-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

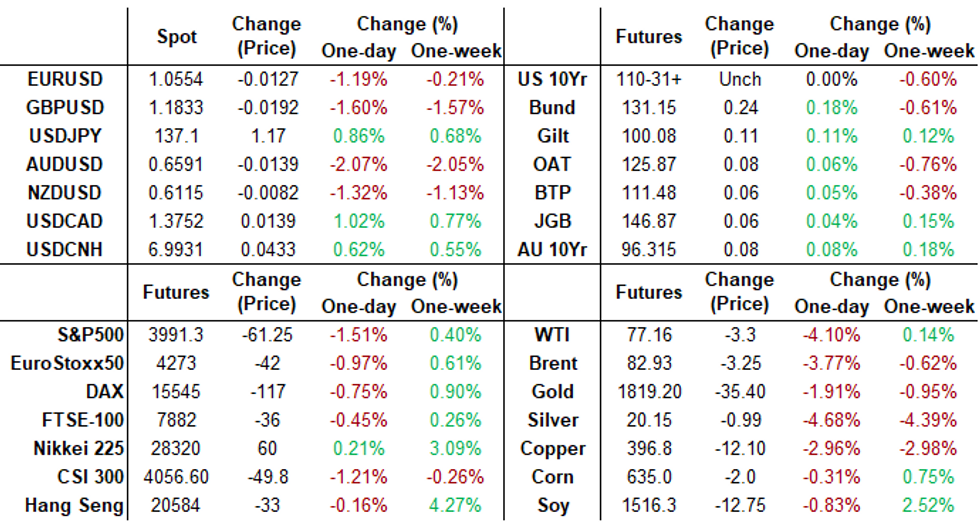

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Chair Powell's Hawkish Delivery

HIGHLIGHTS

- MNI FED: Powell Puts 50bp Option On The Table

- MNI POWELL: ULTIMATE LEVEL OF INTEREST RATES LIKELY HIGHER

- MNI POWELL: PREPARED TO INCREASE HIKE PACE IF WARRANTED

- MNI POWELL: INFLATIONARY PRESSURES RUNNING HIGHER THAN AT FEB FOMC

- US SET TO LIFT COVID TEST MANDATE ON TRAVELERS FROM CHINA: WAPO (BBG)

Key links: MNI INTERVIEW- Fed Will Hike Rates To 6% Or More–Gorodnichenko / MNI: Powell-Fed Rate Peak Likely Higher; Could Quicken Hikes /

US TSYS: Fed Chair Powell Opens Door to 50Bp Hike and Then Some

Tsys reversed gains, yield curves extended inversion to 1981 levels (2s10s -105.513) after this mornings hawkish comments from Chairman Powell: possibility of larger, faster hikes and higher terminal rate spurred heavy selling in short end.

- Salient short end metrics: 2Y yield climbed over 5% to 5.0168% high, March'23 Eurodollar futures traded 94.785 (-0.1325)

- Fed funds implied hike for Mar'23 up to 40.3bp vs. 30.5bp this morning, May'23 cumulative 74.1bp (+14.3) to 5.315%, Jun'23 96.0bp (+18.5) to 5.535%.

- Terminal rate via Fed Funds at 5.635% in Oct'23.

- Focus turns to private ADP employment data at 0815ET Wednesday, Nonfarm Payrolls this Friday at 0830ET.

- Fed enters media blackout in regards to policy this Friday at midnight.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00057 to 4.56229% (+0.00272/wk)

- 1M +0.00771 to 4.71900% (+0.00986/wk)

- 3M +0.01771 to 5.02571% (+0.04171/wk)*/**

- 6M +0.01814 to 5.34614% (+0.02943/wk)

- 12M +0.02614 to 5.71671% (+0.02228/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.02571% on 3/7/23

- Daily Effective Fed Funds Rate: 4.57% volume: $114B

- Daily Overnight Bank Funding Rate: 4.57% volume: $310B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.129T

- Broad General Collateral Rate (BGCR): 4.51%, $460B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $449B

- (rate, volume levels reflect prior session)

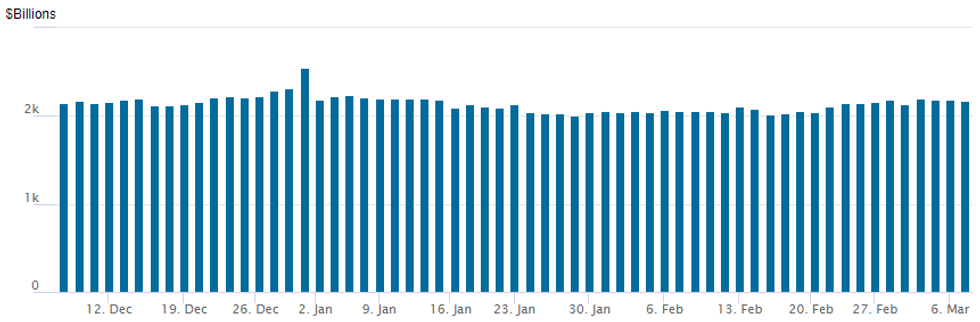

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,170.195B w/ 101 counterparties vs. prior session's $2,190.793B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Net option trade mixed Tuesday, large call and put structures reported as some accounts hedged continued rate hikes telegraphed by Chairman Powell at his semi-annual policy testimony to Congress, while others took the opportunity to buy upside call structures, cheaper premium for a reversal.- SOFR Options:

- Block, 20,000 SFRZ3 94.25/94.75/95.87 broken call flys, 0.0 ref 94.515 to -.515

- Block, total 20,000 SFRZ3 94.00/94.37/94.87/95.12 put condors, 2.5 ref 94.51

- Block/screen, -13,500 SFRH3 94.62/94.75/94.87 put flys, 2.75 vs. 94.8725/0.34%

- Block, total +20,000 SFRU3 93.75/94.87/95.50 broken put flys, 2.0 net ref 94.40-.395

- +30,000 SFRH3 95.00 calls, 0.75

- Block/pit +55,000 SFRZ3 94.25/95.25 strangles 2.5 over SFRZ3 94.00/95.00

- Block, +5,000 SFRM3/SFRU3 94.68/94.75 put spd strip, 8.0

- Block, 10,000 SFRH3 95.00 puts, 4.0 vs. 94.985/0.60%

- over 5,200 OQH3 94.81/94.93 put spds, ref 95.01 to -.005

- 4,000 OQN3 94.00 puts, 1.5 ref 95.81

- over 9,000 SFRM3 94.43/94.68 strangles, 17.0 last ref 94.575

- 2,000 SFRK3 94.81/94.93/95.06 put flys

- Treasury Options:

- 3,700 FVJ 106.5/FVK 105.5/FVM 106.5 put calendar fly, 38.5

- -8,000 TYJ3 108/109/110/111 put condor w/TYJ 108.25/109.25/110.25/111.25 put condor, collect 32 vs. 111-08

- 4,000 FVJ3 107.5/108 call spds, ref 106-24.75

EGBs-GILTS CASH CLOSE: Flattening As Powell Spurs Short-End Rout

The UK and German curves flattened Tuesday, with EGB periphery spreads widening modestly.

- The session began with a strong beat for German factory orders, but more impactful was a drop in inflation expectations in the ECB's Consumer Expectations survey - which saw Bunds extend to intraday highs.

- Bunds and Gilts declined thereafter, with the selloff accelerating in mid-afternoon on hawkish comments from Fed Chair Powell.

- The long end would bounce from session lows but the short end fared worse, with ECB terminal rate expectations rising to a new cycle high of 4.16%. That underperformance meant sharp flattening in the German and UK curves.

- Gilt reaction was limited to BoE hawk Mann who said little new in comments today; ECB dove Herodotou likewise did not move the needle in calling the inflation fight "far from over".

- Wednesday sees German industrial/retail sales and final Eurozone GDP data, Bund and PGB supply, and appearances by BOE's Dhingra and ECB's Lagarde and Panetta.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at 3.311%, 5-Yr is down 5.2bps at 2.846%, 10-Yr is down 5.7bps at 2.692%, and 30-Yr is down 5.6bps at 2.607%.

- UK: The 2-Yr yield is up 2.4bps at 3.8%, 5-Yr is down 0.3bps at 3.7%, 10-Yr is down 4.4bps at 3.822%, and 30-Yr is down 6.3bps at 4.151%.

- Italian BTP spread up 0.9bps at 183.5bps / Greek up 5.8bps at 180.8bps

EGB Options: Condors And Put Spreads

Tuesday's Europe bond/rates options flow included:

- RXK3 127/125ps, bought for 30 in 2k

- ERU3 95.75/95.50ps, bought for 7.25 in 20k

- ERU3 96.125/96.875/96.75/96.50p condor, bought for 6 in 8k

- ERU3 96.12/95.87/95.75/95.50p condor with ERM3 96.12/96.00ps 1x1.5, bought as a strip for 6.25 In 8k

FOREX: Hawkish Powell Emboldens USD Rally, DXY Matches 2023 Highs

- The greenback extended its initial strength on Tuesday with a set of hawkish remarks from Fed Chair Powell underpinning an impressive USD rally. The USD index (1.21%) has risen to the best levels of the year and is currently hugging session highs as we approach the APAC crossover.

- While it was not a big surprise that Powell envisages a higher potential terminal rate, the significant and surprising development that Powell suggests they could re-accelerate to 50bp hikes has placed upward pressure on US yields, with the 2-year yield rising to 5%, the highest level since 2007.

- The broad dollar strength has most heavily weighed on the Australian dollar, impacted by not only a dovish RBA but also the associated pressure on major equity indices throughout the US session.

- AUDUSD (-2.20%) continues to plumb fresh YTD lows and has taken out key support at 0.6629, the Dec 20 low. In more recent trade, the pair has slipped below the 0.66 handle to touch 0.6582, narrowing the gap with the next support seen at 0.6547, a Fibonacci retracement.

- GBPUSD (-1.67%) has now breached key support at 1.1842, the Jan 6 low, which highlights a broader medium-term reversal threat and a potential double top pattern on the daily chart. Below here, the focus turns to 1.1764, the November 17 low.

- USDJPY has recently pierced through last Thursday’s high of 137.09, placing the pair at a fresh 11-week high and signalling scope for a move towards 138.17, the Dec 15 high.

- Potential comments from RBA Governor Lowe kick off Wednesday’s docket before German IP and retail sales data. ECB’s Lagarde may also speak before the Bank of Canada decision/statement. Regarding the US, ADP employment and JOLTS data are scheduled before Friday’s NFP report.

FX: Expiries for Mar08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-05(E797mln), $1.0560-65(E2.5bln), $1.0600(E902mln), $1.0645-60(E1.5bln), $1.0670-90(E2.3bln), $1.0715-35(E1.5bln), $1.0745-55(E1.5bln)

- USD/JPY: Y135.00($1.2bln), Y137.00($1.6bln)

- USD/CAD: C$1.3550-60($623mln)

- USD/CNY: Cny6.8650($1.1bln)

EQUITIES

Stocks weaker, extending lows after digesting hawkish semi-annual testimony from Fed Chairman Powell (senator open remarks ongoing), focus on potential for faster pace and /or larger hikes and higher terminal rates to address inflation.

Financials (-2.52%), Real Estate (-2.49%) and Materials (-2.14%) sectors underperforming.

COMMODITIES: Crude Oil Slides Whilst Gold Takes Step Toward Bear Trigger On Powell

- Crude oil hasn’t escaped the broad cross-asset risk off moves after Fed Chair Powell opened the possibility of a faster pace of rate hikes. Both WTI and Brent fall to lows for the week but remain within Friday’s volatile range.

- WTI is -3.2% at $77.82, moving closer but still some way off support at $75.83 (Mar 3 low) in a reversal of its recent bull cycle.

- Brent is -3.0% at $83.56, equally still above support at $82.36 (Mar 3 low).

- Gold is -1.8% at $1813.95, sliding nearer the bear trigger of $1804.9 (Feb 28 low) as the dollar surges with higher Treasury yields.

- Trafigura CEO Weir says Russian oil continues to flow amid the G-7 price cap and that’s a good thing whilst China is already exerting a pull on some commodities and apppears set to surpass the 5% growth target announced at the weekend.

- In the US, Bloomberg reports that Biden administration officials are meeting with oil industry and environmental leaders to weigh on setting federal standards for green natural gas intended to lure European buyers.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 08/03/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/03/2023 | 0930/0930 |  | UK | BOE Dhingra at Resolution Foundation | |

| 08/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/03/2023 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2023 | 1000/1100 | * |  | EU | Employment |

| 08/03/2023 | 1000/1100 |  | EU | ECB Lagarde at Women's Day WTO Event | |

| 08/03/2023 | 1000/1100 |  | EU | ECB Panetta Intro at Euro Cyber Resilience Board | |

| 08/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/03/2023 | 1300/0800 |  | US | Richmond Fed's Tom Barkin | |

| 08/03/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 08/03/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 08/03/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 08/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 08/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/03/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/03/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.