-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Broad Rally As CPI Seen Transient

HIGHLIGHTS:

- Tsys and stocks initially drop on above-expected U.S. May inflation, but rally to session highs as price spike seen transitory

- ECB meeting did not offer many significant surprises; peripheries enjoy relief rally

- Dollar a little weaker despite post-CPI spike; oil swings on Iran sanctions headlines

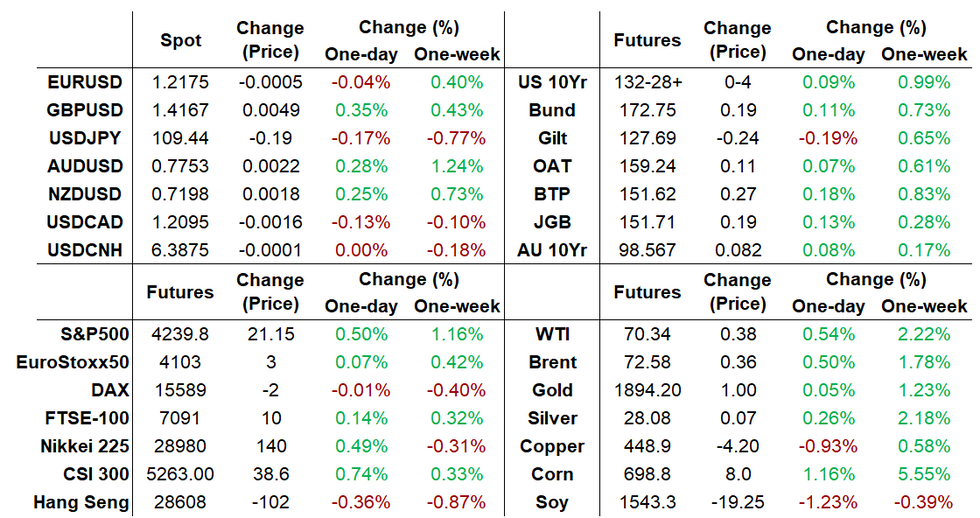

Source: BBG, MNI

Source: BBG, MNI

US TSYS SUMMARY: Impressive Post-CPI Rally Sends Yields To Multi-Month Lows

Tsys initially sank on above-expected May inflation, but decisively reversed course shortly thereafter to session highs with participants looking through the 29-year high in core Y/Y CPI. The curve bull flattened and futures volumes pushed 2M for the first time since the Jun-Sep roll.

- And not at all a risk-off move, given that stocks hit all-time highs. Indeed it was basically one-way traffic lower for yields after the initial spike, with bears appearing to capitulate toward the end of the session.

- The 2-Yr yield is down 0.6bps at 0.1488%, 5-Yr is down 2.1bps at 0.7291%, 10-Yr is down 3.4bps at 1.457%, and 30-Yr is down 1.7bps at 2.1518%. Sep 10-Yr futures (TY) up 5.5/32 at 132-30 (L: 132-10 / H: 132-30.5)

- Implied breakevens headed modestly higher, meaning real yields fell sharply - suggesting market participants both acknowledge higher inflation pressures, while also deferring to the FOMC's insistence that the current spike is only temporary (and that they will be patient before tightening policy).

- The strength in Tsys made an otherwise mediocre 30Y Bond auction look even better given the circumstances - 1.2bps tail, bid-cover a little better than previous auction but weaker than average. While yields bounced off session lows and curve steepened slightly following the auction, the demand for duration was impressive given the lack of concession, and the rally continued afterward.

- It's a quiet calendar from here until the FOMC, with UMich sentiment and a new NY Fed purchase schedule the only things on the data /supply/speaker docket until Tuesday.

EGBs-GILTS CASH CLOSE: Peripheries Outperform On ECB Steadiness

Periphery EGBs outperformed Thursday as the ECB maintained steady policy. Bunds and Gilts were hit in sympathy with US Tsys after a stronger-than-expected US inflation print, but yields ended well off session highs (Gilts underperformed).

- Italian and Greek spreads tightened sharply as the ECB meeting did not offer many significant surprises; staff macro projections were revised higher.

- Supply came from Italy (BTPs, EUR7.75bn) and Ireland (IGBs,EUR1.25bn).

- UK GDP highlights Friday's docket; several speakers including ECB's Holzman and Knot, BOE's Bailey/Ramsden/Cunliffe as well as Chancellor Sunak.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.9bps at -0.685%, 5-Yr is down 1.3bps at -0.628%, 10-Yr is down 1.2bps at -0.256%, and 30-Yr is unchanged at 0.312%.

- UK: The 2-Yr yield is up 0.9bps at 0.067%, 5-Yr is up 1.2bps at 0.321%, 10-Yr is up 1.7bps at 0.747%, and 30-Yr is up 1.3bps at 1.279%.

- Italian BTP spread down 2.2bps at 105.1bps/ Greek spread down 1.7bps at 106.1bps

EUROPE SUMMARY: Large Euribor Call Fly Buyer Pre-ECB

Thursday's options flow included:

- DUU1 112.10/112.00ps, bought for 2.5 in 5k

- RXU1 170/167ps, bought for 39 in 9.5k

- OEU1 134/133.75 put spread bought for 8 in 2k vs DUU1 112.10/112.00 put spread sold at 2.5 in 5k

- 2RH2 100.25/100.37/100.62 broken call fly, bought for 2.25 in 29.6k

- 3RQ1 100.125/100/99.875 p ladder sold at 0.75 in 3k (closing)

- 2LZ1 99.50/99.62/99.75c ladder, sold at 1.25 in 4.5k

USD LIBOR FIX - 10-06-2021

O/N 0.05575 (0.00112)

1W 0.05788 (-0.00525)

1M 0.07263 (-0.002)

2M 0.10463 (-0.0015)

3M 0.11900 (-0.00575)

6M 0.14825 (-0.00863)

12M 0.23925 (-0.00163)

SOFR Steady Tuesday

| REPO REFERENCE RATES (rate, change from prev. day, volume): |

| * Secured Overnight Financing Rate (SOFR): 0.01%, no change, $896B |

| * Broad General Collateral Rate (BGCR): 0.01%, no change, $374B |

| * Tri-Party General Collateral Rate (TGCR): 0.01%, no change, $355B |

STIR: Overall Fed Funds And 75th Percentile Hanging In There

| New York Fed EFFR for prior session (rate, chg from prev day): |

| * Daily Effective Fed Funds Rate: 0.06%, no change, volume: $64B |

| * Daily Overnight Bank Funding Rate: 0.04%, no change, volume: $259B |

Of note is that the 75th percentile of transactions was again at 0.07% for the 2nd consecutive day Wednesday, after dipping to 0.06% Monday (leading to speculation the overall effective rate could dip below 0.06%).

US TSY 29Y-11M BOND AUCTION: HIGH YLD 2.172%; ALLOT 17.17%

- US TSY 29Y-11M BOND AUCTION: HIGH YLD 2.172%; ALLOT 17.17%

- US TSY 29Y-11M BOND AUCTION: DEALERS TAKE 17.98% OF COMPETITIVES

- US TSY 29Y-11M BOND AUCTION: DIRECTS TAKE 17.99% OF COMPETITIVES

- US TSY 29Y-11M BOND AUCTION: INDIRECTS TAKE 64.04% OF COMPETITIVES

- US TSY 29Y-11M BOND AUCTION: BID/COV 2.29

NY Fed Operational Purchase

Tsy 4.5-7Y, $6.001B accepted vs $20.067B submission

Next scheduled purchase:

- Fri 6/11 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 6/11 1500ET Update NY Fed Operational Purchase Schedule

FOREX: G10 Currencies Trade Within Narrow Ranges

- The heavily anticipated inflation prints from the US came and went, prompting no meaningful reaction in the greenback. Dollar Indices find themselves in minor negative territory on Thursday, despite US CPI readings beating market expectations.

- An initial spike in the USD on the release was quickly faded as a deeper dive into the figures, failed to garner sustained enthusiasm.

- EURUSD was confined to a 50-pip range over the ECB policy decision and press conference. Markets were given few clues regarding PEPP and future policy and as such, whipsawed either side of unchanged on the day. EURJPY however, did fail at the first notable resistance level of 133.81, the June 4 high, steadily retreating around 50 points thereafter.

- Despite a choppy session, firmer equities drove stronger performance in the likes of AUD and NZD, rising around 0.3%. The outperformer in G10 is GBP (0.37%) after failing below 1.41, however, it is worth noting that GBPUSD spot resides unchanged from the negative EU comments that soured sentiment on Wednesday at 1.4170.

- Overall G10 currencies have struggled to make any significant moves. Greater volatility was witnessed in EM, with substantial gains in both TRY (+1.96%) and ZAR (+1.08).

- With the bulk of the event risk completed, few fireworks are expected on Friday. UK Industrial Production tomorrow morning before BOE's Bailey is due to speak at an online event. The US session will be headlined by University of Michigan Sentiment.

FX OPTIONS: Larger FX Option Pipeline

- EUR/USD: Jun14 $1.2150-60(E1.0bln). $1.2200(E1.1bln-EUR puts); Jun17 $1.2220-25(E2.55bln-EUR puts), $1.2300(E1.8bln-EUR puts)

- AUD/USD: Jun14 $0.7940(A$1.3bln-AUD puts)

EQUITIES: Stocks Green Following Choppy Post-CPI Session

- US equity markets trading uniformly higher in the close, but the price action was far from one-directional. Stock futures initially dipped on a higher-than-expected CPI print as markets priced in a trickier outlook for the Fed, but this swiftly reversed as re-opening sectors showed evidence that price rises were decelerating.

- With this supporting the Fed's theory that inflation is transitory, equities resumed their upward trajectory, resulting in the e-mini S&P hitting a new all-time high of 4249.00.

- Healthcare and consumer staples were the strongest sectors, while financials and industrials were the only sectors to reside lower. Notable stock movers included Biogen, who rallied sharply on positive drug news, while Electronic Arts slipped on news that hackers had obtained certain source codes for upcoming releases.

- The VIX saw some support following the CPI release, but swiftly reversed course into the close, trading well within range of post-pandemic lows.

COMMODITIES: Oil Bounces as Headline Confusion Sows Hope of Iran Progress

- WTI crude futures initially slipped as various wires cited the US as having dropped sanctions targeting Iranian oil officials. WTI and Brent crude futures both dropped well over $1/bbl as markets looked forward to further progress with Tehran possibly leading to a return of Iranian oil onto the global market.

- This gains swiftly reversed however, as wires clarified that the official in question was a former, and not current, Iranian oil official, leading WTI to bounce smartly off the lows and head into the close in only minor negative territory.

- Precious metals saw support on the back of a higher-than-expected CPI print,with gold living up to its reputation as an inflation hedge. Next resistance for the yellow metal crosses at Wednesday's $1899.0 and the $1900 psychological level.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.