-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Economic Summit

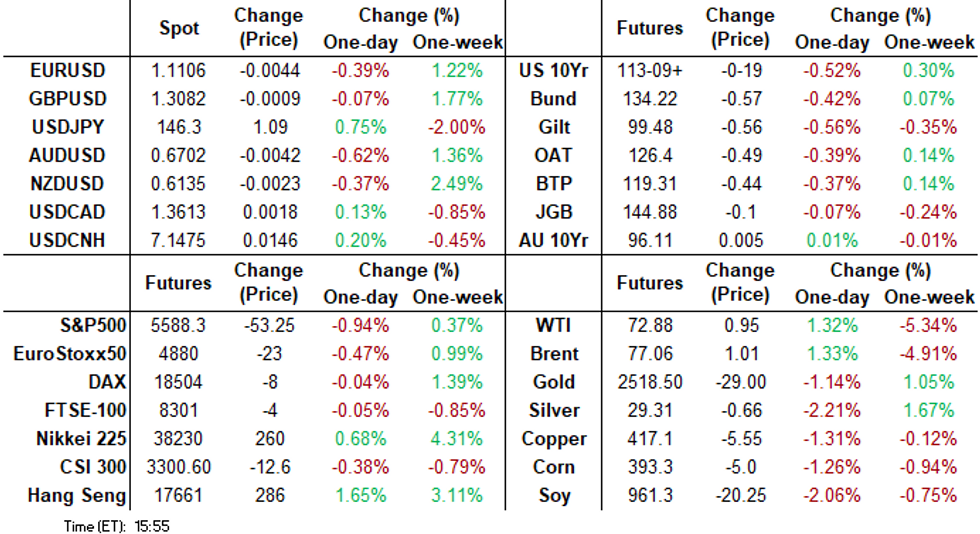

- Treasuries finished weaker after firmer US composite PMI data and cautious comments from KC Fed's Schmid

- Positioning ahead the Jackson Hole economics summit with Fed Chairman Powell speaking Friday morning at 1000ET.

- Still lower for the week, US$ advanced Thursday, adding to pressure in rates and equities.

US TSYS Yields Higher Ahead Jackson Hole Economic Summit, Chair Powell Friday

- Treasuries finished weaker/near lows Thursday after steady to mixed data and cautious comments from Fed’s Schmid. The Fed could be approaching the time to reduce interest rates but it must make sure inflation is coming down sustainably to its 2% target, Kansas City Fed President Jeffrey Schmid said Thursday.

- “We’ve got some data sets to come in before September, I want to be thoughtful about it,” Schmid told CNBC in an interview. “I’m taking a harder look at, I’m going to let the data show where we lead.”

- Fast two-way trade as Treasury futures initially rebound then extend lows after weekly claims data came out in line with expectations, continuing claims a little lower than anticipated with a modest down-revision to the prior.

- Treasury futures gap lower/extend lows after mixed flash PMI figures -- Mfg lower than expected vs. higher than expected Services and Composite. Manufacturing surprises lower at 48.0 (cons 49.5) after 49.6 whilst services surprised higher with a mild increase to 55.2 (cons 54.0) after 54.3. The beat for services, with its much larger weight, would ordinarily drive the market reaction but there was softness in some key areas within the report.

- Focus turns to the KC Fed hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24, Fed Chairman Powell speaking 1000ET Friday morning.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.03063 to 5.27795 (-0.05773/wk)

- 3M -0.03045 to 5.07131 (-0.05710/wk)

- 6M -0.05534 to 4.75475 (-0.08494/wk)

- 12M -0.07526 to 4.26359 (-0.12501/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.975T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $785B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $762B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $273B

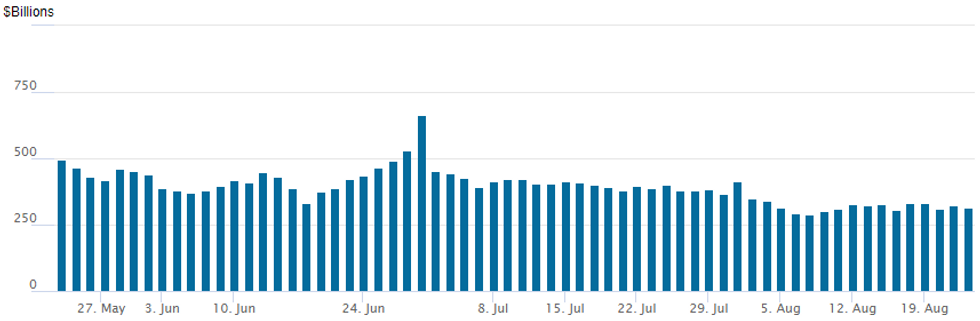

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $316.777B from $321.329B Wednesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties slips to 63 from 66 prior.

US SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options remained mixed on net with some large SOFR call spreads trading in the second half: appr $30M premium on Sep rate cut hedge ahead of Fed Chairman Powell's speech at Friday's Jackson Hole eco-summit. Projected rate cuts through year end have cooled vs. early Thursday levels (*): Sep'24 cumulative -31.3bp (-32.7bp), Nov'24 cumulative -63.1bp (-67.2bp), Dec'24 -96.7bp (-100.4bp).- SOFR Options:

- over +100,000 SFRU4 95.31/95.43 call spds, 0.5

- +10,000 SFRH5 98.00 calls 4.5

- Block, 3,000 SFRZ4 95.18 puts, .125 ref 95.795

- Block, 5,000 SFRZ4 96.00/96.12/96.25 call flys, 0.5

- 20,000 SFRU4 95.37/95.43 call spds ref 95.0875 to -.09

- 10,000 SFRU4 95.06/95.18/95.37 call trees ref 95.0925

- 4,600 SFRU4 95.06/95.12/95.18/95.25 call condors ref 95.0925

- 3,000 SFRZ4 96.12/96.25/96.37 call flys ref 95.755

- 2,500 SFRZ4 95.62/95.75/95.87 put flys ref 95.755

- 10,000 SFRV4 95.62/95.75/95.87 put flys ref 95.76

- 2,500 SFRX4 95.75/95.93/96.00/96.25 call condors ref 95.755

- 10,000 SFRU4 95.00 puts

- 16,000 SFRU4 95.06 puts

- 16,000 SFRU4 95.12 puts

- 3,200 SFRV4 95.75 puts ref 95.78 to -.785

- Treasury Options:

- +4,000 wk4 TY 113 puts, 4 vs. 113-20/0.08%

- -5,000 TYX4 114 straddles, 231

- +16,000 FVU4 108.25/108.5 put spds, 1 expires Friday

- 5,000 FVU4 108 puts, .5

- 1,800 FVX4 110.5/111 call spds

- 2,000 TYX4 112/114 2x1 put spds ref 114-05

- 2,500 TYX4 115/116 call spds ref 114-07

- over 5,900 TYU4 113 puts, 3 last

- over 4,900 TYU4 113.25 puts, 8 last

- 3,200 TYU4 114.5 calls, 3 last ref 113-26

- 3,000 USU4 123/124.5 call spds ref 124-28

EGB OPTIONS: Condors Feature In Active Session Thursday

Thursday's Europe rates/bond options flow included:

- DUV4 106.90c was sold at 11.5 in 3.5k, done vs ~1.2k at 106.265

- DUV4 107.00/107.30cs, 1x2 sold the 1 at flat in 3k

- DUX4 107.00/107.30cs 1x2, bought the 1 for -4 (receive) in 10k.

- RXU4 134/135cs, bought for 43 in 2k vs 1.2k at 134.40

- RXU4 134/133.5/133p fly, bought for 3.5 in 1k

- RXV4 136.5/137.5/139.5/140.5c condor, bought for 11.5 and 12 in 50k

- ERX4 97.00/96.875/96.625/96.50p condor, sold at 5.75-5.5 in 3k.

- ERZ4 96.625/96.75/96.875/97.00c condor sold at 5 in 4k

- SFIU4 95.25/95.35cs, bought for 1.5 in 3.6k

- SFIU4 95.20/95.25/95.30c fly, bought for half in 1.5k

FOREX: Greenback Trades on Firmer Footing as US Yields Rise

- Slightly firmer US composite PMI data and some cautious comments from Fed’s Schmid have seen treasury futures come under pressure Thursday, with US front-end yields rising around 8bps, resulting in a better session for the US dollar.

- The USD index stands 0.45% higher as we approach the APAC crossover, with most notable gains against the Japanese Yen, given the JPY’s ongoing sensitivity to movements in core yields. Despite this furtive advance, the greenback remains much lower on the week and close to the lowest levels of the year and focus will quickly turn to Chair Powell’s comments tomorrow.

- Another impressive range for USDJPY during today’s session, which after printing an overnight low of 144.85, we have rallied as high as 146.29. Overall, the pair continues to trade below the Aug 15 high, and firm resistance at the 20-day EMA is intact. The trend structure is bearish, and MA studies remain in a bear-mode set-up. Resistance to watch is 148.70, the 20-day EMA.

- Weakness for equities and the broader greenback recovery Thursday has weighed on the likes of AUDUSD and EURUSD, with the latter still holding just above the 1.11 handle. This week’s appreciation reinforces the current bullish set-up, with moving average studies highlighting a rising trend. Sights are on 1.1201 next, a Fibonacci projection. The trend has entered overbought territory, and any corrective pullback would allow this condition to unwind. Key short-term support is seen at 1.0973, the 20-day EMA.

- Focus will be on central bank speakers on Friday, who are attending the Jackson Hole symposium. Retail sales data for both New Zealand and Canada highlight Friday’s data calendar.

FX OPTIONS: Funding Currencies in the Spotlight Ahead of Jackson Hole

- Vol markets isolate JPY, CHF as carrying the most sizeable vol premium tied to Jackson Hole and the Ueda appearance, while local risks in Mexico support MXN and BRL vols into the second half of the week. The vol moves keep break-evens on an overnight straddle comfortably ahead of the YTD average (implying a ~125 pip swing in spot for a Friday expiry) however short of the prevailing levels pre-July BoJ and the last US jobs report.

- Front-end G10 FX vols have seen solid support headed into the Jackson Hole Policy Symposium, with Powell and Bailey's respective policy speeches drawing focus as well as an appearance in front of Parliament from BoJ's Ueda. This keeps funding currencies in focus given their sensitivity to the Fed policy cycle - for which markets more than price a 25bps cut in September, and 96bps by year-end.

- Despite the focus on Powell and the proximity to the September Fed meeting, relatively little clarity is expected from the Fed Chair on Friday - he's unlikely to deviate from the script too much - emphasizing data dependence and a meeting-by-meeting approach - however any reference to the envisaged tempo of cuts or the eventual destination for rates would be market-moving. Our full Jackson Hole preview found here: https://roar-assets-auto.rbl.ms/files/66056/Aug2024JHPreview.pdf

Late Equities Roundup: Profit Taking Ahead Jackson Hole

- Still up on the week, major equity indexes are trading weaker late Thursday, taking profits ahead the start of the Jackson Hole economics symposium. Currently, the DJIA trades down 184.22 points (-0.45%) at 40706.9, S&P E-Minis down 39.75 points (-0.7%) at 5602.25, Nasdaq down 229 points (-1.3%) at 17690.33.

- Information Technology and Consumer Discretionary sectors underperformed late trade, semiconductor stocks weighing on the former: Intel -4.86%, Lam Research -3.76%, Applied Materials -3.70%. The Consumer Discretionary sector weighed by autos and broadline retailers: Tesla -4.13%, Amazon -1.44%, Etsy -1.20%.

- Conversely, Energy and Financial sectors outperformed: oil and gas stocks underpinned as crude prices rallied (WTI +0.89 at 72.82): EOG Resources +0.81%, Williams +0.73%, Exxon Mobil +0.68%. Financial services buoyed the latter: Franklin Resources +3.99%, Regions Financial +2.16%, State Street +1.96%.

- Late cycle corporate earnings after today's close Ross Stores. Intuit and Cava Group.

EQUITY TECHS: E-MINI S&P: (U4) Bull Cycle Still In Play

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and Key resistance

- RES 1: 5664.00 High Jul 18

- PRICE: 5600.00 @ 1505 ET Aug 22

- SUP 1: 5482.67 50-day EMA

- SUP 2: 5438.75/5319.50 Low Aug 14 / 9

- SUP 3: 5182.00 Low Aug 8

- SUP 4: 5120.00 Low Aug 5 and the bear trigger

A bullish theme in S&P E-Minis remains intact and the contract has traded higher today. Price has cleared resistance at 5600.75, the Aug 1 high and this signals scope for an extension towards key resistance and the bull trigger at 5721.25, the Jul 16 high. A break would resume the primary uptrend. On the downside, support to watch lies at 5482.67, the 50-day EMA. A clear break of it is required to instead highlight a potential bearish threat.

COMMODITIES: WTI Crude Futures Recover, NatGas Sinks Following Storage Build

- WTI has reversed the losses from yesterday to be back around the Aug. 20 close. Falling US inventories and growing talk of a delay to OPEC cut unwinding weigh against US and Chinese economic weakness. WTI OCT 24 is up 1.7% at 73.18$/bbl as we approach the close.

- Henry Hub is headed for the lowest close since Aug. 7, after a slightly above-expectation build in US natural gas storage levels. US Natgas SEP 24 is down 5.8% at 2.05$/mmbtu.

- The firmer dollar, amid rising US yields, has weighed on the yellow metal Thursday. Spot gold trades down 1.15% and is notably back below $2,500/oz. Similar to a lot of major G10 currencies, this has done little to alter the technical backdrop, which continues to look bleak for the greenback as we approach comments on Friday from Fed Chair Jerome Powell.

- Gold remains in a bull-mode condition and this week’s fresh cycle high reinforces current conditions. The recent breach of resistance at $2483.7, the Jul 17 high, confirmed a resumption of the primary uptrend. Note that moving average studies remain in a bull-mode set-up and this continues to highlight a dominant uptrend.

- Similar price action across industrials saw 1.2% declines for the likes of copper and iron ore, with the latter remaining at depressed levels following the sharp declines across July/August.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/08/2024 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 23/08/2024 | 2330/0830 | *** |  | JP | CPI |

| 23/08/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 23/08/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/08/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 23/08/2024 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/08/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 23/08/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 23/08/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2024 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/08/2024 | 1400/1000 | *** |  | US | US Fed Chair Speech |

| 23/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 23/08/2024 | 1900/2000 |  | UK | BOE's Bailey Speech at Jackson Hole |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.