-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS: Fed Gov Bowman: More Work For Fed

HIGHLIGHTS

- MNI: WORLD BANK CUTS 2023 GDP EST. TO +1.7%, WARNS OF RECESSION RISK

- MNI FED: Gov. Bowman: Fed Has A Lot More Work To Do

- YELLEN TO STAY ON AT BIDEN REQUEST AS SHOWDOWN NEARS OVER DEBT, Bbg

- U.S. EIA RAISES FORECAST FOR 2023 WORLD OIL DEMAND GROWTH BY 50,000 BPD, NOW SEES 1.05 MLN BPD YR-ON-YR INCREASE- U.S. EIA SAYS

US TSYS: Fed Chair at Riksbank Central Bank Conf a Non-Event

Tsys broadly weaker after the bell, off midday lows after 30YY tapped 3.7726% (+.1127), yield curves bear steepening off deeper inverted levels since Fri's NFP (2s10s +4.184 at -64.002).- No relevant data on the day (in-line Wholesale Inventories at1.0%) markets were more focused on Fed Chairman Powell remarks at a Riksbank panel on central bank independence. Non-event as Powell repeated his view that the Fed has "narrow" responsibilities on climate change, a stance for which he faced opposition from Democratic lawmakers during his renomination hearing last year.

- Another strong session for corporate issuance, rate locks tied to a $10B Saudi Arabia three-tranche debt issuance weighed.

- Treasury futures saw modest bounce off lows after decent $40B 3Y note auction (91282CGE5) stopped through: 3.977% high yield vs. 4.000% WI; 2.84x bid-to-cover vs. 2.55x last month. Indirect take-up to 69.54% vs. 61.71% prior; direct bidder take-up at 13.18% vs. 20.44% prior; primary dealer take-up 17.28% vs. 17.85%.

- Focus turns to Thursday's CPI MoM (0.1%, -0.1%); YoY (7.1%, 6.5%).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00358 to 4.30871% (-0.00472/wk)

- 1M +0.02557 to 4.42986% (+0.02829/wk)

- 3M +0.02329 to 4.80586% (-0.00400/wk)*/**

- 6M +0.00086 to 5.14186% (-0.05514/wk)

- 12M -0.02815 to 5.43371% (-0.12526/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.81171% on 1/5/23

- Daily Effective Fed Funds Rate: 4.33% volume: $106B

- Daily Overnight Bank Funding Rate: 4.32% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.127T

- Broad General Collateral Rate (BGCR): 4.27%, $437B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $401B

- (rate, volume levels reflect prior session)

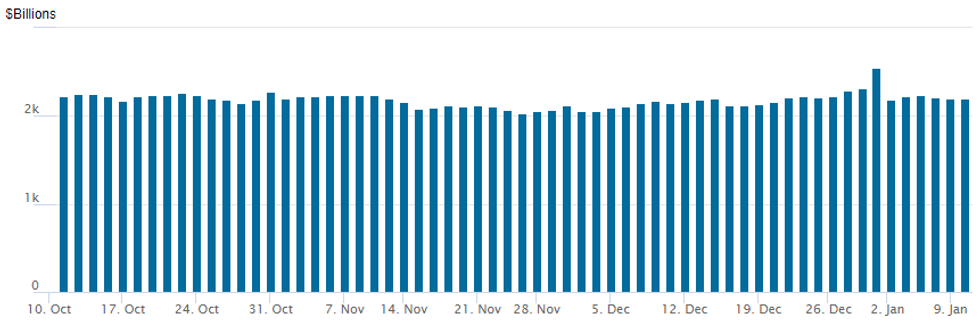

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,192.942B w/ 102 counterparties vs. prior session's $2.199.121B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Session flow focused on downside puts in SOFR options, new and re-positioning as underlying futures continued to unwind post-NFP strength, vol offered. Notable large put condor roll 5.5 net cr: +28,953 SFRJ3 94.62/94.87/95.00/95.25 put condors, ref 95.075-.080 vs. -27,153 SFRH3 94.62/94.87/95.12/95.38 put condors, ref 95.105-.085. Vol seller: appr -20,000 Dec SOFR 95.62 straddles from 81.0-2.0 since Monday.- SOFR Options:

- Block, 5,000 SFRU3 95.00/95.43 1x2 call spds, 0.5 net/2-leg over ref 95.245

- 2,000 SFRU3 95.5/96.00/96.50 call flys

- Block, 5,000 SFRU3 94.75 puts, 10.5 vs. 95.245/0.24%

- Block, 9,500 SFRZ3 97.50/98.50 call spds, 3.5

- Block, 2,500 SFRM3 94.68/94.81/94.93/95.06 put condors, 3.25

- Block, 2,500 SFRU3 94.68/94.81/94.93/95.06 put condors, 2.0

- Blocks, over -14,000 SFRZ3 95.62 straddles, 81.0-82.0

- Block, total 5,030 SFRH3 94.93/95.06/95.18 put flys, 2.5

- 7,750 OQF3 96.12/96.25 call spds, ref 96.075

- 5,000 SFRF3 95.25/95.37 call spds, ref 95.105

- 10,000 OQF3 96.00 puts, ref 96.075

- Large put condor roll 5.5 net cr:

- +28,953 SFRJ3 94.62/94.87/95.00/95.25 put condors, ref 95.075-.080 vs.

- -27,153 SFRH3 94.62/94.87/95.12/95.38 put condors, ref 95.105-.085

- 3,000 SFRF3 95.00 puts, 1.0 ref 95.11-.115

- Block, 2,000 SFRH3 95.12/95.18/95.25/95.37 call condors, 1.0 net ref 95.115

- 6,150 SFRG3 95.31 calls ref 95.105-.115

- Block, 3,750 SFRG3 95.18/95.31/95.43 call flys, 2.5

- Treasury Options:

- 1,000 USG 117/120/124 2x3x1 put flys ref 128-03

- 6,000 TYG3 115 calls, 19 ref 113-31

- over 27,000 TYG3 115.25 calls, 17-20

- 10,000 wk2 TY 114.5 calls, 26 ref 114-02.5

- 4,000 TYH3 111/112/114 broken put flys, 31 ref 114-05

- 2,000 TYG3 110.5 puts, 2 ref 114-09

- 1,500 TYG3 113/113.25/114 put trees, 1 net ref 114-09.5

- +2,000 FVG 110 calls, 11

- +7,150 FVH3 105.25 puts, 2 ref 109-04

EGBs-GILTS CASH CLOSE: Supply Weighs

European core FI weakened Tuesday as extremely heavy corporate and sovereign supply weighed.

- Bunds sold off steadily throughout the session and underperformed Gilts. The German curve bear steepened, with the UK's mixed.

- With Bunds selling off, periphery EGB spreads compressed, with 10Y BTP/Bund dipping below 190bp for the first time since Dec 13.

- Central bank speakers at a Riksbank symposium delivering little impactful communication (Fed Chair Powell's absence of pushback against the recent easing of financial conditions sparked a brief modest rally)

- Attention was on heavy supply, with E39bln of sales including corporates (2nd biggest volume day ever, per BBG).

- Wednesday sees several ECB speakers including Holzmann, Villeroy, Rehn and de Cos; the week's major event remains US CPI Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.2bps at 2.654%, 5-Yr is up 7.8bps at 2.344%, 10-Yr is up 8bps at 2.308%, and 30-Yr is up 6.9bps at 2.249%.

- UK: The 2-Yr yield is up 3.3bps at 3.478%, 5-Yr is up 1.9bps at 3.465%, 10-Yr is up 3.1bps at 3.557%, and 30-Yr is down 3.8bps at 3.907%.

- Italian BTP spread down 4.4bps at 191.4bps / Spanish down 1.8bps at 102.7bps

FOREX: Currency Markets Consolidating Ahead Of Key US Data

- Tuesday did little to alter the narrative across currency markets with the greenback trading in slightly firmer territory but largely consolidating following the renewed weakness seen since Friday’s data.

- The greenback did have a small move lower after the release of Fed Chair Powell’s speech where some potential outside expectations that he might push back against some of the recent dovish re-pricing failed to come to fruition.

- While most of those moves largely reverted to prior levels, EURUSD does sit a little higher on the day, showing clear and relative outperformance to its G10 counterparts.

- A strong recovery extended Monday in EURUSD, confirming the end of the recent corrective pullback. The bull trigger at the Dec 15 high at 1.0735, has been cleared and this confirms a resumption of the uptrend. The break higher maintains the bullish price sequence of higher highs and higher lows and note that MA studies are in a bull-mode position. The focus is on 1.0787, the May 30, 2022 high.

- CNH sits slightly lower on an intraday basis, but USD/CNH did manage a lower low during Asia-Pac hours. This put the pair at new multi-month lows of 6.7589. 6.7359 sits as next support, the Aug 15 2022 low.

- In emerging markets, it is worth noting some outperformance for LatAm currencies where USDMXN is hovering at near 3-year lows and the Brazilian Real continues to bounce back following the weekend’s heightened social unrest.

- Aussie CPI & Retail Sales data is due overnight, however, markets will quickly turn their focus to the key release of US CPI on Thursday.

FX: Expiries for Jan11 NY cut 1000ET (Source DTCC)

Late Equity Roundup: Near Highs, Consumer Services/Discretionary Bid

Major indexes trade moderately firmer, near late session highs in late trade, with Consumer Services and Consumer Discretionary sectors outperforming. SPX eminis currently trade +15 (0.38%) at 3928.5; DJIA +88.7 (0.26%) at 33606.17; Nasdaq +69.7 (0.7%) at 10705.11.

- SPX leading/lagging sectors: Consumer Discretionary (+0.90%) lead by internet retailers (AMZN +2.84%, EBAY +2.49%, ETSY +3.43%) session support tempered by modest reversal for auto makers paring Monday rally (TSLA -1.73%). Consumer Services a close second (+0.89%) lead by telecom names (LUMN +2.32%, T +1.89%, VZ +1.0%).

- Laggers: Utilities (-0.45%), Consumer Staples (-0.26%) and Real Estate (-0.05%) underperformed. Estate investment (KIM -3.27%, WY -2.01%) weighed on otherwise RE management names (HST +2.16$, BXP +1.93%).

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +3.96 at 356.96, Visa (V) +3.57 at 222.17, AMGN +3.19 at 273.31 and Caterpillar (CAT) +2.94 at 249.56 continued to lead gainers in late trade. Laggers: United Health (UNH) -5.38 at 484.68, Boeing (BA) -1.46 at 207.11, JNJ -0.6 at 174.98.

E-MINI S&P (H3): Breaches The 50-Day EMA

- RES 4: 4180.00 High Dec 13 and the bull trigger

- RES 3: 4043.00 High Dec 15

- RES 2: 4000.00 Round number resistance

- RES 1: 3973.25 High Jan 9

- PRICE: 3932.0 @ 1520ET Jan 10

- SUP 1: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 2: 3735.00 Low Nov 3

- SUP 3: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Oct 21

S&P E-Minis traded higher Monday but failed to hold on to the session high and closed at the day low. Key resistance at 3917.35, the 50-day EMA, has been breached. A continuation higher and a clear break of this EMA would suggest potential for a stronger recovery and highlight a possible reversal that would open 4000.00 next. On the downside, a break lower would confirm a resumption of the downtrend - the bear trigger is 3788.50, the Dec 22 low.

COMMODITIES: Crude Oil Edges Higher But Remains Rangebound

- Crude oil has eked out gains today as near-term demand concerns clash with upside risks from Russian supply and a Chinese demand recovery this year. The high uncertainty in both demand and supply is keeping oil bouncing within a range with no clear direction.

- The EIA’s short-term energy outlook sees the US accounting for the lion’s share of non-OPEC oil growth in 2024 as American drillers produce a record 12.8mbpd, above the projected 12.4mbpd for 2023.

- WTI is +0.7% at $75.17, off resistance at $76.50 (20-day EMA) and support at $72.46 (Jan 5 low). The CLG3 sees some downside protection with most active strikes at $70/bbl puts.

- Brent is +0.6% at $80.13, off resistance at $81.74 (20-day EMA) and support at $77.61 (Jan 5 low).

- Gold is +0.3% at $1877.26, continuing to gain despite higher US yields as it instead benefits from a subdued dollar. Within yesterday’s range, resistance remains at $1896.5 (61.8% retrace of the Mar-Sep bear leg).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 11/01/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 11/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/01/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.