-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: Beige Book, Inflation Slows

- MNI US-EU: Spain Prime Minister Sanchez To Visit White House On May 12

- MORGAN STANLEY CEO DOES NOT EXPECT RATE CUTS THIS YEAR, Bbg

- HOUSE SPEAKER MCCARTHY SAYS DEBT BILL WILL REDUCE IRS FUNDING .. CLAW BACK UNSPENT COVID MONEY, bbg

- Beige Book: Southeast Banking Conditions Remain Steady, Atlanta Fed

- Robert F. Kennedy Jr. announces Democratic 2024 presidential bid, NBC

US TSYS: Little Change in Economic Activity: Beige Book

- Treasury futures holding weaker but off midday lows, partially due to $16B total corporate bond issuance pricing and rate locks being unwound, TYM3 currently at 114-06 (-9.5) vs. 113-30.5 low, yield 3.6023% high.

- From a technical perspective, 10Y futures remain in a short-term downtrend as the contract extends the pullback from 117-01+, the Mar 24 high. The contract has recently traded through both the 20- and 50-day EMAs and has pierced the 114-00 handle today. This signals scope for weakness to 113-23, a Fibonacci retracement.

- Curves bear flattened earlier, extending inversion to -66.009 low at -64.181 currently amid chunky short end selling earlier. Projected rate hikes over the next three FOMC meeting firm up (Fed funds implied hike for May'23 at 22bp, Jun'23 +29.7bp cumulative at 5.126%, Jul'23 +25.4bp at 5.083%).

- Large corporate bond issuance ($8.5B Bank of America 2-part, $7.5B Morgan Stanley 3-part) in addition to pre-auction short sets ahead the US Treasury $12B 20Y bond auction re-open weighed on Treasury futures through midday.

- No significant react to data, Federal Reserve Releases Beige Book showed little change in economic activity over the last few weeks while MBA Mortgage Applications recently announced: -8.8% last week (5.3% prior).

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00756 to 4.94596 (+.05290/wk)

- 3M +0.00705 to 5.05550 (+.07262/wk)

- 6M +0.01030 to 5.07839 (+.13537/wk)

- 12M +0.01224 to 4.88293 (+.19866/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00200 to 4.80671%

- 1M +0.02958 to 4.98229%

- 3M +0.01100 to 5.26143% */**

- 6M +0.03928 to 5.45057%

- 12M +0.05614 to 5.48171%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $112B

- Daily Overnight Bank Funding Rate: 4.82% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.364T

- Broad General Collateral Rate (BGCR): 4.77%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $518B

- (rate, volume levels reflect prior session)

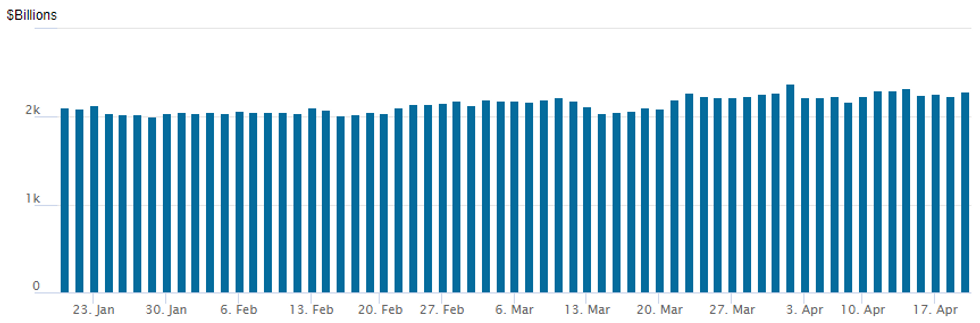

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,294.677B w/ 110 counterparties, compares to prior $2,238.994B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

SOFR/TREASURY OPTIONS SUMMARY

Early two way flow segued to better low delta SOFR puts, put spreads on net as underlying futures hold weaker levels as projected rate hike (s) over the next three FOMC meetings gains momentum (year-end rate cuts recede).- SOFR Options:

- +25,000 SFRN3 94.25/94.50 put spds, 2.0 pit/screen

- +2,000 SFRZ3 97.00/98.50 1x2 call spds, 7.5

- +1,500 SFRZ3 94.50/94.75/95.00/95.25 put condors, 7.0 ref 95.42

- 3,000 SFRZ3 94.93/95.12/95.18/95.43 call condors ref 95.105

- Block, 7,000 SFRN3 94.25/94.50 put spds, 2.0 ref 95.105

- Block, 3,000 SFRU3 94.68/94.93/95.12 broken put trees, 0.0 net ref 95.08

- over 5,000 SFRZ3 94.75/94.81 put spds, 2.5 ref 94.88

- 2,000 SFRM3 94.81/94.94/95.06 put flys ref 94.89

- Block, 10,000 SFRZ3 96.5/97.5 call spds, 11.5 ref 95.395

- 1,750 SFRU3 96.50/97.00 call spds vs. SFRM4 98.50/99.00 call spds, 1.0 db/Jun over

- 4,000 SFRU3 94.75/95.00 call spds, ref 95.08

- 5,000 SFRM3 94.75/95.00 put spds, ref 94.885

- 4,000 SFRM3 94.5/94.81 put spds, ref 94.885

- Treasury Options:

- -4,400 TYM3 112/116 strangles, 50 ref 114-04

- 2,200 FVK3 107.25/110.5 strangles

- over 6,800 TYM3 117 calls, 18 last ref 114-06.5

- over 8,500 TYM3 115 calls, 45 last ref 114-02.5

- 2,500 TUM3 104.75 calls, 3 ref 102-26.5

- over 7,000 TYM3 115 puts, 138 last ref 114-04

- 5,000 FVKs 108.5/108.75 put spds ref 108-27.5

- over 25,000 FVM3 110/111 call spds, 11.5 ref 108-28.25

- 2,000 FVK3 106.75/107/107.75 put trees ref 108-28.5

- 2,000 TYN3 115 calls, 44 ref 114-03.5

EGBs-GILTS CASH CLOSE: Bear Flattening With More BoE Hikes Priced

European curves bear flattened Wednesday, with the UK leading losses for a second straight day on more data spurring higher BoE hike expectations.

- March UK inflation surprised to the upside, which with Tuesday's strong wage growth data cemented a May 25bp hike and led BoE terminal rate pricing to close above 5% for the first time since October (up 15bp on the day).

- ECB pricing lagged but still rose 4bp for a fresh post-Credit Suisse crisis high.

- An MNI article published in late afternoon cited ECB sources as saying the Governing Council looks set to hike 25bp in May with at least one further 25bp increase this summer, and a pause currently foreseen to into 2024.

- Periphery EGBs were mixed, with BTP spreads widening, and GGBs tightening following a solid 2033 auction.

- BoE's Mann speaks after hours; German PPI and various eurozone confidence indices feature early Thursday, while later in the session we get accounts of the ECB's March meeting with appearances by Visco, Holzmann and Schnabel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 2.968%, 5-Yr is up 4.6bps at 2.566%, 10-Yr is up 3.8bps at 2.515%, and 30-Yr is up 1.9bps at 2.552%.

- UK: The 2-Yr yield is up 13.9bps at 3.83%, 5-Yr is up 12.8bps at 3.716%, 10-Yr is up 10.9bps at 3.856%, and 30-Yr is up 8.5bps at 4.183%.

- Italian BTP spread up 2.4bps at 184.8bps / Greek down 4bps at 181.4bps

EGB Options: More Upside In 2024 Euribor W Downside For 2023

Wednesday's Europe rates / bond options flow included:

- ERH4 98.50/99.00cs, bought for 2.5 in 5k - also bought Tues for 2.75 in 5k.

- ERZ3 96.62/96.00/95.37p fly, bought for 20.5 in 25k

- ERZ3 96.62/96.00/95.37p fly, bought for 16.25 in 25k vs ERZ3 97.00c sold in 12.5k at 16.25

FOREX: USDJPY Prints Above 135.00, GBP Whipsaws Post UK CPI Data

- Two-way price action for the US Dollar on Wednesday leaves the USD index moderately higher on the week as US 2-year yields extended their upward shift to around 15bps since Friday’s close.

- USD/JPY underwent a sharp bout of volatility as Bloomberg cited sources in reporting that the Bank of Japan are said to be wary over any tweak of yield curve control in April, with the smoother curve said to suggest no need for a policy move at this juncture. The piece adds that the bank is said to be mulling if a guidance change can wait or not.

- Volumes surged across futures markets, with spot USDJPY very briefly spiking to a fresh high of 135.13 before fading back below the 135 handle. Notably, EURJPY (+0.32%) looks set to extend its two-week rally to around 3.2%.

- GBP also saw some sharp two-way price action after initially rising on an above-expected March inflation release. While headline inflation slowed from the February print, Y/Y CPI remaining in double digits and core CPI holding above forecast poses further problems for the Bank of England, prompting a number of sell-side analysts to add 25bps to their MPC hike cycle.

- GBP/USD's post-data rally put the pair at 1.2472 before running out of momentum and falling victim to a mid-session correction higher for the greenback. However, the pair has settled in positive territory ahead of the APAC crossover with sights remaining on the bull trigger at 1.2546.

- The Canadian dollar is among the weakest G10 performers today, declining 0.45%. The Public Service Alliance of Canada has seen around 150,000 government workers striking in a dispute over wage increases, providing a marginal tailwind for USDCAD.

- New Zealand CPI headlines the APAC docket on Thursday with potential comments from RBA Governor Lowe, due to hold a media briefing about Review of the RBA.

FX Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0870-85(E1.6bln), $1.0895-00(E1.1bln), $1.0920-25(E1.9bln), $1.0975-80(E948mln), $1.1000-10(E1.3bln), $1.1100(E1.1bln)

- GBP/USD: $1.2350(Gbp865mln)

- USD/JPY: Y132.00-15($1.4bln), Y134.30($738mln)

- EUR/JPY: Y142.65-75(E1.1bln)

- AUD/USD: $0.6695-00(A$1.2bln)

- AUD/NZD: N$1.0800(A$602mln)

- USD/CAD: C$1.3290($550mln), C$1.3510($668mln)

Equities Roundup: Off Lows, Awaiting Next Round of Earnings

- Stocks are trading off early session lows, currently steady (SPX at 4180.0) to mixed with Nasdaq shares outperforming (12166.0 +12.6).

- With no pertinent data on the session (upcoming Beige Book at the top of the hour notwithstanding), early weakness partially tied to heavy short end selling in rates as implied rate hikes over the next three FOMC meetings gained traction (while year end rate cuts continued to evaporate).

- The trend outlook in S&P E-minis remains bullish and Tuesday’s gains reinforce current conditions. The contract traded to a fresh cycle high yesterday and is approaching the 4200.00 handle.

- Sights are on 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4073.75, the 50-day EMA. Initial support to watch lies at 4113.07, the 20-day EMA. Pullbacks are considered corrective

- Stock earnings resume after the close: IBM, Kinder Morgan (KMI), Alcoa Corp (AA), Las Vega Sands (LVS), Tesla (TSLA), Discover Financial (DFS), Equifax (EFX), Crown Castle (CCI), Zions Bancorp (ZION).

E-MINI S&P (M3): Bull Cycle Remains In Play

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4200.00 Round number resistance

- PRICE: 4180.00 @ 1330ET Apr 19

- SUP 1: 4148.00/4113.07 Low Apr 17 / 20-day EMA

- SUP 2: 4073.75 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

The trend outlook in S&P E-minis remains bullish and Tuesday’s gains reinforce current conditions. The contract traded to a fresh cycle high yesterday and is approaching the 4200.00 handle. Sights are on 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4073.75, the 50-day EMA. Initial support to watch lies at 4113.07, the 20-day EMA. Pullbacks are considered corrective.

COMMODITIES: Macro Forces Outweigh Larger Oil Inventory Draw

- Crude oil prices have slipped circa 2% today as macro drivers work against it with Fed rate expectations and the USD on net pushing higher.

- The decline comes despite an incerase after a larger than expected inventory draw in the latest EIA data. Gasoline cracks have fallen with a stock build and drop in implied demand while diesel cracks remain steady. Crude stocks declined more than expected with a large increase in refinery utilisation and with a recovery in exports after the dip last week. Cushing stocks drew for the seventh consecutive week.

- WTI (CLK3) is -2.0% at $79.21 with a low of $78.46 pushing through the 20-day EMA at $78.83, with a more concerted push lower opening $77.35 (50-day EMA).

- Within the CLM3, there is again reasonable activity at $70/bbl puts although the day's most active strike is at $80/bbl calls.

- Brent is -1.9% at $83.20, off a low of $82.39 which came close to support at the 50-day EMA of $82.03.

- Gold is -0.5% at $1994.95, still stuck in that range considerably below resistance at $2051.1 (Apr 17 high) and support at $1949.7 (Apr 3 low), creating scope for large daily moves in the interim.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams | |

| 20/04/2023 | 2350/0850 | ** |  | JP | Trade |

| 20/04/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/04/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/04/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 20/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/04/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/04/2023 | 1415/1015 |  | US | Secretary Yellen on U.S.-China economic relationship | |

| 20/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/04/2023 | 1530/1130 |  | CA | BOC Governor testifies at Senate committee | |

| 20/04/2023 | 1530/1630 |  | UK | BOE Tenreyro Panels National Bureau of Economics Research Conf | |

| 20/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/04/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 20/04/2023 | 1620/1220 |  | US | Cleveland Fed's Loretta Mester | |

| 20/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/04/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan | |

| 20/04/2023 | 1900/1500 |  | US | Fed Governor Michelle Bowman | |

| 20/04/2023 | 2015/2215 |  | EU | ECB Schnabel Lecture at Stanford Graduate School of Business | |

| 20/04/2023 | 2100/1700 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.