-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI ASIA MARKETS ANALYSIS: Higher for Longer See Push-Back

HIGHLIGHTS

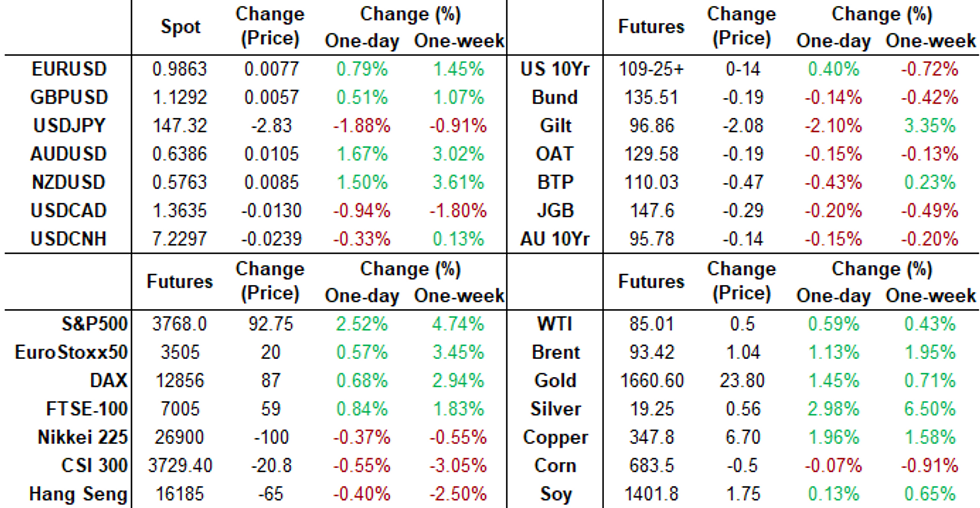

- SF FED DALY: WANT TO AVOID AN UNFORCED DOWNTURN BY OVERTIGHTENING, Rtrs

- JAPAN INTERVENES IN CURRENCY MARKET TO SUPPORT YEN: NIKKEI

- US FISCAL 2022 BUDGET GAP NARROWS BY 50% TO $1.38 TRILLION

- MNI US PRES BIDEN: "Republican Leadership In Congress Will Crash The Economy Next Year"

- ITALY'S MELONI PICKS GIANCARLO GIORGETTI AS FINANCE MINISTER, Bbg

US TSYS: Market Roundup: Dec 75Bp Hike Pricing Fades, Risk-On Cues

Tsys trade mixed after the close, yield curves broadly steeper as 2s through 10s finished broadly higher vs. continued weakness in long end 30Y bonds Friday.

Just minutes after yield hit new cycle highs (10YY 4.3354%) - yields reversed course (10YY 4.2188%) as short end surged following tweet from WSJ's Nick Timiaros:

- Some officials are more eager to calibrate their rate setting to reduce the risk of overtightening. But they won’t want to dramatically loosen financial conditions if and when they hike by 50 bps (instead of 75). This meeting could allow officials to get aligned on next steps."

- Some fast$/prop accts attempted to fade the move prior to a Large 2s30s steepener Block at 0935:14ET:(+11,470 TUZ2 102-62, through 102-01.75 post-time offer vs. -3,000 USZ2 118-19, through 118-22 post-time bid).

- Risk-on tail wind after San Francisco Federal Reserve President Mary Daly said Friday the FOMC needs to start considering a slowing the pace of interest rate hikes in order to avoid tightening monetary policy too much, adding the benchmark lending rate could reach 4.5% to 5% next year.

- “We don’t just keep going up in 75 basis point increments, we do a stepdown," she said. “That doesn’t mean step down as in pause and don’t raise, it means step down to increments that are easier to manage, 50, 25, where you’re still moving up but you’re doing it in a way that is not so aggressive.”

- After the bell, 2s10s curve was +12.828 at -25.775 vs. -38.595 inverted low.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00572 to 3.06686% (-0.01072/wk)

- 1M +0.01314 to 3.58557% (+0.14257/wk)

- 3M +0.03386 to 4.35843% (+0.16472/wk) * / **

- 6M +0.04314 to 4.87500% (+0.18971/wk)

- 12M +0.05443 to 5.47557% (+0.19243/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.35843% on 10/21/22

- Daily Effective Fed Funds Rate: 3.08% volume: $92B

- Daily Overnight Bank Funding Rate: 3.07% volume: $267B

- Secured Overnight Financing Rate (SOFR): 3.03%, $963B

- Broad General Collateral Rate (BGCR): 3.00%, $393B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $380B

- (rate, volume levels reflect prior session)

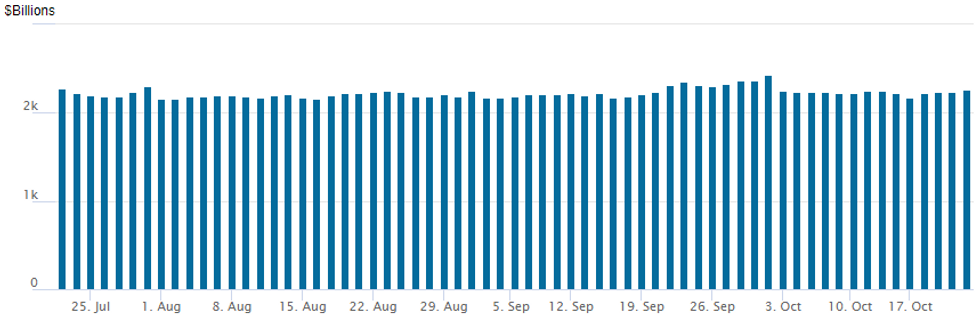

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,265.8091B w/ 100 counterparties vs. $2,234.071B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better put and put spd volume carried over from overnight trade - despite the strong rebound in 2s-10s amid speculation over a 75bps hike at year end (WSJ/Timiraos) underscored by midday comments from SF Fed Daly (FOMC needs to start considering a slowing the pace of interest rate hikes in order to avoid tightening monetary policy too much). Outright positioning for two more 75bp hikes this year with some strike roll-downs continued.- SOFR Options:

- Block, 3,000 SFRZ2 95.37/95.50/95.62/95.87 broken put condors, 3.5 ref 95.405

- Block, 10,000 SFRZ2 95.00/95.12/95.25/95.37 put condors, 5.25

- Block, 20,000 SFRH3 94.75/95.50 put spds, 40.0 ref 95.105

- Block/screen, +14,000 SFRZ2 95.75/96.00 call spds, 1.0 ref 95.385

- Block, 4,000 SFRG3 94.25/94.50/94.75 put flys, 3.0

- Block, 3,000 SFRX2 95.37/95.50/95.62 put trees, 3.0

- Block, 2,000 SFRZ2 95.31/95.43/95.56 call flys, 1.75

- Block, 10,000 SFRM3 94.75/95.00 put spds vs.

- Block, 7,000 SFRM3 95.25/95.50 put spds -- another 8,500 on screen

- Eurodollar Options:

- +4,000 EDZ2 94.62/97.75 put spds, 4.5

- 2,500 EOZ 94.12/94.62 put spds

- Treasury Options:

- +10,000 TYF 103/104 put spds, 5

- 3,000 TYZ 108.5/109.5 put spds 9 over TYZ 111.5/112.5 call spds

- 5,000 TYZ 113 calls, 13

- 3,000 TYZ 105/106.5 put spds, 8

- 2,500 FVZ 106.5 calls, 33.5 ref 105-21.75

- Block, 5,000 TYZ 107 puts, 40 ref 109-06.5

- Block, +20,000 FVZ2 105/105.75 put spds, 20.5 vs.

- Block, -10,000 FVZ 105.25/106 2x1 put spds, 24.5 cr

- 5,000 TYZ 105 puts, 16

- 3,000 TYZ 115 calls, 5

- 2,400 TYZ 114 calls, 8

- 1,500 TYZ2 107.5/109 put spds, 34

EGBs-GILTS CASH CLOSE: UK Bear Flattening On Political Uncertainty

UK yields underperformed with significant bear flattening to end the week, while Germany's curve twist flattened. In a session of limited data aside from weaker-than-expected UK retail sales, there was still a wide range of flashpoints.

- These included UK political uncertainty pushing short end Gilt yields higher, and later, a recovery in European FI following dovish repricing of Federal Reserve tightening expectations on the back of a Wall Street Journal article.

- Also of interest was a newspaper article overnight that the ECB was considering introducing a 4th policy rate for reverse repo operations, which helped swap spreads compress as repo stresses were seen easing, but the central bank later pushed back on the report.

- After hours, attention turns to the ratings agencies (in focus are S&P and Moody's reviews of their ratings for the UK), with the Conservative leadership race heating up as well.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is down 8bps at 2.041%, 5-Yr is down 3.3bps at 2.212%, 10-Yr is up 1.3bps at 2.417%, and 30-Yr is up 7.5bps at 2.442%.

- UK: The 2-Yr yield is up 21.1bps at 3.799%, 5-Yr is up 18.6bps at 4.153%, 10-Yr is up 14.1bps at 4.054%, and 30-Yr is up 10bps at 4.06%.

- Italian BTP spread down 2bps at 233bps / Spanish down 1.3bps at 111.6bps

EGB Options: Mixed German Trade, Euribor Upside In Size

Friday's Europe rates / bond options flow included:

- OEZ2 117.00/115.00 1x2 put spread bought for 23 in 2k

- RXZ2 129.00/127.50 1x1.5 put spread bought for -1 in 1k

- RXZ2 138.5/142.5/144.5 call fly bought for 57 in 4k

- ERZ2 98.00/98.125/98.25 call fly bought for 0.75 in 16k

FOREX: USD Plummets Amid Speculated Japanese FX Intervention, Fed Headlines

- The Dollar index made a new high for October at 113.94 in early trade on Friday and the initial strength was underpinned by USDJPY surging to a 32-year high of 151.95. However, some relatively dovish Fed speak, followed by speculated Japanese intervention in the currency markets sparked a steep greenback selloff, with the USD index plummeting around two percent from the day’s highs.

- WSJ reported that the Federal Reserve’s November meeting could serve as a critical staging ground for future plans, including whether and how to step down to a 50bp increment in December.

- The commentary prompted a sharp rally for the front end of the Tsys curve, in turn weighing on the greenback.

- While USDJPY had only initially dropped between 60-90 pips, the ensuing price action was extremely aggressive, prompting significant moves across the board. Over the course of around an hour, USDJPY traded from 151.50 to an intra-day low of 146.23. While there has been no official confirmation, with MOF officials declining to comment, Nikkei reports did refer to Japanese intervention in the FX market.

- The volatility reverberated across FX markets as a whole, with the USD index briefly slipping back below 112, a fresh weekly low after not long before trading at the week’s best levels.

- Approaching the close, USDJPY resides down 1.15% after bouncing back to 148.50 and is matched by a similar appreciation for AUDUSD, reflecting the strong recovery for major equity indices.

- Flash Manufacturing and Services PMIs will cross Monday. On the central bank slate, policy decisions are due from Canada, the ECB and the Bank of Japan next week.

FX: Expiries for Oct24 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9550(E1.3bln), $0.9600(E1.1bln), $0.9750(E1.3bln), $0.9800-20(E2.1bln), $0.9840-50(E1.6bln), $0.9875(E1.0bln), $0.9970-80(E1.2bln)

- USD/JPY: Y147.35-50($650mln), Y150.00($2.0bln)

- GBP/USD: $1.1445-50(Gbp509mln)

- AUD/USD: $0.6592-10(A$1.2bln)

US STOCKS: Extending Late Session Highs, Materials, Energy Outperforming

Stocks continue to extend highs after the FI close, ongoing risk-on support following the WSJ article speculating currently priced 75bp hike in Dec (also spurring strong bid short end Tsys) overdone.

- Underscoring this take: San Francisco Federal Reserve President Mary Daly said Friday the FOMC needs to start considering a slowing the pace of interest rate hikes in order to avoid tightening monetary policy too much, adding the benchmark lending rate could reach 4.5% to 5% next year.

- At the moment, Materials, Energy and Consumer Discretionary leading move in SPX eminis currently trading +82.25 (2.24%) at 3757.25; DJIA +691.07 (2.28%) at 31022.24; Nasdaq +214.9 (2%) at 10829.26.

- SPX leading/lagging sectors: Materials (+3.24%) lead by mining stocks, Energy (+2.77%) w/equipment and servicers outperforming oil and gas, Consumer Discretionary (+2.58%) edge past Financials (+2.57%). Laggers: Real Estate (+0.30%) followed by Communication Services (+0.60%) weighed by Verizon (VZ) 4.46% despite beating earnings est this morning ($1.32 vs $1.284 est), Twitter (TWTR) -4.60% and META -1.82%.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) continues to gain +13.34 at 324.15, United Health (UNH) +11.63 at 532.51, Caterpillar (CAT) +8.56 at 189.40. Laggers: American Express (AXP) -4.31 at 138.11, Verizon (VZ) -1.71 at 35.29, Intel (INTC) +0.75 at 26.85.

E-MINI S&P (Z2): Corrective Bull Cycle Still In Play Despite Pullback

- RES 4: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 3: 3923.88 50.0% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 3833.33 50-day EMA

- RES 1: 3820.00 High Oct 5 and a bull trigger

- PRICE: 3755.0 @ 1515ET Oct 21

- SUP 1: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 2: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 3: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3388.70 1.764 proj of the Aug 16 - Sep 7 - 13 price swing

Despite the latest pullback, S&P E-Minis maintain a firmer short-term tone. A bullish theme follows the reversal from 3502.00, the Oct 13 low. The recovery suggests the contract has entered a corrective phase and if correct, this is allowing an oversold trend condition to unwind. Attention is on resistance at 3820.00, the Oct 5 high and a bull trigger. Key support is unchanged at 3502.00. Initial support is at 3590.50, the Oct 17 low.

COMMODITIES: Oil Mixed Whilst Gold Rebounds On Fed Stepdown Talk

- Crude oil is ending a mixed week with a volatile session but one that ultimately sees relatively little change on the day, while gas sees heavy declines on signs of optimism that Europe will make it through the winter along with seasonally warm temperature’s limiting heating demand.

- Latest on oil, US officials may aim to set a price cap for Russian oil exports above $60/bbl, a higher level than earlier signaled, Schlumberger shares soared after its best profit in seven years whilst raising guidance for 4Q22 and Saudi's energy minister held talks with counterparts from China and India to strengthen cooperation.

- WTI is +0.3% at $84.74 having not tested resistance at $87.14 (Oct 20 high) nor support at $81.30 (Oct 18 low).

- Brent is +0.8% at $93.1 having not tested resistance at $95.17 (Oct 12 high) nor support at $88.67 (61.8% retrace of Sep 26 – Oct 10 rally).

- Gold is +1.5% at $1652.30, having come close to the bear trigger at $1615.0 (Sep 28 low) before surging back on US dollar weakness and yields rallying on relatively more dovish Fed commentary. It stops short of resistance at the 20-day EMA of $1665.7.

- Weekly moves: WTI -1.1%, Brent +1.7%, Gold +0.5%, US nat gas -23%, EU TTF nat gas -20%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.