-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

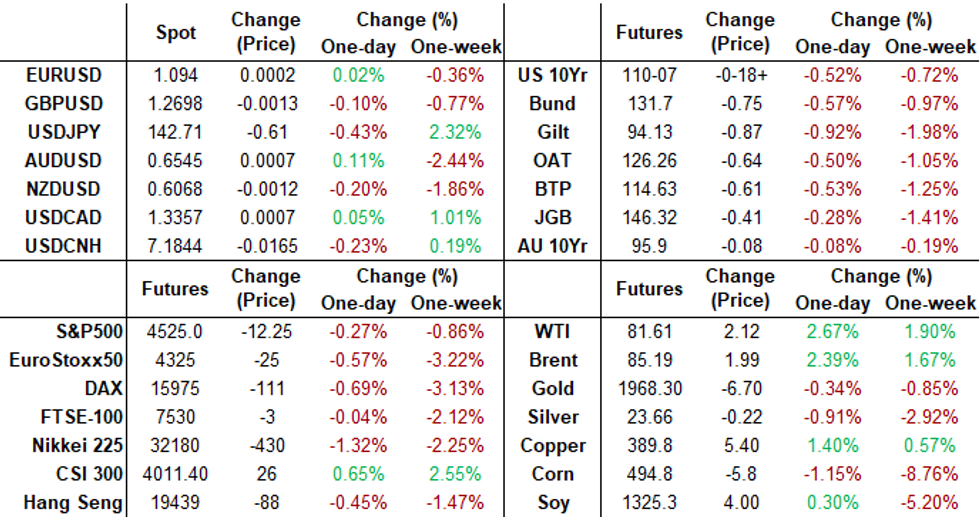

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Reverse Support Ahead Supply

MNI INTERVIEW: US Factories To See Expansion By Feb- ISM

MNI UST Issuance Deep Dive: Jan 2025

MNI ASIA MARKETS ANALYSIS: Curves Hit New 3-4M Highs Pre NFP

- MNI US: Blinken Expects Chinese Counterparts To Come To The US

- MNI US: New Poll Gives Democrats Edge In AZ Despite Indep Run From Senator Sinema

- SAUDI TO EXTEND VOLUNTARY CUT OF 1M B/D THROUGH SEPT.: SPA

- RUSSIA'S DEPUTY PM NOVAK: OIL EXPORT CUT AT 300,000 BPD, Bbg

- HOUSE REPUBLICAN URGES BIDEN TO LIMIT US INVESTMENT IN CHINA: FT

- GALLAGHER URGES LIMIT TO US BUYING CHINESE STOCKS, BONDS: FT

Key Links: MNI Payrolls Preview: Can The Recent Goldilocks Theme Continue / MNI INTERVIEW: US Services Growth Seen Rebounding Into Q4 -ISM / MNI BOE WATCH: BOE Downshifts To 25BP Hike, Rates Restrictive / MNI: BOE Hikes Rates By 25bp As Upside Risks Crystallise

US TSYS: Curves Broadly Steeper Ahead Friday's July NFP

- Treasury futures are drifting near session lows after the bell, generally quiet second half with participants near the sidelines ahead Friday's headline July employment data (+200k est vs. +209k prior).

- First half trade was more lively as Treasury futures bounced briefly after the BOE hikes 25bp to 5.25% as expected (two voted for a 50bp hike, however). The MPC left guidance unchanged that it would tighten further in the face of more persistent inflation pressures, and warned that rates "will be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term."

- Fast two-way trade on decent volumes were reported after Factory Orders came out in line with est at 2.3% vs. 0.3% prior, Durable Goods Orders 4.6% vs. 4.7% est. As to ISMs, Services Index little softer than estimate: 52.7 vs. 53.1, while Prices Paid climbs to 56.8 vs. 54.1 prior, the highest in four months.

- Several curves steepener Blocks (2Y/5Y, 5Y/10Y and 5Y/30Y Ultra) helped push curves to new multi-month highs: 3M10Y +12.886 at -123.759 -- breaching early July highs, the spread is back to early April levels; 2Y10Y +9.953 at -70.594, back to late May levels. Both spreads are still well off Q1 highs: 3M10Y -77.419 on March 2; 2Y1Y -26.706 on March 24.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00071 to 5.31640 (-.00167/wk)

- 3M +0.00044 to 5.36985 (-0.00206/wk)

- 6M -0.00166 to 5.43307 (-0.01493/wk)

- 12M -0.01637 to 5.36487 (-0.04301/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% volume: $266B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.416T

- Broad General Collateral Rate (BGCR): 5.28%, $582B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $565B

- (rate, volume levels reflect prior session)

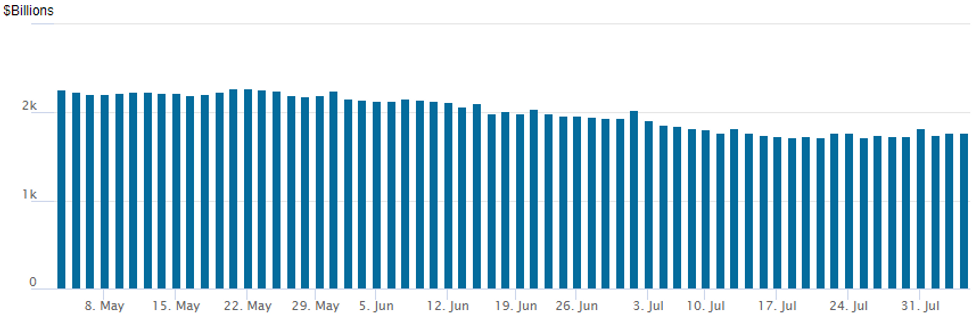

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation inches up to $1,776.774B, w/105 counterparties, compared to $1,770.186B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Better put trade reported on net Thursday though overall volumes remain subdued after the BOE 25bp hike (expected). Underlying futures see-sawed near session lows, curves bear steepened to three month highs in the lead-up to Friday's July employment data. Little change in rate hike projections through year end, Sep 20 FOMC is 17% w/ implied rate change of +4.3bp to 5.371%. November cumulative of +9bp at 5.419, December cumulative of 6bp at 5.389%. Fed terminal holding at 5.42% in Nov'23.

- SOFR Options:

- Block 5,000 SFRZ3 94.50/94.62 put spds 2.5 over SFRZ3 94.75/95.00 call spds ref 94.62

- -10,000 SFRU3 94.56/94.62/94.75 put trees, 6.75

- 5,200 SFRZ3 94.68 straddles, 33.0

- 12,000 SFRV3 94.50 puts, ref 94.63 to -.625

- 4,000 SFRX3 94.87 calls ref 94.63

- 1,000 2QQ3 96.00/96.18 3x2 put spds ref 96.32

- 2,000 2QQ3 96.00 puts, 2.5 ref 96.33

- Treasury Options:

- Block, +9,106 TYV3 110/114 strangles, 117 ref 110-23.5

- +5,000 TYU3 108.25/112 call over risk reversals, 1 net

- Block, 21,000 TYU3 107/108.5 put spds, 11-12 ref 110-13 to -14

- 1,250 FVU3 107.25/108.25 call spds ref 106-13.5

- 6,000 TYU3 107/108.5 put spds, 12 ref 110-13

- over 10,500 TYU3 109.5 puts, 31-34 ref 110-12.5 to -11.5

- 1,500 USU3 114/117 put spds ref 120-29

- 1,800 USU3 116/119 put spds ref 121-26

EGBs-GILTS CASH CLOSE: Post-BoE Gilt Gains Fade

The UK and German curves steepened further Thursday, with the UK short end notably outperforming following the BoE's decision to hike 25bp (and not 50bp).

- While the BoE decision itself was on the dovish end of expectations, UK rates moved off their lows during the press conference with Governor Bailey pushing back on rate cut speculation.

- After gapping higher at the open, 2Y UK yields fell by as much as 11bp before closing just a couple of bp down - mirroring the move in terminal BoE pricing which dropped 12bp at one point but recovered.

- The move in longer-end yields higher was a continuation of Wednesday's US-led sell-off triggered by large announced Treasury supply.

- Overall the UK curve twist steepened, with Germany's bear steeper.

- Periphery spreads mostly tightened, with BTPs underperforming with modest widening.

- Friday's schedule includes multiple Eurozone data points (including German factory orders first thing), and an appearance by BoE's Pill, but most attention is on the latest US employment report.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.1bps at 3.025%, 5-Yr is up 5.1bps at 2.604%, 10-Yr is up 7bps at 2.605%, and 30-Yr is up 6.4bps at 2.687%.

- UK: The 2-Yr yield is down 1.6bps at 4.98%, 5-Yr is up 2.3bps at 4.469%, 10-Yr is up 6.7bps at 4.47%, and 30-Yr is up 10.6bps at 4.655%.

- Italian BTP spread up 1.6bps at 166.9bps / Spanish down 0.6bps at 103.6bps

EGB Options: Distant Downside In Bunds, Sonia Call Spreads In Size

Thursday's Europe rates / bond options flow included:

- OEU3 116.50/117.50cs 1x1.5 sold at 12.5 in 5k

- RXV3 126/124 ps, bought for 13.5 in 5k

- 1Week Bund 133.00/133.50cs, bought for 7.5 in 1k. This was bought for 14 in 2k Yesterday.

- ERU3 96.125/96.00ps 1x2, sold the 1 at 2.25 in 18k (ref 96.185)

- SFIU3 94.70/94.80 call spread bought for 1.25 in 45k on the day

- SFIU3 94.75/94.90/95.00c fly, bought for half in 5k (post-BoE)

FOREX: Upward Pressure on US Yields Weighs Further on EMFX

- Despite the sell-off in treasuries resuming on Thursday, moves for the broad USD index and across G10 have remained fairly contained. The majority off the negative sentiment has continued to be seen impacting the emerging market currency space, with a particular focus on LatAm FX.

- Moves have been most noticeable in USDMXN (+1.54%), with the pair extending its most-recent bounce to over 4% from last Friday’s lows. A larger than expected Brazil rate cut and profit taking dynamics in Colombia prompted widespread losses among regional currencies.

- In similar vein, the likes of PLN, HUF and the ZAR have all weakened by over 1%, highlighting the broad spectrum of declines.

- In G10, the most notable moves were seen in the Japanese Yen, following the Bank of Japan coming into the market for the second time this week to slow gains in benchmark sovereign bond yields and providing a JPY tailwind. USDJPY printed as low as 142.07 from a 143.89 overnight high, with the Yen also benefitting from safe haven flows amid the downturn in equities. However, as markets stabilised, the pair has been lifted back to the 142.75 region ahead of the APAC crossover.

- Price action for GBP was very limited after the Bank of England hiked rates by 25bp. Recent price action has reinforced bearish conditions for GBPUSD, after breaking both the 50-day EMA and the base of a bull channel, drawn from the Mar 8 low. This strengthens a bearish theme and signals scope for weakness towards 1.2591, the Jun 29 low.

- Friday’s focus will be on the release of US non-farm payrolls as well as Canada employment figures.

FX Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950(E545mln)

- USD/JPY: Y142.00($1.1bln), Y143.00($870mln)

- GBP/USD: $1.2700(Gbp711mln)

- EUR/GBP: Gbp0.8575-80(E890mln)

- AUD/USD: $0.6590-00(A$500mln)

- USD/CAD: C$1.3300-05($2.2bln), C$1.3390-00($1.1bln)

Equities Roundup: Off Lows, Energy Shares Outperforming

- Stocks see-sawing off midmorning lows in afternoon trade, Nasdaq shares near steady. Currently, DJIA shares are down 18.2 points (-0.05%) at 35262.15, S&P E-Mini futures down 8.75 points (-0.19%) at 4527.5, Nasdaq up 3.1 points (0%) at 13975.23.

- Laggers: Utilities, Real Estate and Health Care sectors underperformed. Hotel and Resort real estate investment trusts (REIT) traded weaker with Host Hotels and Resorts -6.9%, Equinix -6.05%, and Simon Property Group -4.7%. retail REITS were a distant second. Pinnacle West -3.25% and Southern Co -3.2% weighed on Utilities. Equipment and Services shares weighed on the Health Care sector: Charles River -1.68%,Illumina -1.4%

- Leading gainers: Energy sector shares outperformed after a strong bounce in crude prices on the day (WTI +2.15 at 81.64) after headline "SAUDI TO EXTEND VOLUNTARY CUT OF 1M B/D THROUGH SEPT". APA Energy +5.8%, Devon +3.45%, and Hess Energy +2.8% lead gainers. Consumer Discretionary and Communication Services sectors followed. Autos buoyed discretionary shares after trading weaker the last few days Aptiv +4.0%, Tesla +1.65%.

- Technicals: E-mini S&P contract continues to trade below 4634.50, the Jul 27 high and hit a fresh pullback low of 4505.75 just after the cash open. Wednesday’s move lower reinforces a bearish theme and has resulted in a break of support around the 20-day EMA. The recent failure at the top of the bull channel and the break of the 20-day average, highlights a developing bearish threat. A continuation lower would open 4449.29, the 50-day EMA.

- Sampling of larger stocks expected to report earnings after the close include:

- Booking Holdings Inc

- Stryker Corp

- Fortinet Inc

- Apple Inc

- Coinbase Global Inc

- Floor & Decor Holding

- DraftKings Inc

- Gilead Sciences Inc

- Airbnb Inc

- Motorola Solutions In

- Amazon.com Inc

- Redfin Corp

- Monster Beverage Co

- Amgen Inc

E-MINI S&P TECHS: (U3) Clears Support At The 20-Day EMA

- RES 4: 4720.36 3.0% 10-dma envelope

- RES 3: 4670.25 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 2: 465981 Bull channel top

- RES 1: 4593.50/4634.50 High Aug 2 / Jul 27

- PRICE: 4530.50 @ 1425 ET Aug 3

- SUP 1: 4505.75 Low Aug 3

- SUP 2: 4470.00 Low Jul 12

- SUP 3: 4449.29 50-day EMA

- SUP 4: 4413.21 Bull channel base drawn from the Mar 13 low

The E-mini S&P contract continues to trade below 4634.50, the Jul 27 high and hit a fresh pullback low of 4505.75 just after the cash open. Wednesday’s move lower reinforces a bearish theme and has resulted in a break of support around the 20-day EMA. The recent failure at the top of the bull channel and the break of the 20-day average, highlights a developing bearish threat. A continuation lower would open 4449.29, the 50-day EMA. First key resistance is at 4634.50, the Jul 27 high.

COMMODITIES: Crude Oil Rebounds On Production Cuts Ahead Of OPEC+ Meeting

- Crude oil has rebounded today as Saudi and Russia production cuts provide upward support to oil markets ahead of tomorrow’s virtual OPEC+ JMMC Meeting, in the process reversing yesterday’s sharp move lower despite a record draw in US inventories .

- Saudi Arabia announced to extend its 1mbpd voluntary production cut until end-September, while leaving the door open to “extend” and/or “deepen” them. Following announcement, Russia’s Novak has said Russia will cut oil exports by 300kbpd in September, down from a voluntary cut commitment of 500kbpd in August.

- Key members of OPEC+ are due to “assess market conditions” in the online meeting on Friday 2pm Vienna time. Little in the way of recommended policy change is expected from the event, with the market more hinged on Saudi/Russia voluntary cut intent this week.

- WTI is +2.7% at $81.63 as it tilts back closer to next resistance at $83.59 (Nov 7, 2022 high).

- Brent is +2.4% at $85.20, moving back nearer a key resistance at $86.18 (Jan 23 high).

- Gold is -0.05% at $1933.41 off a low of $1929.65 with conflicting forces from softer USD index on the day but a large bear steepening in the Treasury curve. Support remains at $1924.5 (Jul 11 low) after which lies $1902.8 (Jul 6 low).

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/08/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/08/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 04/08/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 04/08/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/08/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 04/08/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/08/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 04/08/2023 | 1115/1215 |  | UK | BOE Pill and Shortall speak at MPR National Agency briefing | |

| 04/08/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 04/08/2023 | 1230/0830 | *** |  | US | Employment Report |

| 04/08/2023 | 1400/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.