-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: Fed Funds Implied Hike Climbing

HIGHLIGHTS

- MNI US: Sununu Considers White House Bid As "Campaign Season" Draws Near

- MNI US: China "Spy Balloon" Incident Fails To Dent Biden's Approval Rating

- MNI: NATO: Biden Appeals To Russian People In Speech Declaring Support For Ukraine

- MNI: ITALY: Meloni Doubles Down On Support For Ukraine Despite Rift In Government

Key links: FED: FOMC Minutes: Eyeing 50bp Support, And "A Lot Of Detail" On A Pause / US Treasury Auction Calendar / US$ Credit Supply Pipeline / MNI: US Existing Home Sales Likely Bottoming Out At 4.0M Pace

US Tsys Finish Heavy

Tsys traded heavy Tuesday, hugging lows in second half on subdued trade following whipsaw action in the first half.- Tsy futures gap lower post PMI, rebounds on 2-way trade, USH3 124-17 low, 124-23 last, 30YY 3.9513 high

- Inching off lows after Existing Home Sales came out weaker than forecasted, USH3 12409 vs. 124-04 low pre-data (30YY taps 3.9774% high). Yield curves extend steeper, 2s10s tapping -76.749 highs. Heavy volumes more associated to Mar/Jun quarterly rolls, pre-auction short sets in 2s.

- Tsy futures inch lower, modest selling after weak $42B 2Y note auction (91282CGN5) tails: 4.673% high yield vs. 4.667% WI; 2.61x bid-to-cover vs. 2.94x prior. Indirect take-up slips to 62.04% vs. 64.99% prior month, direct take-up 22.99% vs. 18.73% prior, primary dealer take-up 14.97% vs. 16.28%.

- Equity earnings continue after the close: FANG ($5.23 est), PSA ($3.97 est), TOL ($1.38 est), CHK ($2.86 est)..

- Focus turns to Wednesday's Feb FOMC minutes release at 1400ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00300 to 4.55986% (+0.00300/wk)

- 1M -0.00071 to 4.59200% (+0.00071/wk)

- 3M +0.01271 to 4.92214% (+0.00685/wk)*/**

- 6M +0.01672 to 5.25743% (+0.01443/wk)

- 12M +0.01929 to 5.63943% (-0.00343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.92214% on 2/21/23

- Daily Effective Fed Funds Rate: 4.58% volume: $107B

- Daily Overnight Bank Funding Rate: 4.57% volume: $292B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.209T

- Broad General Collateral Rate (BGCR): 4.52%, $461B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $450B

- (rate, volume levels reflect prior session)

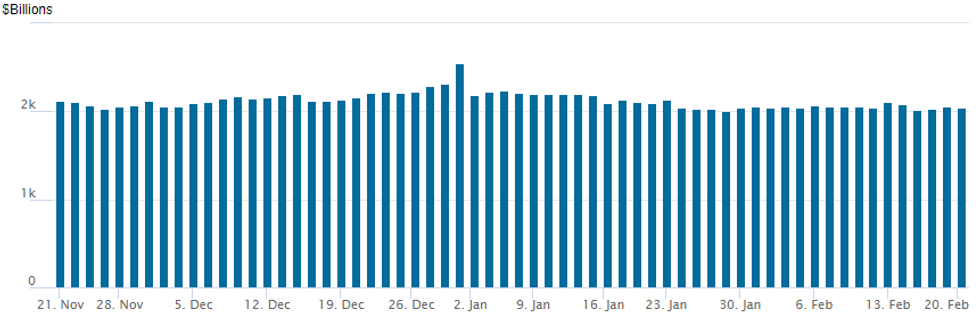

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,046.064B w/ 100 counterparties vs. prior session's $2,059.662B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Surge in low delta Treasury put options as FI markets return from extended holiday weekend Tuesday. Despite a rise in implied rate hike probability and terminal rate to 5.36%, SOFR options were little more mixed with a couple notable trades: over 35,000 short Jun'23 SOFR 95.75 straddles at 69.5 and buyer of over 11,000 Jul'23 SOFR95.37 calls. Additional salient trade includes:- SOFR Options:

- Block, 11,750 SFRN3 95.37 calls, 4.0 vs. 95.655/0.12%

- Block, 6,000 OQH3 95.50/95.75 put spds, 21 ref 95.28

- Block, 5,000 SFRZ3 94.25 puts, 14.5 ref 94.91

- Block, 6,000 2QH3 96.50 puts, 16.5 ref 96.445

- Block, -35,000 OQM3 95.75 straddles, 69.5 ref 95.785 to .755

- 4,000 SFRU3 94.25/94.37 put spds, ref 94.71

- 2,100 SFRU3 94.68/94.87/94.93/95.12 call condors ref 94.71

- Block, 10,000 SFRU3 93.75/94.00/94.25 put flys, 3.0

- 7,000 SFRZ3 93.75/94.00/94.25 put flys ref 94.935

- +2,500 OQZ3 96.37 straddles, 100-101.0

- Block, 5,000 SFRJ3 94.56/94.68 call spds 1.25 over SFRJ3 puts ref 94.70

- Treasury Options:

- 4,300 TYK 115/115.5 call spds, 1

- -5,000 TYH3 110.5 puts, 7 ref 111-06, total over 14.2k

- over 55,000 TYM3 107/108 put spds, ref 111-28.5

- Block, +10,000 TYJ3 107/108 put spds, 3 vs. 111-26/0.04%

- Block, 5,000 TYH3 111/111.25 put spds, 4

- 9,000 TYH3 112 puts, 39 ref 111-17

- 7,500 FVJ3 106.5/107.5 put spds ref 107-17

- 2,000 TYJ3 107/108/110 broken put flys, ref 112-08.5

- over 10,000 TYH3 110.25 puts, 2 ref 111-20.5

- 5,000 TYJ3 115/117 1x2 call spds ref 112-05 to -05.5

- over 4,000 USH3 122.5 puts, 3

- over 12,000 FVJ3 106.5 puts, 17.5-18 ref 107-20.5

- over 6,000 TYJ3 109.5 puts, 12-13 ref 112-07

- over 15,000 TYJ3 110 puts, 16 ref 112-09

- over 29,000 TYH3 111 puts, 6-9 ref 111-25.5

EGBs-GILTS CASH CLOSE: Unexpected PMI Jump Sinks Gilts

Strong PMIs - particularly on the services side - saw European bonds sell off Tuesday, with Gilts easily underperforming.

- UK short-end/belly yields rose sharply following the 53.0 Composite prelim PMI print for February (vs a contractionary 49.0 expected), which bear flattened the curve amid reconsideration of the BoE hiking path.

- A 25bp March BoE hike became fully priced for the first time since last week's UK CPI print, while the implied terminal rate jumped 17bp to 4.64%.

- The bearish move in EGBs following above-consensus German/French prints in the morning was exacerbated in the afternoon by a much-better-than-expected US PMI print. Implied terminal ECB depo rates hit a new cycle high of 3.78%, up 6bp on the session.

- The more hawkish ECB outlook, and weakness in risk assets more broadly, saw BTP spreads widen nearly 7bp, underperforming on the periphery.

- Attention first thing Wednesday is on final German CPI - preview here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.1bps at 2.949%, 5-Yr is up 6.4bps at 2.602%, 10-Yr is up 6.5bps at 2.529%, and 30-Yr is up 5.4bps at 2.463%.

- UK: The 2-Yr yield is up 17.3bps at 3.919%, 5-Yr is up 17.6bps at 3.56%, 10-Yr is up 14.3bps at 3.614%, and 30-Yr is up 11.1bps at 4.009%.

- Italian BTP spread up 6.8bps at 193.7bps / Spanish up 2.6bps at 99bps

EGB Options: Mixed Upside And Downside In Rates

Tuesday's Europe rates / bond options flow included:

- RXK3 137.50 calls bought for 55.5 in 3.8k

- 0RJ3 97.37c, bought for 1.5 in 3k

- SFIZ3 95.60/96.00/96.40c fly, bought for 8.25 in 2.5k

- SFIJ3 95.50/95.35ps vs SFIJ3 95.70c, bought the ps for 2.5 in 6k (ref 95.485).

FOREX: Dampened Sentiment Boosts Greenback, GBP Outperforms

- Despite the flurry of two-way trade following US PMI data and the brief slip into negative territory for the USD index, the greenback edged back towards its best levels approaching the end of Tuesday’s session.

- Higher core yields and lower equities have renewed the bid for the greenback and risk sensitive Aussie and Kiwi are feeling the pinch. For AUDUSD, the broader uptrend remains intact for now, and the recent move lower highlights a correction that is allowing a recent overbought trend condition to unwind. Attention is on 0.6812, the Feb 17 low, and then 0.6781, the 38.2% retracement of the Oct 13 - Feb 2 uptrend. For NZDUSD, the focus is on 0.6191. A breach of this level would place the pair at the lowest level since late November last year.

- GBP’s initial data boost earlier today is cementing it as the key notable outperformer on Wednesday. Strength in GBP has been broad based with prominent gains in the crosses. GBPJPY (+1.09%) has breached the late December highs and is trading at 2-month highs, while EURGBP (-0.91%) has also broken a small uptrend, potentially signalling some further positive GBP momentum.

- EURUSD (-0.42%) breached session lows as the pair slowly grinds south approaching the APAC crossover. 1.0700 once again capped today’s price action with short-term momentum signalling further weakness for the pair. The clear break of the 50-day EMA strengthens the bearish cycle and exposes 1.0484, the Jan 6 low. Initial support is at 1.0613, last Friday’s low.

- Event risk overnight commences with Australian Wage Price Index data before the February RBNZ decision. Attention then turns to final readings of German CPI on Wednesday morning, followed by German IFO sentiment data. Focus then quickly turns to the FOMC minutes.

FX: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.3bln), $1.0635-50(E571mln), $1.0670-75(E833mln)

- USD/JPY: Y134.00($599mln), Y134.25($715mln)

- AUD/USD: $0.7000(A$828mln)

Late Equity Roundup: Higher Implied Rate Hikes Sap Stocks

Stocks continue to extend lows in late trade, traders partially tying sell-off to rise in implied rate hike probability and terminal rate to 5.36%. SPX eminis currently trading -81 (-1.98%) at 4006.25; DJIA -679.42 (-2.01%) at 33144.92; Nasdaq -273.2 (-2.3%) at 11513.23.

- SPX leading/lagging sectors: Consumer Discretionary leads laggers (-3.20%) w/ autos (F -5.08%, Tesla -4.08%, GM -4.34%) and retailers (CarMax -6.43%, Home Depot -6.20%, Lows -5.17%) weighing. Industrials and Financials both -2.4%, banks weighing on the latter (SBNY -6.36%, FRC -5.0%, Key -3.84%).

- Leaders: Consumer Staples (-0.32%), Energy (-0.42%) and Health Care (-1.41%), equipment and suppliers weighing on the latter (EW -3.95%, IDXX -3.91%, LH -3.37%).

- Dow Industrials Leaders/Laggers: Walmart +0.82 at 147.26 (off lows following earning's annc this morning, margins on the rise), PG -0.05 at 139.95, KO -0.27 at 59.85. Laggers: Home Depot (HD) hammered -20.35 at 297.60, Goldman Sachs (GS) -7.87 at 360.63., United Health (UNH) -7.66 at 491.42.

- Equity earnings continue after the close: FANG ($5.23 est), PSA ($3.97 est), TOL ($1.38 est), CHK ($2.86 est).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 22/02/2023 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 22/02/2023 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 22/02/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 22/02/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 22/02/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 22/02/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2023 | 0900/1000 | *** |  | DE | Hesse CPI |

| 22/02/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 22/02/2023 | 0900/1000 |  | DE | Destatis Press Conference on Updated CPI Weights | |

| 22/02/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 22/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 22/02/2023 | 2230/1730 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.