-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI ASIA MARKETS ANALYSIS: Greenback Recovers From Fresh Trend Lows

- Mixed day for EU FI as the UK curve bear flattened while Germany's twist steepened amid limited trading ranges in Bund and Gilt yields in a US holiday-thinned session.

- Despite the greenback trading to fresh trend lows in early trade on Monday, the USD index has recovered well to trade in positive territory for the session.

- Crude oil trims some of last week's strong gains whilst Goldman's Currie sees commodities as having the strongest outlook of any asset class in 2023.

- Immediate focus shifts to Chinese growth data ahead before a gentle first day back for the US before the BoJ and a stacked US docket on Wednesday.

US TSYS: Consolidating Friday's Cheapening, Awaiting Wednesday Deluge

- TYH3 trades 4 ticks lower at 114-20+ with the entirety of the move coming through European hours before an unsurprisingly muted US session with the US out for Martin Luther King Day (~200k volumes). It extends Friday’s decline but keeps well within Thursday’s CPI-induced ranges.

- The technical trend needle continues to point north, with resistance at 115-15+ (Jan 13 high) whilst to the downside sits 113-26+ (20-day EMA).

- Tomorrow’s session provides a steady first day back for the US (although China data overnight of importance), with data limited to the Empire manufacturing index, as usual providing the first regional steer for January. Followed by Fedspeak late on with NY Fed’s Williams giving welcoming remarks at 1500ET.

- The week then kickstarts in earnest on Wed, following the BoJ with a deluge of US data including retail sales, PPI inflation, industrial production, inventories, NAHB homebuilder sentiment and the Fed Beige Book along with four separate Fed speakers.

EGBs-GILTS CASH CLOSE: Early Weakness Fades Ahead Of UK Data

The UK curve bear flattened while Germany's twist steepened Monday, amid limited trading ranges in Bund and Gilt yields in a US holiday-thinned session.

- Core FI sold off early in the session on no particular catalyst, potentially in a continuation of the profit-taking and position squaring seen late last week. Yields then fell steadily for most of the session.

- BTP spreads narrowed from early wides, with 10Y closing flat to Bunds.

- BoE's Bailey told Parliament of risks of inflation not dropping as fast as expected due to supply side factors (China reopening, UK labour force constraints), though his comments had little discernable market impact.

- Likewise, little immediate reaction to ECB's/Finland's Rehn calling for "significant" hikes at the upcoming ECB meetings.

- UK data takes centre stage with jobs data early Tuesday, and CPI Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.7bps at 2.566%, 5-Yr is down 1.2bps at 2.19%, 10-Yr is up 0.7bps at 2.175%, and 30-Yr is up 1.3bps at 2.147%.

- UK: The 2-Yr yield is up 2.7bps at 3.516%, 5-Yr is up 0.7bps at 3.312%, 10-Yr is up 1.8bps at 3.384%, and 30-Yr is up 0.3bps at 3.727%.

- Italian BTP spread unchanged at 184.3bps / Spanish down 0.9bps at 98.9bps

STIR: BoE Hike Pricing Awaits Data Catalyst

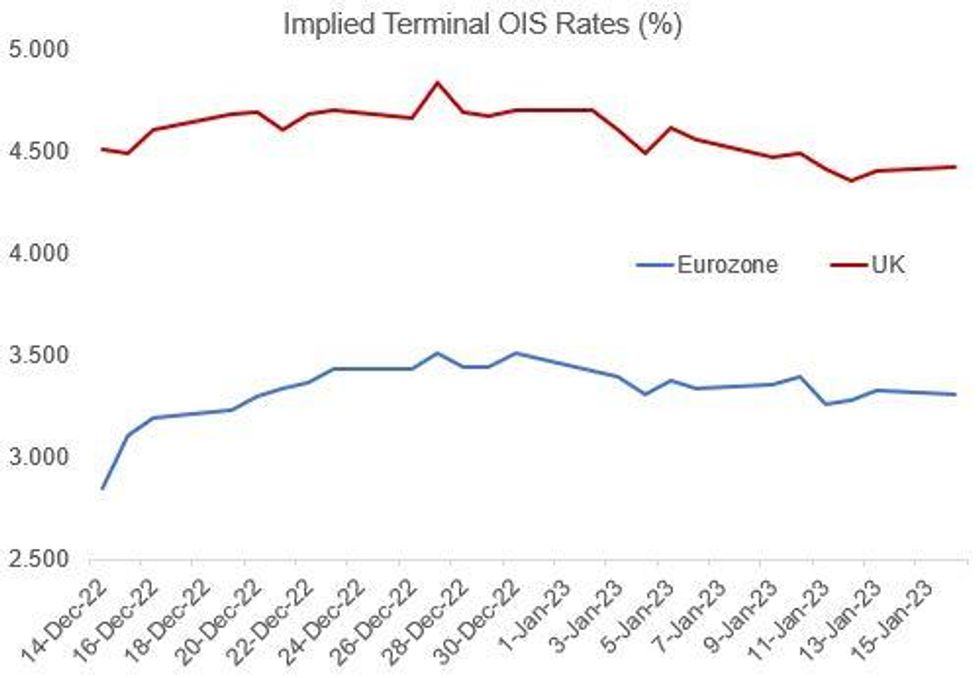

ECB and BoE hike pricing remained steady Monday, with UK data (including CPI Wednesday) seen as the next major potential catalyst.

- In particular, the data may help cement conviction toward either a 25bp or 50bp hike at the Feb meeting - 43bp is currently implied (70+% prob of a 50bp raise), with 75bp priced through the second meeting in March. Both of those figures were basically unchanged Monday, with around 100bp of BoE hikes still priced to the cycle peak in August.

- There remains more conviction on a 50bp Feb ECB hike, with hawk Olli Rehn today reiterating a preference for "significant" hikes at the upcoming meetings (92bp is priced through March). Peak pricing of 143bp (at the Jul meeting) was a touch lower on the session.

Source: BBG, MNI

Source: BBG, MNI

FOREX: Greenback Recovers Well After Printing Fresh 7-Month Lows

- Despite the greenback trading to fresh trend lows in early trade on Monday, the USD index has recovered well to trade in positive territory for the session. The US market closure for MLK Day prompted further stabilisation for the USD after last week’s slump, although ranges for major currencies remained subdued throughout typical US trading hours.

- The key laggards on Monday are the Chinese Yuan and the Japanese Yen, both depreciating around half a percent. For USDJPY in particular, the pair has made a substantial recovery after printing 127.23 during APAC hours and now resides back above the 128.50 mark.

- The overnight selloff extended USDJPY’s downswing briefly to over 4% from last week’s highs before the US CPI data. The JPY will remain in focus this week with speculation that the Bank of Japan could potentially make further policy tweaks at its January meeting, scheduled on Wednesday.

- Moving average studies remain in a bear mode condition and a bearish price sequence highlights a clear downtrend. Furthermore, the 50- and 200-dmas have crossed, highlighting a potential bearish death cross. The focus is on 126.81, a Fibonacci projection. The first resistance is at 129.52, the Jan 3 low and a recent breakout point.

- Little to report across the rest of G10 FX and the immediate focus shifts to Chinese growth data which kicks off the docket during Tuesday’s APAC session. UK employment figures will then cross before US traders return and Canadian CPI will be published.

COMMODITIES: Goldman Bullish But Crude Oil Fades On Demand Concerns

- Crude oil fades through a light US session with MLK Day on ongoing concern for global oil demand.

- Goldman’s Currie however says “you cannot come up with a more bullish concoction for commodities” and that global oil use may rise by 2mbpd this year if international travel resumes. It follows last week making the case for $105/bbl Brent by 4Q23.

- WTI is -1.3% at $78.85, pulling back from an intraday high of $80.22 that sets initial resistance after which sits the bull trigger at $85.59 (Jan 3 high). The latest declines in WTI and Brent don’t yet trouble support levels.

- Brent is -1.3% at $84.18, pulling back from an intraday high of $85.59 that sets initial resistance after which sits the key $87.00 (Jan 3 high).

- Gold is -0.2% at $1915.57, pulling back from an earlier high of $1929.03 that moves closer to testing resistance at $1934.4 (Apr 25, 2022 high).

- Buoyed by the GS commodity outlook, aluminium has touched a seven-month high with a 1.8% rise to $2595 with Goldman targeting an average $3125/ton this year.

CANADA: BAX Inversion Builds On BoC Surveys

- Demand fears in the BOS and modest improvements in longer-term expectations drive significant further inversion in BAX futures, building on an already large rally earlier in the session.

- Front BAH3 +0.02 but Dec’23 +0.14 and Jun’24 +0.16 despite coming off highs.

- Last week’s trend had been growing inversion in 1H24 but today’s is more heavily front-loaded, with the Mar’23-Dec’23 spread tilting back to recent record lows at -0.84 whilst Dec’23-Jun’24 ekes out new lows with -0.95.

- Near-term, BoC-dated OIS eases to 21bps for next week’s meeting but with Dec CPI still to come tomorrow.

CANADA DATA: Dovish FI Reaction To BOS/CSCE Surveys

- GoCs see a dovish reaction to the BOS/CSCE surveys, with 2YY rallying a further 4bps for now down almost 10bps on the day with the belly also rallying 7bps. USDCAD meanwhile largely looks through the report with the US out.

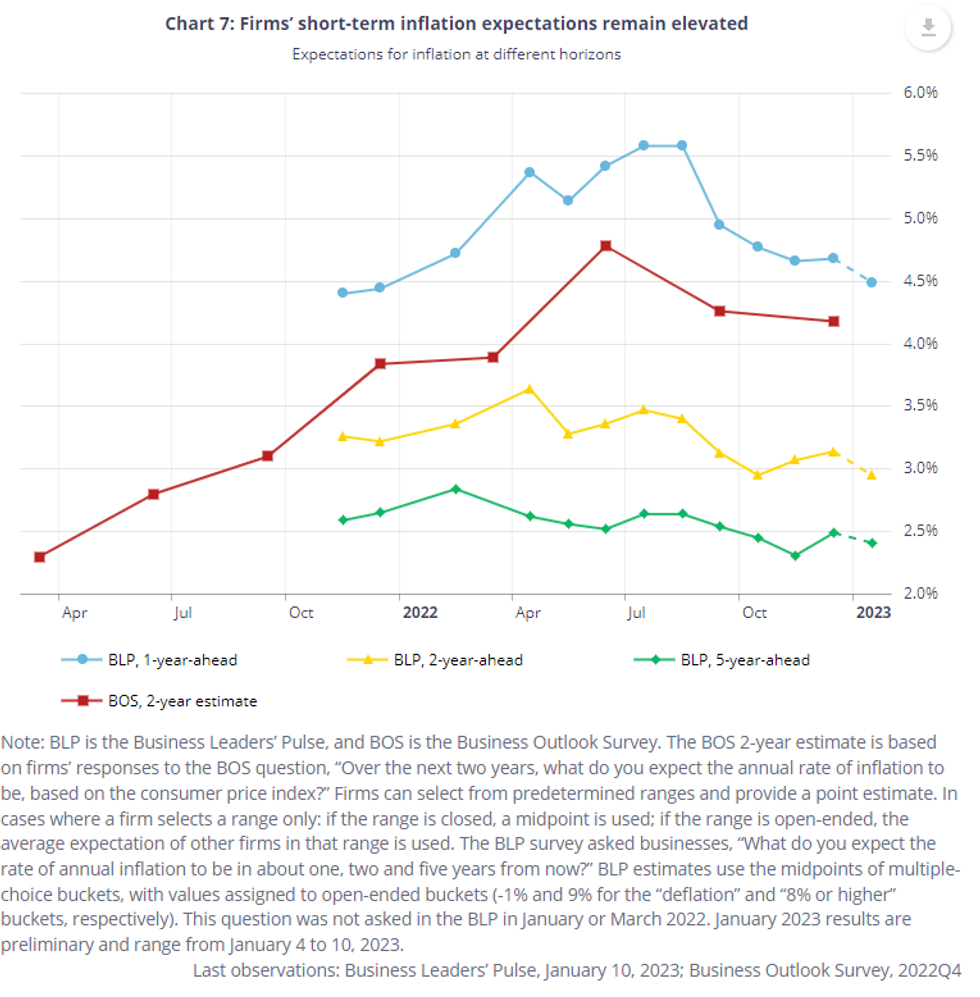

- Overall confidence in the Business Outlook Survey fell further in Q4, at +0.1 touching new lows since 3Q20 albeit still close to average levels through 2019.

- Most firms expect a mild recession in Canada this year, with increases in the share of those worried about demand and credit availability along with reduced supply chain concerns.

- Inflation expectations were somewhat mixed. A record 84% of firms expected inflation to average above 3% over the next two years having dipped 1pp to 77% back in Q3. However, actual expectations eased to an average 4.18% (from 4.26) over two years and the additional more timely Business Leaders’ Pulse saw 2-year ahead inflation at 2.95% (from 3.14) and 5-year ahead at 2.41% (from 2.49).

- Further, average year-ahead expected wage increases cooled another 0.2pps to 4.7% Y/Y having potentially peaked at 5.8% in Q2.

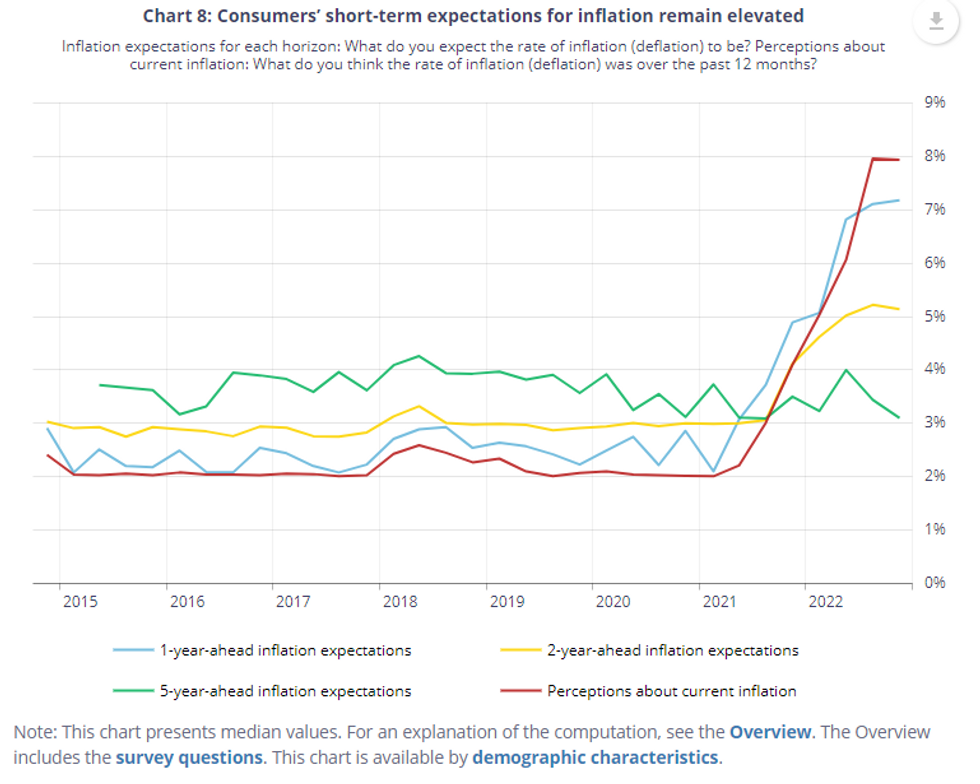

CANADA DATA: Consumer Inflation Expectations Edge Lower Two Years Out And Beyond

- Near-term consumer inflation expectations poked to new cycle highs in the Q4 consumer survey at 7.18% (from 7.11%).

- Importantly though, longer-term measures moderated, slightly in the case of the 2Y-ahead (5.14 from the record 5.22 in Q3) and more meaningfully for the 5Y-ahead (3.1 from 3.44 and a recent high of 4 in Q2).

- Further moderately dovish implications, at least for near-term demand, were found in the continued increase in the share of those reducing spending or making purchases later because of expected inflation and interest rates.

- This was consistent with an experimental daily online survey of consumers trending to the lowest share expecting employment in the community to improve over the next six months since Mar’21 at 20%.

- The main CSCE took place between Oct 27-Nov 17 with a follow-up in Nov and Dec 2022.

Source: Bank of Canada

Source: Bank of Canada

CANADA DATA: Further Price Declines Help Sales Stabilise

- Existing home sales increased 1.3% M/M in Dec after -3.5% in Nov but are beginning to stabilise with two increases in the past three months following a -37% Y/Y slide.

- Prices fell -1.6% M/M, the tenth consecutive decline for a 13% drop since the Feb’22 peak, bigger than the 9% fall from the 2008-09 peak-to-trough, but still more than 30% above pre-pandemic levels.

- Months of inventory edged further higher to 4.2, similar to “the months leading up to the initial COVID-19 lockdowns, and still nearly a full month below its long-term average.”

- CREA senior econ: “Demand for housing continues to grow and supply remains the biggest issue across the entire spectrum. Whether that plays out in the rental market in 2023 or shifts back over into the ownership space is a matter of how quickly the BoC can get inflation under control and starts turning the dial back down on borrowing costs.”

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.