-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

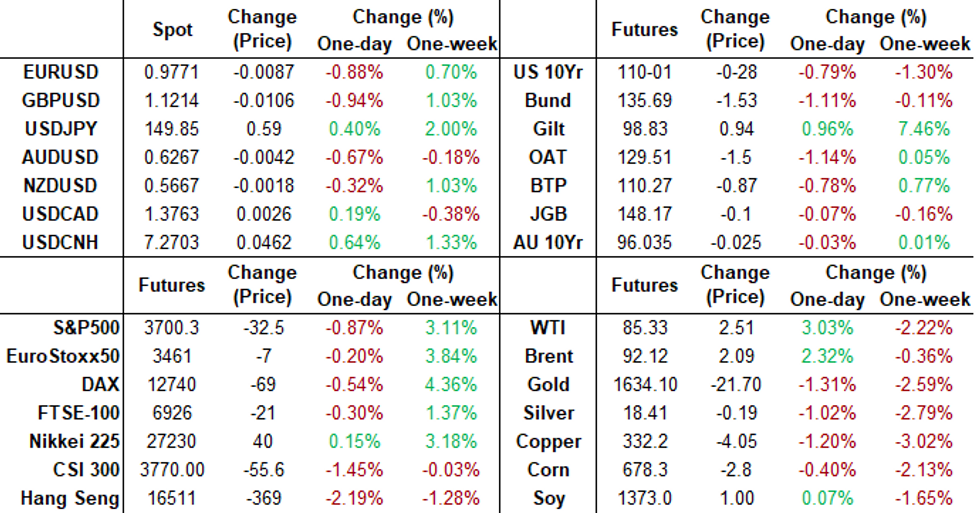

Free AccessMNI ASIA MARKETS ANALYSIS: New Tsy Yld Cycle Highs

HIGHLIGHTS

FED KASHKARI: LOT OF EMBEDDED HOUSING INFLATION YET TO APPEAR, Bbg

US: Not Announcing Export Curbs in Near Future: Hochstein

US: Biden To Announce Energy Security Measures Amid Criticism Of Abortion Focus

UK: Truss: 'I Am Completely Committed To Triple Lock, So Is Chancellor'

RUSSIA: Putin Declares Martial Law Across 4 Ukrainian Regions

Key links: MNI INTERVIEW: Another Fed 75BP Hike Likely In Dec.- Rosengren / MNI: Ex-Officials Now See Fed Rate Peak At 5% Or Higher / MNI INTERVIEW: Sterling To Fall Significantly Over Time -Weale / MNI: Italy's Coalition Eyes Bigger 2023 Deficit Target-Sources / US Treasury Auction Calendar

US TSYS: New Cycle Highs for Tsy Yields

Tsys weaker after the close, near session lows w/ TYZ2 through 110-00 psychological support of 110-00 briefly to 109-30.5 low, new cycle highs for yields: 10YY 4.1335%, 30YY 4.1302%.- Tsys tendency to mirror moves in EGBs, particularly Gilts reversed this morning after initially following EGBs lower (UK inflation rising to 40Y highs).

- Tsys continued to decline amid on rising inflation and tighter policy from the Fed (MN Fed Kashkari late Tue: rates could go above 4.5-4.75% if no progress with CPI and former Boston Fed's Rosengren telling MNI he sees prospects of a 2023 rates above 5%.).

- Gilts, on the other hand, reversed course, rebound a strong vote of confidence in new finance minister Jeremy Hunt in cleaning up UK markets since the Sep-23 mini-budget inception. Exclusion of longer dated Gilts as sales resume Nov 1, helping long end.

- Any react to mixed data lost in the shuffle: housing start weaker than expected (including revision) while build permits stronger (including revision). Tsy $12B 20Y bond auction re-open (912810TK4) tail didn't help matters any: 4.395% high yield vs. 4.375% WI; 2.5x bid-to-cover vs. prior month's 2.65x.

- More Fed speak this evening: Chicago Fed Evans economic outlook at 1800ET, StL Fed Bullard at 1830ET. Philly Fed Harker economic outlook at noon Thursday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00172 to 3.06057% (-0.00557/wk)

- 1M +0.01157 to 3.50071% (+0.05771/wk)

- 3M +0.03500 to 4.27757% (+0.08386/wk) * / **

- 6M +0.02243 to 4.73743% (+0.05214/wk)

- 12M +0.00057 to 5.33943% (+0.05629/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.24257% on 10/18/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 3.04%, $967B

- Broad General Collateral Rate (BGCR): 3.00%, $388B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $375B

- (rate, volume levels reflect prior session)

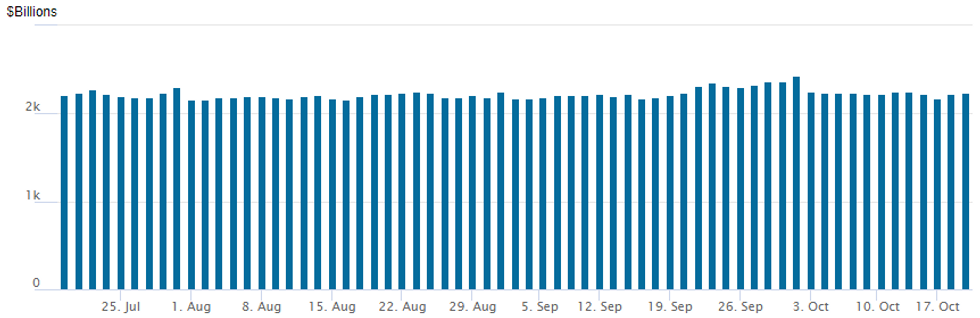

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,241.835B w/ 101 counterparties vs. $2,226.725B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, 10,000 SFRF3 94.87 puts, 15.5

- Block, 44,000 SFRZ2 95.56/95.81 put spds, 22.75 on splits (95.81 leg price split between 50.5 and 51.0)

- 3,500 SFRZ2 95.31/95.43/95.56 put flys

- 1,000 Blue Aug 96.75/97.00/97.12 broken call flys

- Eurodollar Options:

- 37,000 Dec 98.25/98.50 put spds, 25.0 ref 94.88

- Block, total 20,000 Mar 94.50/95.00/95.25/95.50, 5.5 net

- Treasury Options:

- -7,500 TYZ2 115 calls, 7 (total volume >24k on day)

- 6,000 TYZ2 116 calls, 4 ref 110-01.5

- 2,000 TYZ2 114 calls, 13

- 2,000 TYX2 115/117 call spds

- 3,500 TYX2 110/110.5 put spds, 22 ref 110-06

- over 6,500 TYZ2 106 puts, 17

- over 8,000 TYZ2 107 puts, 24-26

- over 6,000 USX2 120 puts, 11-8

- 2,000 TYX2 109.5/112.5 strangles, 36

- 1,000 TYZ2 103/105/106/108 put condors ref 110-08

- 6,000 FVZ2 107.5 calls ref 106-09

- 6,000 TYZ2 108.5/109 put spds, 9-11 ref 110-15 to -15.5

EGBs-GILTS CASH CLOSE: Gilt Bull Flattening Continues

Gilt bull flattening continued Wednesday, with 30Y yields nearly erasing October's rise following overnight news that the BoE would not initially target longer-dated instruments in its upcoming QT operations.

- European bonds had sold off on the open following a slightly higher than expected UK inflation print, but diverged thereafter. Gilts rallied for almost the entire session, while German yields rose, with bear flattening in the curve.

- Bunds came under pressure after the German finance agency announced it would increase its bond holdings in order to make available more instruments for repo operations.

- German cash bond yields rose as swap spreads fell sharply, as the finance agency's move was seen easing long-standing repo market pressure.

- Periphery spreads were relatively steady.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 11.8bps at 2.095%, 5-Yr is up 12.3bps at 2.213%, 10-Yr is up 9.1bps at 2.376%, and 30-Yr is up 2.5bps at 2.347%.

- UK: The 2-Yr yield is down 6.2bps at 3.506%, 5-Yr is down 2.6bps at 3.872%, 10-Yr is down 7.2bps at 3.878%, and 30-Yr is down 31.7bps at 3.989%.

- Italian BTP spread down 1bps at 239.7bps / Spanish up 0.3bps at 115bps

Large Sonia Upside Buying Continues

Wednesday's Europe rates / bond options flow included:

- RXX2 142^, bought for 572 in 10k. Looks done vs 9.9k Bund at 136.38

- ERZ2 97.87/98.00/98.12c fly, bought for 1.5 in 12k and 8k

- SFIZ2 96.15/96.40cs, bought for 4.25 in 5k

FOREX: USD Bounces Back As US Yields Surge To Fresh Highs

- The greenback rallied firmly on Wednesday, with the USD index erasing the majority of the week’s weakness amid further pressure on US treasuries with yields climbing to fresh cycle highs and major equities turning back lower.

- Greenback strength was broad based against G10 and EM currencies alike, with notable 1% declines for GBP, CHF and EUR standing out during the session.

- EURUSD traded back below its 20-day EMA and for now the trend remains down. This week’s rally fell short of key resistance at 0.9910 - the top of the bear channel drawn from the Feb 10 high. Gains are still considered to be corrective at this juncture - key short-term support is at 0.9633, the Oct 13 low.

- USDJPY continues to edge higher and print within 11 pips of the psychological 150.00 mark. Above here we have 150.45, a Fibonacci projection, with markets continually assessing the probability of another round of intervention from Japanese officials. Additionally, 1.0065-75 provides a strong horizontal technical point in USDCHF, that has seen strong 1.10% gains today.

- USDCNH also breached the September highs above 7.2674 and has consolidated around 7.27 as we approach the APAC crossover.

- Technical levels of note on the topside include 7.2851, a Fibonacci projection, before 7.3000, round number resistance.

- Thursday’s APAC session is highlighted by Australian employment data for September. In Europe, minor releases of German PPI and Swiss trade balance are scheduled. In the US, Philly Fed Manufacturing Index, unemployment claims and existing home sales are in focus.

FX: Expiries for Oct20 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9685-00(E1.9bln), $0.9750(E787mln), $0.9800(E1.9bln), $0.9850(E1.3bln), $0.9870-80(E $0.9990-00(E1.4bln)

- USD/JPY: Y145.00($3.5bln), Y147.90-00($3.7bln)

- GBP/USD: $1.1145-60(Gbp606mln)

- EUR/JPY: Y146.00(E753mln)

Late Equity Roundup, Late Bounce Ahead More Round of Earnings

Stocks still weaker after the FI close, but bouncing ahead another round of earnings announcements after the close:

- IBM $1.808 est;

- Alcoa (AA) $0.026 est,

- Tesla (TSLA) $1.02 est;

- Crown Castle (CCI) $1.918 est.

- PPG Industries (PPG) $1.659 est

- Kinder Morgan (KMI) $0.277 est

- Otherwise, Energy (+3.28%) sector shares continued to outperform, leavening ongoing weakness in Real Estate (-2.09%) and Financials (1.64%) shares. Currently, SPX eminis trade -29.75 (-0.8%) at 3703.5; DJIA -124.4 (-0.41%) at 30400.13; Nasdaq -107 (-1%) at 10666.51.

E-MINI S&P (Z2): Corrective Cycle Still In Play

- RES 4: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 3: 3923.88 50.0% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 3849.78 50-day EMA

- RES 1: 3820.00 High Oct 5 and a bull trigger

- PRICE: 3705 @ 1525 ET Oct 19

- SUP 1: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 2: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 3: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3388.70 1.764 proj of the Aug 16 - Sep 7 - 13 price swing

Despite today’s pullback, S&P E-Minis maintains a firmer tone following last week’s reversal from 3502.00, the Oct 13 low. The latest recovery suggests the contract has entered a corrective phase and if correct, this is allowing an oversold trend condition to unwind. The 20-day EMA has been breached. The break reinforces a bullish theme and opens 3820.00, the Oct 5 high and a bull trigger. Key support is unchanged at 3502.00.

COMMODITIES: Oil Bounces Despite Biden’s Gasoline Plea Whilst Gold Slides

- Crude oil reverses yesterday’s sizeable slide with a sizeable gain of its own, boosted after initially little impact from IEA data and continuing despite Biden looking at ways of lower gasoline prices.

- IEA data showed a small draw in crude stocks compared to the expectation of a small build and distillate four-week average demand continued to recover back up to above normal levels for the time of year.

- WTI is +2.7% at $85.06, moving back closer to resistance at the 50-day EMA of $87.31.

- Brent is +2.0% at $91.82, moving closer to resistance at $95.17 (Oct 12 high).

- Gold is -1.44% at $1628.33 as it is hit hard by a surging USD and Tsy yields. It clears support at $1640.2 and next eyes the bear trigger at $1615.0 (Sep 28 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/10/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 20/10/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/10/2022 | 0720/0320 |  | ID | Bank of Indonesia Rate Decision | |

| 20/10/2022 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/10/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 20/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/10/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/10/2022 | 1600/1200 |  | US | Philadelphia Fed's Patrick Harker | |

| 20/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/10/2022 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 20/10/2022 | 1745/1345 |  | US | Fed Governor Lisa Cook | |

| 20/10/2022 | 1805/1405 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.