-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Implied Hike Steady: 25.9Bp Pre-FOMC

HIGHLIGHTS

- MNI US: House Of Representatives Passes SPR "Protest" Bill

- MNI US-CHINA: US, Japan, Netherlands Close In On Export Controls Deal

- Summers Urges Fed to Avoid Pledging Rate Hikes After Next Week, Bbg

- BOEING TO HIRE 10,000 WORKERS THIS YEAR; ADDED 15,000 IN 2022, Bbg

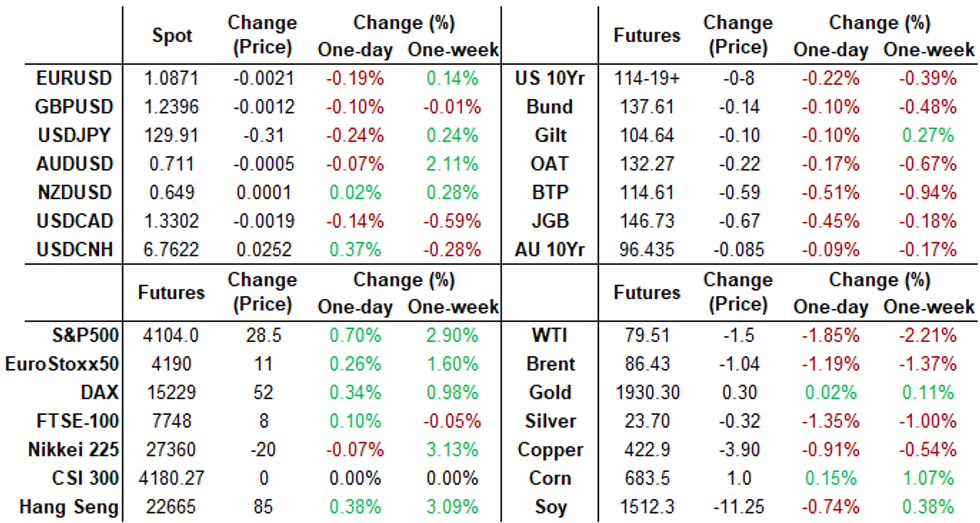

US TSYS: Late Tsy Roundup: Implied Hike Steady at 25.9Bp Ahead Wed FOMC

- Tsys mildly weaker after the bell, well off late morning lows to near middle of range through early overnight trade. Tsy 30YY currently 3.6306 -.0091, vs. 3.6845% high)

- Higher than expected Japanese CPI data overnight (+4.4% Y/Y; MEDIAN 4.0%; Dec 3.9%) got the ball rolling overnight, Tsys extending lows ahead the NY open.

- Tsys see-sawed off lows drawing modest buying in intermediates to long end after largely in-line data: personal income +0.2%; NOM PCE -0.2%, modest lower revision to prior. Little react to midmorning Pending Home Sales (+2.5% MOM; -33.8% YOY) and UofM sentiment 64.9; est. 64.6.

- Fed funds implied hike for Feb'23 at 25.9bp (-0.7), Mar'23 cumulative at 46.4bp (-0.5) to 4.793%, May'23 56.9bp (+.1) to 4.898%, terminal at 4.905% in Jun'23.

- Focus on next week Wed's FOMC policy annc, dovish risks to this meeting appear at least partly priced in, including some expectations of Statement language acknowledging decelerating inflation, or a clear signal that the end of the hiking cycle is near.

- Next employment report covering January out next Friday as well, current median est at +175k vs. +223k prior..

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 to 4.30471% (-0.000043/wk)

- 1M +0.02242 to 4.56971% (+0.04643/wk)

- 3M +0.02286 to 4.82529% (+0.00972/wk)*/**

- 6M +0.00000 to 5.10229% (+0.00029/wk)

- 12M +0.01529 to 5.31614% (-0.03114/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $113B

- Daily Overnight Bank Funding Rate: 4.32% volume: $302B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.165T

- Broad General Collateral Rate (BGCR): 4.27%, $473B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $455B

- (rate, volume levels reflect prior session)

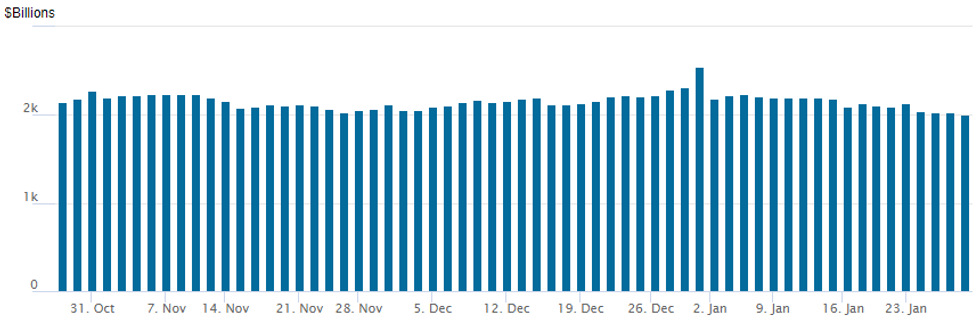

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,003.634B w/ 96 counterparties vs. prior session's $2,024.069B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Low delta put and put spreads reported Friday, lighter volumes ahead the weekend. Underlying futures weaker but well off early session lows, cautious hedging ahead next Wednesday's FOMC policy anns.- SOFR Options:

- Block, total 30,000 SFRM3 96.00/EDM3 95.87 call spds, 0.0

- Block, 9,000 OQM3 95.50 puts, 5.0 vs. 96.50/0.10%

- over +10,000 SFRK3 94.75/94.87 5x4 put spds, 3.25 (active strikes after paper bought SFRK3 94.75/95.00 2x1 put spds and 94.75/94.87/95.00 put flys over last week; OI 57/686 in 94.75 put, 110,324 in 94.87 put)

- 2,000 SFRZ3 96.50/97.00/97.50/98.00 call condors ref 95.59

- Block/screen, 10,000 OQH3 95.62/95.87 put spds, 6.0-6.5 ref 96.085 -.08

- 5,000 SFRM4 98.25/98.50 call spds, ref 96.555

- Eurodollar Options:

- 10,000 EDM3 94.75 puts, 5.5 ref 94.92

- Treasury Options:

- 3,500 TYH3 114/117 call spds ref 114-15.5

- over 13,000 TYG 115 puts, 39-37

- 10,000 TUH3 102.25 puts, 4 ref 102-27

- over 6,000 FVH 109 puts, 27.5-29.5 ref 109-10.25 -10

EGBs-GILTS CASH CLOSE: Modest Steepening Ahead Of A Big Week

European curves steepened modestly to end the week, with periphery EGB spreads widening in anticipation of next week's data- and central bank-heavy schedule.

- 10s outperformed on the UK curve, though 30s underperformance meant the curve bear steepened overall; the German curve twist steepened with 2Y yields dipping.

- BTPs underperformed alongside a tick higher in terminal ECB hike expectations +2bp to 143bp), in preparation for next Thursday's decision.

- With limited data on the European docket, attention was on the US personal income/spending release which was in line with expectations and not a market mover. Likewise, no central bank speakers of note ahead of next week's key decisions, including the Federal Reserve, BoE and ECB.

- Next week we also get heavy EGB supply and flash January eurozone inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at 2.58%, 5-Yr is up 2bps at 2.258%, 10-Yr is up 2.3bps at 2.239%, and 30-Yr is up 1.4bps at 2.195%.

- UK: The 2-Yr yield is up 1bps at 3.474%, 5-Yr is up 0.9bps at 3.201%, 10-Yr is up 0.6bps at 3.323%, and 30-Yr is up 1.9bps at 3.681%.

- Italian BTP spread up 3.9bps at 185.8bps / Spanish up 1.8bps at 98.7bps

EGB Options: Some Euribor Downside Ahead Of Next Week's ECB

Friday's Europe rates / bond options flow included:

- RXH3 136.50/134.50/133.50p fly, sold at 44 in 2k

- DUH3 106.20c sold at 7.5 in 5k

- ERG3 97.00p, bought for 2.75 in 3.75k

- ERM3 96.25/96.62/96.75 broken put ladders bought for 2.75 in 10k

- ERM3 96.50/96.25ps vs 0RM3 96.875/96.625ps, bought the front for -1 and -0.75 in 20k

FOREX: G10 FX Little Changed Ahead of Busy Central Bank Week

- Major currencies remain close to unchanged for Friday, as markets digest the end of the Lunar New Year holiday in China and contemplate the Federal Reserve’s first monetary policy decision next week.

- The greenback spent the day trading in moderately firmer territory with a noted uptick approaching the WMR fix for value-date month end. However, the USD gradually faded approaching the close, leaving the USD index very close to last Friday’s close but still within close proximity to most recent trend lows.

- G10 majors were mixed with the Euro moderately lower and the JPY slightly firmer on the session. For now, EUR/USD remains in a broader uptrend, with Thursday's 1.0929 print highlighting the upside bias. Key short-term support levels remain intact and note that moving average studies continue to highlight positive market sentiment. The next objective is 1.0954, the Apr 11, 2022 high.

- Focus clearly on the FOMC next week where the Fed are expected to downshift its rate hike pace in February for the second consecutive meeting, to 25bp from 50bp. The dovish risks to this meeting appear at least partly priced in, including some expectations of statement language acknowledging decelerating inflation, or a clear signal that the end of the hiking cycle is near.

- As well as the Fed, we have the BOE and ECB rate decisions next week which will be followed up by Friday’s release of US non-farm payrolls.

FX: Expiries for Jan30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E581mln), $1.0950(E783mln), $1.1315(E529mln)

- USD/JPY: Y130.00($785mln), Y131.40($1.3bln), Y133.50($801mln)

- USD/CAD: C$1.3400($841mln)

Late Equity Roundup: Extending Rally, Tesla Lifts Autos

Major indexes continued to extend modest gains in late Friday trade, Consumer Discretionary and Communication Services sectors continue to lead. SPX eminis currently trades +26 (0.64%) at 4101.5; DJIA +150.43 (0.44%) at 34099.35; Nasdaq +156.1 (1.4%) at 11668.48.

- SPX leading/lagging sectors: Consumer Discretionary (+2.68%) lead by auto maker Tesla for a second day: +11.71% after positive midweek earnings, strong guidance and price target upgrades (Wedbush and Cowen). GM (+4.30%) and F (+3.51%) up as well. Communication Services (+1.27%) lead by interactive media and entertainment (Meta +3.4%, Google +2.30%).

- Laggers: Energy (-1.54%) weighed by oil and gas refiners (CVX -4.17% after disappointing earnings $4.09 EPS vs $4.27 est), followed by Health Care (-0.60%) managed health care providers underperforming (HUM -3.41%, ELV -2.05%, CAH -1.81%).

- Dow Industrials Leaders/Laggers: Despite missing earnings est ($2.07 vs. $2.22) American Express (AXP) has surged over 10% (+17.54 at 173.42) on dividend increase. Visa (V) +6.88 at 231.59, Caterpillar (CAT) +3.52 at 265.64.

- Laggers: Chevron (CVX) -7.94 at 179.85, United Health (UNH) -4.12 at 488.36, Travelers (TRV) -3.06 at 189.05.

E-MINI S&P (H3): Bull Cycle Extends

- RES 4: 4250.00 High Aug 26, 2022

- RES 3: 4194.25 High Sep 13

- RES 2: 4180.00 High Dec 13 and the bull trigger

- RES 1: 4103.00 Intraday high

- PRICE: 4102.00 @ 1500ET Jan 27

- SUP 1: 3949.56 50-day EMA

- SUP 2: 3901.75/3891.50 Low Jan 19 / Low Jan 10

- SUP 3: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 4: 3735.00 Low Nov 3

S&P E-Minis have traded higher again today and confirmed a resumption of the current uptrend. The breach of resistance has exposed the 4100.00 handle. Further out, an extension higher would open 4180.00, the Dec 13 high and a bull trigger. Initial firm support has been defined at 3949.56, the 50-day EMA. A move below the average would be seen as a bearish development and signal a short-term reversal.

COMMODITIES: Crude Futures Continue Slide, WTI Hits Fresh Weekly Lows

- While crude futures had been easing back from earlier gains during the US session, downside momentum has picked up in recent trade.

- WTI, now down 1.7%, led the move and briefly printed a fresh low for the week of $79.07. Analysts have pointed out that the reversal may have been exacerbated following an inability to sustain a break above the 100-day moving average (intersects ~$82), a tech level that has capped the topside this week.

- The market continues to weigh recession concerns with demand uncertainty from China and potential Russian supply disruption with sanctions due to start of 5 Feb.

- It is also worth reiterating that OPEC+ delegates expect the JMMC advisory committee to keep oil production levels unchanged when they meet on 1 Feb next week according to Reuters earlier this week. With the date coinciding with the February FOMC decision and the close proximity to month-end, profit taking dynamics could well have been in play ahead of the weekend close.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/01/2023 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2023 | 1000/1100 | ** |  | IT | PPI |

| 30/01/2023 | 1000/1100 |  | EU | Consumer / Economic Confidence Indicators | |

| 30/01/2023 | 1500/1000 |  | US | Treasury Quarterly Financing Estimates | |

| 30/01/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.