-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI ASIA MARKETS ANALYSIS: Late Equity Slump Takes The Headlines

HIGHLIGHTS

- A late slump in US equity indices headlines the US session, with S&P declines accelerating into the close for the largest decline since late September. It appeared to start with program selling/late profit taking that then saw momentum pick-up with spillover to broader FI and FX.

- Treasuries, already biased richer by notably softer than expected UK CPI overnight, were belatedly driven to fresh highs, having proven unwilling to cheapen for long after back of stronger than expected data and the largest tail for a 20Y auction this year.

- The equity slide saw a modest USD bid, with GBP bottom of G10 FX owing to its soft CPI.

- Final US GDP reading for Q3 will cross tomorrow, along with core PCE price index data, Philly Fed manufacturing and jobless claims figures. Canadian retail sales data is also scheduled.

US TSYS: Treasuries Touch Session Highs With Equity Drop, Three Cuts Priced For June

- Cash Tsys trade 6-9.5bp richer, led by 2s as has been the case through the day.

- There have been various stages to today’s rally. An overnight bid was accelerated by spillover from notably softer than expected UK CPI, and whilst beats for existing home sales and Conf. Board consumer confidence prompted cheapening it didn’t last long. The same can be said for the modest sell-off seen after the largest tail for a 20Y auction this year, before the late session slide in equities belatedly fed through to Treasuries.

- It’s seen TYH4 recently touch a fresh high of 112-30+ (+ 16+), pushing through resistance at 112-28+ after which lies 113-12+ (both Fibo projection points).

- Fed Funds implied rates have also slipped, modestly for near-term meeting with the 22bp of cumulative cuts for March similar to levels at the start of the US session, but more notably beyond with now a cumulative 75bp for June and 155bp for end-2024.

- Tomorrow sees jobless claims, with initial for a payrolls reference week, plus the third revision for Q3 GDP before Friday’s monthly PCE report, durable goods and the finalized U.Mich consumer survey.

EGBs-GILTS CASH CLOSE: Front-End UK Yields Collapse On Weak CPI

Front-end UK yields collapsed Wednesday after a soft inflation print opened the door to earlier and deeper BoE cuts, with core/semi-core EGBs also strengthening.

- With UK November core inflation coming in 0.5pp lower than expected (5.1% Y/Y) and the key Services category missing by 0.3pp(6.3%), 2Y UK yields fell upwards of 19bp at the early low, before ticking a little higher over the session. The UK curve bull steepened on the day.

- With little else in the way of impactful data or newsflow, the Gilt move set the tone for the global core FI rally to continue, with German yields down 4-5bp across the curve.

- EGB periphery instruments were mixed, with GGBs outperforming.

- ECB's Knot said 1H 2024 rate cuts were "rather unlikely"; both he, and a presentation by ECB's Lane, noted the importance of wages to the inflationary outlook.

- There are no further scheduled ECB/BoE speakers this year, but UK data remaining includes public sector finances (Thursday), and retail sales/Q3 GDP (Friday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4bps at 2.473%, 5-Yr is down 4.6bps at 1.954%, 10-Yr is down 4.5bps at 1.971%, and 30-Yr is down 5.3bps at 2.152%.

- UK: The 2-Yr yield is down 17.8bps at 4.115%, 5-Yr is down 16.7bps at 3.509%, 10-Yr is down 12.4bps at 3.528%, and 30-Yr is down 8.3bps at 4.069%.

- Italian BTP spread up 0.7bps at 162.2bps / Greek down 2.9bps at 110.2bps

EU STIR: Weak CPI Adds Nearly A Full Cut To 2024 BoE Path; ECB Dovishness Extends

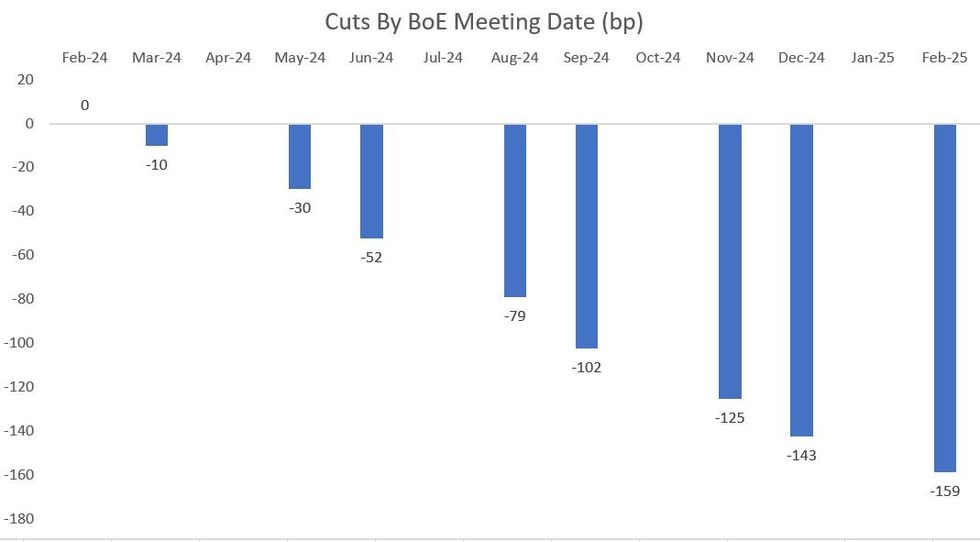

BoE rate cut pricing for 2024 extended by nearly a full 25bp reduction Wednesday, after the November UK CPI report showed much softer inflation pressures than expected.

- The current implied BoE rate path shows 143bp of 2024 cuts implied - that's up from 121bp Tuesday. The first full implied cut has been moved up by one meeting to May, with two reductions now fully priced by June, three by August, four by September, and five by November - with nearly a sixth through December.

- ECB cut pricing extended as well in sympathy with UK developments, but the move wasn't as extreme - 9bp more reductions now seen in 2024 vs Tuesday's pricing.

- There's 164bp of 2024 reductions now seen, with the first full cut by April, two (and nearly three) through June, four through July, Five through September, five (and nearly 6) through October, and 6 and a half 25bp reductions through December.

FOREX: Equity Weakness Underpins Moderate USD Bid, GBP Consolidates Post-CPI Decline

- Sterling remains the weakest G10 currency, holding the vast majority of the post-CPI losses, after inflation slowed markedly faster than forecast in November. Core CPI posted a 0.6ppts drop to hit a new post-COVID low of 5.1%. Monday's lows of 1.2629 provided firm support on the session and remains the notable downside level for the pair. GBPUSD 0.66% decline is reflecting the retracement in yields across both STIR and Gilt markets, with BoE rate cut pricing for 2024 extending by nearly a full 25bp reduction Wednesday.

- Despite a bounce for the broad dollar index across European hours, gains were moderated throughout the US session, with overall G10 ranges remaining contained amid a lack of tier-one data and as we approach the holiday season. Some late pressure for equities is underpinning the advance for the DXY (+0.26%) as we approach the APAC crossover.

- This late pressure on stocks has seen AUDUSD slip to the worst levels of the session, down 0.32%, however the uptrend for the pair remains firmly intact and Tuesday’s gains reinforced current conditions. This marks an extension of last week’s move higher and the break of resistance at 0.6691, the Dec 4 high and a bull trigger. Overall, scope is seen for a climb for a climb towards the 0.6800 handle and 0.6821, the Jul 27 high.

- JPY had initially been the firmest currency in G10, reversing a good chunk of yesterday's post-BoJ weakness. USDJPY printed a session low of 143.27, after peaking on Tuesday at 144.96. A lack of momentum and the slightly more optimistic feel for the dollar, prompted a gradual recovery to 143.90 at typing.

- Final US GDP reading for Q3 will cross tomorrow, along with core PCE price index data, Philly Fed manufacturing and jobless claims figures. Canadian retail sales data is also scheduled.

Larger FX Option Pipeline

- EUR/USD: Dec22 $1.0945-60(E1.7bln)

- USD/JPY: Dec22 Y143.00($1.1bln), Y143.50-55($1.2bln), Y144.00($1.2bln), Y144.45-50($1.4bln), Y145.00($2.7bln)

- AUD/USD: Dec22 $0.6650(A$1.7bln), $0.6775(A$1.3bln)

- USD/CAD: Dec22 C$1.3500($1.3bln)

US FI OPTIONS: Wednesday Options Summary

Wednesday's US rates/bond options flow included:

- SFIM4 95.60/95.80cs vs 94.95/94.75ps, bought the cs for 3 in 5k

- SFRF4 94.75/95.25/95.75c fly sold at 15 in 4k

- SFRF4 94.56/94.81cs sold at 23.5 in 20k total

- SFRF4 94.68/94.75/94.81/94.87c condor, traded half and 0.75 in 3k

- SFRG4 94.87/94.75ps 1x2 traded 2.25 in 2k

- SFRH4 94.68/94.62/94.56p fly traded half in 2k

- SFRH494.75/94.68/94.62p ladder traded for half in 5k

- SFRM4 95.37/95.62cs traded 9.5 in 4k

- SFRM4 95.50/95.62/95.75/95.87c condor traded 1 in 3k

- SFRM4 95.50^ vs 2QM4 96.75^ spread traded 13.5 for the 2yr mid in 5k

- SFRM4 96.12c traded 12 in 4k.

- SFRU4 96.50/98.00cs vs 2QU4 9700.97.37cs, bought the front for 5.75 and 6 in 5k

- SFRM4 95.00/95.25/95.50/95.75c condor, sold at 9 in 5k

EU FI OPTIONS: Bullish UK Rate Trades Feature Post-CPI Wednesday

Wednesday's Europe rates/bond options flow included:

- SFIH4 95.05/95.15cs vs 94.80/94.70ps bought the cs for 1.5 in 6k

- SFIH4 95.05/95.30/95.55c fly, bought for 3.5 in 5k

- SFIM4 95.50/95.70cs vs 95.00p bought the cs for -3 in 2k

- SFIM4 95.60/95.80cs vs 94.95/94.75ps bought the cs for 3 in 5k

- SFIM4 95.70/95.90/96.10c fly bought for 1.75 in 2k

- SFIU4 96.10/96.30cs vs 94.95/94.75ps bought cs for 4.5-4.75 in 8k

- SFIZ4 96.50/96.70cs vs 95.20/95.00ps bought cs for 4.5 and 5 in 9k

- ERH4/ERZ4 99.25/100.00cs 1x2 strip sold at half in 4.5k

- DUH4 106.40/106.00ps vs 106.60c, bought the ps for -9 (receive) in 20k

US STOCKS: Late Equity Rout Sees Worst Day Since October For S&P 500

- The late equity rout across indices appears to have slowed, after modest selling pressure, perhaps on late profit taking, snowballed into the largest sell program since Jul and before that Mar 9.

- It’s seen ESH4 touch a low of 4671.0 after a session high of 4830.75 marked a further clearing of prior resistance and a move closer to 4854.75 (Fibo projection of Nov -Dec price swings).

- Across the main e-minis, the S&P 500 trades -1.1%, Nasdaq 100 -1.3%, Dow -0.9% and Russell 2000 -1.4%, with the latter seeing a swift reversal from earlier outperformance.

- Within cash S&P 500, losses are seen across all sectors, led by consumer staples (-1.7%), consumer discretionary (-1.5%) plus utilities, financials, IT and industrials all with -1.3% declines. Communication services (unch) are the outperformers, relatively buoyed by still large gains for Alphabet (+1.7%) who have pared gains but still benefit from a reported restructuring of their ad sales unit.

- The NDX has seen a strong pullback off fresh record highs of 16860.68 notched an hour after the open, currently 280pts off those levels. SPX never managed to re-touch the 2022 highs of 4818.62 earlier, peaking at 4778.01.

S&P 500 e-miniSource: Bloomberg

S&P 500 e-miniSource: Bloomberg

COMMODITIES: Crude Reverses Gains After Stock Build And Late Equity Slide

- Crude markets are approaching US close unchanged to down slightly. Red Sea shipping risks buoyed prices, but an unexpected build in weekly EIA crude inventories trimmed earlier gains before spillover from a sharp rolling over in equity indices late in the session.

- Yemen’s Houthi rebels have vowed to continue targeting ships in the Red Sea despite the planned US-led naval task force to secure the area, according to Bloomberg.

- EIA Weekly US Petroleum Summary - w/w change week ending Dec 15: Crude stocks +2,909 vs Exp -2,355, Crude production +200, SPR stocks +629, Cushing stocks +1,686

- The US will tighten enforcement of the price cap on Russian oil exports, a senior US Treasury Official said Dec. 20, cited by Bloomberg.

- WTI is -0.1% at $73.84 after an earlier high of $75.33 cleared resistance at $74.61 (Dec 18 high) and moved closer to $76.14 (50-day EMA).

- Brent is unch at $79.26 after a high of $80.57 cleared the Dec 18 high of $79.67 and stopped fractionally shy of resistance at $80.59 $50-day EMA).

- Gold is -0.3% at $2033.7, fading with late USD strength. It doesn’t trouble resistance at $2054.3 (50% retrace of Dec 4-13 bear leg) or support at $1973.2 (Dec 13 low).

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX:

1M 5.35689 -0.00067

3M 5.37106 -0.00356

6M 5.23809 -0.0157

12M 4.90219 -0.01722

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.31%, -0.01%, $1757B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $632B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $622B

SOFR dipped 1bp back to 5.31% yesterday after two sessions at 5.32%. It's held at 5.31/5.32% since Dec 7 after it's early Dec spike to 5.39%. Volumes of$1757bn remain at the high end of historical ranges, off the Nov 30 high of$1850bn.

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $96B ($95B prior)

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $254B ($250B prior)

FED: RRP Uptake Only Inches Higher Despite Seasonal Counterparty Increase

- RRP uptake increased for the third day running today to $779bn, although only by $9bn after a combined $90bn Mon-Tue.

- It lifts usage further off Friday’s $683bn marked fresh lows since Jun 2021, but the latest increase is small considering the increase in counterparties from 87 to 95 on seasonal flows.

- As such, the $ take per counterparty of $8.2bn is a fresh low since May 2021.

US DATA: Conf Board “Hard To Get” A Job Still Trending Higher

- Conference Board consumer confidence beat expectations in Dec, at 110.7 (cons 104.5) after 101.0, its highest since July on similar relative trends in both the present situation and expectations components.

- The labor market differential didn’t improve though, essentially unchanged at 23.9 from 23.8 for the lowest levels since Apr 2021 and still below the 33 averaged in 2019.

- The unchanged differential came as another push higher in “hard to get” work as offset by a bounce in jobs plentiful. At 15.4% from 14.1%, the hard to get measure marked a high since Mar 2021 vs the 12.6% averaged in 2019.

US DATA: Existing Home Sales Nudge Higher After Five Monthly Declines

- Existing home sales saw a modest beat in November, at 3.82m (cons 3.78m) after an unrevised 3.79m in Oct.

- It leaves a 0.8% M/M increase after five consecutive monthly declines, most recently a heavy -4.1% in Oct, and marks its largest increase since February’s spike. Sales are still almost 30% below 2019 levels.

- When combined with a fall in inventory, the months of supply bucked its recent upward trend, easing a tenth to 3.5 months with its the first decline since February.

- Nevertheless, this uptrend has helped relative supply push back closer to pre-pandemic averages, having averaged 3.8 months in Nov for 2017, 2018 and 2019.

US DATA: Mortgage Applications Consolidate Prior Climb Despite 30Y Falling 24bps

- MBA composite mortgage applications dipped a seasonally adjusted -1.5% in the week to Dec 15, with refis -1.8% and purchases -0.6%.

- It fades another large decline in the 30Y conforming mortgage rate, but has followed a 10% rise in the prior two weeks (that was in turn driven by refis).

- Specifically, the 30Y conforming rate fell 24bps to 6.83%, its lowest since June. It has now fallen 107bps since its late October peak.

- Rates for jumbo loans saw a more modest decline on the week, an effective tightening in conditions, with the regular-jumbo spread falling from -15bps to -29bps for its lowest since Jan 2021.

MNI UK Inflation Insight: November 2023: Significant downside surprise

Significant downside surprise; tightening bias to go in Feb?

- After a downside surprise to both headline CPI and services CPI a month ago (October data), the November inflation report repeated those surprises again, meaning that headline CPI surprised the BOE’s November MPR forecasts by 0.7ppt in November with services CPI 0.6ppt below the Bank’s forecast.

- Some of the downside surprise can be attributed to potentially "temporary factors" but even if there is some scope for a bit of a rebound in December services CPI, it is unlikely to be anywhere near the magnitude of a 0.6ppt reversal to get us close to the BOE's November MPR forecast.

- We discuss the main components that have driven the move.

- We reiterate our view that it will be hard for markets to meaningfully price more than the 140bp of cuts currently priced in. However, we also think that there is a good chance that the Bank’s February communication potentially removes the tightening bias.

MNI POLITICAL RISK ANALYSIS - Political Event Calendar 2024

In our Political Risk calendar for 2024 we include details on the major political events scheduled to take place in developed and major emerging markets over the course of the next 12 months. We only include those events that have a set date or period in which they will take place.

Moreover, in a year that is already packed with major market-moving elections, summits, bilaterals, and conferences, there are a number of potential event that are seen as likely to take place but have no confirmed date, such as snap elections in Japan or the United Kingdom.

The plethora of dates outlined in the table below, combined with unconfirmed but expected events; ongoing conflicts in Ukraine, the Middle East and elsewhere; continued political, economic, and resource competition between global powers; and the ever-present prospect of ‘black swan’ events will ensure that political risks continue to have a significant impact on financial and commodity markets through 2024.

Full article PDF attached below:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/12/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2023 | 0900/1000 | ** |  | IT | PPI |

| 21/12/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 21/12/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 21/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/12/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 21/12/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/12/2023 | 1330/0830 | *** |  | US | GDP |

| 21/12/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 21/12/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 21/12/2023 | 1600/1700 |  | EU | ECB Lane Participates In Workshop Panel | |

| 21/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/12/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.