-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: Atl Fed Bostic Buoys Stocks

HIGHLIGHTS

- MNI G20: Blinken Downplays G20 Support For Russia

- MNI US-EU: Von Der Leyen To Visit WH For Talks On Ukraine, Energy, IRA, And China

- MNI UKRAINE: BRAZIL: President Lula To Speak With President Zelensky Today

- FED BOSTIC FAVORS RAISING RATES 25 BPS IN MARCH BUT WATCHING DATA, Bbg

- FED BOSTIC: FED COULD BE IN POSITION TO PAUSE BY MID TO LATE SUMMER. Bbg

- FED COLLINS: NEED SOME ADDITIONAL FED RATE HIKES TO CURB INFLATION - Bbg

- JPMORGAN NOW SEES ECB RAISING INTEREST RATES BY 50 BPS IN MAY, FROM AN EARLIER FORECAST FOR A 25-BPS RISE, Rtrs

Key links: MNI: Fed’s Bostic Says Rates Might Need To Go Higher / MNI INTERVIEW: BOE Should Set Out Views On Policy Transmission / MNI BOC WATCH: Macklem Seen On Hold, Affirming Longer Pause

US TSYS: Bear Curve Steepening, Short End Resists Broader FI Selling

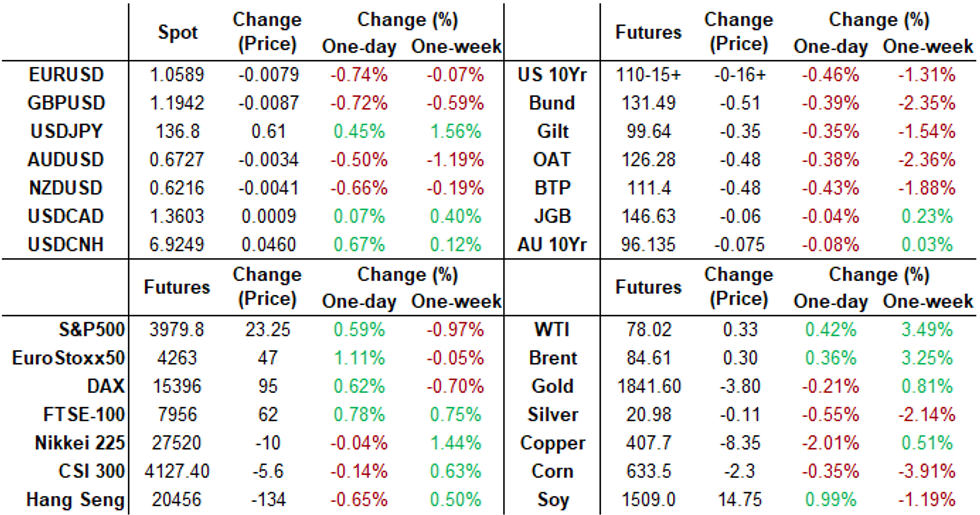

Tsys trading near midday lows after the bell, yield curves bear steepening (2s10s +6.188 at -82.828) with short end resisting broader selling in intermediates to long end.

- Brief risk-on in rates (while stocks continued to rally late) in response to dovish tones (favors 25bp hike in March .. maybe pause late summer) on otherwise balanced comments from Atlanta Fed Bostic (unscheduled conf call w/ reporters: “There is a case that could be made that we need to go higher" while "inflation is remaining stubborn at elevated levels, labor markets remain quite tight.

- Early technical buying after 2YY tapped 4.9414%, highest level since mid-2007, while intermediates to long end yields still below Nov'22 levels. 10YY tapped 4.0893% high, 30YY tapped 4.0446% - highest since Nov 10.

- Fed funds implied hike for Mar'23 at 30.5bp, May'23 cumulative 57.6bp to 5.154%, Jun'23 75.3bp to 5.331%, terminal slips to 5.430% in Oct'23 vs. 5.51% morning high.

- Fed speaker scheduled later: Fed Gov Waller eco-outlook, text, moderated virtual event at 1600ET

- MN Fed Kashkari on race, justice and economy w/ MN Supreme Court Justice Alan Page at 1830ET, Livestreamed

SHORT TERM RATES

NY Federal Reserve/MNI

- O/N +0.00215 to 4.55929% (-0.00242/wk)

- 1M +0.02843 to 4.70143% (+0.06657/wk)

- 3M +0.00457 to 4.98571% (+0.03228/wk)*/**

- 6M +0.02272 to 5.31086% (+0.07572/wk)

- 12M +0.02786 to 5.71400% (+0.07529/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.58% volume: $107B

- Daily Overnight Bank Funding Rate: 4.57% volume: $304B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.172T

- Broad General Collateral Rate (BGCR): 4.52%, $462B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $446B

- (rate, volume levels reflect prior session)

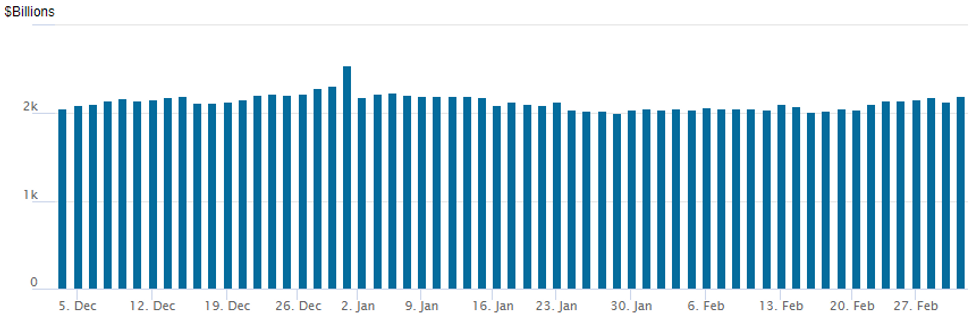

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,192.355B w/ 99 counterparties vs. prior session's $2,133.950B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Option trade more mixed Thursday, some chunky put fly trade in SOFR options (+50,000 SFRJ3 94.12/94.25/94.37 put flys, 1.0 ref 94.575) as option accts continued to hedge downside risk in face of stubborn inflation. Large strangle blocks in late trade.- SOFR Options:

- Block, 29,200 SFRZ3 94.25/95.25 strangles, 34.5

- Block, 25,000 SFRZ3 94.50/95.50 strangles, 40.0

- Update, over +50,000 SFRJ3 94.12/94.25/94.37 put flys, 1.0 ref 94.575

- 10,000 SFRM3 94.37/94.50/94.56/94.68 put condors, ref 94.565

- Block, 10,500 SFRM3 94.50/94.62 3x2 put spds 2.0

- Block, 8,000 SFRN3 94.81/94.93/95.06 put flys, 0.75 ref 94.51

- Block, 6,000 2QH3 96.25 puts, 16.5 ref 96.155

- Block, 8,880 SFRJ3 95.00 calls, .5 ref 94.555

- 6,700 SFRM3 94.43/94.75 strangles, 11.5-12.0 ref 94.565

- Block, 3,000 OQJ3 95.75/95.93 put spds 4.5 over 2QJ3 96.31/96.50 put spds

- Treasury Options:

- 5,800 TYM3 108.5/110.5 2x1 put spds, 3 net refc 110-15.5

- -6,200 TYK3 114 calls, 14 ref 110-17

- +20,000 wk1 FV 106.75 calls, 3.5 ref 106-12.25 to -12.5

- 3,000 TYK3 108/109/110 put flys, 20 ref 110-15

- over 10,200 USM3 116/120 put spds vs. USJ3 122 puts, 17 net/Apr over

- 7,700 TYJ 110.75/112 vs. TYJ 109.75 puts, 5 net ref 110-25

- 2,000 TYJ 112.5/113 call spds, 4

- over 4,400 TYJ3 108.5 puts, 14-15 ref 110-24

- 2,000 TYK3 107/108 2x1 put spds, ref 110-22

- 4,000 FVJ3 106 puts, 28.5-29 ref 106-14.75

- 2,600 USM3 113/114 put spds, 7 ref 123-24

- 2,500 USJ3 119/119.5 put spds, 5 ref 123-24

- 2,300 TYK3 109/110 put spds, 21 ref 110-26

FOREX: USD Index Set To Post 0.5% Advance, US ISM Services PMI Data Awaits

- Despite some moderate greenback selling following Fed’s Bostic comments and a pop higher for equities, the USD index is holding onto half a percent gains as we approach the APAC crossover.

- EUR, GBP, AUD and NZD are all showing declines of around 0.75% with most majors reversing the moves seen on Wednesday. This leaves the DXY broadly unchanged on the week and places the near-term focus on Friday’s ISM Services PMI in dictating the greenback’s momentum into the Friday’s close.

- Having previously breached resistance, EURUSD has traded back below the 50-day EMA, at 1.0659. The short-term focus on the downside would be a break of 1.0533, Monday’s low, which would resume the bear cycle and initially open 1.0484, Jan 6 low and key support.

- Outperforming on Thursday is the Canadian Dollar, less affected by the renewed greenback strength. USDCAD is consolidating, however, bulls remain in the driver’s seat for now and sights are on the key short-term resistance at 1.3705, the Dec 16 high. A clear break of this hurdle would strengthen bullish conditions and clear the way for a test and break of the 1.3800 handle.

- USDJPY bulls remain in the driver’s seat and the pair is holding on to the majority of Thursday’s gains. Price has pierced and traded above 136.67, the 38.2% retracement of the downleg between Oct 21 and Jan 16. A clear break of this hurdle would set the scene for a climb towards 138.17, the Dec 15 high.

- Chinese Caixin Services PMI kicks off the overnight docket on Friday before German trade balance data and Eurozone PPI highlight the European session.

FX: Expiries for Mar03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.8bln), $1.0550(E577mln), $1.0595-00(E2.2bln), $1.0625-35(E893mln), $1.0675(E969mln), $1.0700-05(E1.8bln)

- USD/JPY: Y135.00($795mln), Y136.00($718mln)

- GBP/USD: $1.2060(Gbp645mln)

- AUD/USD: $0.6800(A$951mln)

- NZD/USD: $0.6100(N$1.0bln)

- USD/CAD: C$1.3500-15($591mln), C$1.3600($702mln)

- USD/CNY: Cny6.9000($1.3bln), Cny7.0000($800mln)

Late Equity Roundup: Looking for Reason to Rally

Stocks extending gains in late trade, apparently fixated on more dovish tones (favors 25bp hike in March .. maybe pause late summer) on otherwise balanced comments from Atlanta Fed Bostic an hour ago: “There is a case that could be made that we need to go higher" while "inflation is remaining stubborn at elevated levels, labor markets remain quite tight.

- Stocks favoring the former: SPX eminis currently trading +18.75 (0.47%) at 3975.25; DJIA +282.29 (0.86%) at 32943.05; Nasdaq +53.3 (0.5%) at 11432.39.

- SPX leading/lagging sectors: Utilities (+1.75%) take the lead, electric utility shares outperforming (NEE +3.23%, CEG +2.95%, ETR +2.51, LNT +2.38%), Information Technology, Communication Services and Consumer Staples all appr +1.0%, software/services shares helping IT (CRM +12.64%, ADBE +3.17%, ANSS +3.08%).

- Laggers: Financials (-0.95%) w/ banks weighing (SBNY -4.42%, ZION -4.06%, PNC -3.56%, Key -3.47%); Consumer Discretionary (-1.16%) weighed by automakers, in particular Tesla -6.0% after poor response to "Investor Day".

- Dow Industrials Leaders/Laggers: Salesforce (CRM) surges +21.00 to 188.35 after better than expected earnings and beating guidance late Wed; McDonalds (MCD) +5.39 at 268.11, MSFT +4.26 at 250.63. Laggers: JPM -1.82 at 140.73, Travelers (TRV) -1.15 at 182.90, Amgen -1.13 at 235.06.

E-MINI S&P (H3): Trading Lower As The Bear Leg Extends

- RES 4: 4168.50 High Feb 16

- RES 3: 4096.00 High Feb 17

- RES 2: 4038.61 20-day EMA

- RES 1: 4020.29 50-day EMA

- PRICE: 3975.00 @ 14:55 ET Mar 2

- SUP 1: 3901.75 Low Jan 19

- SUP 2: 3787.62 76.4% retracement of the Dec 22 - Feb 2 bull cycle

- SUP 3: 3819.00 Low Jan 6

- SUP 4: 3788.50 Low Dec 22 and a key support

S&P E-Minis trend conditions remain bearish and the contract is trading lower today. Price remains below the 50-day EMA, at 4020.29 and sights are set on 3901.75, the Jan 19 low and 3887.62, the 76.4% retracement of the Dec 22 - Feb 2 bull cycle. Resistance to watch is at the 50-day EMA and 4038.61, the 20-day EMA. Note that a clear break of both the 50- and 20-day EMAs would signal a possible reversal.

COMMODITIES

- WTI Crude Oil (front-month) up $0.35 (0.45%) at $78.04

- Gold is down $0.79 (-0.04%) at $1835.96

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/03/2023 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 03/03/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/03/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/03/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/03/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/03/2023 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/03/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/03/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/03/2023 | 0830/0930 |  | EU | ECB de Guindos Q&A at CUNEF University | |

| 03/03/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/03/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/03/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/03/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/03/2023 | 0900/1000 | *** |  | IT | GDP (f) |

| 03/03/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/03/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/03/2023 | 1330/0830 | * |  | CA | Building Permits |

| 03/03/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/03/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/03/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 03/03/2023 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/03/2023 | 2000/1500 |  | US | Fed Governor Michelle Bowman | |

| 03/03/2023 | 2115/1615 |  | US | Richmond Fed Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.