-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed on Hold, Plots 3 Cuts in '24

- FOMC KEEPS FED FUNDS RATE UNCHANGED AT 5.25%-5.5%

- FED DOT PLOT SEES 3 CUTS IN 2024 (MEDIAN RATE 4.6%)

- FED:DETERMINING EXTENT OF 'ANY ADDITIONAL POLICY FIRMING'

- MNI: Powell-Focused On Not Waiting Too Long To Cut Rates

- MNI EU: Brussels Unblocks EUR10.2bn To Hungary, Could Smooth Path To Ukraine Aid

- MNI US: Yellen-WH Likely To Revive Corp Tax Rise; Commits To Position Thru '24 Vote

- MNI SWISS DEFENSE MINISTER VIOLA AMHERD ELECTED PRESIDENT FOR 2024

- MNI JAPAN: Kyodo-Factionless Saitō To Replace Nishimura As Economy & Trade Minister

Key Links: FED: Statement Changes: Dec vs Nov / MNI FED: Dovish Powell Acknowledges FOMC Is Thinking About Thinking About Cuts / MNI US DATA: Core PPI Misses In November Along With Net Softer Revisions / MNI US Inflation Insight, Dec'23: Strong Supercore Modestly Trims Cut Expectations / MNI BOE WATCH: MPC On Hold, Too Early To Consider Cuts / US-CHINA: Yellen To Deliver Remarks On US-China Economic Relationship Tomorrow

US TSYS Fed Leaves Rate Steady, Projected 2024 Rate Cuts Reignited

- Tsy futures gap higher/extend highs well past pre-NFP levels after Fed held rate steady, acknowledging inflation has eased but reiterated the Fed is "prepared to tighten policy further, if appropriate". FOMC-dated OIS for March fell 8.5bps to 5.108%, back to pre-payrolls levels pricing in a cumulative 22.4bp of easing.

- "Achieving a stance of monetary policy that is sufficiently restrictive to bring inflation sustainably down to 2% over time and to keeping policy restrictive until we're confident that inflation is on a path to that objective" Powell added.

- Tsy 10Y yield fell to 4.0051% low -- last seen on September 1, while March'24 10Y futures tapped 112-03 high (+1-18), tapping technical resistance 112-03 (1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing) before settling at 111-31.

- Futures had gapped higher following this morning's in-line to slightly lower PPI measures for November: Final Demand MoM (0.0% vs. 0.0% est, -0.4% prior revised from -0.5%), YoY (0.9% vs. 1.0% est, 1.2% prior revised from 1.3).

- The combination of the solid supercore print overall core running well above target, and the unexpected dip in the unemployment rate in the past week.

- Thursday Data Calendar: Weekly Claims, Retail Sales and Import/Export index data

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00302 to 5.36181 (+0.00178/wk)

- 3M -0.00143 to 5.38463 (+0.01859/wk)

- 6M -0.01426 to 5.33224 (+0.04013/wk)

- 12M -0.02558 to 5.10516 (+0.08504/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.713T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $617B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $602B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $106B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $257B

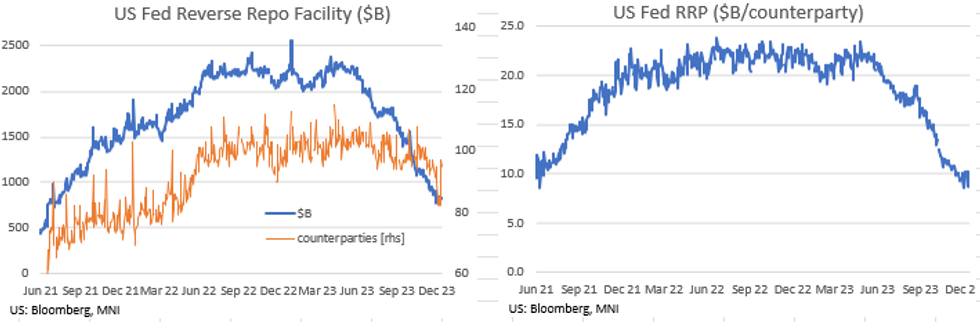

FED: RRP Usage Recedes

- RRP usage was receded today to $823B (-$15B) for still close to last week’s average of $829B.The recent low still stands at $769B on Dec 1.

- The number of counterparties down to 95 from 97 yesterday - highest since Nov 22.

SOFR/TREASURY OPTION SUMMARY

SOFR option trade continued to revolve around rate cut insurance via upside calls - apt given the market rally that followed the Fed's latest steady policy annc where they acknowledged inflation has eased though reminding the Fed is "prepared to tighten policy further, if appropriate". Projected rate cuts for early 2024 gained momentum: January 2024 cumulative -2.5bp at 5.307%, March 2024 chance of rate cut climbs to -62% vs. -41.6% this morning w/ cumulative of -18bp at 5.153%, May 2024 up to -79.2% vs. -59.3% this morning, cumulative -37.7bp at 4.956%, June'24 at -89.2% with cumulative at -60.6bp at 4.726%. Fed terminal at 5.33% in Feb'24.

- SOFR Options: Reminder, Dec'24 options expire Friday

- over 21,000 SFRZ3 94.62 calls, 0.5

- 2,500 SFRJ4 94.50/94.75/95.00 put flys, 3.0 ref 95.35

- Blocks, total +45,000 SFRM4 96.12 calls, 8.5 vs. 95.14/0.17%

- 5,000 SFRM4 96.25 calls, 7.5 ref 95.15

- +15,000 SFRF4 94.87/95.00/95.06 call flys, 2.0

- +5,000 SFRJ4 95.25/95.56/95.68 call flys 1.25 over SFRJ4 94.62 puts vs. 95.14/0.20%

- +2,500 SFRM4 95.00/95.50/95.75 broken call flys, 12.75

- +2,500 SFRU4 96.00/96.50/97.00/97.50 call condors, 5.75

- +1,000 SFRH4 94.68/94.81/94.93 call flys ref 94.795

- +1,000 SFRH4 94.75/94.87/95.00 call flys, 1.5 ref 94.80

- +3,000 SFRH4 94.75/94.87/95.00 call flys .5 over SFRH4 94.37 puts ref 94.795

- 2,500 0QZ3 95.62/95.87 put spds ref 95.77

- 1,500 0QZ3 95.87 calls ref 95.87

- 5,000 SFRH4 95.00/95.25/95.43 broken call flys ref 94.805

- Block, 3,000 SFRZ3 94.62/94.68 call spds, cab

- 1,000 SFRF4 94.68/94.75/94.81/94.87 call condors ref 94.795

- Treasury Options:

- 4,000 TYF4 111.5 calls, 22 ref 110-27

- +15,350 TYG4 109/110.5 2x1 put spds, 9 ref 110-27.5

- 1,600 TYG4 109/111 3x2 put spds

- 8,100 Wed wkly 5Y 107 puts, 5.5 ref 107-07

- -5,000 wk5 TY 110.75 straddles, 125 ref 110-24.5

- +9,000 wk5 TY 109/110 put spds, 15 (expires Dec 29).

- (Yesterday, paper bought 10,000 wk5 TY 109 puts at 17 ref 110-21.)

- +3,000 TYG4 112/114.5 1x2 call spds, 16

- -4,500 TYF4 108.5/110 put spds, 17 vs. 110-21.5/0.25%

- 5,000 TYF4 111.25 calls, 23 ref 110-21

- 1,300 Wed wkly 110.25 puts, 6 ref 110-20

- 2,000 Wed wkly 109.75 puts, 1 (expire today)

EGBs-GILTS CASH CLOSE: UK Belly Outperforms Ahead Of BoE / ECB Decisions

Gilts rallied sharply Wednesday with the belly of the UK curve outperforming, with EGBs gaining in their wake.

- Weaker-than-expected UK economic activity/GDP data kicked off a strong session for Gilts, which gained for most of the session ahead of Thursday's BoE decision.

- BoE cut pricing ramped up: rates are expected to end 2024 101bp below current levels and 105bp below the February 2024 peak.

- Conversely, Bunds started the day on the back foot but regained ground on multiple factors, getting a tailwind from Gilt and Treasury gains, and softer-than-expected Eurozone industrial production data helping. While

- Bunds temporarily weakened on comments by German Chancellor Scholz that while a budget deal has been reached, the "debt brake" could be suspended again in 2024. However, Bunds ended on the session highs.

- Periphery EGBs traded mostly tighter to Bunds, with Greece the outlier, widening for a 2nd consecutive session.

- The Federal Reserve decision and communications take focus after the European close, with attention then swiftly turning to the ECB (MNI preview here) and BoE (MNI preview here) decisions on Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.2bps at 2.667%, 5-Yr is down 4.3bps at 2.167%, 10-Yr is down 5.3bps at 2.173%, and 30-Yr is down 5.5bps at 2.346%.

- UK: The 2-Yr yield is down 14.8bps at 4.381%, 5-Yr is down 15.4bps at 3.886%, 10-Yr is down 13.7bps at 3.83%, and 30-Yr is down 14.1bps at 4.333%.

- Italian BTP spread down 2.2bps at 175.6bps / Greek up 3.1bps at 125bps

EGB Options: UK Rate Upside, Bobl Put Strips Feature Wednesday

Wednesday's Europe rates/bond options flow included:

- OEG4 118.00/117.25ps 1x2 with OEG4 117.75/117.00ps 1x2, bought the 1 strip for-7 (receive) in 2k.

- OEG4 118/116.75ps 1x2 with OEH4 117.5/116ps 1x2 bought the strip for 45 in 1k. Recall same strip was bought Yesterday for 44 in 1k

- ERM4 96.87/97.12/97.37c fly bought for 2.5 in 8.5k

- 0RH4 97.625/98.125 1x1.5 call spread bought for 10.25 - 10.5 in 10k

- SFIM4 95.40/95.60cs vs 94.75/94.55ps, bought for 2.25 and 2.75 in 10k

- SFIU4 95.80/96.00cs vs 94.75/94.55ps, bought for 2.75 in 5k.

FOREX Sharp Greenback Weakness As Fed Projections See 3 Cuts Next Year

- The US dollar sold off aggressively in the direct aftermath of the Fed rate decision and release of its summary of economic projections. With the median dot plot forecasting three rate cuts in 2024 and an acknowledgement that inflation is easing, the greenback remained under pressure throughout the late US session, with the USD index down roughly 0.85% as we approach the APAC crossover. Broad greenback weakness consolidated as Chair Powell delivered little to no pushback to market expectations of significant rate cuts next year.

- USDJPY extended losses to as much as 1.95% on the session, briefly breaking back below the 143.00 handle and printing a low of 142.65. As a reminder, last week’s impulsive sell-off confirmed the break of trendline support drawn from the Mar 24 low. This strengthens a bearish threat and signals scope for a continuation lower towards 140.71 next, a Fibonacci retracement point. In between that level and the current spot rate, attention should be paid to 142.50 & 141.71, the Dec 8 low and the bear trigger respectively.

- The beneficial price action for equities and waning greenback sees AUD among the best performers on the G10 leaderboard, registering gains of roughly 1.65% on the session.

- The uptrend in AUDUSD remains intact, and moving average studies remain in a bull-mode set-up, highlighting this bullish theme. The bull trigger has been defined at 0.6691, the Dec 4 high. Clearance of this level would confirm a resumption of the uptrend. Above here, markets will focus on 0.6747, the 76.4% retracement of the Jul 13 - Oct 26 bear leg.

- New Zealand GDP and Australia employment data kicks off Thursday’s docket. Focus then turns to central bank decisions from the SNB, Norges Bank, BOE and ECB. Additionally, US retail sales data is scheduled.

FX Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0715-25(E2.7bln), $1.0790-10(E3.3bln), $1.0825-35(E1.8bln), $1.0855-70(E2.5bln), $1.0900(E1.8bln)

- USD/JPY: Y145.00($698mln), Y147.50-55($1.1bln), Y146.25-30($745mln), Y147.50-55($1.1bln)

- GBP/USD: $1.2465-75(Gbp755mln), $1.2640(Gbp528mln)

- AUD/USD: $0.6500-15(A$1.8bln), $0.6600(A$1.7bln), $0.6700(A$2.1bln)

- NZD/USD: $0.6090(N$750mln), $0.6150(A$611mln), $0.6190(N$1.1bln)

LATE US EQUITIES SUMMARY: Post-FOMC React: Nearing Late July Highs

- Stocks surged higher, S&P Eminis back to late July levels after the FOMC held rate steady, acknowledged inflation is easing, projected rate cuts for 2024 pull higher (March'24 pricing in nearly 75% of 25bp cut vs. 41.6% this morning).

- Focus turns to Fed Chairman Powell's press conference at 1430ET.

- Currently, DJIA trades is up 447.56 points (1.22%) at 37025.52, S&P E-Mini futures up 55.75 points (1.19%) at 4753, Nasdaq up 157.9 points (1.1%) at 14692.28.

- Leading gainers: Utilities and Real Estate sectors continue to lead gainers after the Fed, independent and multi-energy providers supporting the former: WEC Energy +2.34%, Ameren Corp +2.0%, Sempra +1.96%. Real Estate Investment Trusts (REITs) buoyed the latter with industrial and residentials leading: Prologis +2.47%, Boston Properties +2.66%, Alexandria Real Estate +2.47%.

- Laggers: Materials and Consumer Discretionary sectors continued to underperform, industrial gas providers weighing on the former: Linde -4.25% to around 408.75 after climbing to all-time high of 433.53 Tuesday. Air Products steady in comparison. Auto makers and parts providers weighed on the Discretionary sector: Tesla -1.51%, Ford -1.48%, Aptiv -0.96%.

COMMODITIES Gold Surges With Fed-Triggered USD Slide, Crude Also Benefits

- Crude futures have been supported today by first a larger than expected draw in US crude inventories from the weekly EIA data before a tailwind from a sharp fall in the USD index on the FOMC’s dovish SEP and Fed Chair Powell’s press conference.

- EIA Weekly US Petroleum Summary - w/w change week ending Dec 08: Crude stocks -4,258 vs Exp +20, Crude production 0, SPR stocks -6.

- Two missiles fired from Yemen’s Houthi rebel territory missed a tanker loaded with jet fuel near the Bab el-Mandeb Strait on Wednesday according to AP News reports citing US officials. The Marshall Islands-flagged tanker was traveling north toward the Suez Canal in the Red Sea.

- OPEC left oil demand growth expectations for this year and next unchanged while raising its 2023 global economic growth forecast in its latest monthly report.

- WTI is +1.25% at $69.47, but remains well within yesterday’s range after declining heavily to late June levels. Resistance is seen at $71.96 (Dec 12 high) whilst support is seen at $67.28 (Jun 23 low).

- Brent is +1.4% at $74.26. Key short-term resistance is seen at $76.66 (Dec 12 high) whilst support is seen at $71.45 (Jun 23 low).

- Gold is +1.9% at $2016.54, surging higher to unwind the slide seen since US payrolls on Friday. It punches through resistance at $2003.9 (20-day EMA) to open $2041.3 (Dec 5 high).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/12/2023 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 14/12/2023 | 0430/1330 | ** |  | JP | Industrial production |

| 14/12/2023 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/12/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 14/12/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/12/2023 | 0830/0930 | *** |  | CH | SNB Interest Rate Decision |

| 14/12/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 14/12/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 14/12/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 14/12/2023 | 1230/1230 |  | UK | MPR Press Conference MPR Press Conference | |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 14/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/12/2023 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/12/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 14/12/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 14/12/2023 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 14/12/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 14/12/2023 | 1500/1000 | * |  | US | Business Inventories |

| 14/12/2023 | 1515/1615 |  | EU | ECB Lagarde participates in MP Podcast | |

| 14/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 14/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/12/2023 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 15/12/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.