-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Kashkari 40% Odds Higher Rates

- MNI US: FTC Files Antitrust Lawsuit Against Amazon

- MNI US: Menendez Scandal Could Shakeup US Foreign Policy In Middle East

- MNI US: McCarthy Will Bring CR To Floor If Rule Passes On FY24 Spending Bills

- ECB HOLZMANN: UPSIDE INFLATION RISKS STILL OUT THERE, CAN'T EXCLUDE FURTHER RATE HIKES, Bbg

Key Links: MNI INTERVIEW: Fed’s Wright Optimistic On Further Disinflation / MNI BRIEF: MN Fed Kashkari Puts 40% Odds On Larger Tightening Scenario / MNI Eurozone Inflation Preview – September 2023

Tsys Near Lows Despite Soft Data, 10Y Yield Taps 4.5622% High

- Treasury futures trading mixed after the bell, inside a moderate range on decent volumes (TYZ3>1.4M). Tsys followed Bunds higher overnight after slightly larger than expected German supply reduction annc (DFA).

- Rates extended gains after a flurry of morning data: New Home Sales came out slower than expected: 675k vs. 699k est; prior up-revised to 739k from 714k, MoM -8.7% vs. -2.2% est. Conf. Lower than expected Consumer Confidence: 103 vs. 105.5 est.

- Little reaction from Tsy futures after the $48B 2Y note auction (91282CJB8) trades on the screws: 5.085% high yield vs. 5.085% WI; 2.73x bid-to-cover vs. 2.94x prior.

- Current Dec'23 10Y futures -.5 at 108-05 vs. 108-17 high, 10YY back near highs after the close at 4.5499% vs. 4.5622% (new 16Y high). Technical resistance just above at 109-03/109-17+ (Low Sep 13 / 20-day EMA), while round number support holds below at 108-00 after falling to 108-00.5 early overnight.

- Curves rebounded in the second half: 3M10Y +2.394 at -92.616, 2Y10Y +1.638 at -57.943.

- Focus on Wednesday Data Calendar: Durables, Cap Goods, 2Y FRN/5Y Note Sale. MN Fed president Kashkari is scheduled to speak on CNBC at 0800ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00098 to 5.31843 (+0.00092/wk)

- 3M -0.00554 to 5.38558 (-0.01423/wk)

- 6M -0.00599 to 5.46327 (-0.01628/wk)

- 12M -0.00715 to 5.45973 (-0.02590/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% volume: $260B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.524T

- Broad General Collateral Rate (BGCR): 5.30%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $561B

- (rate, volume levels reflect prior session)

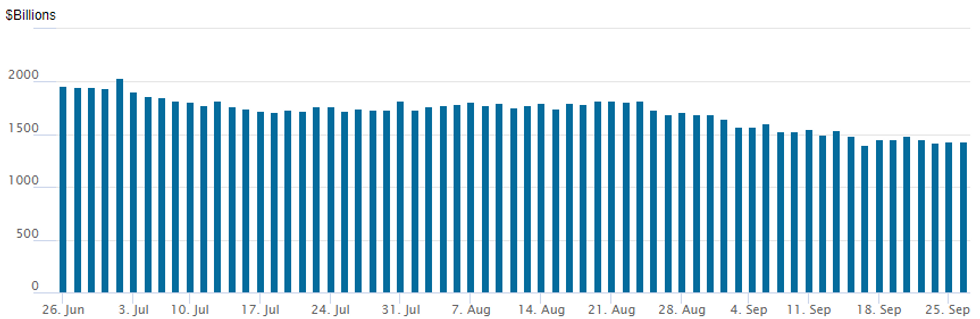

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation inches up to 1,438.301B w/97 counterparties, compared to $1,437.310B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury option trade remained paired between calls and puts Tuesday. Decent volumes as underlying futures reversed early gains - near new lows for the month overnight (TYZ3 108-00.5), 10Y yield near new 16Y high of 4.5622% at 4.5519% at the moment. Rate hike projections into early 2024 largely static: November at 20.7% w/ implied rate change of +5.2bp to 5.379%, December cumulative of 10.7bp at 5.435%, January 2024 12bp at 5.448%. Fed terminal at 5.445% in Feb'24.

- SOFR Options:

- 1,000 0QZ3 94.75/95.00/95.25 2x3x1 put

- Block, 13,888 SFRH4 94.37/94.50 2x1 put spds, 9.0 vs. 94.62/0.26%

- 12,100 SFRZ3 94.50/95.00 box, 49.5 ref 94.535

- -20,000 SFRV3 94.31/94.43/94.50/94.62 put condors, 7.5

- 2,000 SFRH4 94.75/94.87/95.00/95.12 call condors ref 94.62

- 2,000 SFRH4 97.25/97.37 put spds ref 94.62

- 4,000 SFRZ3 94.56/94.62/94.68 call flys

- 4,500 SFRH4 97.25/97.50 put spds ref 94.62

- Block, 3,000 0QZ3 95.50/95.68/95.81 call flys, 3.0 vs. 95.37/0.10%

- over 2,600 0QM4 97.00 calls ref 95.855

- 1,250 0QZ3 95.00/95.50 put spd vs. 2QZ3 95.50/96.00 put spds

- Block, 3,000 SFRH4 94.00/94.25 put spds, 2.5 vs. 94.605/0.10%

- Blocks, total 6,000 SFRH4 94.75/94.87/95.00/95.12 call condors, 1 ref 94.62

- 10,000 SFRF4 94.12/94.37 put spds, 3.0 ref 94.615 to -.62

- 2,500 SFRM4 95.00/96.00/97.00 call flys ref 94.775

- Treasury Options:

- over 19,000 TYX3 110 calls, 18

- over 8,000 TYX3 110.5 calls, 12 ref 108-02

- +17,500 TYX3 106.5/107/108 broken put trees, 1 net/1-leg over

- over 12,400 TYX3 107.5 puts, 37 ref 108-10.5

- over 12,200 TYX3 111 calls, 9 ref 108-10.5

- +10,000 TYX3 106 puts, 13

- over +10,100 FVX3 108 calls, 3.0 ref 105-12.25

- 2,500 wk5 TY 109.75/110.75 1x2 call spds ref 108-12.5

- over 4,800 TYZ3 112 calls, 15 ref 108-12

- 2,000 wk2 TY 109.25/110/110.5 broken call flys ref 108-08.5

- 1,250 TYX3 107/107.5/108.5 broken put flys, 58 ref 108-06.5

- over 11,000 10Y weekly 107.5 puts, 4 ref 108-02

- 6,000 TYX3 107/108 2x1 put spds, 12 ref 108-02 to -03

- 2,400 TYZ3 106.5/107 put spds ref 108-01.5

EGBs-GILTS CASH CLOSE: BTPs Hit March Wides To Bunds

The German and UK curves twist steepened modestly Tuesday, with core yields closing within 1bp of Monday's close after several intraday changes in direction.

- Yields opened the session wider in a continuation of the "higher for longer" rates theme, but fell sharply alongside weakness in oil prices, and a more sizeable-than-expected cut in Germany's Q4 issuance plan.

- Meanwhile, BTP spreads closed at post-March wides, with another report (from Bloomberg) pointing to a sizeable upward revision in the 2024 fiscal deficit target to be unveiled Wednesday by the Italian coalition gov't.

- Between Italy and broader risk-off (Eurostoxx down nearly 1%), other periphery spreads were dragged wider.

- Gilts were largely a bystander to broader events, though relatively weak demand details at today's auction was of some note.

- While there is some data Weds morning (eg German and French consumer confidence), attention is still firmly on the Eurozone September flash inflation data out Thursday and Friday - MNI's preview went out today (PDF link).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.6bps at 3.231%, 5-Yr is up 0.6bps at 2.771%, 10-Yr is up 1bps at 2.808%, and 30-Yr is up 0.6bps at 3.004%.

- UK: The 2-Yr yield is down 0.8bps at 4.808%, 5-Yr is down 0.3bps at 4.398%, 10-Yr is up 0.3bps at 4.326%, and 30-Yr is up 0.9bps at 4.805%.

- Italian BTP spread up 7bps at 193.4bps / Spanish up 2.5bps at 109.7bps

EGB Options: Plenty Of Interest In Mid/Late 2024 Euribor Structures

Tuesday's Europe rates / bond options flow included:

- RXX3 131/132/133c fly, bought for 8 in 8k

- ERM4 96.50 call/95.75 put combo sold at 6 in 18k v 96.19 (buys put, sells call)

- ERU4 98.00/98.50 call spread bought for 2.5 in 5k

- ERM4 97.50/98.00cs bought for 2 with ERU4 99.00/99.50cs bought for 1.25 in 5k

FOREX Greenback Resumes Ascent, Fresh Trend Highs For USD Index

- Despite the USD index dipping across European hours and sliding into negative territory on the day, the greenback has regained its poise and resumed its ascent. The DXY is printing fresh cycle highs as we approach the APAC crossover, currently up another 0.25% and extending above the 106.00 mark.

- Weakness for equities have weighed on more risk sensitive currencies with the likes of AUD and GBP among the worst performers, declining half a percent.

- GBPUSD stands out as the pair extends its decline below 1.2200. The recent move down confirms a resumption of the bear trend and maintains the bearish price sequence of lower lows and lower highs. The focus is on 1.2120, a Fibonacci projection.

- EURUSD also spent the majority of the session consolidating around 1.0600 before extending to fresh lows at typing. Price action narrows the gap with 1.0516, the March 15 and a key support.

- In emerging markets, there was some notable weakness for the South African rand, which weakened over 1.5% against the greenback. The move was largely playing catch up following the national holiday on Monday with familiar broader-picture concerns that have weighed on some EM currencies.

- Australian August CPI data will highlight Wednesday’s docket before US Durable Goods. Focus will then turn to Eurozone inflation data later in the week.

Late Equity Roundup: Near Late Lows, Utilities, Cons Disc, IT Lagging

- Stocks continued to decline following this morning's weaker than expected consumer confidence and home sales data. drifting near late session lows as apprehension ahead a likely US government shutdown this Saturday spurs position unwinds.

- Currently, the DJIA is down 386.64 points (-1.14%) at 33619.18, S&P E-Mini Future down 66.25 points (-1.51%) at 4312.25, Nasdaq down 214.3 points (-1.6%) at 13056.12.

- Laggers: Utilities, Consumer Discretionary and Information Technology sectors underperformed in the second half, electric and multi energy providers weighed on the former: Sempra and Dominion Energy -3.4, Alliant and Constellation Energy -3.3%.

- Broadline retailers weighed on Consumer Discretionary stocks: Etsy -4.3%, while Amazon -4.2% after the Federal Trade Commission, and 17 state attorneys general, have filed a large-scale antitrust lawsuit against tech giant Amazon. Washington Post reports that the suit, "seeks to bar the company from allegedly abusing its powers to raise prices for shoppers and levy high fees against businesses that sell on its platform."

- Leaders: Energy and Health Care sectors outperformed, oil and gas exploration stocks led gainers: EOG Resources +0.75%, Pioneer Natural Resources +0.35%. Pharmaceuticals and biotech shares buoyed the Health Care sector: Incyte Corp and Gilead both +1.3%, Biogen Inc +1.04%.

E-MINI S&P TECHS: (Z3) Trading At Its Recent Lows

- RES 4: 4673.50 High Aug 1

- RES 3: 4617.40 76.4% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4566.00/4597.50 High Sep 15 / 1 and a near-term bull trigger

- RES 1: 4447.00/4492.05 High Sep 21 / 50-day EMA

- PRICE: 4311.00 @ 1505 ET Sep 26

- SUP 1: 4338.25 Low Sep 25

- SUP 2: 4318.00 Low Jun 2

- SUP 3: 4300.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 4: 4259.00 Low May 31

A bear cycle in S&P E-minis remains in play and price is trading closer to recent lows. Last Thursday’s sell-off resulted in a break of support at 4397.75, the Aug 18 low. This breach reinforces bearish conditions and signals scope for a continuation lower. Sights are on 4318.00 next, the Jun 2 low. Initial firm resistance is 4492.05, the 50-day EMA. Short-term gains would be considered corrective.

COMMODITIES: Crude Oil Reverses Early Losses But Gold Tests Support On USD Bid

- Crude oil has reversed any pessimism seen in Asia and London trade and instead continues to push higher. Tight supplies and inventory drawdowns due to OPEC+ production cuts are providing upside, while a broader risk appetite weakness and a stronger US dollar today offer some downside.

- The API oil inventory data is due for release today at 16:30 ET. China demand will be in focus this week with PMI data due out at the end of the week and with a demand boost expected during the upcoming Goldan Week holiday period.

- Heavy Western Canadian Select’s discount to WTI in Alberta for Q1 has narrowed to $18.90/b from $19.61/b, according to Bloomberg sources, following regulatory approval for the expansion of Canada’s Trans Mountain Pipeline.

- WTI is +0.9% at $90.46. Resistance is seen at $92.43 (Sep 19 high) and support at $87.17 (20-day EMA) with the uptrend remaining inteact albeit within a short-term bearish corrective cycle.

- Brent is +0.8% at $0.8% at $94.02. Resistance is seen at $95.96 (Sep 19 high) and support at $91.12 (20-day EMA).

- Gold is -0.8% at $1900.03 off a low of $1899.24, down heavily again from a combination of another real yield driven step higher in the USD amidst solid equity declines. It has tested $1901.1 (Sep 14 low) after which lies the bear trigger at $1884.9 (Aug 21 low).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 27/09/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/09/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 27/09/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/09/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/09/2023 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 27/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/09/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/09/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/09/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.