan are expected to report after the close Citizens Financial, Charles Schwab and US Bancorp reported this morning.

- Technicals: S&P E-Minis are trading lower today but - for now - remain above the Jan 5 low. Key resistance and the bull trigger is unchanged at 4841.50, the Dec 28 high. A break of this level would resume the uptrend and open 4854.75, a Fibonacci projection. Support at the 20-day EMA of 4773.54 has recently been pierced. A clear break of this average would strengthen a short-term bearish threat and open the 50-day EMA, at 4684.17.

E-MINI S&P TECHS: (H4) Watching Support

- RES 4: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4900.00 Round number resistance

- RES 2: 4854.75 1.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4841.50 High Dec 28 and the bull trigger

- PRICE: 4765.00 @ 1540 ET Jan 17

- SUP 1: 4702.00 Low Jan 05

- SUP 2: 4688.59 2.0% 10-dma Envelope

- SUP 3: 4684.17 50-day EMA

- SUP 4: 4594.00 Low Nov 30

S&P E-Minis are trading lower today but - for now - remain above the Jan 5 low. Key resistance and the bull trigger is unchanged at 4841.50, the Dec 28 high. A break of this level would resume the uptrend and open 4854.75, a Fibonacci projection. Support at the 20-day EMA of 4773.54 has recently been pierced. A clear break of this average would strengthen a short-term bearish threat and open the 50-day EMA, at 4684.17.

COMMODITIES Crude Oil Supply Concerns Helps Offset USD Strength, But Gold Nears Key Support

- WTI has seen strong intraday increases in the second half of the day to sit higher on the day, as further attacks in the Red Sea and additional outages in North Dakota offset a higher US dollar and wider economic concerns.

- White House National Security Adviser Sullivan has released a statement confirming that the Houthi rebels in Yemen have been re-designated as a 'specially designated terrorist group'.

- UKMTO has received a report of an incident 60 miles Southeast of Aden, Yemen Jan. 17. The master reports the vessel has been hit on the Port side by an uncrewed aerial system.

- Global oil markets are able to cope with Red Sea disruptions in the short term, but prolonged attacks could lead to tanker shortages in an already tightening oil market, Aramco CEO, Amin Nasser, told Reuters.

- North Dakota oil production is down about 650-700k barrels per day, gas output off 1.7-1.9 bcf per day due to freezing weather - state pipeline authority.

- WTI is +0.35% at $72.65, off a low of $70.50 that came closer to support at $69.28 (Jan 3 low).

- Brent is -0.35% at $78.01, off a low of $76.50 that still sat above support at $74.79 (Jan 3 low).

- Gold is -1.1% at $2005.84 for another large decline amidst USD strength, pushing through supports at $2017.3/2013.4 (50-day EMA/Jan 11 low) to next open a key support at $1973.2 (Dec 13 low).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/01/2024 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 18/01/2024 | 0900/1000 | ** |  | EU | EZ Current Account |

| 18/01/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 18/01/2024 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 18/01/2024 | 1330/0830 | *** |  | US | Housing Starts |

| 18/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/01/2024 | 1445/0945 | *** |  | US | MNI Chicago Business Barometer Seasonal Adjustment |

| 18/01/2024 | 1515/1615 |  | EU | ECB's Lagarde participates in Stakeholder Dialogue at WEF | |

| 18/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 18/01/2024 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 18/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/01/2024 | 1705/1205 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/01/2024 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.