-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: No Month End Fireworks Ahead FOMC

HIGHLIGHTS

- MNI US DATA: ECI Confirms AHE Wage Growth Moderation In Q4

- MNI SECURITY: US Accuses Russia Of Breaching Terms Of New START Nuclear Treaty

- LULA: I'M ALL FOR ECONOMIC STABILITY, FISCAL RESPONSIBILITY, Bbg

US TSYS: No Month End Fireworks Ahead Wed FOMC

Tsys trading firmer after the bell, near middle of narrow range (30YY 3.6487%, -.0033, yield curves steeper 2s10s +1.591 at -68.776) - no month end fireworks. Several factors at play as markets otherwise await Wed's FOMC policy annc.

- US FI broke higher after Q4 ECI data rises less than expected: 1% vs. 1.1% est (Q3 1.2%), equities reacted positively as well as SPX eminis bounced back to steady at the time (ESH3 4032.5). Rates peaked following round of mixed data (Home Prices dip 0.1%, Chicago PMI contracts: 44.3 vs. Dec 45.1, Consumer Confidence decline 107.1; EST. 109.0).

- Rate support evaporated around midmorning, long end extended session lows amid spurious reports that German inflation data (delayed since late last wk) had been released - it has not. MNI has received nothing from German stats agency that can back up any German Jan inflation release. MNI's latest confirmation is that the Destatis release has been delayed, and publication date to be confirmed later this week.

- Citing historicals, brief opportunity for tactical month-end buyers: reversal in Tsys (partially spurred by Block sale of 6.6k FVH3 at 109-06) presented a speculative opp ahead month end rebalancing today. Indeed, Tsys did rebound off lows. - still time to unwind risk.

- Fed funds implied hike for Feb'23 at 25.8bp (-.6), Mar'23 cumulative 46.1bp (-.8) to 4.793%, May'23 56.6bp (-1.3) to 4.898%, terminal at 4.91% in Jun'23.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00686 to 4.29843% (-0.00628/wk)

- 1M +0.00872 to 4.57429% (-0.00458/wk)

- 3M +0.00000 to 4.81357% (-0.01172/wk)*/**

- 6M +0.00886 to 5.10043% (-0.00186/wk)

- 12M +0.01157 to 5.33757% (+0.02143/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $109B

- Daily Overnight Bank Funding Rate: 4.32% volume: $289B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.158T

- Broad General Collateral Rate (BGCR): 4.27%, $473B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $452B

- (rate, volume levels reflect prior session)

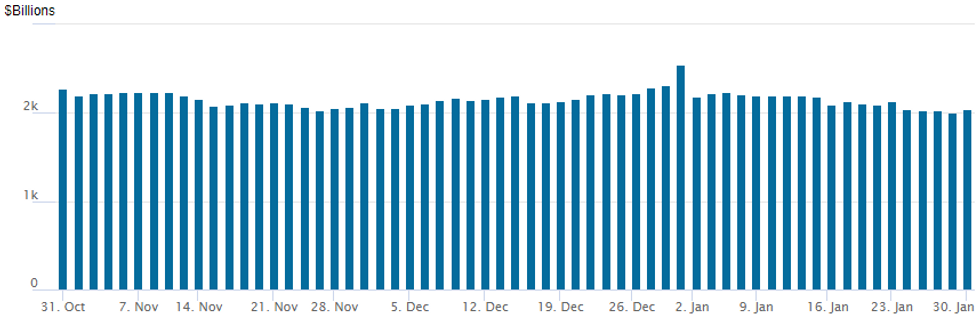

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbed to $2,061.572B w/ 104 counterparties vs. prior session's $2,048.714B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Chunky two-way wing trade continued for the second consecutive session tied to consolidation, re-positioning ahead Wednesday's FOMC policy announcement.- SOFR Options:

- Block, 5,000 SFRJ3 95.06/95.18 1x2 call spds, 0.0 ref 95.10

- -40,000 TYH3 110.5/111.5/112.5/113.5 put condors, 11.0 ref 114-19.5

- Block, 10,000 SFRG3 95.06/95.18/95.31 call flys, 7.5 ref 95.16

- Update Block/screen +30,000 SFRG3 95.12/95.18 put spds, 2.75 ref 95.165

- +4,000 OQG3 95.75 puts, 1.5

- +3,000 SFRJ3 94.87/95.00/95.12/95.18 broken put condors 0.5 over SFRJ3 95.31/95.43 call spds

- +1,000 SFRU 95.50/95.75 call spds, 5.25

- Screen/Block, 28,000 SFRG3 95.18 calls, 2.0 vs. 95.16/0.36%

- Update, over +25,000 SFRG3 95.12/95.18 strangles, 4.0-4.5 ref 95.16

- Block, 2,500 SFRZ3 96.00/97.00 call spds, 2.5 over 95.00 puts ref 95.545

- 2,000 OQM3 96.06/96.56 3x2 put spds ref 96.48

- Block, 3,500 SFRG3 95.06/95.12 put spds, 1.25 vs. 95.145/0.12%

- 3,500 SFRZ3 94.50 puts, 4.5 ref 95.545

- Treasury Options:

- -5,000 TYH3 114.5 straddles, 135 ref 114-16

- -28,000 TYH3 110.5/111.5/112.5/113.5 put condors, 11.0-10.0

- 1,100 FVH3 109.25 straddles, 107 ref 109-10.5

- 3,000 FVH3 110 calls, 19 ref 109-10.5

- 2,000 TYH3 118 calls, 4 ref 114-12.5

- over 18,000 TYH3 115.5 calls, 25-27 ref 114-15 to -17.5

FOREX: US Data Weighs On Greenback, Swiss Franc Surges

- Early weakness in equities underpinned a firmer USD in early trade on Tuesday, extending on Monday’s more buoyant price action. However, lower than expected US data and potential flows relating to month-end prompted a reversal for the greenback, with the USD Index trading close to unchanged for the week approaching the Fed’s February decision tomorrow.

- US Employment Cost Index data confirmed that AHE wage growth moderated in Q4, sparking a quick gap lower from which the US dollar was unable to recover from.

- Topping the G10 leaderboard is the Swiss Franc, which has advanced close to 1% against both the Euro and the dollar. The move lower in USDCHF follows three straight days of gains, the entirety of which have been erased today. The pair has significantly narrowed the gap with the trend lows and key support around the 0.91 handle. There appears nothing notable driving the CHF bid, with potential month-end dynamics contributing to the outperformance.

- The Norwegian Krone is one of the poorest performers in G10, as the Norges Bank confirmed a larger than expected schedule for February FX purchases. Consensus looked for an unchanged clip of NOK 1.5lbn per day, not the NOK 1.9bln confirmed this morning. EUR/NOK rallied to new cycle highs in response, trading as high as 10.9276 in early US trade before moderating.

- GBP has also traded on the weaker side, with cable unable to bounce amid the broad dollar weakness. EURGBP (+0.37%) has maintained a bid tone throughout the session and further gains would expose resistance at 0.8897, the Jan 13 high and a bull trigger. Clearance of this hurdle would confirm a resumption of the bull cycle that started early December last year.

- US ADP, ISM Manufacturing PMI and JOLTS data all play second fiddle to the FOMC decision where the Fed will downshift its rate hike pace in February for the second consecutive meeting, to 25bp from 50bp. All eyes will then be on Chair Powell’s press conference.

FX: Expiries for Feb01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0765-70(E675mln), $1.0790-05(E996mln), $1.0850-55(E718mln), $1.0885-10(E3.0bln)

- USD/JPY: Y129.00($596mln), Y130.50($636mln)

- AUD/USD: $0.6920(A$527mln), $0.7000(A$572mln), $0.7140-50(A$683mln), $0.7185(A$1.1bln)

- USD/CNY: Cny6.82($1.1bln)

Late Equity Roundup: Extending Session Highs

Major indexes extending session highs in late trade, Materials and Consumer Discretionary sectors continuing to outperform after mixed data. SPX eminis currently trades +38.75 (0.96%) at 4071.5; DJIA +221.74 (0.66%) at 33942.03; Nasdaq +146.5 (1.3%) at 11540.67.

- SPX leading/lagging sectors: Materials (+1.76%) lead containers/packaging subsector, particularly paper: International Paper (IP) +10.74% after reporting $0.87 adj EPS this morning, additional gainers WRK +4.52%, PKG +2.49%. Consumer Discretionary (+1.70%) lead by auto makers: GM surging 7.74%, Ford +4.27% compared to Tesla +3.22.

- Laggers: Utilities (-0.16%) weighed by shares of electric utilities underperformed: NEE (-1.35%), FE (-1.23%), SO (-0.47%). Next up: Energy (+0.48%) and Consumer Staples (+0.53%) w/ oil, gas and consumables weighing on the former.

- Dow Industrials Leaders/Laggers: adding to Monday's gains, United Health (UNH) +11.25 at 497.04, Home Depot (HD) +7.72 at 321.96, Microsoft (MSFT) +3.99 at 246.70. Laggers: Caterpillar (CAT) -9.56 at 251.94 after announcing $2.79 EPS and lagging sales in China, McDonalds (MCD) -4.53 at 266.36 after missing operating margins ests, IBM -0.90 at 134.40.

- Earning roundup: After market: EA, AMD, AMGN.

E-MINI S&P (H3): Uptrend Remains Intact

- RES 4: 4250.00 High Aug 26, 2022

- RES 3: 4194.25 High Sep 13

- RES 2: 4180.00 High Dec 13 and the bull trigger

- RES 1: 4109.25 High Jan 27

- PRICE: 4075.00 @ 1505ET Jan 31

- SUP 1: 4007.50/3957.89 Low Jan 26 / 50-day EMA

- SUP 2: 3901.75/3891.50 Low Jan 19 / Low Jan 10

- SUP 3: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 4: 3735.00 Low Nov 3

S&P E-Minis have started the week on a bearish note and the contract traded lower today again but has recovered from the session low. The move down appears to be a correction and the uptrend remains intact. The recent breach of resistance resulted in a print above the 4100.00 handle and an extension higher would open 4180.00, the Dec 13 high and a bull trigger. Initial firm and key support has been defined at 3957.89, the 50-day EMA.

COMMODITIES: Mixed Session For Crude, OPEC+ Eyed Tomorrow

- Crude oil has seen a mixed session with WTI gaining but Brent slipping, with some of the differential perhaps helped by EIA data showing a 20kbpd uptick in oil demand whilst crude production slipped 0.3% to 12.375mbpd in November.

- Analysts expect no change to OPEC+ policies with tomorrow's meeting.

- In earnings news, ExxonMobil reported record profits of $55.7B for 2022 (prior record of $45B in 2008), following prior news of record profits at Chevron of $36.5B.

- WTI is +1.4% at $78.93, moving back closer to initial resistance at $80.49 (Jan 30 high) after which sits $82.66 (Jan 18 high). Some covering in front contract options though, with by far the most active strikes in CLH3 today in $70/bbl puts.

- Brent is -0.5% at $84.47 having pushed higher after testing support at $83.76 (Jan 19 low) earlier in the session.

- Gold is +0.3% at $1929.74, gaining later in the session as US depreciation continued to extend well after softer US data. It sits between resistance at $1949.2 (Jan 26 high) and support at $18999.5 (20-day EMA).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 01/02/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/02/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/02/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 01/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/02/2023 | 1900/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.