-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Censure Motion Against France Gov't Due Today

NBP Data Watch

MNI ASIA MARKETS ANALYSIS: Downbeat on Debt Ceiling Progress

- MNI US: White House: Biden Asia Trip To Go Ahead As Planned

- MNI US: Adeyemo: Default Would Have Implications For Years To Come

- MNI US: McCarthy Downbeat On Debt Ceiling Progress Ahead Of Key WH Meeting

- KASHKARI: FED HAS LONG WAY TO GO TO GET INFLATION TO 2% GOAL, Bbg

- MICROSOFT’S $69 BILLION ACTIVISION DEAL WINS EU APPROVAL, Bbg

- TUDOR JONES: THINK THE FED IS DONE RAISING RATES .. FED COULD DELCARE VICTORY OVER INFLATION

- NOW, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Markets Roundup, Yields Grind Higher Ahead Tue's Debt Limit Confab

Treasury futures held weaker levels for much of the session, curves steeper (2s10s +3.042 at -50.058) in late trade with bonds underperforming. Treasury notes in 2s to 10s have held to a narrow range after briefly extending highs after this morning's weaker than expected Empire Mfg index (-31.8 (cons -4.0) in May from +10.8). Support quickly reversed after the "noisy" metric.- A surge in swappable corporate issuance kept the pressure on rates for much of the session, over a dozen companies issued near $18B debt Monday, more to follow as the latest quarterly earning cycle winds down.

- Stocks had ignored this morning's weaker data, fixated on generally hawkish comments from Atlanta Fed Bostic (nonvoter) on sticky inflation not coming down fast enough, potential for recession (though not base case), does not expect to see rate cut until "well into 2024".

- Debt limit chatter: House Speaker Kevin McCarthy (R-CA) has appeared to counter positive assessments from President Biden, Treasury Secretary Janet Yellen, and NEC Director Lael Brainard on preliminary debt-limit talks ahead of a key White House meeting between Biden and the four leaders of Congress tomorrow.

- Punchbowl reports: "The president is scheduled to leave Wednesday for the G7 meeting in Japan. Biden will want to see significant progress in the talks before his departure in order to insulate himself from any criticism over flying to Asia with a debt-limit breach looming."

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00951 to 5.06642 (+.00665 total last wk)

- 3M +0.02287 to 5.08967 (+.02807 total last wk)

- 6M +0.04302 to 5.02849 (+.03996 total last wk)

- 12M +0.08027 to 4.68141 (+.04754 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06229%

- 1M +0.00228 to 5.10771%

- 3M +0.01214 to 5.33043% */**

- 6M +0.04000 to 5.38314%

- 12M +0.04743 to 5.30343%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.07% volume: $294B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.352T

- Broad General Collateral Rate (BGCR): 5.02%, $581B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $574B

- (rate, volume levels reflect prior session)

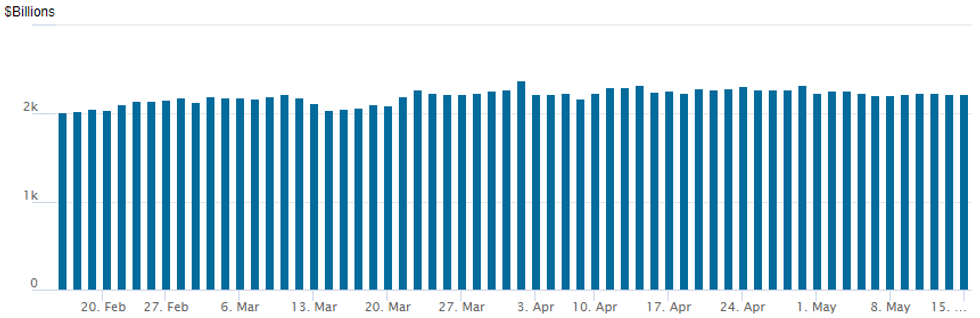

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,220.927B w/ 103 counterparties, compares to prior $2,229.199B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Despite the short end outperforming on Monday's curve steepening sell-off, FI option trade leaned toward batter downside put and put structure buying. In other words, trading with underlying futures as projected rate hikes for the later half of the year receded from last week's post-PPI highs.- SOFR Options:

- +15,000 SFRM3 94.87/94.93/95.00 put flys, 2.75 ref 94.9225

- +5,000 SFRM3 94.56/94.68/94.81 put flys, 1.75 vs. 94.92

- +7,500 SFRM3 94.93/95.00/95.06 put flys, 0.75

- Block, 5,750 SFRM3 94.81/94.87/94.93 put flys, 1.25 ref 94.93

- Block, 4,500 SFRM3 94.56/94.75/94.81/94.87 put condors, 0.12 ref 94.9225

- 5,000 SFRN3 95.12/95.25 put spds vs. 95.50/95.56 call spds

- 3,000 SFRM3 95.06/95.18 call spds ref 94.9225

- 2,000 SFRM3 94.93/95.06/95.18 call flys ref 94.9225

- 1,000 SFRM3 94.50/94.75 call spds vs. 94.12/94.37/94.93 put flys

- 2,800 SFRU3 95.81/96.18 call spds ref 95.225

- 3,000 SFRU3 94.81 puts ref 95.225

- 4,000 OQM3 96.12 puts ref 96.66

- Treasury Options:

- 4,800 FVM3 109 puts, 5 ref 109-31.75

- 2,000 TYN3 113/115.5 2x1 put spds over TYN3 119 calls ref 116-02

- 3,000 TUU3 99.50/100 put spds ref 103-27.25

- 3,100 FVN3 111 calls ref 110-20

- over 22,300 FVM 111.25 calls, 7-7.5 last ref 109-31 to 110-02.25

- 6,000 FVQ3 112.5/114 call spds ref 110-19

- 1,800 TYM/TYN 115.5 put calendar spds 11

- 3,000 TYM3 114.5 puts, 16 ref 115-11.5

- 3,800 FVN3 112.25 calls, 24.5 ref 110-21 to -20

- 5,000 FVN3 109.5 puts, 25 ref 110-21 to -20

EGBs-GILTS CASH CLOSE: Mildly Bear Steeper To Start The Week

The German and UK curves bear steepened modestly Monday, with Gilts marginally underperforming as core FI failed to recover from losses at the open.

- European-specific catalysts were limited, with US data providing the biggest single market mover on a weak Empire State manufacturing survey. However, a pickup in corporate issuance helped keep a lid on nascent rallies.

- Periphery EGBs outperformed, led by GGBs- Greek legislative elections and Moody's review of Italy eyed in the coming weekend.

- There was little discernable reaction to BoE Pill's comments after the close (noted risk of second-round effects). ECB / BoE hike pricing was basically unchanged on the day, with 48bp and 45bp seen remaining in the respective tightening cycles.

- UK labour market data features Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1bps at 2.604%, 5-Yr is up 2.5bps at 2.246%, 10-Yr is up 3.3bps at 2.309%, and 30-Yr is up 5.1bps at 2.513%.

- UK: The 2-Yr yield is up 2.5bps at 3.826%, 5-Yr is up 2.7bps at 3.628%, 10-Yr is up 3.9bps at 3.817%, and 30-Yr is up 3.4bps at 4.25%.

- Italian BTP spread down 2.8bps at 187.7bps / Greek down 4.1bps at 170.4bps

EGB Options: Unwinding 3.75-4.00% End-Year ECB Play

Monday's Europe rates / bond options flow included:

- +5.4k RXN3 136.50/137.50 call spread / -7.2k RXN3 139.00/140.50 call spread, rolling down for net 13 up to 14.5

- SFIQ3 95.25/95.35/95.45 call fly bought for 1.25 in 2k

- ERZ3 96.375/96.25/96.125 put fly sold at 1 in 10k

- ERZ3 96.125/96.00/95.875 put fly sold at 1 in 10k

FX: Expiries for May16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0710(E517mln), $1.0815-20(E555mln), $1.0895-00(E675mln), $1.0950-65(E925mln), $1.0995-00(E813mln)

- AUD/USD: $0.6700-10(A$1.3bln)

Late Equities Roundup: Firmer Ahead Tue Debt Ceiling Discourse

Stocks recovered from midmorning lows to near middle of narrow range at the moment. S&P E-Mini Future currently up 2.75 points (0.07%) at 4141; Nasdaq up 40.7 points (0.3%) at 12325.02; DJIA down 2.32 points (-0.01%) at 33298.79.

- Stocks had ignored this morning's data and generally hawkish comments from Atlanta Fed Bostic (nonvoter) on sticky inflation, instead fixated on downbeat assessment from House speaker McCarthy over the debt ceiling.

- Leading laggers: Utilities, Consumer Staples and Real Estate sectors underperformed while Financials, Materials and IT sector shares outperformed.

- From a technical point of view S&P E-minis remain in consolidation mode and continue to trade above the 50-day EMA, which intersects at 4107.61.

- An extension higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would confirm a resumption of the bull trend that started Mar 13.

- Key support has been defined at 4062.25, the May 4 low. A move through this support would instead highlight a bearish threat.

E-MINI S&P TECHS: (M3) Resistance Remains Exposed

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4173.25/4206.25 High May 10 / 1

- PRICE: 4145.00 @ 14:20 BST May 15

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis remain in consolidation mode and continue to trade above the 50-day EMA, which intersects at 4107.61. An extension higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would instead highlight a bearish threat.

COMMODITIES: Oil Buoyed By Near-Term Supply Disruptions

- Crude oil has settled higher for the first time in four sessions has pushed higher for most of the day with only a modest trimming of earlier gains as McCarthy pushed back on previously more optimistic-sounding debt ceiling progress.

- Increases are buoyed by short-term supply disruptions. Notably, further Canadian wildfires are still a risk to Canadian oil sands output after a heat wave resulted in an increase in fires over the weekend. Production has been gradually returning following outages last week with Vermilion Energy today saying 60% of the shut in production has been restored.

- Separately, crude oil exports from Iraq’s northern fields in the Kurdistan region have yet to restart despite Iraq’s desire to resume flows on Sat 13 May. Approximately 470kbpd of production has been missing from the market since 25 March.

- WTI is +1.4% at $71.03 off an intraday low of $69.41 as it shifts closer to resistance at $73.93 (Apr 28 low).

- Brent is +1.4% at $75.17 off resistance at $77.61 (20-day EMA).

- Gold is +0.2% at $2015.0 having gyrated its way higher with the USD index steadily unwinding Friday’s sizeable gain. Resistance remains considerably to the upside at $2063.0 (May 4 high).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/05/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/05/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/05/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 16/05/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/05/2023 | 0900/1100 | *** |  | EU | GDP (p) |

| 16/05/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2023 | 0900/1100 | * |  | EU | Employment |

| 16/05/2023 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/05/2023 | - |  | EU | ECB de Guindos in ECOFIN Meeting | |

| 16/05/2023 | 1215/0815 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2023 | 1230/0830 | *** |  | CA | CPI |

| 16/05/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/05/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 16/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/05/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2023 | 1400/1000 | * |  | US | Business Inventories |

| 16/05/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/05/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/05/2023 | 1615/1215 |  | US | New York Fed's John Williams | |

| 16/05/2023 | 1915/1515 |  | US | Dallas Fed's Lorie Logan | |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.