-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

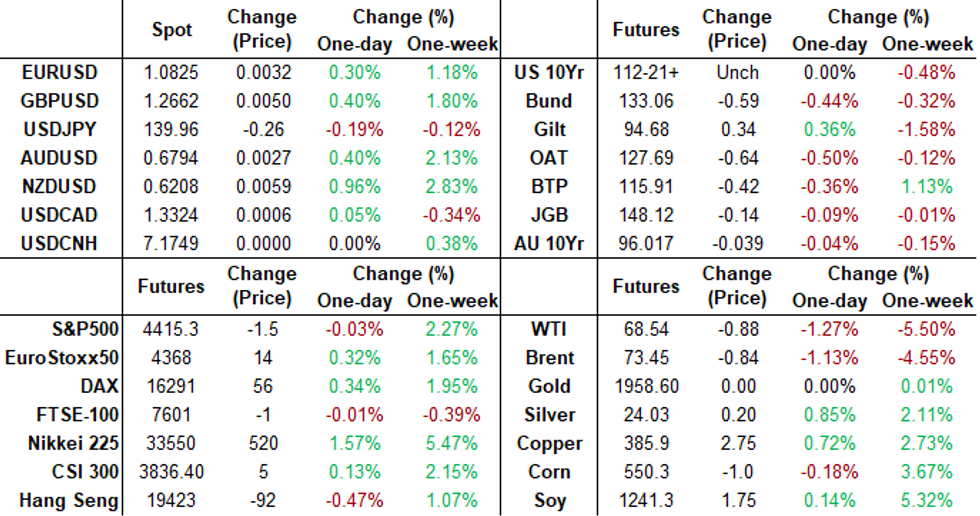

Free AccessMNI ASIA MARKETS ANALYSIS: "July is Live" Fed Chairman Powell

- MNI: FED HOLDS RATES UNCHANGED AT 5%-5.25%; VOTE 11-0

- POWELL: PROCESS OF GETTING TO 2% INFLATION HAS LONG WAY TO GO

- BLINKEN TO VISIT CHINA, UK JUNE 16-21, US STATE DEPARTMENT SAYS, Bbg

- U.S. Resumes Diplomacy With Iran on Prisoners, Nuclear Issues .. Officials Say U.S, Iran Exploring Understanding to Cool Tensions -- Sources, WSJ

Key Links:MNI: Fed Holds Rates Steady But Points To Likely Future Hikes / FED: Statement Changes: Looking For Time To Assess / MNI US Inflation Insight, Jun'23: Core CPI Accelerates But Some Better Details / MNI BRIEF: BOE To Formally Review Its Forecasting Processes / MNI INTERVIEW:ECB Dilemma As German Inflation Outruns Eurozone

US TSYS: Late Markets Roundup: July is Live

- Treasury futures are holding firmer for the most part, just off pre-FOMC levels with the short end underperforming after the Fed kept rates steady, as expected. But hawkish forward guidance with 12 of 18 Fed officials expecting another 50bp later this year saw futures gap lower. Chairman Powell: July is Live.

- The unexpected guidance weighed heavily on the short end, curves flattening sharply (2s10s fell to -95.800, lowest since March 10s when the spread inverted to the lowest level since the early 80s.

- The decision comes against the backdrop of an inflation picture that has been improving but is still a far cry from the central bank's official 2% target. CPI inflation slipped to a two-year low of 4.0% in May but core inflation remained quite elevated at 5.3%.

- Treasury futures extended highs this morning after lower than expected PPI (-0.3% vs. -0.1% est; YoY flat vs +1.5% est).

- STIR: July hike: +16bp having sat at +18.5bp after the announcement, back at the +16bp cumulative pre-decision. Terminal: 5.29% in Sep (and 5.28% in Nov), vs 5.32% held after announcement vs 5.25% pre-decision

- Cuts from terminal to year-end: near unchanged on presser, currently at 8bps vs 15bps pre-decision for a rate that’s 13bps higher than the current effective of 5.08%.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.04511 to 5.10188 (-.03682/wk)

- 3M -0.03621 to 5.21811 (-.03127/wk)

- 6M -0.02769 to 5.26695 (-.01916/wk)

- 12M -0.00589 to 5.15284 (+.00467/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00343 to 5.06543%

- 1M -0.03515 to 5.15814%

- 3M -0.04357 to 5.50843 */**

- 6M +0.00100 to 5.65143%

- 12M +0.01543 to 5.81886%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

- Daily Effective Fed Funds Rate: 5.08% volume: $131B

- Daily Overnight Bank Funding Rate: 5.06% volume: $291B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.375T

- Broad General Collateral Rate (BGCR): 5.03%, $620B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $611B

- (rate, volume levels reflect prior session)

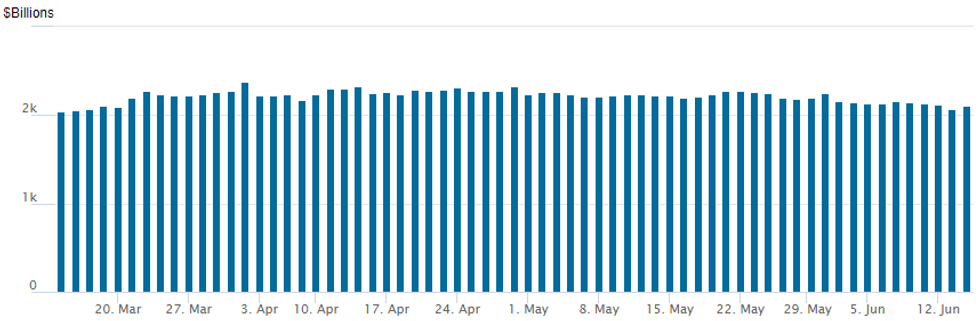

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,109.105B w/ 106 counterparties, compared to $2,074.520B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Fading the hawkish forward guidance (12 of 18 Fed officials see another 50bp in hikes this year) reported option flow segued to better upside call buying in the second half. Salient trade was a sclae buyer of over 100,000 Dec'23 SOFR 96.50 calls from 6.0-7.5 in the second half, underlying futures 94.78 to -.77 on 10% delta.

Better put volume in SOFR options overnight, nearly all in June ahead today's FOMC annc (pause expected with a hawkish tone for forward guidance), June lead quarterly and midcurve options expire Friday. Treasury options mixed but on very light volumes.

- SOFR Options:

- Block/screen, +100,000 SFRZ3 96.50 calls, from 6.0-7.5 vs. 94.78 to -.77/0.10%

- +10,000 SFRU3 98.50 calls, 0.75 ref 94.755

- +6,000 SFRQ3 94.75/95.12 call spds, 8

- Block, +5,000 SFRM4 95.75 calls, 58.5 vs. 95.69/0.50% vs.

- Block, -5,000 OQM4 96.75 calls, 54.0 vs. 96.66/0.25%

- 4,750 OQM3 95.50 puts, 3.5 ref 95.68

- 1,500 SFRN3 94.81/94.93/95.00/95.12 put condors

- 2,000 SFRZ3 94.31 puts, 8.5 ref 94.895

- 28,000 OQM3 94.56 puts, 0.5 ref 95.65

- 2,000 OQM3 95.00/95.25/95.50 put flys ref 95.65

- Block/screen, 4,900 SFRM3 94.75/94.81/94.88/94.93 put condors, 3.5

- 6,000 OQM3 94.81 puts, .25

- 5,000 SFRM3 94.68/94.75/94.81 put flys

- 5,000 SFRM3 94.50/94.56/94.62 1x1x2 put trees ref 99.7725 to -.775

- Treasury Options:

- 2,500 TYN3 111.5/112.5 put spds 2 over TYN 114 calls

- 3,000 TYN3 112.25/112.75 put spds, 10 ref 113-02

- over 17,500 TUU3 100.5/102 put spds, 3 over TUU3 103 calls

- Block, +12,000 wk3 TY 112.25 puts, 7 ref 113-01.5

- 5,500 TYU3 109 puts, 21 ref 113-03

- over 5,800 TYQ3 114.5 calls, 30 last ref 113-04

- over 3.300 TYN3 114.5 calls, 7 last ref 113-03

- 1,000 USN3 123/125 put spds, 13 ref 126-22

- 1,000 FVN 106/107 put spds vs. 107/108 call spds ref 107-29.5

- over 8,200 TYN3 112 puts, 14-15 ref 112-27

- Block/screen, 9,000 FVQ3 109.5 calls, 14.5 ref 107-29.25

EGBs-GILTS CASH CLOSE: Gilts Only Partially Recover

Tuesday's Gilt selloff partially reversed Wednesday as UK yields fell led by the short-end. The German curve bear flattened ahead of Thursday's ECB decision.

- UK yields traded with more directional (downward) impetus than German counterparts, which weakened on the day but lacked clear direction.

- Even with a 7bp decline in yields (UK Apr GDP was a little softer than expected), with a fairly strong last hour of trade, 2Y Gilts sit 18bp higher than Monday's open.

- Periphery spreads likewise gave back some of Tuesday's tightening vs Bunds. Greek spreads widened for the 3rd straight session following the lack of ratings action from Fitch last Friday.

- BoE terminal hike pricing pulled back 7bp on the day, with ECB +2bp.

- Attention turns to the Federal Reserve decision after hours (no change in rates expected), with the ECB waiting in the wings Thursday (to hike rates by 25bp and confirm previous decision to end APP reinvestments in July - our preview is here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.2bps at 3.016%, 5-Yr is up 3.2bps at 2.507%, 10-Yr is up 2.9bps at 2.452%, and 30-Yr is up 2bps at 2.584%.

- UK: The 2-Yr yield is down 7.5bps at 4.822%, 5-Yr is down 5.6bps at 4.472%, 10-Yr is down 4.2bps at 4.392%, and 30-Yr is down 5.6bps at 4.559%.

- Italian BTP spread up 0.4bps at 163.6bps / Greek up 2.9bps at 131.3bps

EGB Options: Euro Rates See Large Call Spread Sales Pre-ECB, With UK Downside Eyed

Wednesday's Europe rates / bond options flow included:

- RXN3 135.5/136cs, bought for 8 in 6.3k.

- ERV3 96.00/95.75 1x2 put spread bought for 0.75 in 2k (bought the 1)

- ERZ3 96.375/96.50cs vs 95.75/95.625ps, bought the cs for 1.75 in 3k

- ERH4 98.00/99.00cs sold at 2.75 in 50k

- ERM4 98.00/99.00cs sold at 5 in 20k

- SFIN3 94.35/94.20ps vs SFIN3 94.80/95.05cs, bought the ps for 1 in 3k

- SFIU3 94.80c sold at 11 in 6k (ref 94.50)

FOREX: Hawkish Fed Projections Unable To Curtail Overall Greenback Weakness

- The greenback weakened steadily throughout Wednesday in the lead up to the June FOMC decision. The sell-off had been exacerbated by the USD index breaching its 100-day moving average with initially buoyant global equity benchmarks underpinning the rally for other G10 currencies with particular outperformance amid high beta currencies such as AUD & NZD.

- A surprisingly hawkish set of Fed projections to accompany the unchanged decision on rates boosted the greenback and saw the USD index recover the majority of these losses in the immediate aftermath.

- However, with Chair Powell dismissing the ‘skip’ thesis and declaring that each meeting will be live going forward, the USD’s renewed support waned. As we approach the APAC crossover, the DXY sits around 0.25% lower on the session with antipodeans continuing to outperform.

- GBPUSD has also posted a 0.4% advance, extending on an impressive rally Tuesday. Cable did pierce a key resistance point at 1.2680, the May 10 high. The next objective for the rally comes in at 1.2759, the 61.8% retracement of the Jun - Sep bear leg.

- In emerging markets, local currencies have benefitted from the greenback weakness and the consolidation of strength for major equity benchmarks. ZAR and PLN were standout performers as well as MXN and BRL continuing their impressive recent runs higher.

- With the Fed out of the way, the central bank focus turns to Europe, with Thursday’s ECB meeting expecting rates to be increased by 25bps. On the data front, New Zealand GDP and Australia employment kick off the APAC docket, before China releases a host of production/activity data. US retail sales, Philly Fed and initial jobless claims will also hit the wires.

FG Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0830-35(E944mln), $1.0875(E634mln)

- USD/JPY: Y138.90-00($794mln), Y140.00($550mln)

- USD/CAD: C$1.2850($1.0bln), C$1.3180-00($790mln)

Late Equity Roundup: Well Off Post FOMC Lows

- Stocks reversed course traded mildly weaker after the Fed held rates steady (5-5.25%) while 12 of 18 officials expect two additional hikes sometime this year. Chairman Powell's press conference had a moderating effect on initial moves with stocks rebounding to pre-FOMC levels after rates closed.

- Currently, S&P E-Mini future are down 0.25 points (-0.01%) at 4416.25, Nasdaq up 25.8 points (0.2%) at 13600.6, DJIA down 225.05 points (-0.66%) at 33988.78.

- Leading gainers: Information Technology and Consumer Staples sectors outperformed, led by semiconductor shares: Intel +4.25%, Nvidia +3.5%, AMD +2.15% as companies continued to focus on AI-tied demand. Consumer Staples led by retailers: Target +4.2%, Dollar Tree +1.5%, Kroger +1.5%.

- Laggers: Health Care and Energy sectors continued to underperform, pharmaceuticals and biotech shares outperforming health care equipment makers. Meanwhile, nnergy stocks sagged with crude reversing early gains (WTI at 68.40 vs 70.47 high).

- For a technical perspective, S&P futures continued gains confirm a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on a climb towards 4452.42, a Fibonacci projection. Firm support is at 4292.26, the 20-day EMA. Initial support is at 4348.75, the Jun 5 high.

E-MINI S&P TECHS: (U3) Bullish Extension

- RES 4: 4492.25 2.00 projection of the May 4 - 19 - 24 price swing

- RES 3: 4485.18 Channel top from the Oct ‘22 low (cont)

- RES 2: 4452.42 1.764 projection of the May 4 - 19 - 24 price swing

- RES 1: 4431.50 Intraday high

- PRICE: 4417.00 @ 1535 ET Jun 14

- SUP 1: 4348.75/4292.26 High Jun 5 / 20-day EMA

- SUP 2: 4225.03 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

S&P E-minis traded higher Tuesday and the contract is firmer today. The move confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on a climb towards 4452.42, a Fibonacci projection. Firm support is at 4292.26, the 20-day EMA. Initial support is at 4348.75, the Jun 5 high.

COMMODITIES: Hawkish FOMC Rhetoric Takes The Wind Out Of Oil, Gold

- Crude Oil has slipped circa 1% today, with declines starting ahead of EIA inventories data that unwound gains through the European session, continuing to trend lower after some volatility on the release and then with a further tilt lower on hawkish FOMC projections.

- There was a larger than expected build in crude stocks, whilst diesel crack spreads fell back from earlier gains after a drop in implied demand. The crude build was driven by a large fall in refinery utilisation and despite higher exports with another large increase in the unaccounted oil adjustment. Cushing stocks were the highest since June 2021 after another build this week. The fall in refinery utilisation reflects outages in the week as well as the 240kbpd inclusion of the new Beaumont crude unit.

- WTI is -1.1% at $68.41 having lifted circa $50 cents off post-FOMC lows but doesn’t trouble support at $66.80 (Jun 12 low).

- Brent is -1.0% at $73.53 after a similar bounce to WTI and again, doesn’t trouble support at $71.50 (May 31 low).

- Gold is +0.1% at $1944.7 after a mixed session with a paring of post-PPI gains after the FOMC decision saw an increase in front end Treasury yields and some trimming of earlier USD weakness. It remains above support at $1932.2 (May 31 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/06/2023 | 2350/0850 | ** |  | JP | Trade |

| 15/06/2023 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 15/06/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/06/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/06/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/06/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/06/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/06/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 15/06/2023 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 15/06/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 15/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 15/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/06/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/06/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/06/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/06/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/06/2023 | 1245/1445 |  | EU | Post-Meeting ECB Press Conference | |

| 15/06/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/06/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/06/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/06/2023 | 1535/1635 |  | UK | BOE Cunliffe at Politico Global Tech Summit | |

| 15/06/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.