-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA MARKETS ANALYSIS: Debt Ceiling Talks Resume Sunday

- US: McCarthy Indicates Talks Collapsed On Reverting To 2022 Spending Levels

- MNI: Powell-Fed Restrictive, Meeting-By-Meeting Decisions

- MNI INTERVIEW: Higher ECB Peak Rate Means Faster To Cut-Simkus

- MNI FED: Williams' Comments Point To Steady Longer-Run "Dot"

US

US: Update: House Speaker Kevin McCarthy said he and President Joe Biden will meet Monday afternoon and negotiators will resume debt talks later Sunday. The Republican leader said he and the president had a

“productive” call Sunday, Bbg. On Friday House Speaker Kevin McCarthy (R-CA) has told reporters: “We can't be spending more money next year. we have to spend less than we spent the year before. it's pretty easy.” McCarthy continued, "We've got to get movement from the White House and don't have any movement yet."

- McCarthy pivoted from Thursday's optimistic assessment: “I mean yesterday, I really felt we were at the location where I could see the path. The White House is just…” According to Max Cohen at Punchbowl, "McCarthy trailed off. He’s clearly frustrated..."

- Jake Sherman at Punchbowl: "McCarthy is reflecting that the impasse is over reverting spending to 2022 levels, which is something Dems have no interest in." The White House has also confirmed that talks are currently on pause, stating that Biden will be briefed on developments in the morning, Tokyo time.

- AP reported this morning: "McCarthy’s Republicans want to roll back spending to fiscal 2022 levels and cap annual increases at just 1% over the next decade — sparing Defense and Veterans accounts... Democrats are resisting, and negotiators are eyeing budget caps for the next several years as an alternative to limits that would extend for a decade."

- "We've come a long way in policy tightening and stance of policy is restrictive and we face uncertainty about the lagged effects our tightening so far and about the extent of credit tightening from recent banking stresses," he said.

- "Today our guidance is limited to identifying the factors we'll be monitoring as we assess the extent to which additional policy firming may be appropriate to return inflation to 2% over time. That assessment will be an ongoing one, meeting by meeting."

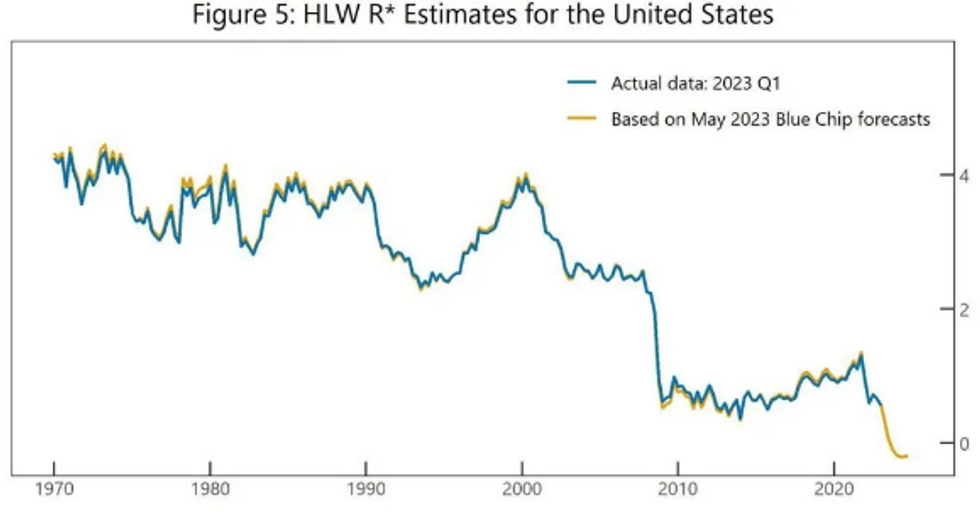

FED: The key takeaway from NY Fed Pres Williams' speech today is his announcement that the Fed will resume publication of their r-star (real natural rate of interest) estimates which they abandoned in 2020 due to COVID shocks which threw off the model.

- While the headlines say Williams didn't comment on current monetary policy, it certainly would have been impactful if he had said his estimate of r-star had changed substantially, and thus potentially impacting where the FOMC saw longer-run Fed funds in the quarterly Dot Plot (which since mid-2019 has been 2.5% - or roughly 0.5% r-star plus 2% inflation).

- But a paper published today co-authored by Williams that updates the r-star estimate, finds that for the US/Canada/Eurozone they saw little change (within 0.2pp of the 2019 estimates).

- Williams notes that r-star for the US was about 0.5% in Q1 2023, and using private sector economic forecasts as inputs, the model indicates that it "subsequently falls to slightly below zero" in the quarters ahead. While Williams notes that the pandemic's fallout may have impacted on r-star by reducing potential output, he says the effect is modest, and "there is no evidence that the era of very low natural rates of interest has ended."

- He said in the post-speech Q&A that it's possible the r-star estimate could rise again, but this was qualified by saying this could arise from an unexpected upward productivity shock, etc, rather than anything he's seeing now. And r-star estimates "are very imprecise and subject to real-time measurement error."

- Given Williams' conclusion that no major changes to r-star is warranted for the post-pandemic era, it's doubtful any adjustments to the Dot Plot longer-run median is likely any time soon.

EUROPE

ECB: The European Central Bank is set to hike by another 25 basis points from 3.25% in June and the deposit rate is likely to peak at 3.75% or slightly higher, Lithuanian central bank chief Gediminas Simkus told MNI, adding that the higher the peak the quicker rates will also be able to come down.

- “I do not think that hike in June will be the last one,” he said in an interview, adding, “There are four months and two forecasts before the middle of September. I’m not sure if 3.75% is the peak, but in any case I don’t think we would go much above 3.75% if so, at least from the data I have at the moment.”

- ECB rates are already in restrictive territory, with monetary policy making an impact largely through financial conditions for the the moment, and set to kick in through other macroeconomic channels as well, but inflationary pressures remain strong despite the ECB’s determination to reach its 2% target, Simkus said. For more see MNI Policy main wire at 0955ET.

US TSYS: Debt Ceiling Headline Risk Overshadows Powell/Bernanke Policy Forum

Treasury futures look to finish weaker for the most part, near the middle of a moderate session range after some late morning volatility tied to debt ceiling headlines.- Rate futures extended lows after (10s marked 113-11 low, -18.5, yield rising to 3.7186% high) on carry-over optimism over the last 36 hours that a debt ceiling negotiations to avoid a default were close to an agreement.

- That was until late morning when headlines hit that GOP negotiators walked out of debt talks with no follow-up scheduled. Punchbowl News' Jake Sherman tweeted ""We're at an impasse," a source involved with the talks tells me. Not one issue, but multiple issues have proven problematic, I am told."

- The impasse spurred a fast risk-off move as Treasury futures rallied (10s bounced to 114-01.5) and stocks reversed modest gains: SPX falling to 4192.0 low after marking 4227.0 high in early trade.

- The headlines completely overshadowed headlines of Fed Chairman Powell amid former chair Bernanke at a policy forum scheduled at the same time. Federal Reserve policy is already restrictive, allowing caution about whether more tightening is needed given the lagged effects of past rate hikes, Chair Powell said.

- "We've come a long way in policy tightening and stance of policy is restrictive and we face uncertainty about the lagged effects our tightening so far and about the extent of credit tightening from recent banking stresses," he said.

- Markets settled near midrange through the second half, decent overall volumes (TYM>1.75M) tied to a pick-up in Jun/Sep quarterly futures rolls. Focus turns to May 3 FOMC minutes release next Wednesday.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 80.62 points (-0.24%) at 33456

- S&P E-Mini Future down 7 points (-0.17%) at 4205

- Nasdaq down 37.7 points (-0.3%) at 12651.63

- US 10-Yr yield is up 4.2 bps at 3.6879%

- US Jun 10-Yr futures are down 12/32 at 113-17.5

- EURUSD up 0.0038 (0.35%) at 1.0808

- USDJPY down 0.62 (-0.45%) at 138.08

- WTI Crude Oil (front-month) down $0.27 (-0.38%) at $71.59

- Gold is up $19.56 (1%) at $1977.23

- EuroStoxx 50 up 27.85 points (0.64%) at 4395.3

- FTSE 100 up 14.57 points (0.19%) at 7756.87

- German DAX up 112.02 points (0.69%) at 16275.38

- French CAC 40 up 45.07 points (0.61%) at 7491.96

US TREASURY FUTURES CLOSE

- 3M10Y +4.377, -155.592 (L: -174.533 / H: -155.592)

- 2Y10Y +0.864, -60.372 (L: -64.381 / H: -55.956)

- 2Y30Y +0.432, -34.972 (L: -40.235 / H: -28.362)

- 5Y30Y -2.189, 19.613 (L: 16.725 / H: 25.505)

- Current futures levels:

- Jun 2-Yr futures down 1.5/32 at 102-19 (L: 102-15.625 / H: 102-24.875)

- Jun 5-Yr futures down 8/32 at 108-22 (L: 108-16.5 / H: 109-03.5)

- Jun 10-Yr futures down 12/32 at 113-17.5 (L: 113-11 / H: 114-05)

- Jun 30-Yr futures down 25/32 at 127-4 (L: 126-26 / H: 128-06)

- Jun Ultra futures down 1-03/32 at 134-25 (L: 134-13 / H: 136-03)

US 10YR FUTURE TECHS: (M3) Southbound

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 117-00 High May 4

- RES 2: 115-18+/116-16 High May 16 / 11

- RES 1: 114-05/114-28+ Intraday high / 50-day EMA

- PRICE: 113-22 @ 1435ET May 19

- SUP 1: 113-08+ Low Mar 15

- SUP 2: 112-30 61.8% retracement of the Mar 2 - 24 rally

- SUP 3: 112-21 Low Mar 13

- SUP 4: 111-31 76.4% retracement of the Mar 2 - 24 rally

Treasury futures are heading South again. This week’s price action has resulted in a break of both the 20- and 50-day EMAs. The move lower has also cracked support at 114-10, the May 1 low and cleared 113-30+ , the Apr 19 low and a key support. Sights are on 113.08+ next, the Mar 15 low. On the upside, firm resistance is seen at 115-18+, the May 16 high. Ahead of 115-18+ is resistance at the 50-day EMA, at 114-28+ - a key level.

SOFR FUTURES CLOSE

- Jun 23 +0.033 at 94.843

- Sep 23 +0.015 at 95.035

- Dec 23 steady at 95.395

- Mar 24 -0.020 at 95.850

- Red Pack (Jun 24-Mar 25) -0.07 to -0.04

- Green Pack (Jun 25-Mar 26) -0.085 to -0.08

- Blue Pack (Jun 26-Mar 27) -0.075 to -0.06

- Gold Pack (Jun 27-Mar 28) -0.055 to -0.045

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01161 to 5.09373 (+.03682/wk)

- 3M +0.03411 to 5.16347 (+.09367/wk)

- 6M +0.05277 to 5.14653 (+.16106/wk)

- 12M +0.08100 to 4.87766 (+.27652/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00472 to 5.06529%

- 1M -0.00872 to 5.139271%

- 3M +0.01357 to 5.39271% */**

- 6M +0.04143 to 5.46657%

- 12M +0.05214 to 5.44457%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.39271% on 5/19/23

- Daily Effective Fed Funds Rate: 5.08% volume: $127B

- Daily Overnight Bank Funding Rate: 5.07% volume: $289B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.401T

- Broad General Collateral Rate (BGCR): 5.02%, $586B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $577B

- (rate, volume levels reflect prior session)

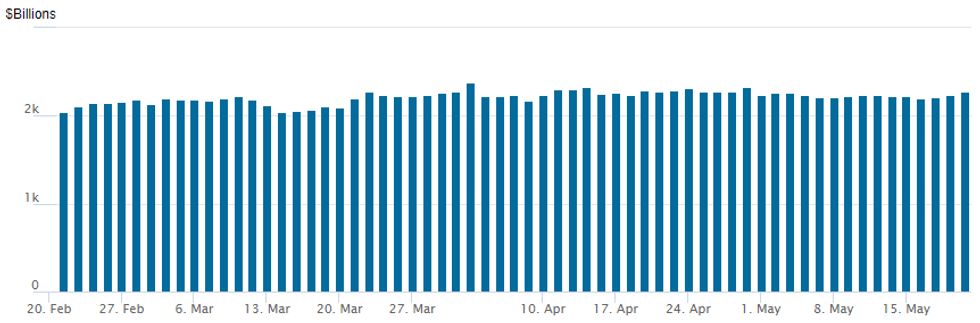

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,276.720B w/ 106 counterparties, compares to prior $2,238.266B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Late Recovery

European yields pulled back sharply in the final hours of the week's cash trade, leaving German instruments stronger on the day, and paring Gilt losses.

- Developments in Europe were limited Friday, with the US again dominating market-moving events as reports emerged of debt limit negotiations breaking down in Washington, hammering risk appetite.

- 10Y Gilt yields dropped 10bp in the last two hours of trade (from a 2023 high of 4.093%), with Bunds pulling back 7bp.

- There were few identifiable catalysts for the early weakness, but it came alongside strengthening equities and firming ECB/ BoE hike pricing.

- Peripheries are in focus over the weekend. Moody's review of Italy's credit rating will garner attention after Friday's market close, while Greece holds legislative elections on May 21 (our briefing is here).

- Otherwise, next week gets off to a relatively quiet start, with little data, and mainly ECB speakers of note (Vujcic, Guindos, Holzmann, Lane, Villeroy appear Monday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.5bps at 2.757%, 5-Yr is down 1bps at 2.406%, 10-Yr is down 1.8bps at 2.428%, and 30-Yr is down 2.9bps at 2.603%.

- UK: The 2-Yr yield is up 0.5bps at 3.96%, 5-Yr is up 2.7bps at 3.822%, 10-Yr is up 3.9bps at 3.996%, and 30-Yr is up 3.3bps at 4.414%.

- Italian BTP spread down 2.3bps at 184.4bps / Greek down 0.4bps at 159.1bps

FOREX: Greenback Ends Week On Weaker Note Amid Debt-Ceiling Talks Collapse

- The USD spent the majority of Friday trading on a weaker footing as the currency pulled back a small part of this week's rally. This weakness was exacerbated by a wave of risk-selling following headlines on the debt ceiling. Headlines citing GOP negotiator Graves as stating that talks are at a pause, and the White House are not being reasonable. The USD index is down half a percent as we approach the week’s close, however, does remain stronger on the week by around 0.4%.

- Following the headlines and corresponding sell-off across major equity benchmarks, USDJPY had an impressive slide from levels around 138.50 to a fresh intra-day low of 137.43, before paring some of these losses into the close.

- Separately, the PBoC re-stated their vow to curb speculation in the FX market, urging institutions to maintain FX market stability. The statement sees curbing of speculation "when necessary". USD/CNH traded to fresh daily lows on the back of the headlines – with the pair printing as low as 7.0121 and looking set to snap its 3-day advance.

- Antipodean currencies are firmer, keeping AUD and NZD top of the pile in G10. NZD/USD (+1.05%) has notably cracked the 100-day moving average to the topside. Market moves come ahead of the RBNZ rate decision next week, at which consensus looks for a 25bps hike to 5.50% - with a number of sell-side analysts switching their views to see a peak rate further north of current levels following this week's budget.

- The economic calendar is very light on Monday but hots up Tuesday with a host of European Flash PMIs.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/05/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 22/05/2023 | 0900/1100 |  | EU | ECB de Guindos Opens ECB/EIOPA Workshop | |

| 22/05/2023 | 0900/1100 |  | EU | ECB Elderson Guest Lecture Utrecht University | |

| 22/05/2023 | 1230/0830 |  | US | St. Louis Fed's James Bullard | |

| 22/05/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/05/2023 | 1415/1615 |  | EU | ECB Lane Panels OeNB Economics SUERF Conference | |

| 22/05/2023 | 1430/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 22/05/2023 | 1500/1100 |  | US | Fed's Tom Barkin, Raphael Bostic | |

| 22/05/2023 | 1505/1105 |  | US | San Francisco Fed's Mary Daly | |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/05/2023 | 1600/1700 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 23/05/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.