-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA MARKETS ANALYSIS - Oil Above $46, New Multi-Month High

HIGHLIGHTS:

- WTI crude futures hit new multi-month high

- NOK narrows gap with multi-year high on oil strength

- Fed minutes don't move the market needle

US TSYS SUMMARY: Strength Amid Mixed Data, Slightly Dovish Fed Minutes

A heavy pre-Thanksgiving data slate proved mixed, and did nothing to reverse steady strength in Treasuries throughout the session. FOMC Minutes gave enough of a taste of potential action at forthcoming meetings (at least on guidance) to nudge the curve flatter ahead of the holiday.

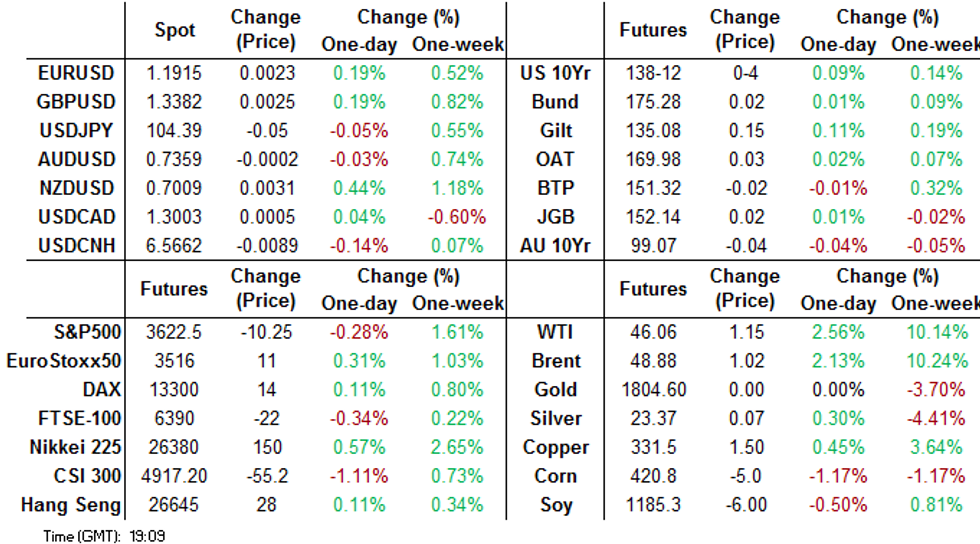

- Curve trading mixed: 2-Yr yield is down 0.2bps at 0.1583%, 5-Yr is down 1.3bps at 0.3829%, 10-Yr is down 1.6bps at 0.8635%, and 30-Yr is down 0.9bps at 1.596%.

- Dec 10-Yr futures (TY) up 4/32 at 138-12 (L: 138-04 / H: 138-15)

- Tsys ticked higher after the 0830ET release of jobless claims (weak) and durable goods (strong), then again to session highs after personal income (mixed) and home sales (strong) data released at 1000ET.

- FOMC November minutes were initially digested bullish for Tsys, with some discussion of asset purchases pointing toward outcome-based guidance on asset purchases favored by participants, with guidance coming "fairly soon" enough to help reverse earlier curve steepening though only slightly.

- Overall though it was the steady weakness in equities (from Tue's jump), not the data, that Tsys most closely tracked. The next set of data is not until next week (starting with MNI Chicago PMI).

- Thursday sees a bond market holiday, with Friday a half-day.

EGBs-GILTS CASH CLOSE: UK Linkers And BTPs Make Moves

Bunds and Gilts opened Wednesday on the back foot following Tuesday's surge in risk appetite but yields fell over the session and finished not far from the lows.

- The morning's move to new record lows for Italian 10-Yr yields faded over the day however, with BTP spreads ultimately widening. The afternoon's big move was in Gilt linkers which rallied sharply following the announcement that the UK RPI review would not come into effect until 2030.

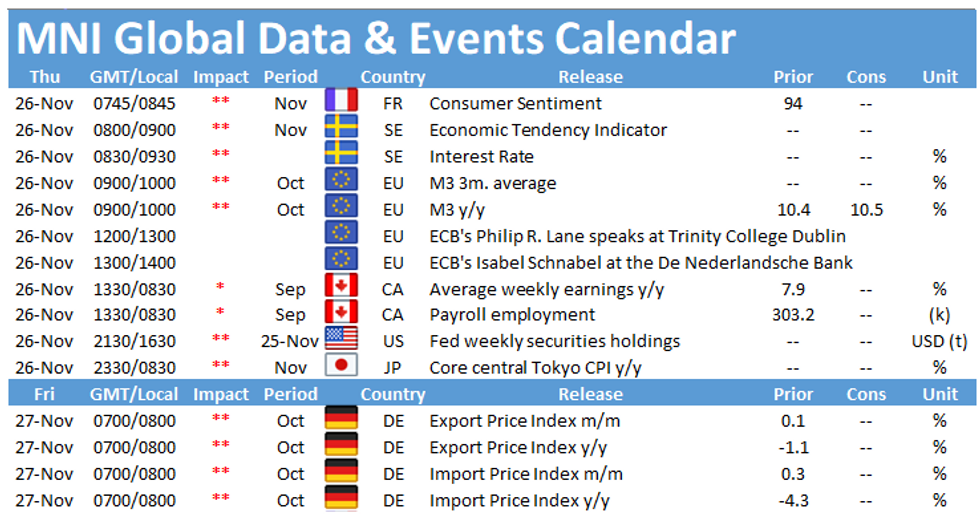

- In contrast w the US holiday, a reasonably active Thursday in Europe ahead: data including French and German consumer confidence, with the Swedish Riksbank decision eyed. ECB's Lane and Schnabel speak, while the October ECB meeting's accounts are published. No issuance though.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.7bps at -0.75%, 5-Yr is down 1bps at -0.755%, 10-Yr is down 0.5bps at -0.568%, and 30-Yr is down 0.7bps at -0.156%.

- UK: The 2-Yr yield is down 0.7bps at -0.025%, 5-Yr is down 0.9bps at 0.015%, 10-Yr is down 1.2bps at 0.318%, and 30-Yr is down 2bps at 0.881%.

- Italian BTP spread up 0.8bps at 118.3bps

- Spanish bond spread unchanged at 63.7bps

- Portuguese PGB spread down 0.7bps at 58.9bps

- Greek bond spread up 2.2bps at 125.5bps

EUROPE FI FLOW SUMMARY: Short-Sterling Upside Buying

Today's options flow included:

- 0LH1 100.00/100.125cs vs 2LH1 100.00/100.125cs, bought the 1yr for -0.25 (receive) in 18k

- 0LJ1 (April) 100.12/100.25cs, bought for 1 in 2k (ref 99.92, 9 del)

- 0LM1 99.62/99.75/100.00/100.12c condor, bought for 8.75 in 2k

- 0LM1 99.62/99.75/100.12/100.25c condor, bought for 10 in 6.5k

- LZ1 100^, bought for 19.25 in 1k

- ERH2/ERH1 100.50/100.37ps spread, sold the red at 1.5 in 3k

- 2LM1 99.62/99.37ps, bought for 2.5 in 5k

UK Issuance Outlook and Spending Review Recap

- Today's spending review delivered a dour outlook but a "rabbit from the hat" in terms of the levelling up fund.

- From the markets side, we look at the implications for gilt issuance and set out our expectations for each gilt auction until the end of the 2020/21 fiscal year, see page 3 of the document for our expected issuance calendar.

- Our political risk team also look at the highlights of the Spending Review and the most politically controversial parts.

- For the full document click here

FOREX: NOK on Top as Crude Rally Extends

The near 30% rally in crude oil prices across November continues to lend support to commodity-tied currencies, with NOK outperforming again Wednesday. This keeps USD/NOK on track to test the early September lows of 8.6570, which would be the lowest rate since mid-2019.

The greenback came under some fix-related selling pressure despite starting the US session well. This kept a lid on the greenback, which underperformed all others in G10.

Brexit negotiations clearly remain fractious, with no signs of a deal emerging as yet. Markets continue to price for a favourable outcome in the talks that continue this week, raising interest in a suggestion from the Irish PM, who suggested a deal could be agreed on a "staged" basis in an attempt to find common ground. GBP/USD, while stronger, failed to reach new weekly highs.

Tier one data releases are few and far between Thursday, with US markets close for the Thanksgiving holidays. ECB's Schnabel & Lane and BoC's Macklem & Wilkins are due to speak.

OPTIONS: Expiries for Nov26 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1740-50(E1.7bln), $1.1765-70(E643mln), $1.1800(E662mln), $1.1815-30(E1.0bln), $1.1850-60(E1.35bln), $1.1950-60(E654mln)

USD/JPY: Y102.50($1.3bln-USD puts), Y104.00($1.7bln), Y104.90-00($1.1bln), Y106.45-50($907mln)

EUR/JPY: Y124.00-15(E609mln)

AUD/USD: $0.7300-10(A$1.2bln), $0.7400(A$733mln)

USD/CNY: Cny6.6250($780mln)

EQUITIES: US Futures Continue to Drift Pre-Thanksgiving

In cash markets, the S&P500 and Dow Jones sit in minor negative territory, opening a small gap with all time highs as the Dow ebbs back below the 30,000 level.

In the US, consumer discretionary & staples are outperforming very slightly, with energy, industrials and materials providing an anchor.

E-Mini S&P futures continue to trade within the 3668.00, Nov 9 high and3506.50, Oct 11 key parameters.

The deluge of data earlier today had little lasting impact, with focus now turning to FOMC minutes, with markets watch for any mention of a tweak to the Fed's QE programme.

COMMODITIES: WTI Continues to Inch Higher

Both Brent and WTI crude futures inched higher Wednesday, extending the sharp November rally. WTI showed above 45.50 for the first time since March and the early 2020 sell-off. An unexpected draw in reserves at the weekly DOE crude oil inventory numbers provided some support, with markets also keeping an eye on reports in the Middle East after an oil tanker was subject to an attack in the Saudi Arabian terminal off the Red Sea.

Spot gold stabilised after successive sessions of weakness on both Monday and Tuesday. This keeps spot gold above key support at the 200-dma of 1798.15, which will be closely watched in the coming sessions.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.