-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS: Near Term Rate Cut Recedes Post CPI

- Treasuries look to finish Tuesday weaker, near lows after some initial CPI induced volatility.

- Inflation metrics weighed on projected rate cut chances in the near term.

- Stronger stocks looked past the higher than hoped for CPI inflation data.

US TSYS CPI Higher Than Hoped For

- After some initial volatility this morning's higher than hoped for CPI inflation data weighed on rates as projected rate cut pricing has receded - CPI data unlikely to provide the FOMC confidence of inflation returning to 2% in the near term.

- CPI MoM (0.4% vs. 0.4% est), YoY (3.2% vs. 3.1% est); CPI Ex Food and Energy MoM (0.4% vs. 0.3% est) YoY (3.8% vs. 3.7% est). Meanwhile, Real Avg Hourly Earning YoY (1.1% vs. prior 1.3% (rev), Weekly Earnings YoY (0.5% vs. prior 0.1% (rev).

- Estimated dispersion across 57 items over the entire CPI basket saw relatively limited moderation in February considering the sharp increase in the breadth of inflationary pressure back in January. As such it lends support to that Jan jump for figures that can be noisy from month-to-month.

- Treasury futures extended lows (TYM4 111-03) after the $39B 10Y re-open sale (91282CJZ5) tailed 1.1bp: 4.166% high yield vs. 4.155% WI; 2.51x bid-to-cover vs. 2.56x prior. Indirect take-up recedes to 64.29% vs. 70.97% prior; direct bidder take-up rebounds to 18.65% from 16.05% prior; primary dealer take-up rebounds to 17.06% vs. 12.98%.

- Look ahead: data limited to Mortgage Applications and a Treasury bond sale re-open, the main focus is on Thursday's Retail Sales and PPI data.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00475 to 5.32544 (+0.00674/wk)

- 3M +0.01018 to 5.32516 (+0.00432/wk)

- 6M +0.02405 to 5.23326 (+0.00342/wk)

- 12M +0.04021 to 4.98235 (-0.00459/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.804T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $689B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $680B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $263B

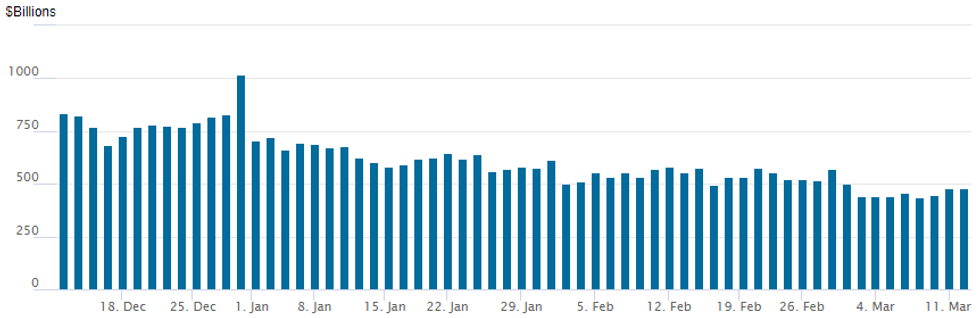

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $476.862B from $478.728B on Monday, compares to $436.754B last Thursday - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties remains steady at 73 (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options remained mixed on heavier volumes Tuesday, underlying futures weaker in the aftermath of higher than hoped for CPI inflation data. Projected rate cut pricing has receded - CPI data unlikely to provide the FOMC confidence of inflation returning to 2% in the near term: March 2024 chance of 25bp rate cut currently -0.8% w/ cumulative of -0.02bp at 5.328%; May 2024 at -14.5% vs. -20.7% earlier w/ cumulative -3.8bp at 5.291%; June 2024 -63% w/ cumulative cut -19.6bp at 5.134%. July'24 cumulative -33.7bp at 4.993%.

- SOFR Options:

- Block, 18,000 SFRM4 95.12/95.50 call spds 2.5 vs. 94.905/0.12%

- +10,000 SFRJ4 94.87/94.93/95.00 put flys, 1.5

- -10,000 0QH4 96.12/96.18 call spds .25 ref 9593

- +14,000 SFRU4 96.00 calls, 8.5 ref 95.22

- -3,000 0QH4 96.12/96.25 call spds .5 ref 9593

- -5,000 SFRZ4 96.50/97.00/97.50 call flys, 1.5 ref 95.54

- +5,000 SFRZ4 94.37 puts 4.0 ref 9558.5

- +4,000 0QM4 96.37/96.87 call spds v 2QM4 96.75/97.25 call spds .75

- Block, 4,000 0QJ4 95.93/96.06 call spds 4.0 vs. 95.91/0.23%

- 2,000 SFRK4 95.00/95.12 2x1 put spds ref 94.925

- Block/screen, 10,000 SFRJ4 95.25/95.37 call spds, 0.5 vs. 94.93/0.04%

- 2,000 SFRJ4 94.93/95.00/95.06/95.12 call condors, ref 94.925

- 6,000 SFRJ4 95.06/95.12/95.25/95.31 call condors, ref 94.93 to -.925

- 2,000 SFRM4 94.68/94.87 2x1 put spds

- 9,500 0QH4 95.68/95.75 put spds ref 95.91

- Block/screen, 9,500 2QM4 96.62 calls, 20.5vs. 96.46/0.44%

- 2,000 SFRM4 95.00/95.06/95.31 put trees ref 94.93

- Treasury Options:

- 5,000 TYK4 114.5/116 1x2 call spds, 0.0 ref 111-05

- +10,000 TYJ4 111.5/112.25 call spds, 14 ref 111-05

- 2,500 USM9 130/131/132/133 call condors

- Block, 8,500 TYM4 108 puts, 20 vs. 111-09/0.14%, adds to 15k earlier

- 5,000 TYK4 110/111 3x2 put spds, 14 net ref 111-07

- 3,500 TYM4 107.5 puts, ref 111-07.5

- Block, 7,500 TYK4 108.5 puts, 13 vs. 111-09/0.20

- 3,500 FVK4 111/112/113/114 call condors ref 107-11.75

- 2,800 wk3 TY 108.25/109/109.75 put flys, ref 111-06.5, expire this Friday

- 10,000 TYK4 107.5 puts, 111-09

- over 15,200 TYM4 108 puts, 18 ref 111-11

- +6,000 TYM 107.5 puts, 13 ref 111-19.5

- Block, 7,500 TYM4 107 puts, 10 vs 111-20.5/0.20%

- 7,000 TYJ4 108.5 puts, ref 111-21

- 1,200 TYJ4 108.75/109.75/110.75 put flys ref 111-20

- 17,000 FVJ4 108.25 calls vs. FVJ4 106.75/107.25 put spds ref 107-19.25

EGBs-GILTS CASH CLOSE: Softer UK Labour Data Sees Gilts Outperform Bunds

Gilts outperformed Bunds for a second day this week Tuesday as UK labour market data was seen bolstering the case for BoE cuts.

- UK wage data came in on the soft side of consensus, with the unemployment rate also a touch higher than expected, helping spur an early Gilt bid (our review of the data is here).

- The highlight of the global session was US CPI data which spurred a selloff in rates upon initial release as the core figure was above expectations.

- The initial move reversed briefly as some softer details of the report were digested, but ultimately Treasuries resolved decisively lower, dragging down core European FI.

- ECB's Holzmann said in an MNI interview published today that a rate cut by June would depend on inflation projections being confirmed. UK implied rates ticked lower toward the end of the session as BoE's Bailey noted that concerns about second-round inflation have fallen.

- The German curve bear flattened with the UK's bull flattening. Periphery EGB spreads closed tighter in a largely risk-on session, with 10Y BTP/Bund moving well below 130bp.

- UK data features once again early Wednesday, with GDP / activity data. Eurozone industrial production is out later in the morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.3bps at 2.847%, 5-Yr is up 3.8bps at 2.359%, 10-Yr is up 2.7bps at 2.33%, and 30-Yr is up 1.4bps at 2.472%.

- UK: The 2-Yr yield is down 1.7bps at 4.22%, 5-Yr is down 2.3bps at 3.871%, 10-Yr is down 2.5bps at 3.946%, and 30-Yr is down 0.7bps at 4.403%.

- Italian BTP spread down 4.7bps at 127.9bps / Greek down 4.2bps at 95.4bps

EGB Options: Multiple Rate Condor Trades Tuesday

Tuesday's Europe rates/bond options flow included:

- OEJ4 118.75/118ps 1x2, bought for 19.5 and 20 in 4k

- ERM4 96.37/96.50/96.62/96.75c condor, bought for 2.25 in 10k

- 0RM4 97.62/97.75/98.00 1 x 1.5 x 0.5 broken call fly bought for 1.5 in 5k

- SFIK4 95.00/94.90/94.80/94.70p condor sold at 4 in 13k

FX: Expiries for Mar13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875-85(E2.6bln), $1.0900-10(E989mln), $1.0920-40(E1.5bln), $1.0945-60(E1.1bln), $1.0975-80(E610mln)

- USD/JPY: Y147.25-35($1.6bln), Y147.75($899mln), Y148.50($842mln), Y149.50($1.1bln)

- AUD/USD: $0.6600(A$584mln), $0.6640-50(A$1.3bln), $0.6680(A$1.3bln)

- NZD/USD: $0.6070-85(A$1.3bln)

- USD/CAD: C$1.3500($562mln), C$1.3525($578mln), C$1.3555-75($900mln), C$1.3600($1.0bln)

Late Equities Roundup: Marking Late Session Highs

- Stocks continue to gain in late trade, S&P Eminis near last Friday's all-time high of 5193.00. Looking past the higher than hoped for CPI inflation data that weighed on Tsys and chances of a rate cut in the near term, S&P E-Minis currently trades up 57 points (1.1%) at 5242.5, Nasdaq up 233.3 points (1.5%) at 16251.87, DJIA up 281.01 points (0.72%) at 39051.4.

- Leading gainers: Information Technology and Consumer Discretionary sectors continued to outperform in late trade: Nvidia +5.78%, Micron +2.65%, Monolithic Power +1.92%. Broadline retailers supported the Discretionary sector: Best Buy +2.15%, Amazon +2.22%, DR Horton +1.63%.

- Laggers: Utility and Real Estate sectors underperformed in the second half, Independent and multi energy stocks weighed on the former: AES Corp -2.1%, Sempra -1.94%, Pinnacle West -1.89%. Real Estate investment trusts displaced mining stocks as the next lowest performer: particularly residential and office REITS: Ventas -2.25%, UDR inc -2.11%, Regency Centers -1.95%.

E-MINI S&P TECHS: (M4) Trend Structure Remains Bullish

- RES 4: 5303.38 3.0% Bollinger Band

- RES 3: 5300.00 Round number resistance

- RES 2: 5282.68 2.0% 10-dma envelope

- RES 1: 5257.25 High Mar 8

- PRICE: 5239.00 @ 1535 ET Mar 12

- SUP 1: 5137.36 20-day EMA

- SUP 2: 5022.53 50-day EMA

- SUP 3: 4994.25 Low Feb 13

- SUP 4: 4921.00 Low Jan 31

The trend condition in S&P E-Minis is bullish and the latest pullback is considered corrective. Last week’s fresh highs reinforce current conditions. Note that price action continues to highlight the fact that corrections remain shallow. This is a bullish signal highlighting positive market sentiment. Support to watch is 5137.36 the 20-day EMA. A clear break of this average would open 5022.53, the 50-day EMA. Sights are on 5300.00 next.

COMMODITIES Spot Gold Extends Pullback Following US CPI

- Spot gold extended its pullback following Tuesday’s US CPI data, moving down by 1.3% on the day to $2,154/oz. The price has now shed ~$41/oz off the all-time high posted last Friday.

- USD strength and a return higher for US yields drove price action. However, silver underperformed today and tested handle support of $24/oz. This kept the Gold/Silver ratio higher on the day - although well below late February highs.

- For spot gold, a further pullback would encounter first strong support at 2145.40 - the 23.6% retracement for the Feb - Mar upleg. Initial resistance is at $2195.2, the March 8 high.

- In oil markets, crude futures are now down on the day, with WTI 0.3% lower at $77.69/bbl. Front month has returned towards levels seen after the US CPI data release and OPEC’s monthly oil market report.

- OPEC raised oil output 200,000 bpd to 26.6 mln bpd in February, OPEC+ overshot its production target by 200,000 bpd.

- The WTI futures trend condition remains bullish despite the latest pullback - a correction. The recent breach of key resistance at $79.09, the Jan 29 high, reinforces a bullish theme, highlighting potential for a continuation towards $81.70, a Fibonacci retracement. On the downside, support to watch is $76.57, the 50-day EMA.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/03/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/03/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/03/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 13/03/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 13/03/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/03/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/03/2024 | 1145/1245 |  | EU | ECB's Cipollone at conference in Milan | |

| 13/03/2024 | - | *** |  | CN | Money Supply |

| 13/03/2024 | - | *** |  | CN | New Loans |

| 13/03/2024 | - | *** |  | CN | Social Financing |

| 13/03/2024 | 1230/0830 | * |  | CA | Household debt-to-income |

| 13/03/2024 | 1400/1000 | * |  | US | Services Revenues |

| 13/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 13/03/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.